Good News On Climate

/

To be a climate scientist means to live with a dour outlook. The news is never good. We’re always at a tipping point beyond which irreversible damage to the planet will result. Humanity may die out.

Therefore, it was cheering to find some good news in the International Energy Agency’s (IEA) World Outlook 2025, albeit not something the report’s authors highlighted.

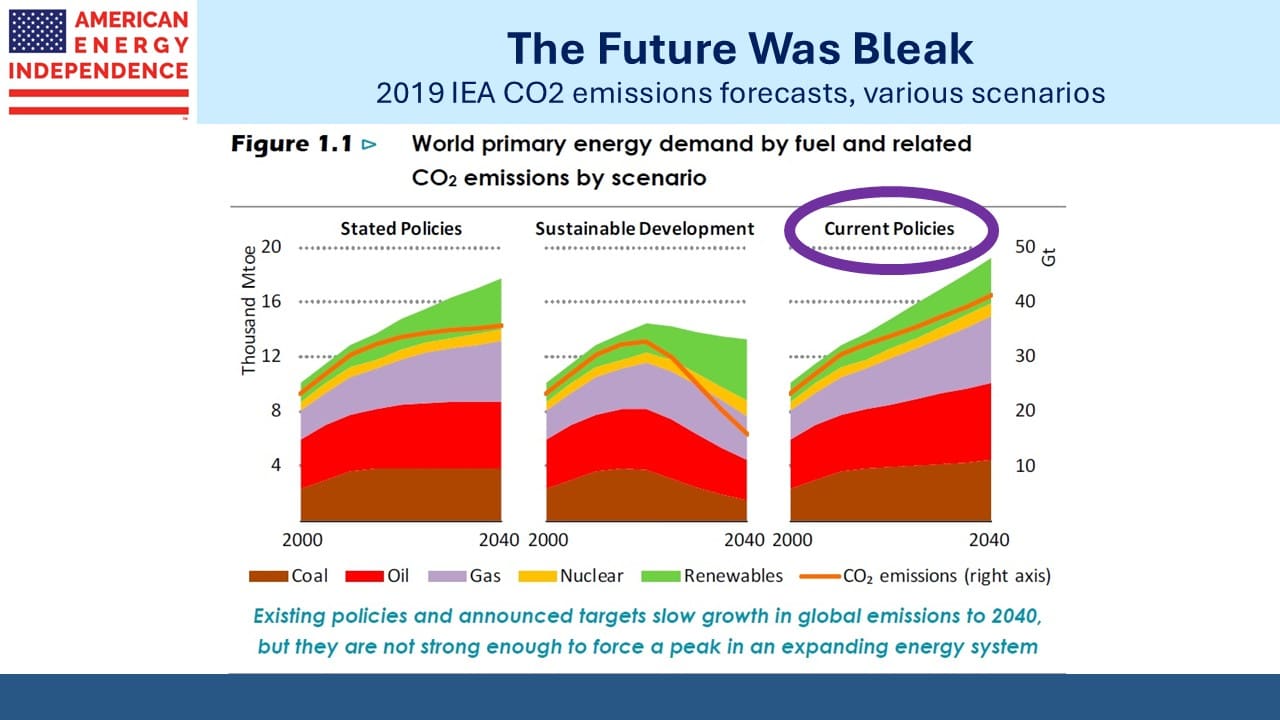

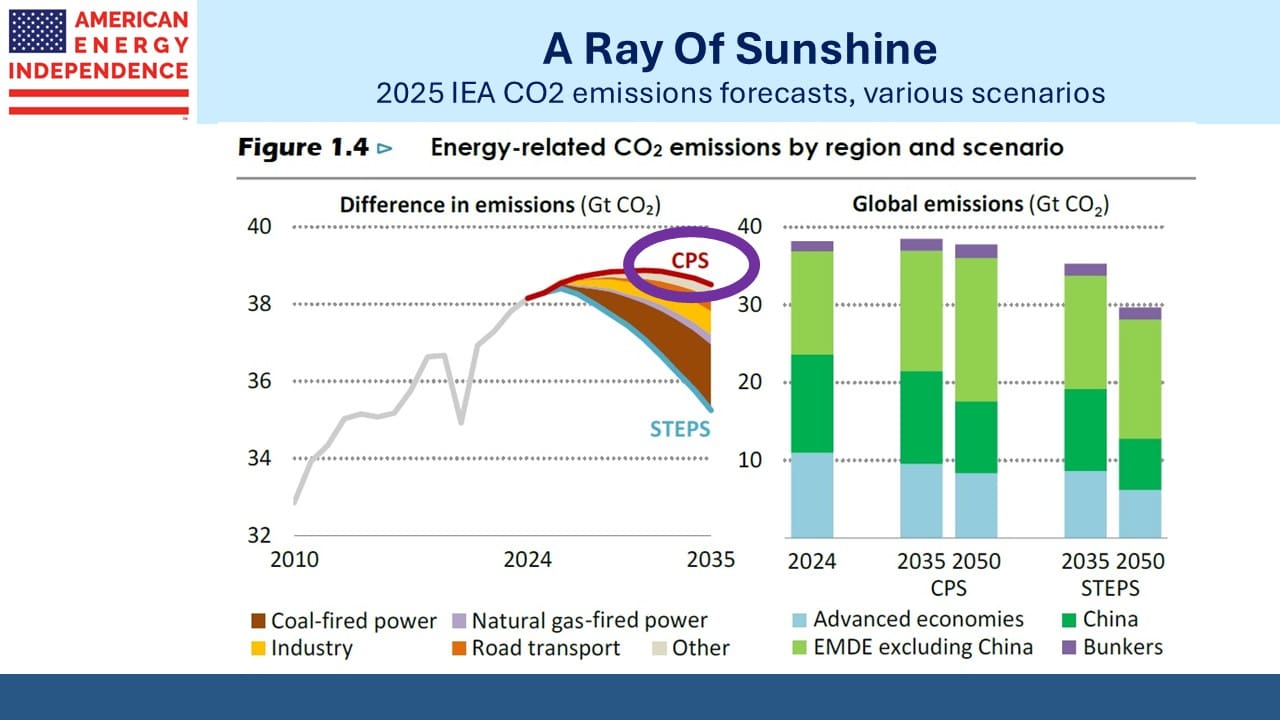

In recent years, the IEA has presented various scenarios that are aspirational and have little relevance to what is really happening. In 2020 they dropped the Current Policies Scenario (CPS), which was the only one worth considering. The IEA became an expensive, irrelevant left-wing renewables advocate. US Energy Secretary Chris Wright wondered whether the 14% of the IEA’s budget we fund was money well spent. Consequently, the CPS has returned.

CPS just assumes existing policies stay in place. By contrast, the Stated Policies scenario assumes governments would do what they’d promised. The Sustainable Development scenario is just fantasy and so a waste of time.

But if you look carefully at the two charts, you’ll see that in 2019 the CPS envisaged Greenhouse Gas emissions (GHGs) rising steadily to almost 50 Gigatonnes (GTs) by 2040. Six years later, the current CPS sees GHGs peaking at below 40 GTs within the next decade.

The CPS has generally been too pessimistic on GHGs, so the forecast peak has a decent chance of being right. Few climate scientists are celebrating, because we’re drifting farther away from the Zero by 2050 goal that was agreed at the COP21 in Paris in 2015. It was an implausible goal, wildly inconsistent with the aspirations of emerging economies to raise living standards and use more energy.

Nonetheless, a peak in GHGs is good news. We should recognize it as such.

Perhaps some of those young people who think the future is too awful to contemplate having children will indulge their animal spirits and be moved towards a little more procreation.

The IEA’s outlook sees increased electricity consumption for data centers, EVs and rising global living standards. This is all good for natural gas demand. Like some other forecasters, the IEA thinks we’ll have a glut of LNG in the years ahead. This view continues to depress sentiment around LNG exporters.

This just seems implausible to us. Cheniere has contracted 95% of its liquefaction capacity through 2035. The inference of the oversupply thesis is that many of the Sale/Purchase Agreements Cheniere and other exporters have signed are with relatively unsophisticated buyers who will get stuck with expensive LNG.

More likely is that they have end users lined up. Regassification capacity, required to turn LNG back into gas so it can be consumed, is also growing at roughly the same pace as export capacity and is around twice as big.

The world is preparing to buy more LNG, just as the US is preparing to sell more.

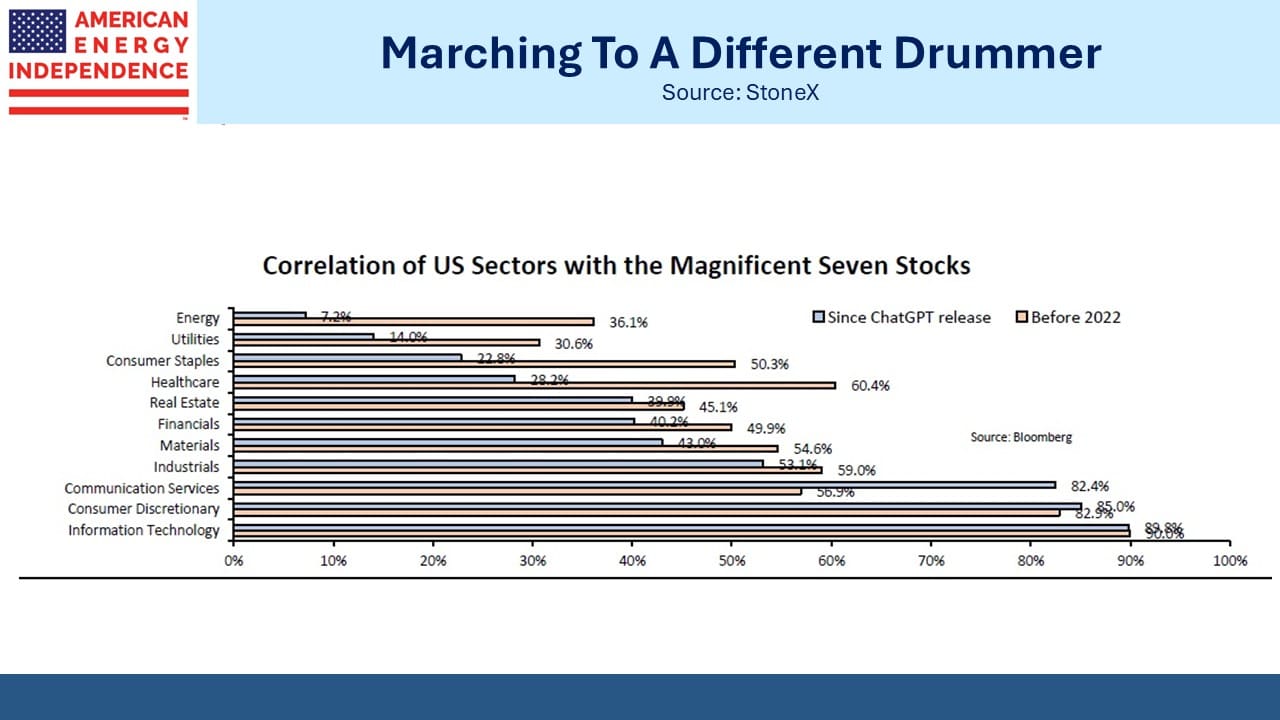

StoneX recently published a bullish case for energy in their Global Macro Report. They note that the futures curve for crude has been in backwardation all year, reflecting strong demand in the spot market. They also note that energy has the lowest correlation of the eleven S&P500 sectors with the MAG7 stocks, something that has become more pronounced since the release of ChatGPT.

StoneX also notes that a rally in gold has often preceded a broader move higher in the CRB Commodity Index. Your blogger has never owned the barbaric relic – there seems little point is spending money to extract, move and store it.

But with new supply adding only 1.5-2% to the total stock every year and gold’s long history as a store of value, many others disagree. A move higher in the CRB would probably be mirrored in oil prices, bringing energy sentiment into better alignment with the strong fundamentals.

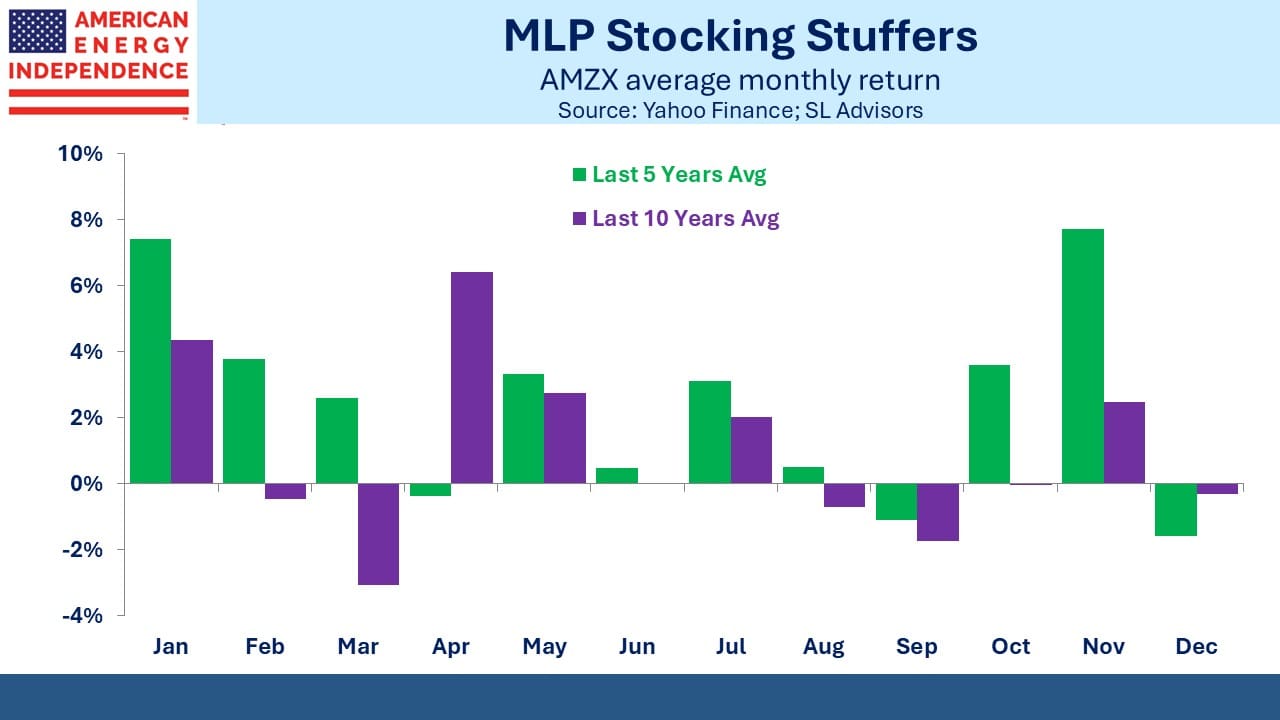

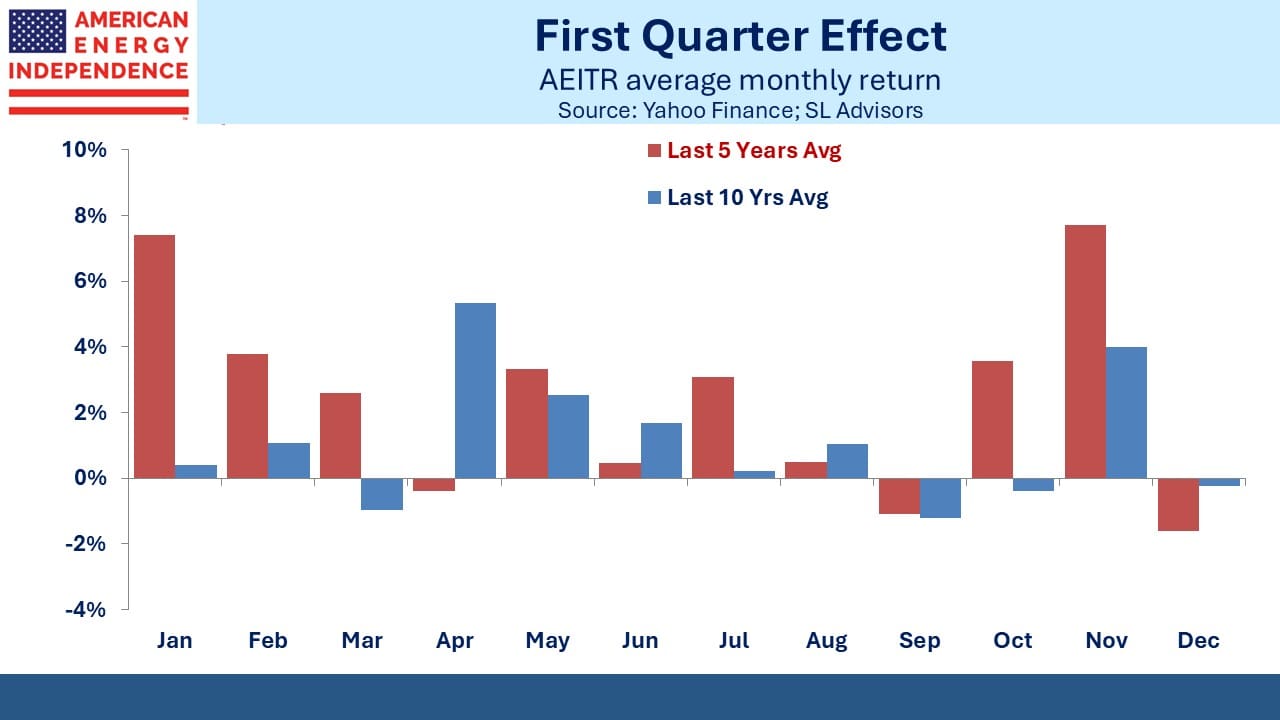

For many years, MLPs had a seasonal tendency to trade up in January. Our theory was that the retail investor base was biased towards December sales and January purchases, in both cases to avoid one more K1. The effect has become more muted, perhaps with greater institutional ownership, but over the past five years there’s still a clear benefit to being invested during the first quarter. This is true both for the Alerian MLP Index (AMZX) which is 100% MLPs and the American Energy Independence Index (AEITR) which is 20% MLPs.

The ten year data is distorted by March 2020 when leveraged funds run by a few incompetent PMs (see MLP Closed End Funds – Masters Of Value Destruction) took the AMZX down 47% for the month. Regrettably for their hapless clients but happily for the rest of us, enough capital was vaporized that they’re now smaller and irrelevant.

If the ten reasons to invest in midstream have left you still unconvinced, perhaps the seasonals will help.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!