MLP Investors Learn About Logistics

We hear so often how energy infrastructure is all about pipelines and storage assets with fee-based contracts that when another part of the business pops up it can cause quite a stir. So it was that Plains All American (PAGP), one of the biggest crude oil pipeline operators in the U.S., provided an unwelcome example of the uncertainty surrounding one aspect of their business. Accelerating changes in the marketplace adversely affected their Supply and Logistics segment, such that PAGP thought it worthwhile holding their Wednesday morning earnings call on Tuesday evening, immediately following their earnings release.

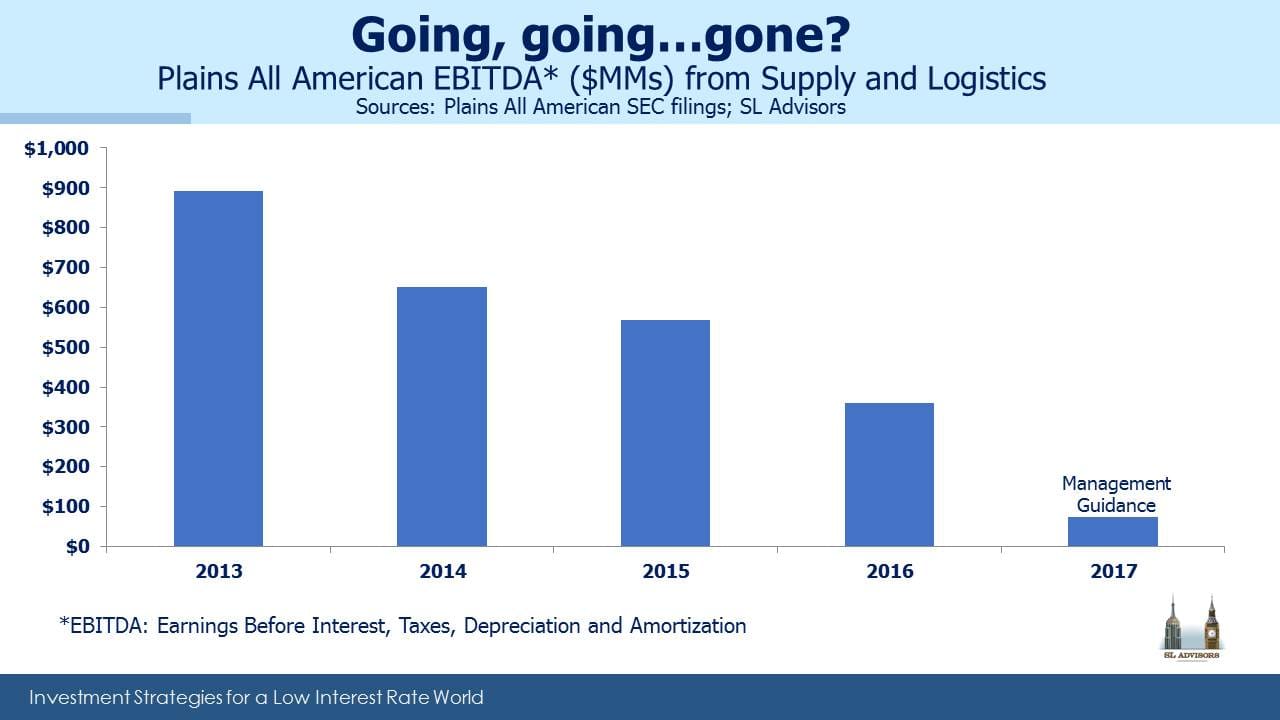

Supply and Logistics involves taking temporary ownership of crude oil, Natural Gas Liquids (NGLs) and natural gas with the objective of unloading it elsewhere for a profit. The idea is not to make money from price moves, but rather to generate a profit from known inefficiencies in the transportation network. If you can buy crude oil at point A for $45 a barrel and sell it at point B for $48 while spending less than $3 on storage, transportation and overhead, it can be a profitable business. It has been so in the past; in 2013 PAGP generated $893MM in EBITDA from this activity, although its profits have been declining since. It is in effect a profit from inefficiency of the domestic transport network. If crude is worth $3 more at point B compared with point A, the cost of transport should be around $3, or crude will flow until the arbitrage is eliminated.

The problem, as PAGP belatedly discovered, is that the market is becoming more efficient. Three years ago Congress lifted the ban on crude exports, which removed one significant inefficiency. Patches of excess pipeline capacity further challenged arbitrage opportunities by providing shippers with more choices. More recently, a flattening of the crude oil futures curve along with lower volatility reduced opportunities, as did more competition. Several other firms have de-emphasized or exited the business over the past couple of years.

The deep disappointment no doubt felt by PAGP CEO Greg Armstrong and those who know him is that they didn’t see this coming. Plains is better positioned than most to see first-hand changes in the supply and logistics of hydrocarbons. They pride themselves on a very sophisticated view of shifts in the marketplace. Three months ago a weak first quarter in this segment was partly blamed on warm winter weather. Propane held in inventory anticipating stronger prices had to be sold on weakness.

The outlook for profits in Supply and Logistics is so uncertain that PAGP says they’ll likely exclude it from their calculations of Distributable Cash Flow (DCF), the metric underpinning their distribution. They’re currently forecasting only $75MM this year. Although a strategic review is underway and will likely take a couple of months, the Facilities and Transportation businesses can only support a payout of around $1.80 per share (albeit with 1.1X coverage), down from $2.20 currently. Plains cut their distribution last year when combining their MLP and GP, so this likely represents a second cut in two years. Another management team’s reputation is shredded. Greg Armstrong will not care to be compared with Rich Kinder who also oversaw two dividend cuts in as many years at Kinder Morgan, but many investors will see little between them. In both cases a seasoned CEO has been shown to poorly anticipate changes in a business in which he’s spent his entire career. If Greg Armstrong didn’t see it coming, it’s hardly surprising that PAGP investors didn’t either.

We are invested in PAGP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Could you comment on your decision about the investment, given that while EBITDA is now guided lower, so is the valuation of the units – significantly so.

We think it’s a good investment here although there may be some further near term weakness given the surprise PAGP provided investors.

Thank you for the reply. I appreciate your blog content!

And you did God’s work with Hedge Fund Mirage.

You’re very kind, thank you.

Simin—do you have confidence in Armstrong going forward? You mention above that you think PAGP is a good investment here. Can you elaborate? Thanks

Yes — they just missed this one. But at least Greg’s straight in his dealings with shareholders, unlike Kelcy Warren for example.

Simon — Any comment/thoughts on Armstrong’s open market buying of PAGP in June and August? ~100K shares, taking his holdings to ~700K shares. About $2M in cost. Could PAGP be loaning him the money?

I have no idea but I highly doubt it. It would be misleading and I think Greg Armstrong can pretty easily fund a $2MM investment anyway.