Gas Production Is Our Strategic Advantage

Williams Companies’ (WMB) youthful President and CEO Chad Zamarin gave an inspiring presentation to kick of their Investor Day last week. He described US energy infrastructure as a blessing, and natural gas as our competitive advantage. Zamarin traced the company’s origins back to World War II, when German U-boats were sinking US ships transporting fuel from the Gulf to New York, imperiling the war effort.

The construction of War Emergency Pipelines was contracted by the Federal government, and within a year fuel was moving by pipeline from Texas to New York. Zamarin thinks we need a similar sense of urgency today around infrastructure. For example, their Atlantic Sunrise project went into service in 2018, but 13 years of litigation surrounding the project only finished last year.

John Williams led Williams Brothers, founded in 1908 and one of the key construction companies on the war-time project. D-Day might not have been possible without it, and naturally Williams subsequently saw combat with the D-Day landings.

After the war, Williams Brothers moved from construction to pipeline operations and became Williams Companies. Cementing his legacy as a member of the Greatest Generation, the pipeline John Williams built is still in service today, showing the long-lived nature of midstream assets when properly maintained.

In 1947, the pipeline was sold by the Federal government to Texas Eastern Transmission, now a subsidiary of Enbridge. Chad Zamarin tells the 118-year story of Williams Companies like a political candidate, and at 48 has plenty of runway ahead of him if he ultimately runs for public office. He described their financial goals as not an aspiration but a destination.

This sector needs inspirational leaders, and Zamarin can marshall solid fundamentals into a compelling vision.

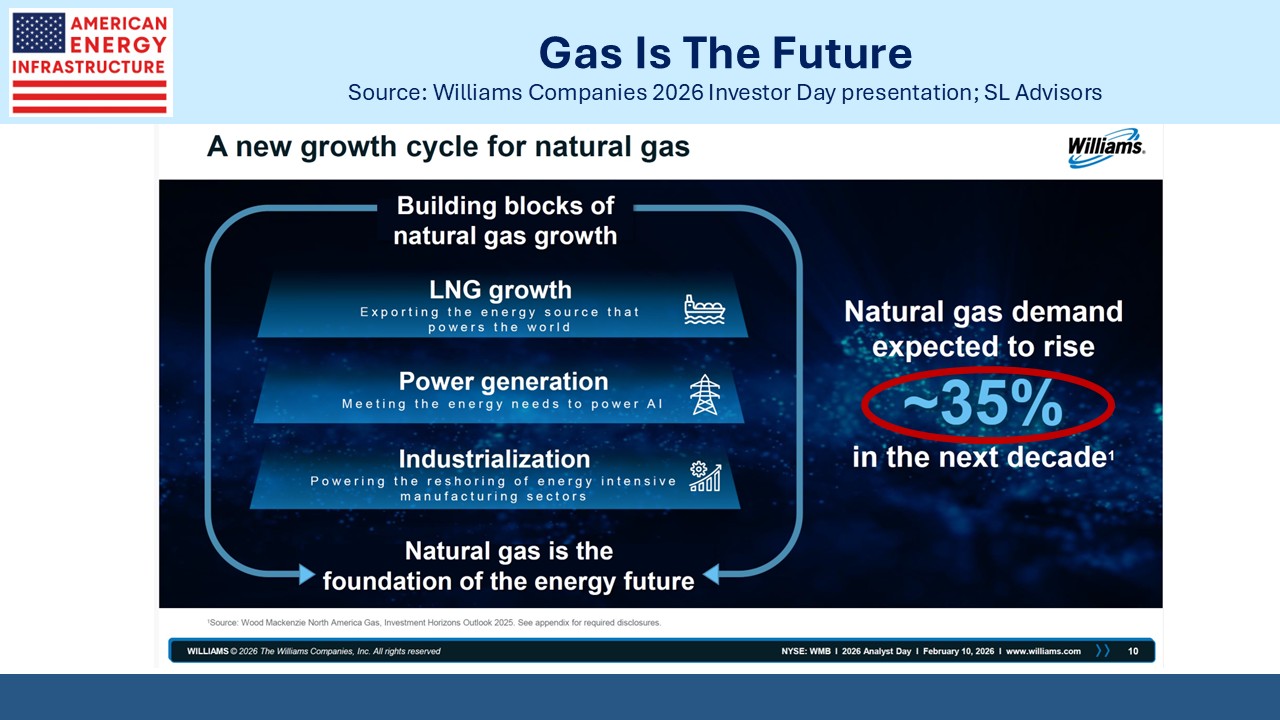

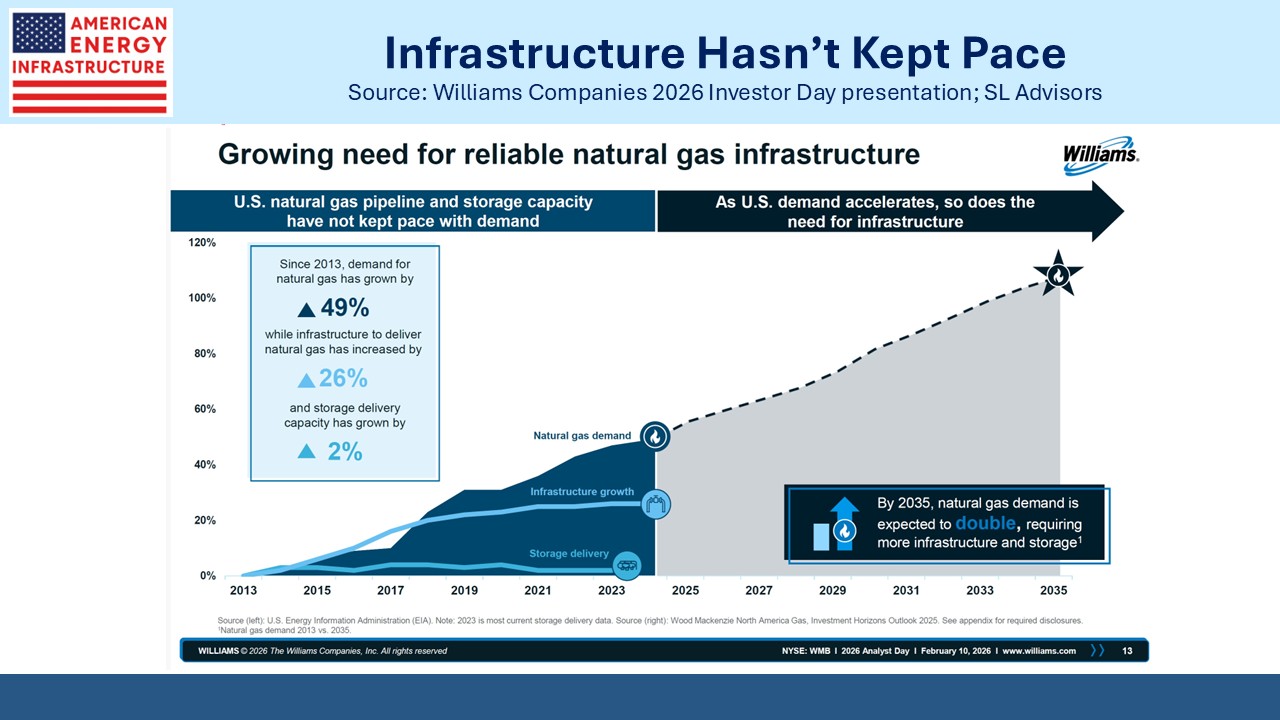

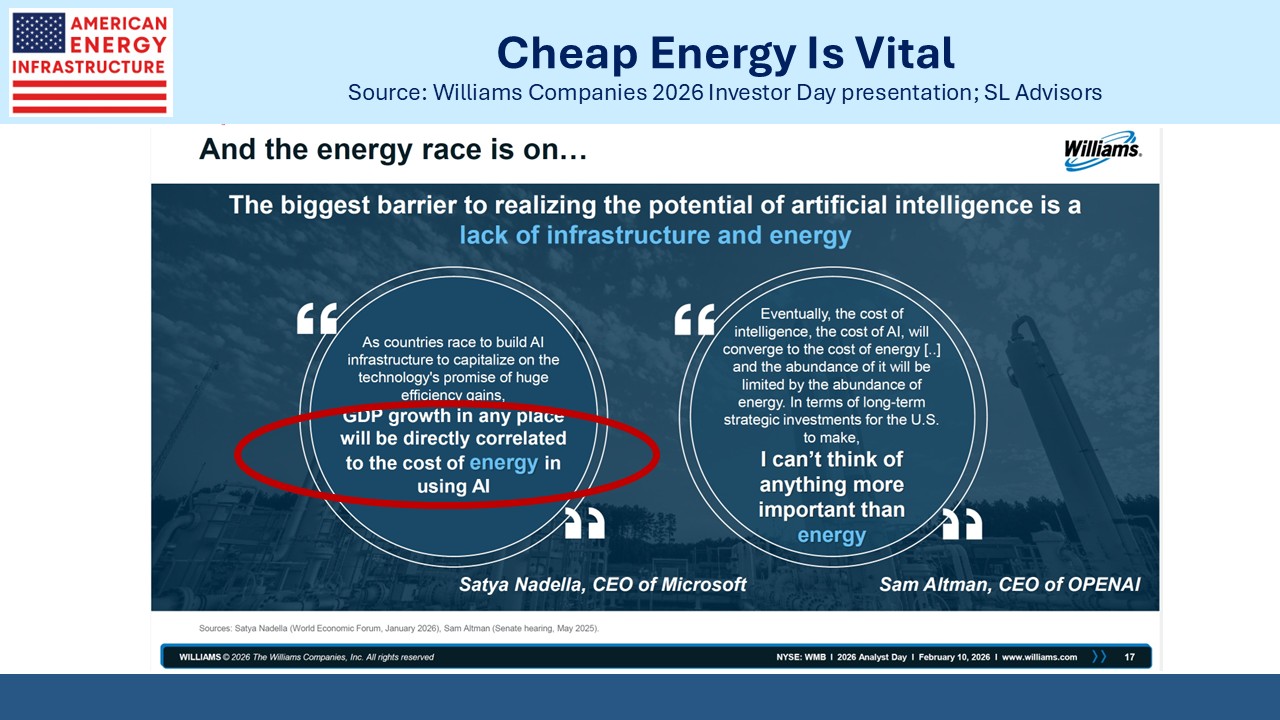

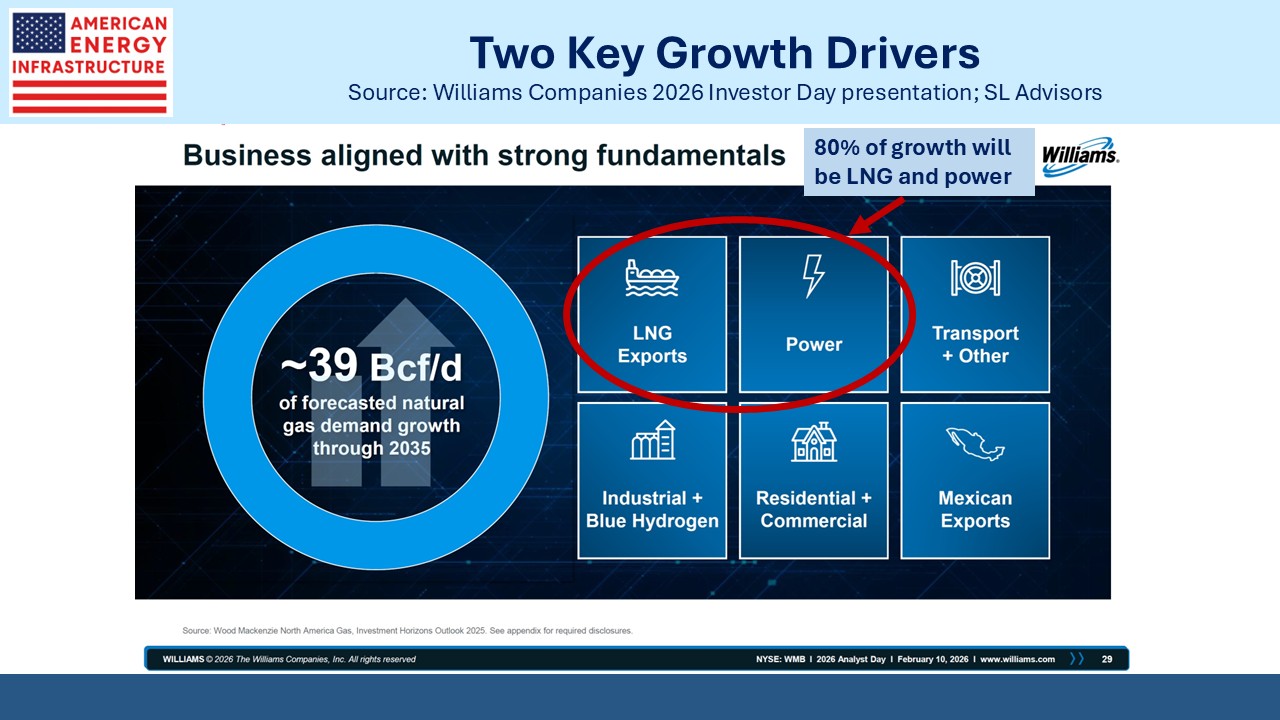

Having chronicled the company’s history, Zamarin walked through the strong fundamentals underpinning the natural gas business. Powering data centers and LNG exports are the two big drivers of natural gas demand, along with resurgent US manufacturing due to cheap domestic energy. Natural gas demand is expected to rise by 35% over the next decade.

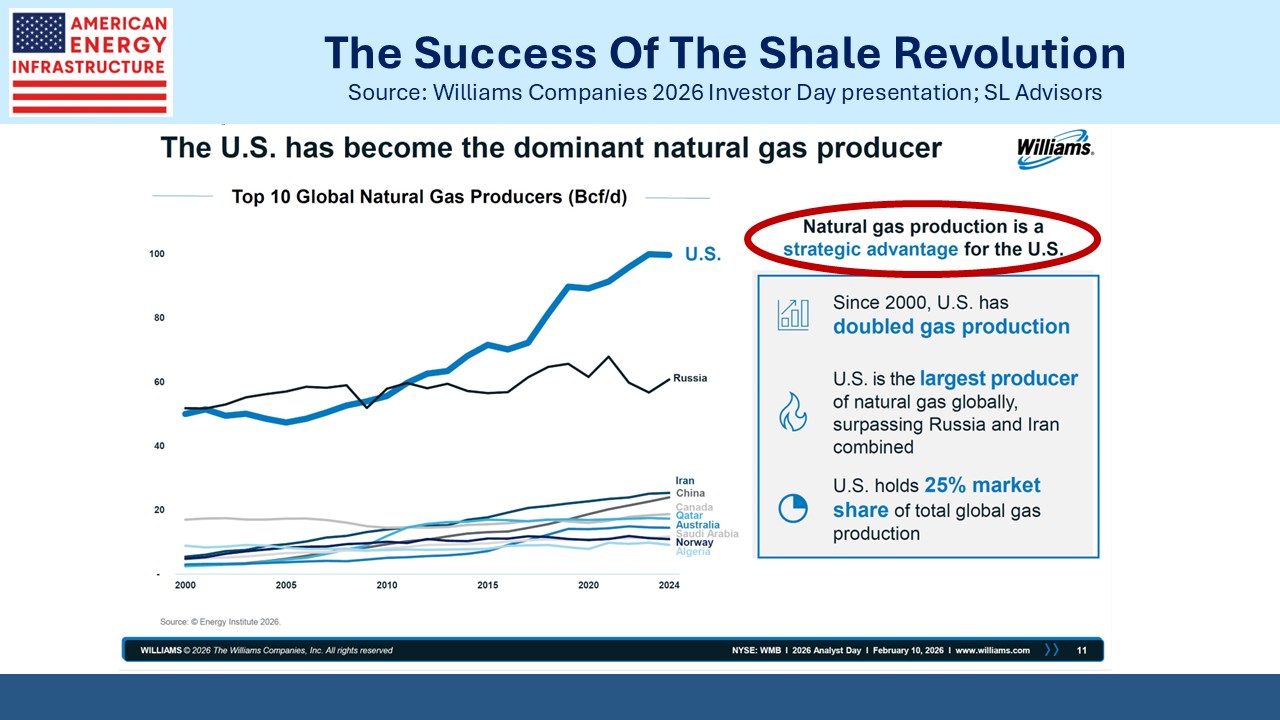

The doubling of US gas production so far this century is the most important change in the global gas market. We surpassed Russia as the biggest producer fifteen years ago and now hold a 25% market share.

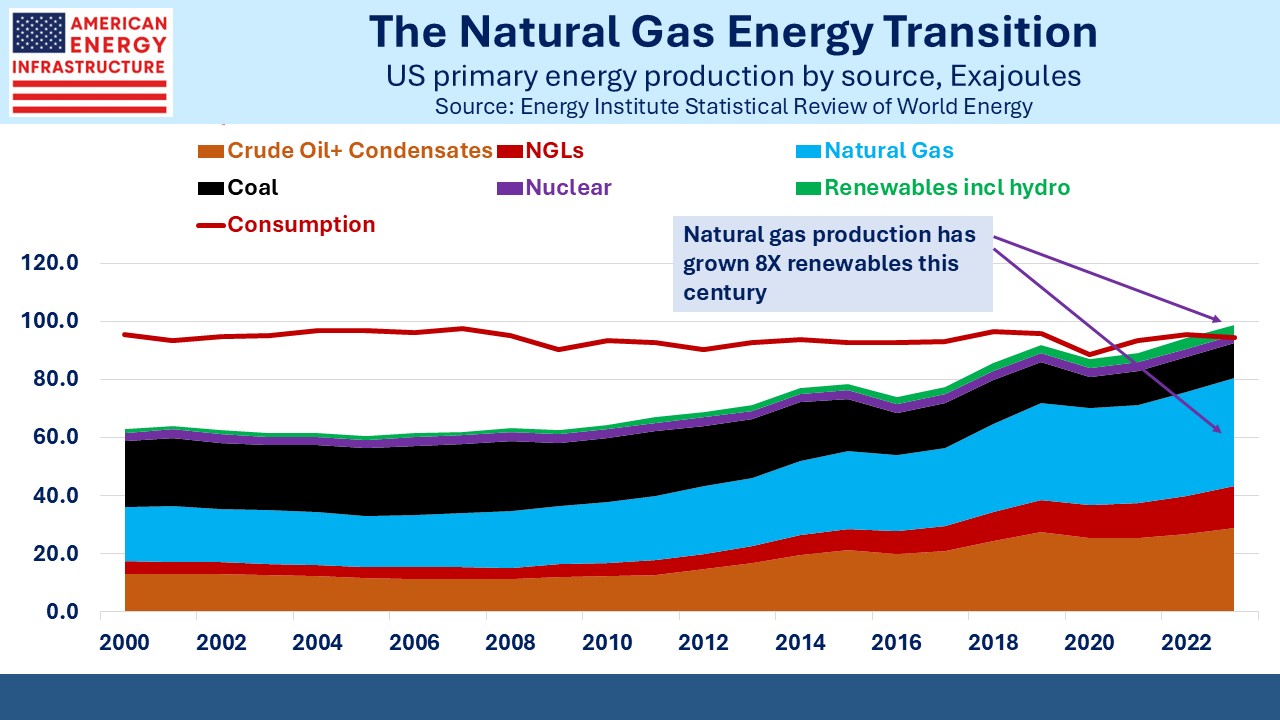

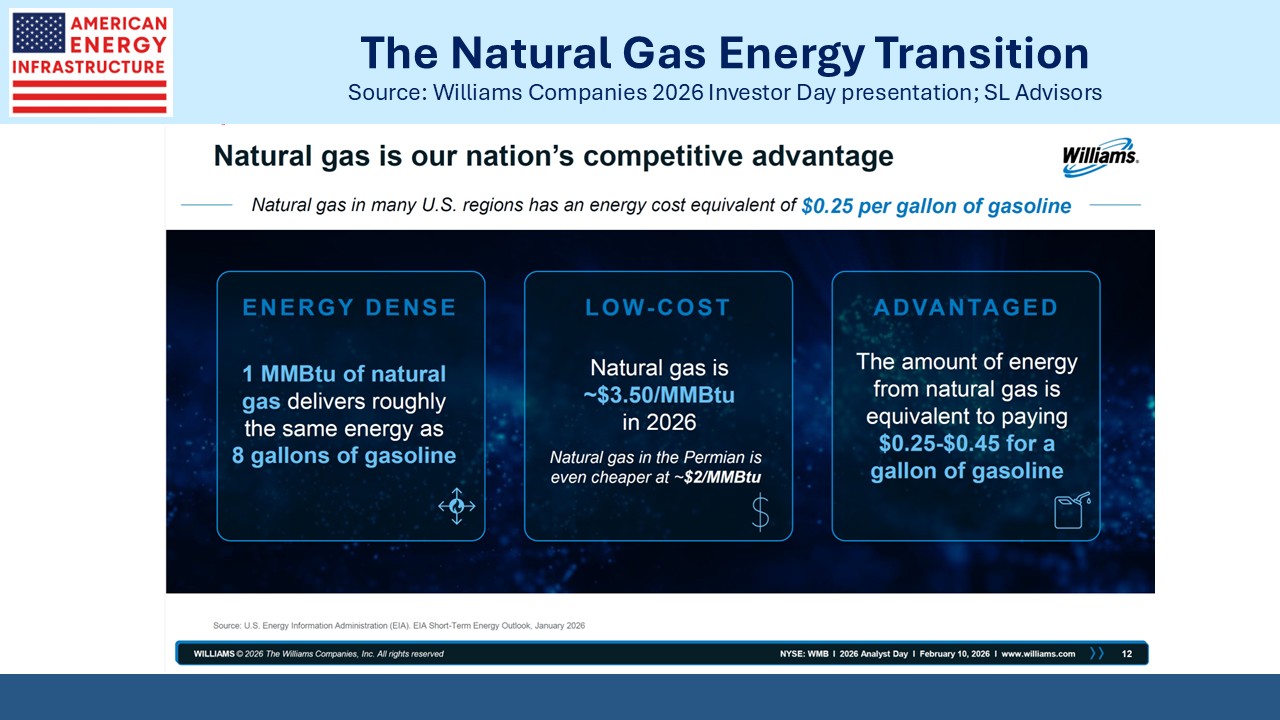

Gas is cheap and energy dense, which is why we often note that the true energy transition in the US is the one towards natural gas, whose output has grown 8X as much as renewables on an energy equivalent basis since 2000. It’s by far our most important source of power generation. Following Russia’s invasion of Ukraine, the US doubled LNG exports to the EU. No other country could do that.

WMB builds energy infrastructure, and Zamarin pressed the case for permitting reform which has widespread industry support but is still short of votes in Congress. He noted that winter gas prices are significantly higher in New England than the rest of the nation, a result of regional constraints on new infrastructure that raise prices for consumers.

In the Q&A in response to a question about the importance of permitting reform, Zamarin cited gas prices in New England that reached $200 per Million BTUs, more than 50X the price in gas-producing Pennsylvania. He argued that price spikes in gas are caused by inadequate infrastructure.

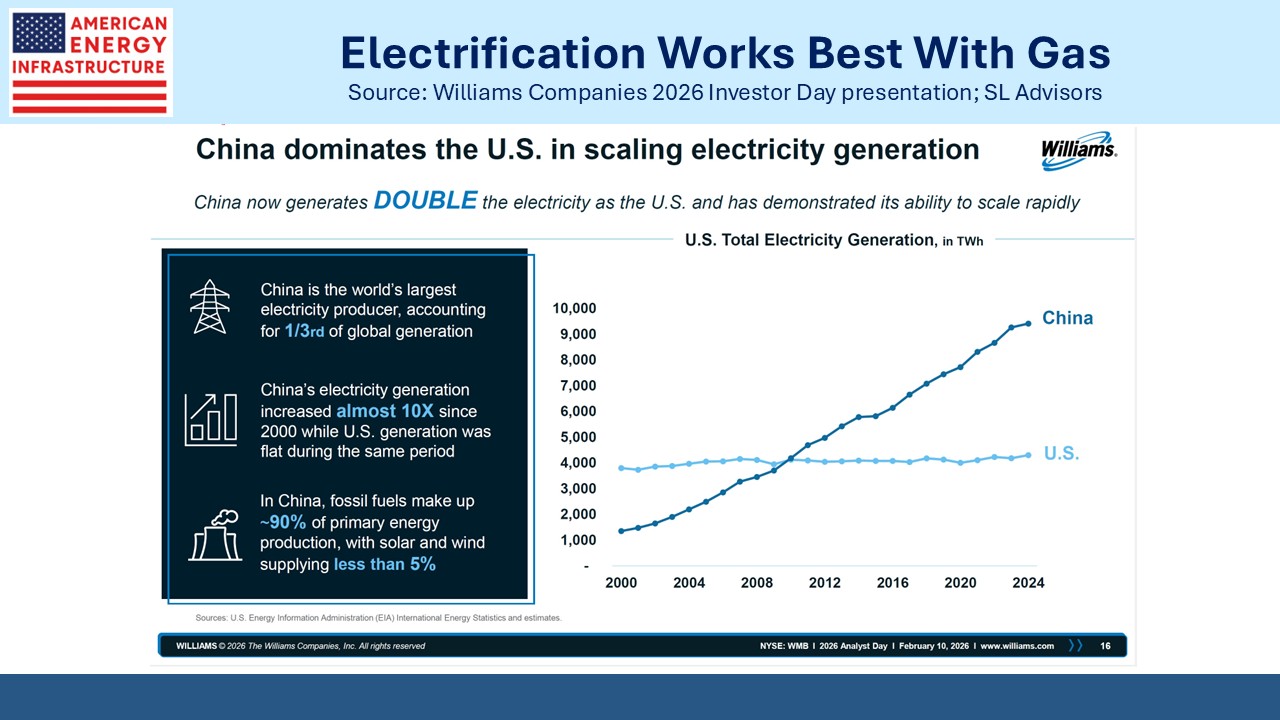

China produces more than 2X the electricity as the US, up almost 10X over the past quarter century. The global AI race will turn on who has the cheapest, most accessible electricity for data centers. This makes improved access to natural gas a national security imperative.

You’d expect the CEO of a gas pipeline company to make this argument. But it’s one that’s likely to find support in Washington, and as investors, we find the tailwind of regulatory support another reason to commit capital to the sector.

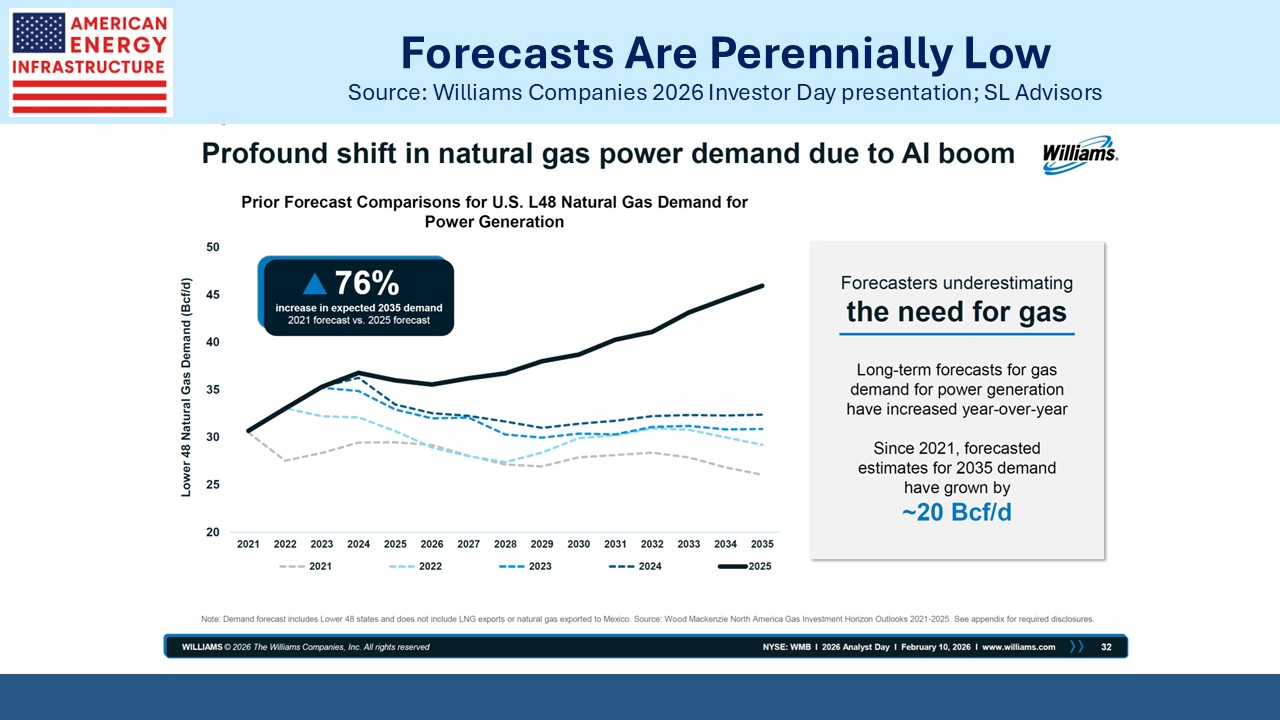

Over the years we’ve found that forecasts of natural gas demand have been consistently too low. Many have lazily bought into the narrative that electricity generation from renewables undercuts traditional power, in spite of abundant evidence from Germany, the UK and California among others that when climate change dominates energy policy, consumers pay more.

The result is that gas demand forecasts keep getting revised up. They’re probably still too low. Apart from the US, the world has barely begun to displace coal with gas for power generation. This has been our biggest source of emissions reduction, and while US policy currently dismisses greenhouse gases as a problem, many other countries disagree.

As countries buy more US LNG to reduce their coal consumption and fight climate change, this White House should retain enough intellectual agility to have no problem supporting that.

The US natural gas story remains compelling, and we think WMB represents a good way to gain exposure to it.

We have two have funds that seek to profit from this environment: