Good News On Climate

To be a climate scientist means to live with a dour outlook. The news is never good. We’re always at a tipping point beyond which irreversible damage to the planet will result. Humanity may die out.

Therefore, it was cheering to find some good news in the International Energy Agency’s (IEA) World Outlook 2025, albeit not something the report’s authors highlighted.

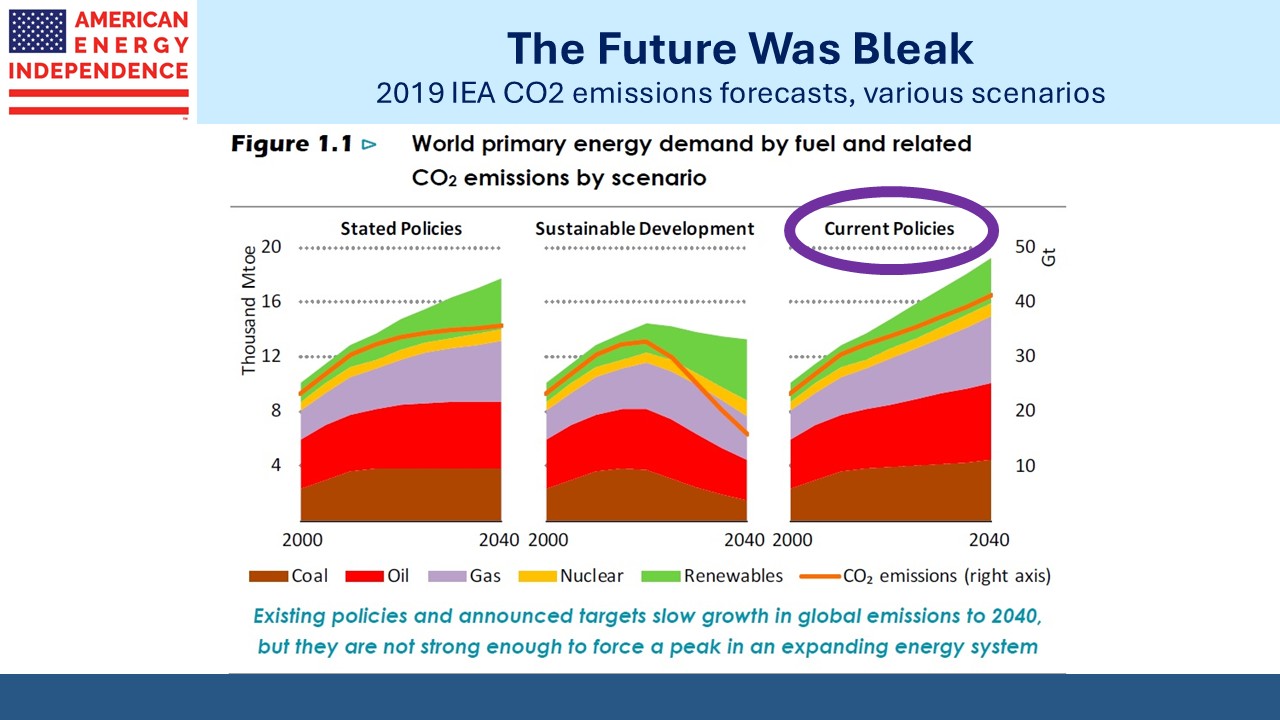

In recent years, the IEA has presented various scenarios that are aspirational and have little relevance to what is really happening. In 2020 they dropped the Current Policies Scenario (CPS), which was the only one worth considering. The IEA became an expensive, irrelevant left-wing renewables advocate. US Energy Secretary Chris Wright wondered whether the 14% of the IEA’s budget we fund was money well spent. Consequently, the CPS has returned.

CPS just assumes existing policies stay in place. By contrast, the Stated Policies scenario assumes governments would do what they’d promised. The Sustainable Development scenario is just fantasy and so a waste of time.

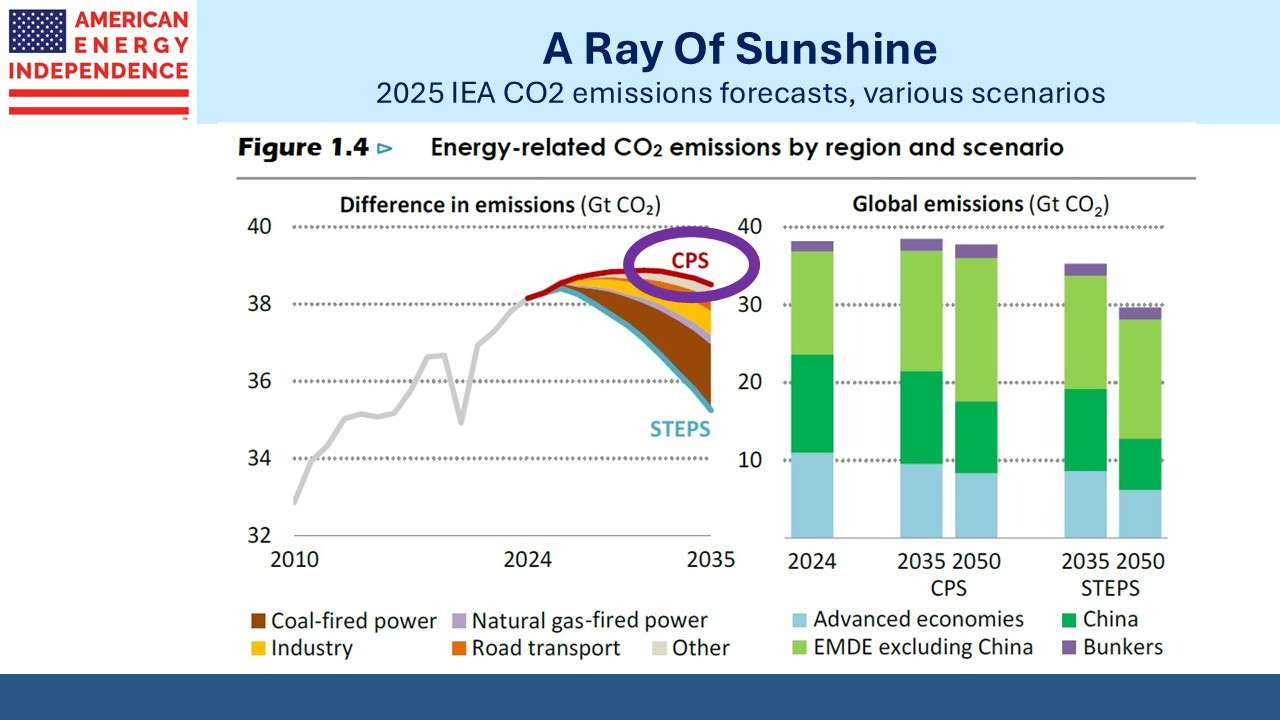

But if you look carefully at the two charts, you’ll see that in 2019 the CPS envisaged Greenhouse Gas emissions (GHGs) rising steadily to almost 50 Gigatonnes (GTs) by 2040. Six years later, the current CPS sees GHGs peaking at below 40 GTs within the next decade.

The CPS has generally been too pessimistic on GHGs, so the forecast peak has a decent chance of being right. Few climate scientists are celebrating, because we’re drifting farther away from the Zero by 2050 goal that was agreed at the COP21 in Paris in 2015. It was an implausible goal, wildly inconsistent with the aspirations of emerging economies to raise living standards and use more energy.

Nonetheless, a peak in GHGs is good news. We should recognize it as such.

Perhaps some of those young people who think the future is too awful to contemplate having children will indulge their animal spirits and be moved towards a little more procreation.

The IEA’s outlook sees increased electricity consumption for data centers, EVs and rising global living standards. This is all good for natural gas demand. Like some other forecasters, the IEA thinks we’ll have a glut of LNG in the years ahead. This view continues to depress sentiment around LNG exporters.

This just seems implausible to us. Cheniere has contracted 95% of its liquefaction capacity through 2035. The inference of the oversupply thesis is that many of the Sale/Purchase Agreements Cheniere and other exporters have signed are with relatively unsophisticated buyers who will get stuck with expensive LNG.

More likely is that they have end users lined up. Regassification capacity, required to turn LNG back into gas so it can be consumed, is also growing at roughly the same pace as export capacity and is around twice as big.

The world is preparing to buy more LNG, just as the US is preparing to sell more.

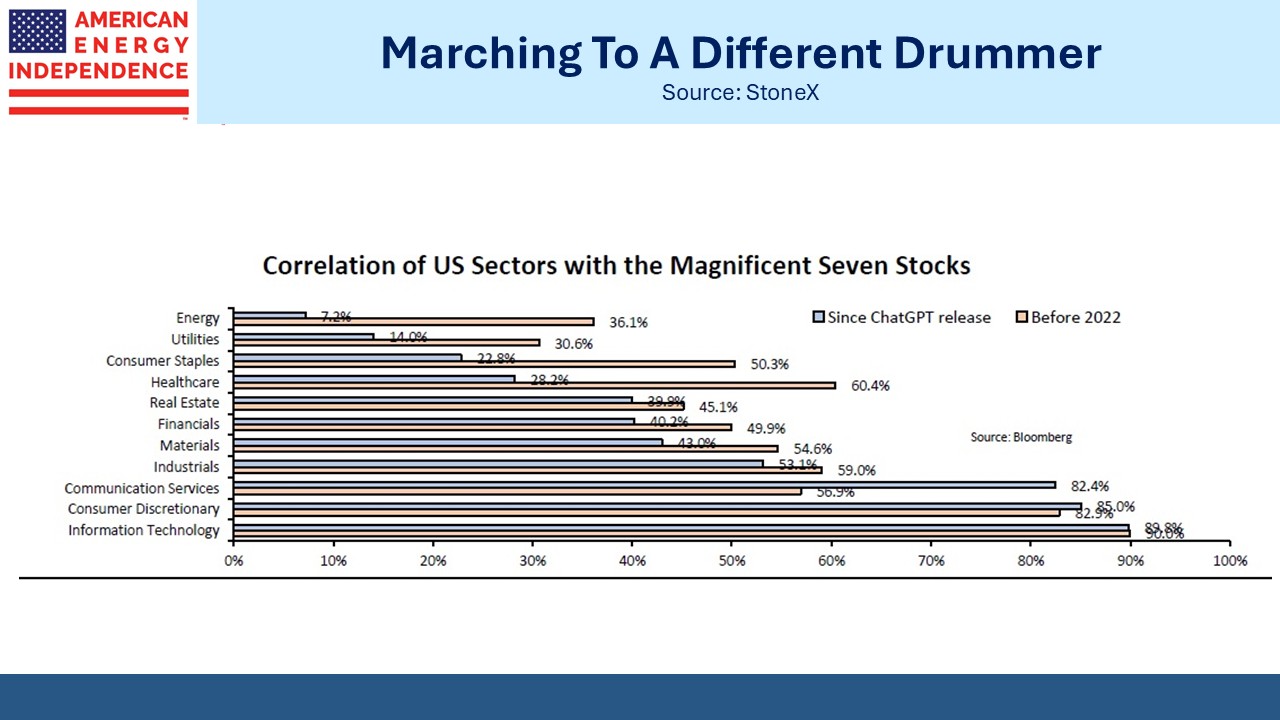

StoneX recently published a bullish case for energy in their Global Macro Report. They note that the futures curve for crude has been in backwardation all year, reflecting strong demand in the spot market. They also note that energy has the lowest correlation of the eleven S&P500 sectors with the MAG7 stocks, something that has become more pronounced since the release of ChatGPT.

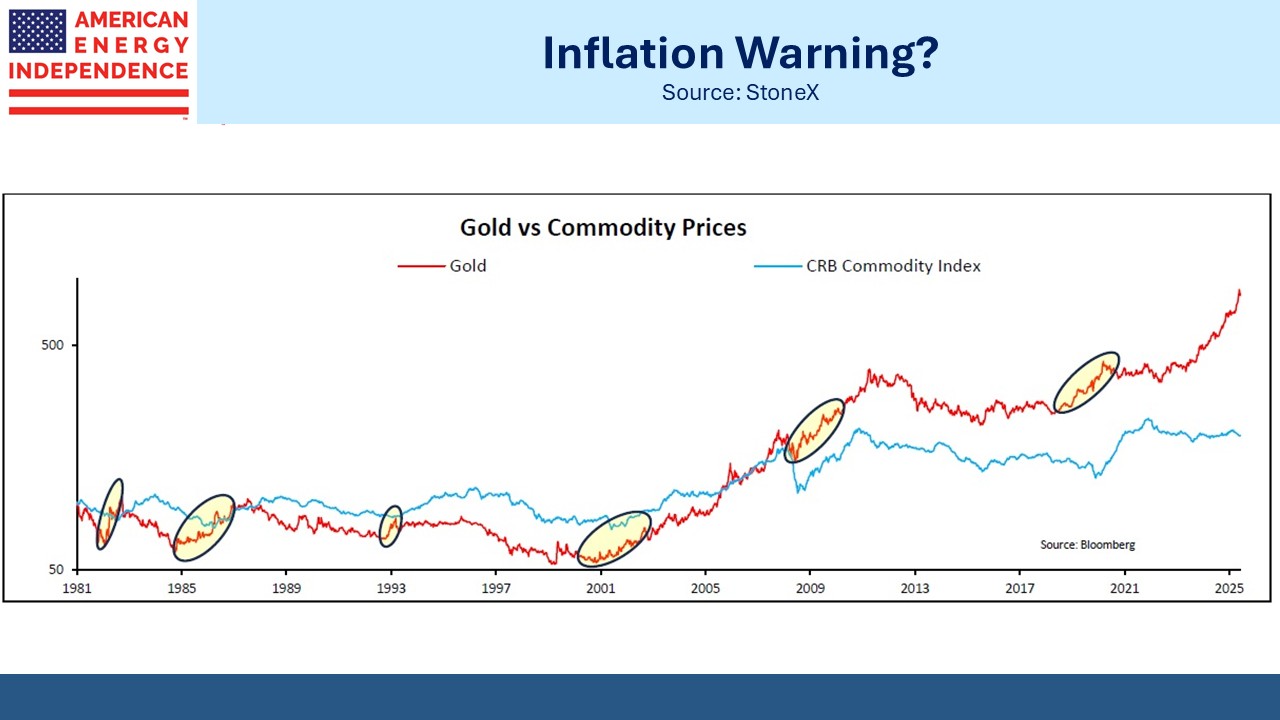

StoneX also notes that a rally in gold has often preceded a broader move higher in the CRB Commodity Index. Your blogger has never owned the barbaric relic – there seems little point is spending money to extract, move and store it.

But with new supply adding only 1.5-2% to the total stock every year and gold’s long history as a store of value, many others disagree. A move higher in the CRB would probably be mirrored in oil prices, bringing energy sentiment into better alignment with the strong fundamentals.

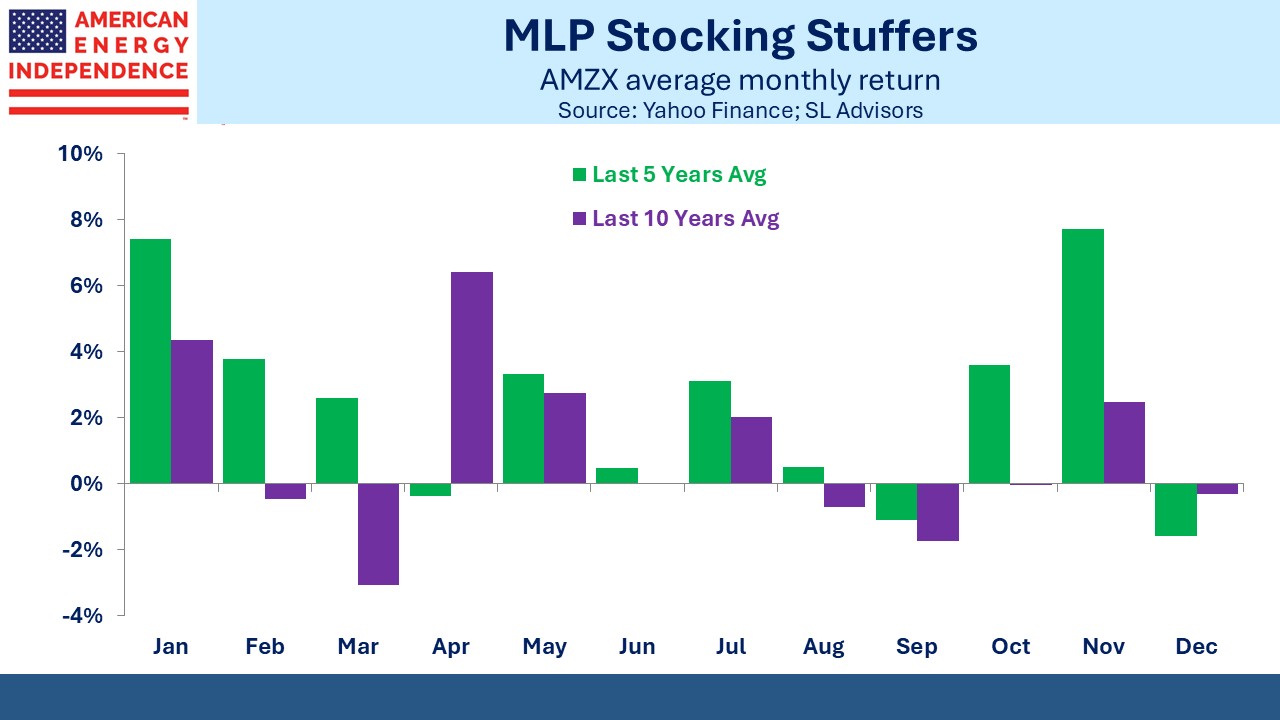

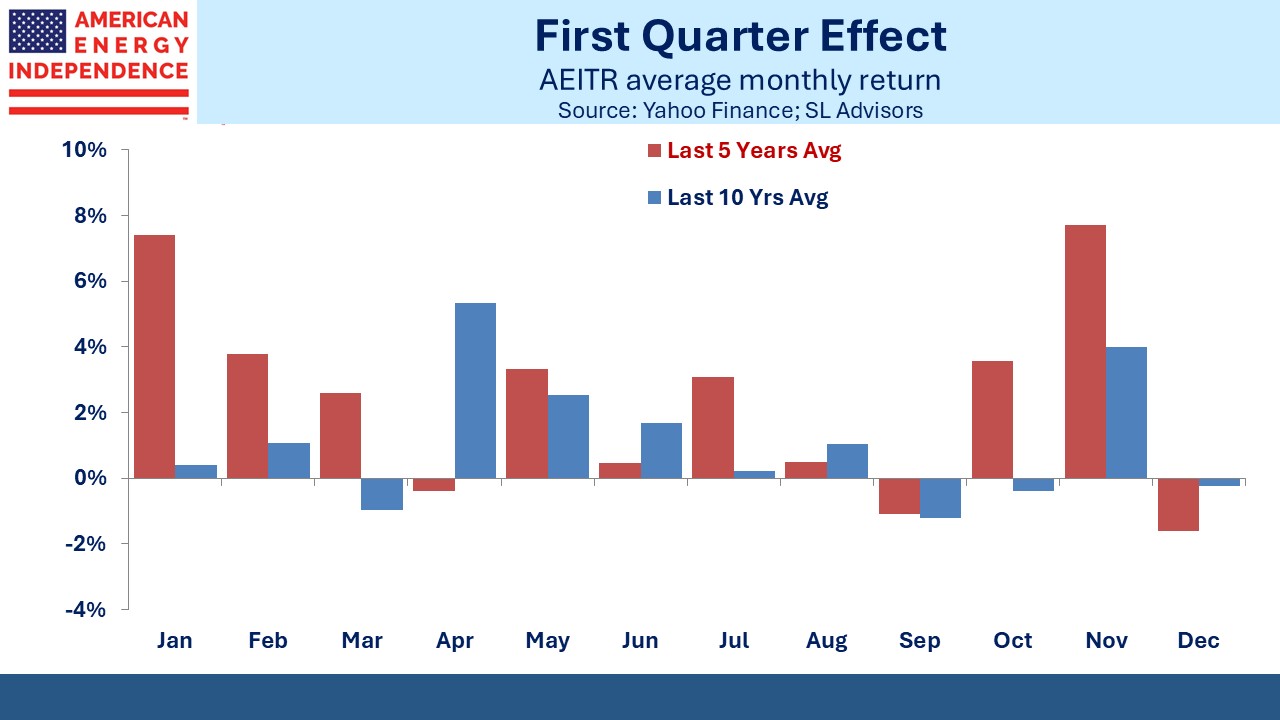

For many years, MLPs had a seasonal tendency to trade up in January. Our theory was that the retail investor base was biased towards December sales and January purchases, in both cases to avoid one more K1. The effect has become more muted, perhaps with greater institutional ownership, but over the past five years there’s still a clear benefit to being invested during the first quarter. This is true both for the Alerian MLP Index (AMZX) which is 100% MLPs and the American Energy Independence Index (AEITR) which is 20% MLPs.

The ten year data is distorted by March 2020 when leveraged funds run by a few incompetent PMs (see MLP Closed End Funds – Masters Of Value Destruction) took the AMZX down 47% for the month. Regrettably for their hapless clients but happily for the rest of us, enough capital was vaporized that they’re now smaller and irrelevant.

If the ten reasons to invest in midstream have left you still unconvinced, perhaps the seasonals will help.

We have two have funds that seek to profit from this environment: