Gas Production Is Our Strategic Advantage

/

Williams Companies’ (WMB) youthful President and CEO Chad Zamarin gave an inspiring presentation to kick of their Investor Day last week. He described US energy infrastructure as a blessing, and natural gas as our competitive advantage. Zamarin traced the company’s origins back to World War II, when German U-boats were sinking US ships transporting fuel from the Gulf to New York, imperiling the war effort.

The construction of War Emergency Pipelines was contracted by the Federal government, and within a year fuel was moving by pipeline from Texas to New York. Zamarin thinks we need a similar sense of urgency today around infrastructure. For example, their Atlantic Sunrise project went into service in 2018, but 13 years of litigation surrounding the project only finished last year.

John Williams led Williams Brothers, founded in 1908 and one of the key construction companies on the war-time project. D-Day might not have been possible without it, and naturally Williams subsequently saw combat with the D-Day landings.

After the war, Williams Brothers moved from construction to pipeline operations and became Williams Companies. Cementing his legacy as a member of the Greatest Generation, the pipeline John Williams built is still in service today, showing the long-lived nature of midstream assets when properly maintained.

In 1947, the pipeline was sold by the Federal government to Texas Eastern Transmission, now a subsidiary of Enbridge. Chad Zamarin tells the 118-year story of Williams Companies like a political candidate, and at 48 has plenty of runway ahead of him if he ultimately runs for public office. He described their financial goals as not an aspiration but a destination.

This sector needs inspirational leaders, and Zamarin can marshall solid fundamentals into a compelling vision.

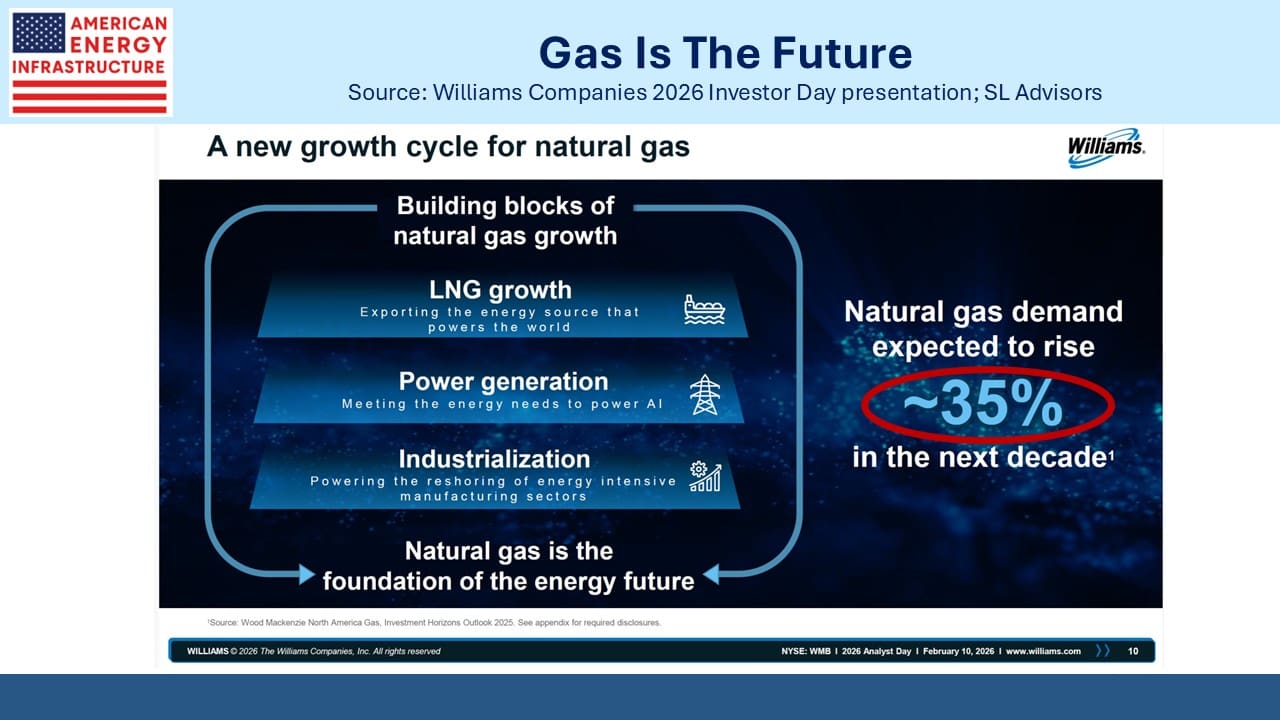

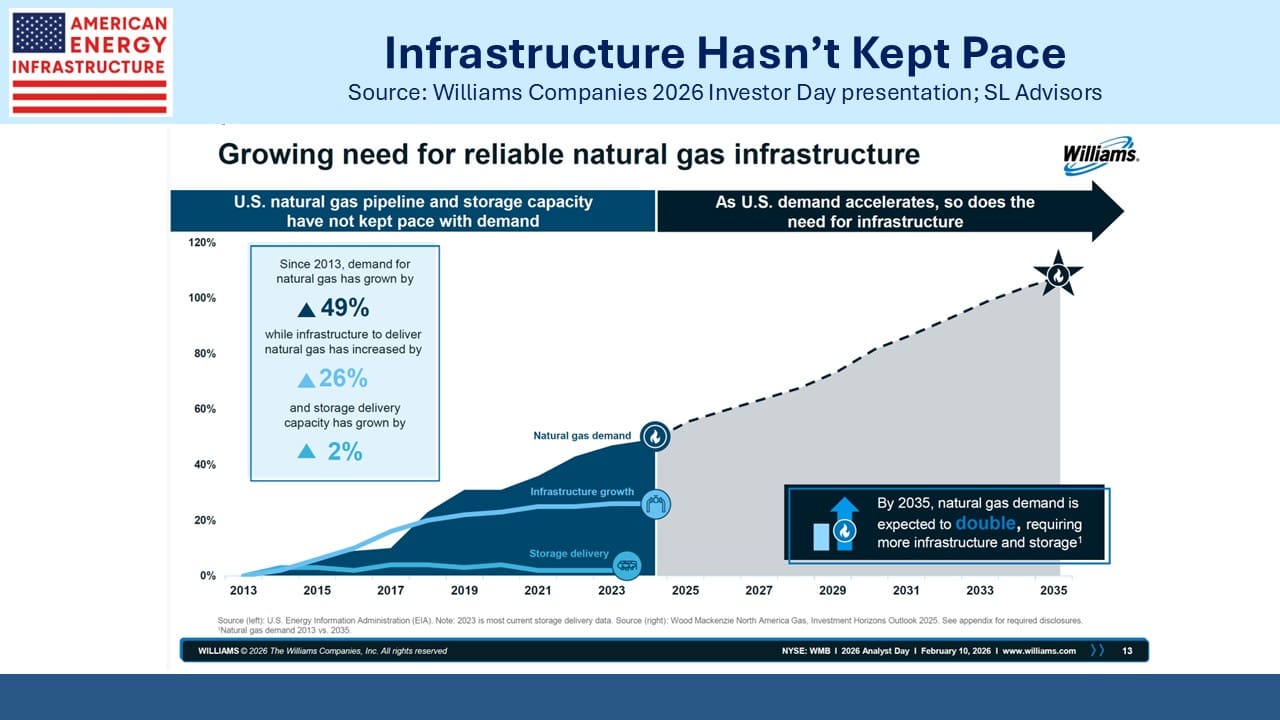

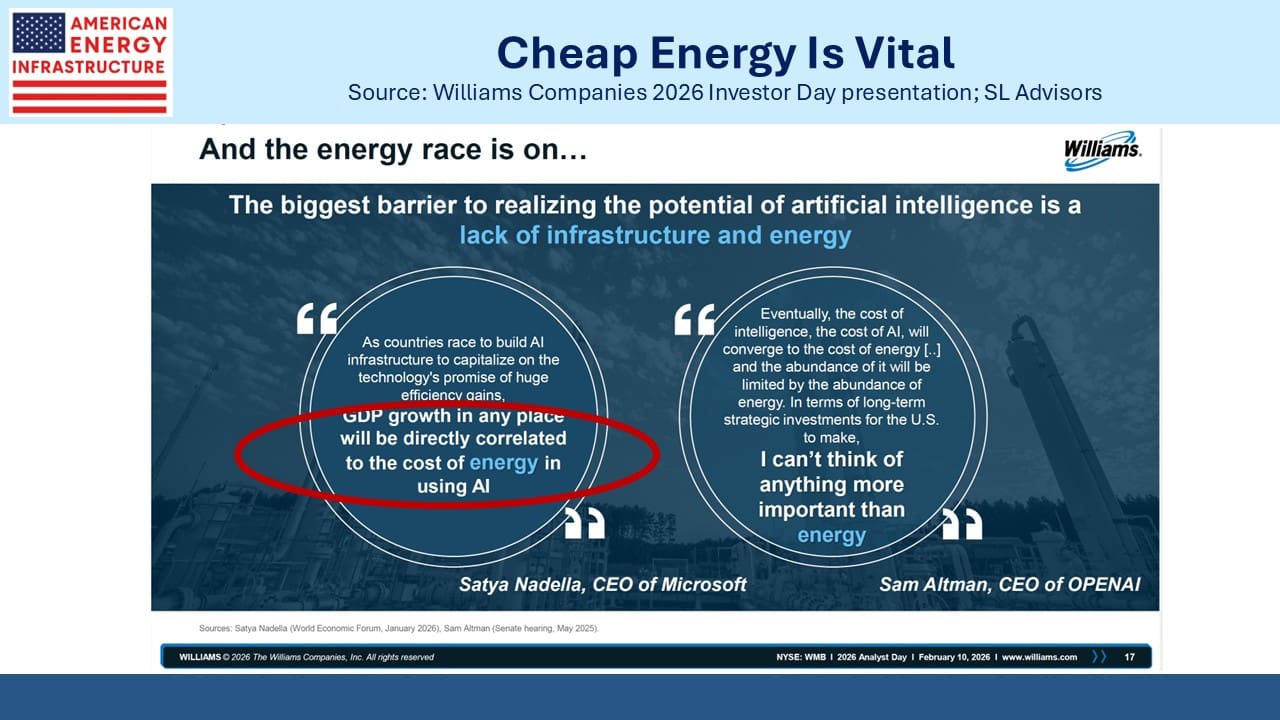

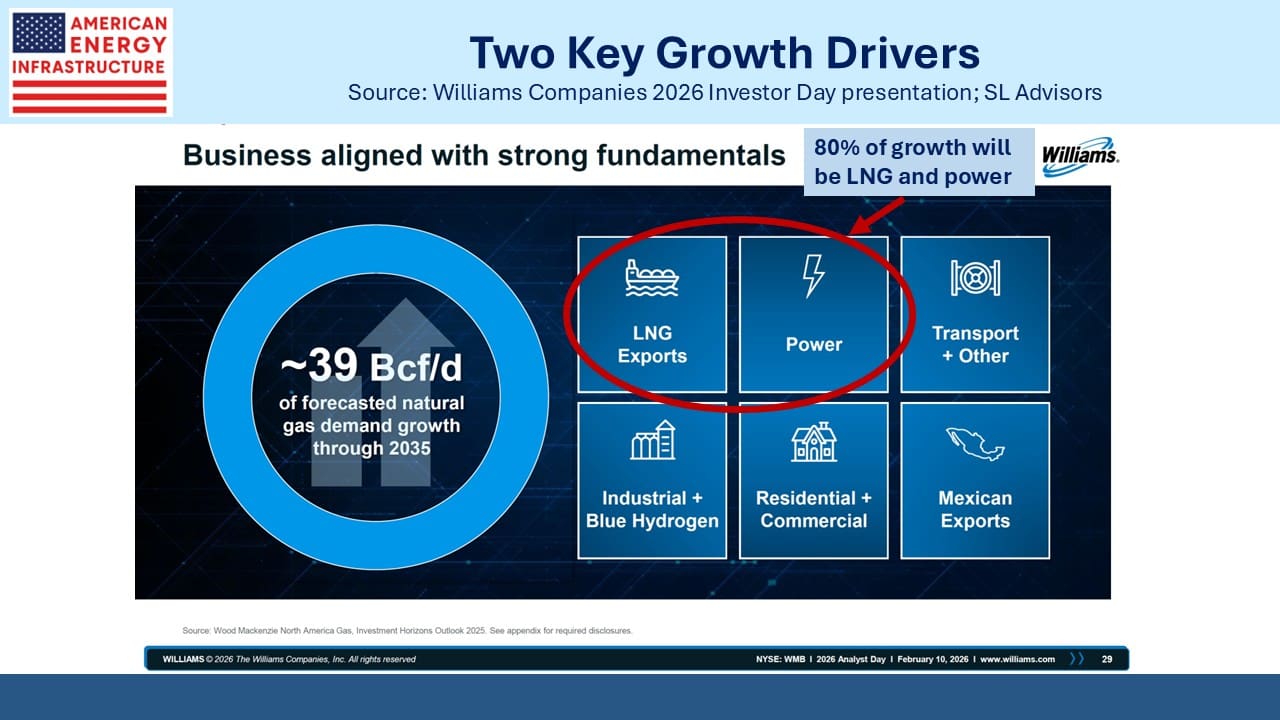

Having chronicled the company’s history, Zamarin walked through the strong fundamentals underpinning the natural gas business. Powering data centers and LNG exports are the two big drivers of natural gas demand, along with resurgent US manufacturing due to cheap domestic energy. Natural gas demand is expected to rise by 35% over the next decade.

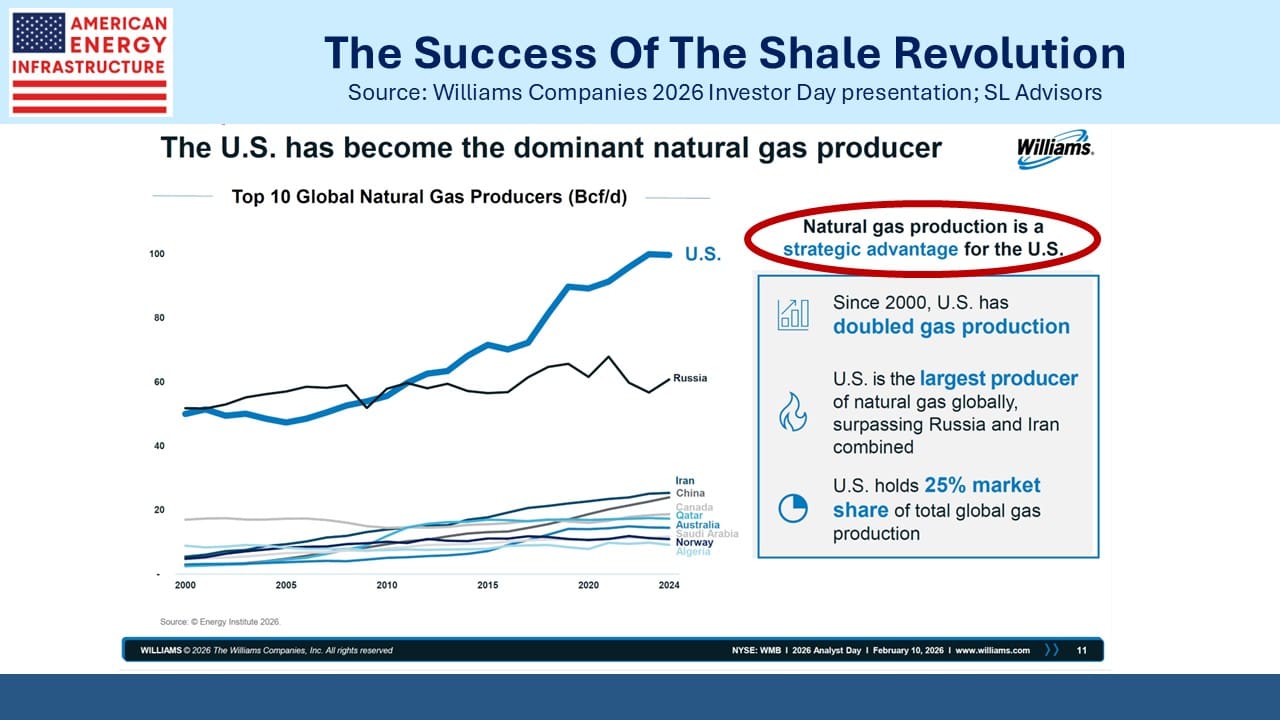

The doubling of US gas production so far this century is the most important change in the global gas market. We surpassed Russia as the biggest producer fifteen years ago and now hold a 25% market share.

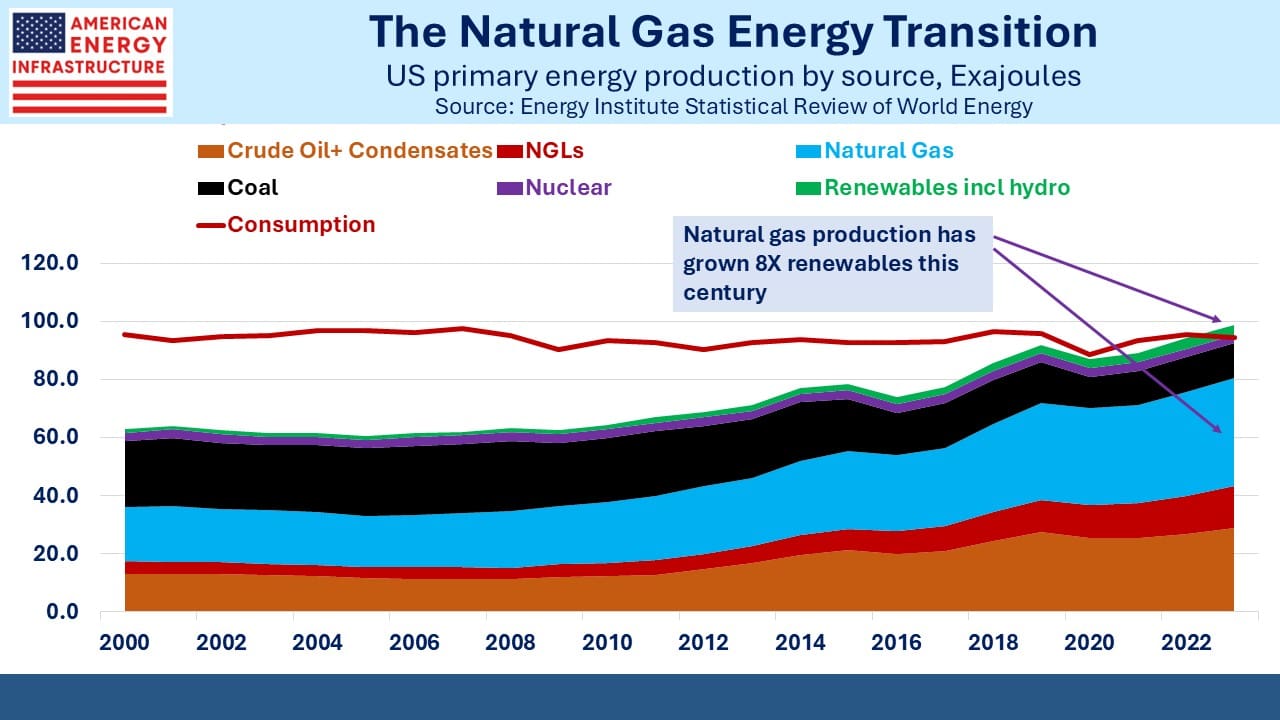

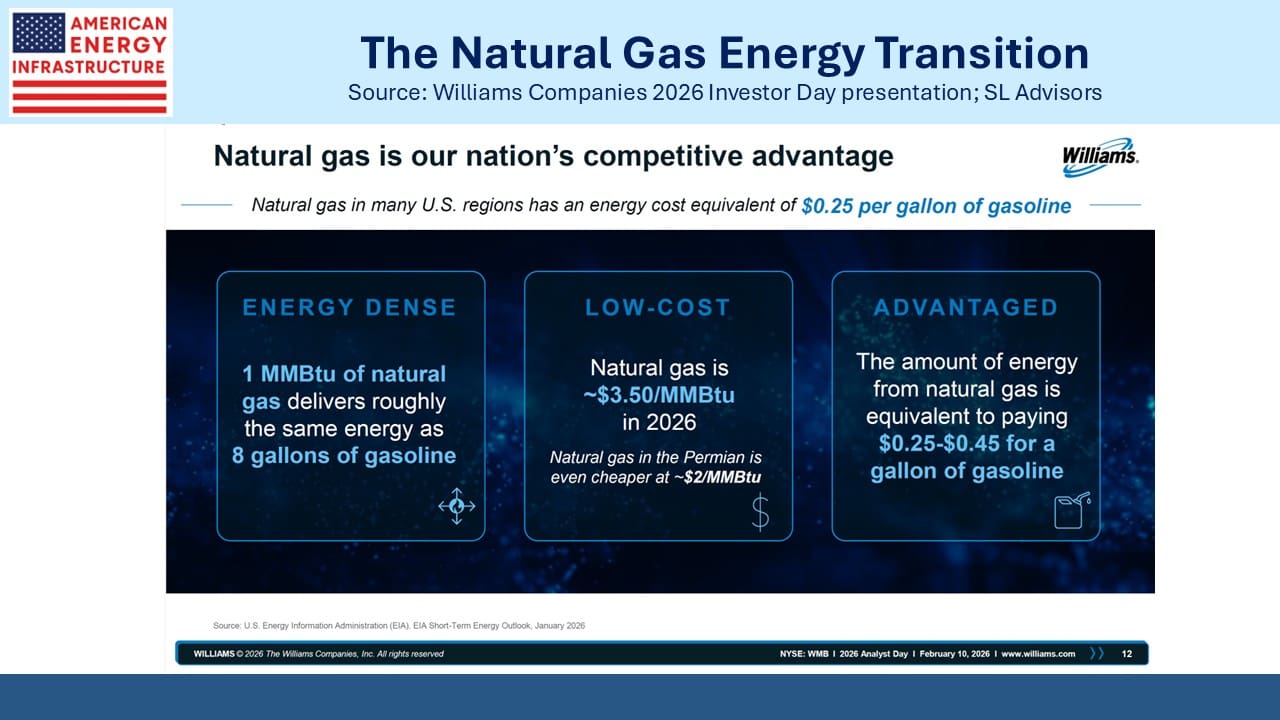

Gas is cheap and energy dense, which is why we often note that the true energy transition in the US is the one towards natural gas, whose output has grown 8X as much as renewables on an energy equivalent basis since 2000. It’s by far our most important source of power generation. Following Russia’s invasion of Ukraine, the US doubled LNG exports to the EU. No other country could do that.

WMB builds energy infrastructure, and Zamarin pressed the case for permitting reform which has widespread industry support but is still short of votes in Congress. He noted that winter gas prices are significantly higher in New England than the rest of the nation, a result of regional constraints on new infrastructure that raise prices for consumers.

In the Q&A in response to a question about the importance of permitting reform, Zamarin cited gas prices in New England that reached $200 per Million BTUs, more than 50X the price in gas-producing Pennsylvania. He argued that price spikes in gas are caused by inadequate infrastructure.

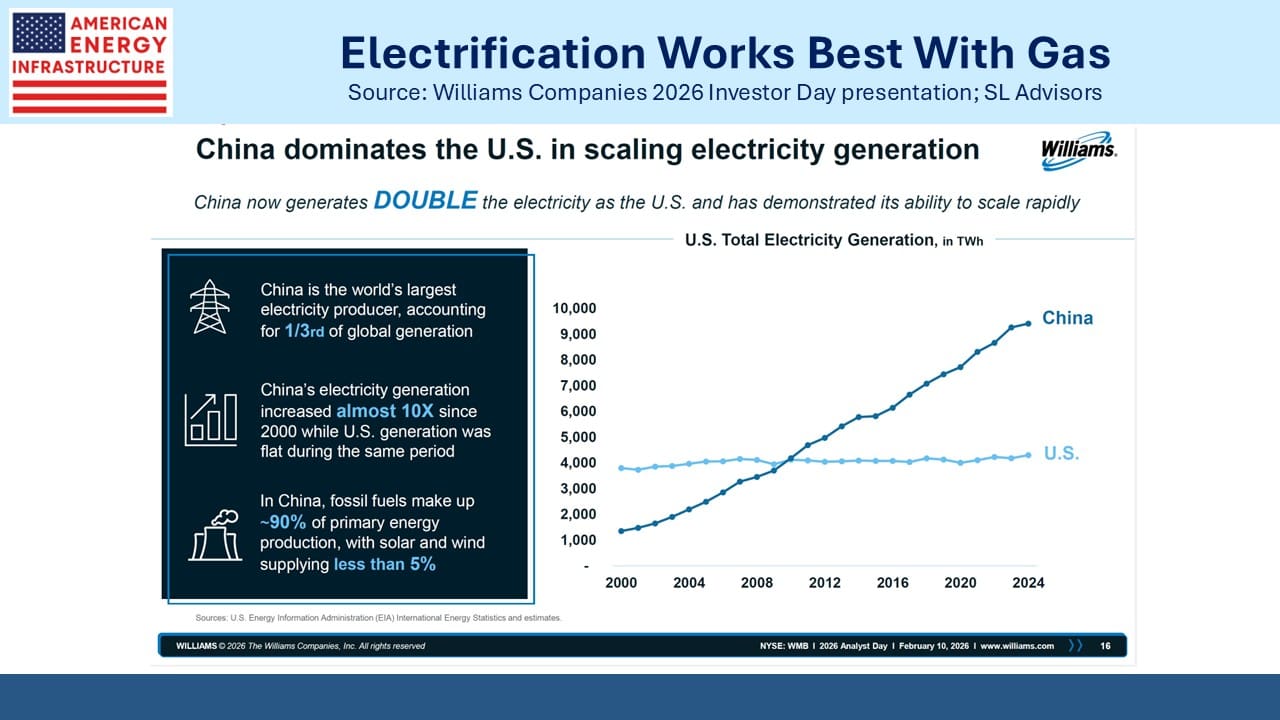

China produces more than 2X the electricity as the US, up almost 10X over the past quarter century. The global AI race will turn on who has the cheapest, most accessible electricity for data centers. This makes improved access to natural gas a national security imperative.

You’d expect the CEO of a gas pipeline company to make this argument. But it’s one that’s likely to find support in Washington, and as investors, we find the tailwind of regulatory support another reason to commit capital to the sector.

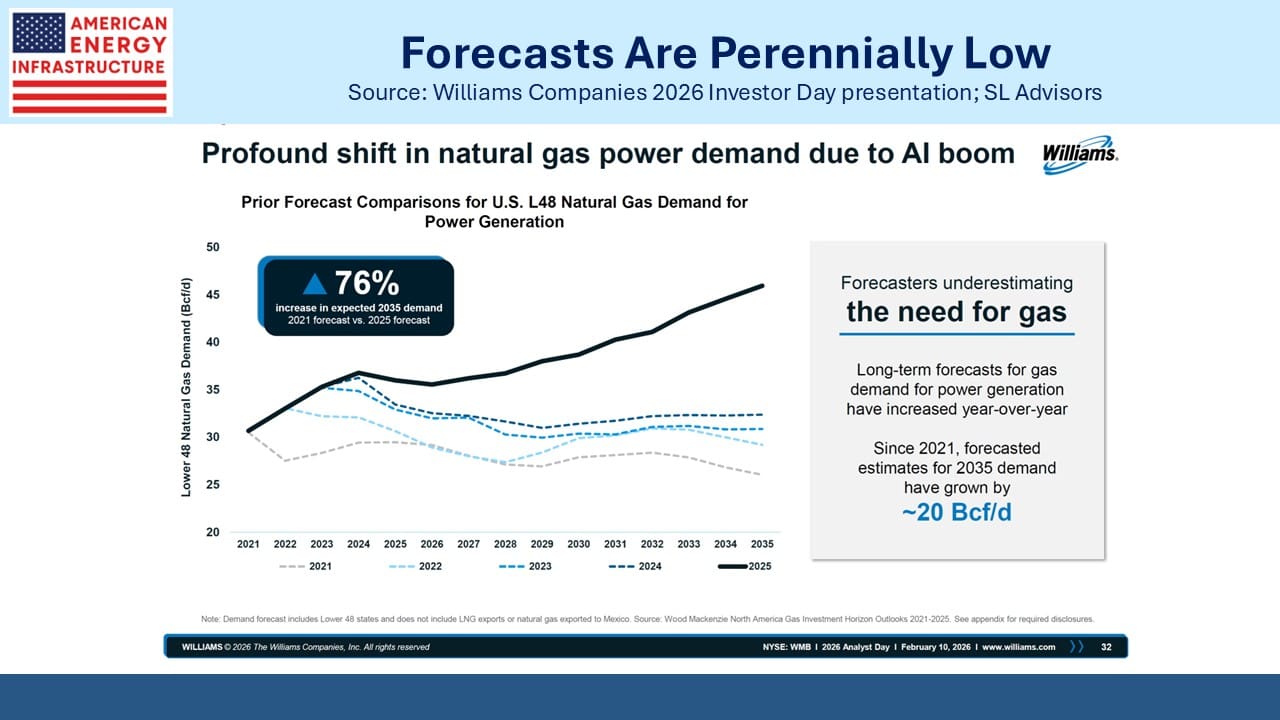

Over the years we’ve found that forecasts of natural gas demand have been consistently too low. Many have lazily bought into the narrative that electricity generation from renewables undercuts traditional power, in spite of abundant evidence from Germany, the UK and California among others that when climate change dominates energy policy, consumers pay more.

The result is that gas demand forecasts keep getting revised up. They’re probably still too low. Apart from the US, the world has barely begun to displace coal with gas for power generation. This has been our biggest source of emissions reduction, and while US policy currently dismisses greenhouse gases as a problem, many other countries disagree.

As countries buy more US LNG to reduce their coal consumption and fight climate change, this White House should retain enough intellectual agility to have no problem supporting that.

The US natural gas story remains compelling, and we think WMB represents a good way to gain exposure to it.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!