Shale Drillers Find Efficiency Isn't Rewarded

Master Limited Partnerships (MLPs) have been reporting earnings over the past couple of weeks. For the most part they have come in as expected, with few surprises in either direction. Crestwood (CEQP) and Tallgrass (TEGP) both reported system volumes slightly higher than expected; generally though, they were unremarkable, which is the sort of boring stability MLP investors like. Although most CEOs are pretty sure their stock is undervalued, TEGP CEO David Dehaemers is positively convinced this is the case. And since TEGP sports a 5.25% yield forecast to grow by 40% (not a misprint) in 2018, his case appears compelling to us.

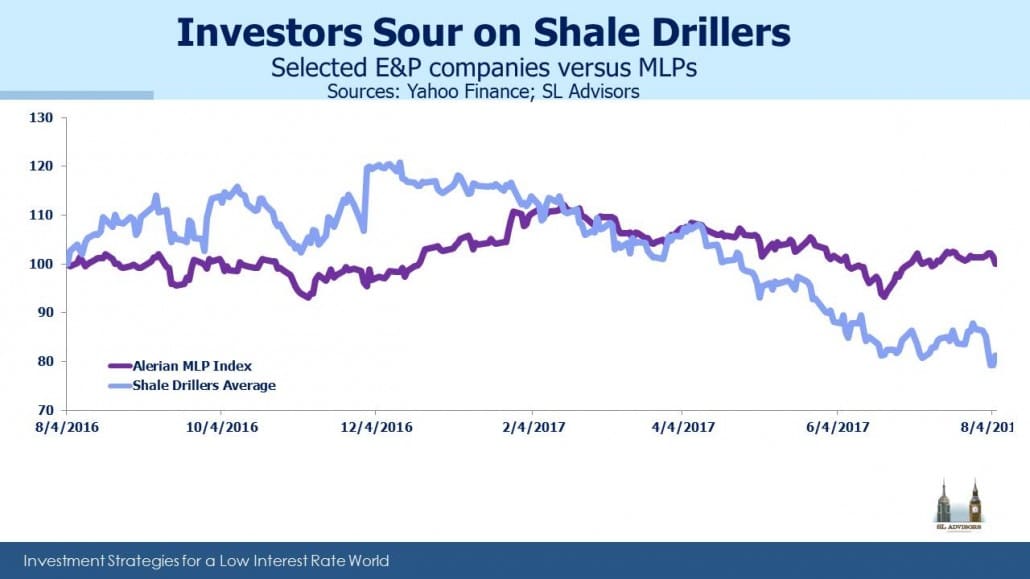

The real story of the past week is not MLPs but their customers, who we also follow closely. MLP investors may feel that their patience is being tested, as the sector gyrates with crude oil while persistently refusing to appreciate as its high yields imply it should. At least MLP investors are being rewarded to wait, with attractive quarterly distributions being paid in many cases during August. Even so, the trailing one year return on the Alerian Index of 2% seems paltry compared with the S&P500, whose one year return is 16%. MLP investors might feel unloved. In the classic British sitcom Fawlty Towers, manic hotel owner John Cleese is told not to worry, that there’s always someone else worse off. To which he replies, “Is there really. Well I’d like to meet him, I could do with a laugh.” You can see the clip here at the 18 minute mark.

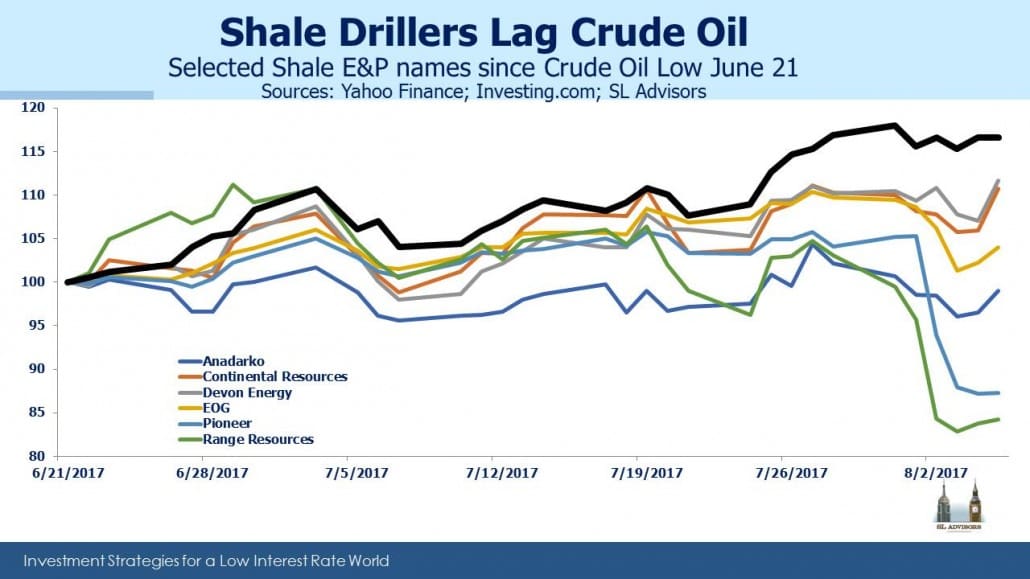

Therefore, the recent performance of U.S. shale drillers is worth considering, albeit with less shadenfreude than John Cleese. They are the customers of MLPs, and the regularly demonstrated efficiencies with which they extract hydrocarbons are not, of late, rewarding their investors. Over the past year, the six most active independent shale drillers have returned -21%. 2Q17 earnings reports over the past couple of weeks have hastened this slide, as future production growth has been guided down. The announced capex reductions across the exploration and production sector (see Financial Discipline Among MLP Customers) have helped boost crude prices by around $6 a barrel since June 21. However, lower guidance from the six names highlighted is in most cases due to specific technical challenges they’re encountering and resolving. They’re not reporting that margins are too tight. Nonetheless, in such a market investors want every name in the group except the ones they hold to produce less.

Weakness in the stock prices of shale drillers may be weighing on MLPs. Energy infrastructure inevitably trades with the sector it supports. Kinder Morgan (KMI) is in XLE, the energy sector ETF. Swings in sentiment inevitably move its price regardless of its fundamentals.

A piece of good news that didn’t receive much attention was Senate approval of two new commissioners to the Federal Energy Regulatory Commission (FERC). This will restore their quorum, and should allow a substantial backlog (estimated by RW Baird at $14BN) of infrastructure projects to receive approvals and proceed. Their completion will add incrementally to the cashflows of their owners and ultimately augment payouts to investors.

We are invested in CEQP, KMI ad TEGP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It is incredibly frustrating for MLP investors that unit prices decline–in some cases dramatically–without equally negative fundamentals. Fortunately we are being paid to wait, but we should not calculate our returns on a total return basis.