Inflation Protection From Pipelines

/

The link between inflation and fee increases for liquids pipelines doesn’t draw much attention, but it proved to be valuable to midstream investors three years ago when the Biden administration’s excessive stimulus drove the Producer Price Index (PPI) up 13%.

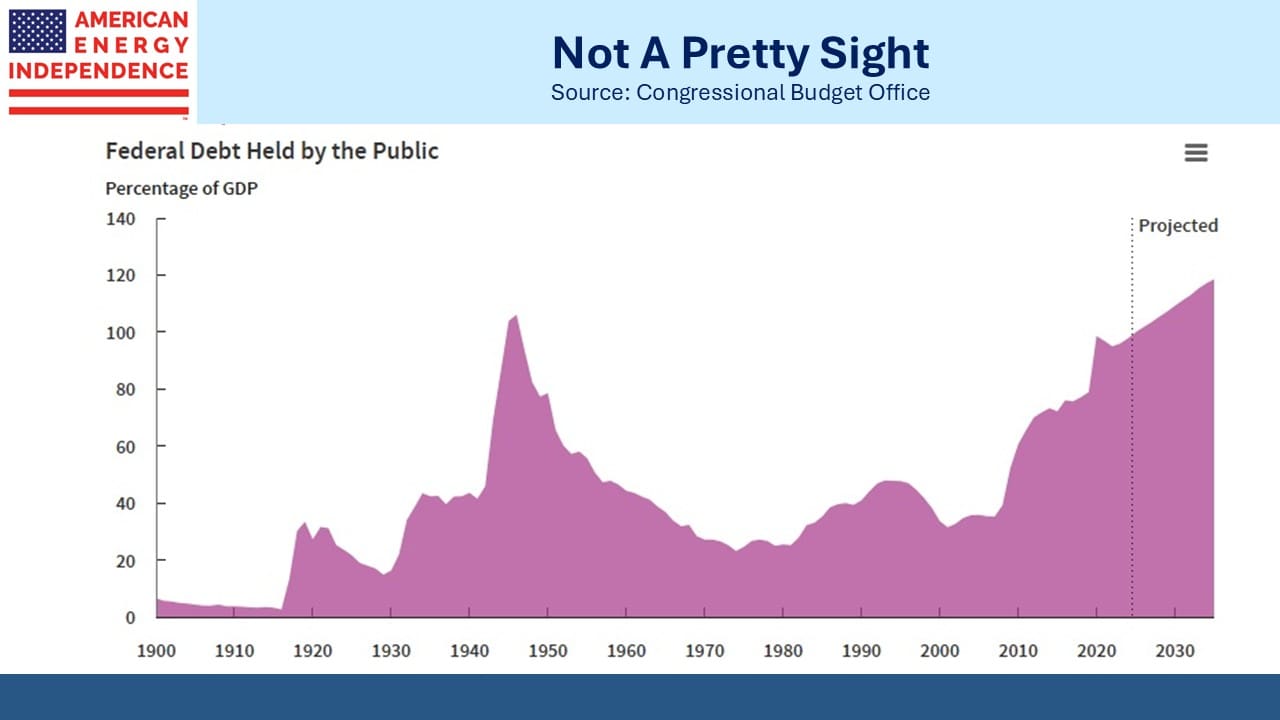

Maintaining purchasing power is the goal of most long-term investors. Inflation is reasonably close to the Fed’s target, but our dire fiscal outlook is well known. The White House is likely to maintain pressure for low rates for the remainder of Trump’s term in office, and through relentless criticism plus the choice of co-operative FOMC appointments when given the opportunity, he’ll probably get his way.

Last week the WSJ reminded us that during and after World War II, the Fed co-operated with the Treasury in maintaining low rates while “…inflation rose into the teens” (see How Federal Reserve Interest Rates Could Get Stuck on the Floor).

We’re heading into a period of political constraints on the Fed to raise rates in response to higher inflation.

With US Debt:GDP approaching the levels of 1946 when the war ended and assuredly heading higher, it’s worth reviewing the pricing power embedded in pipeline contracts.

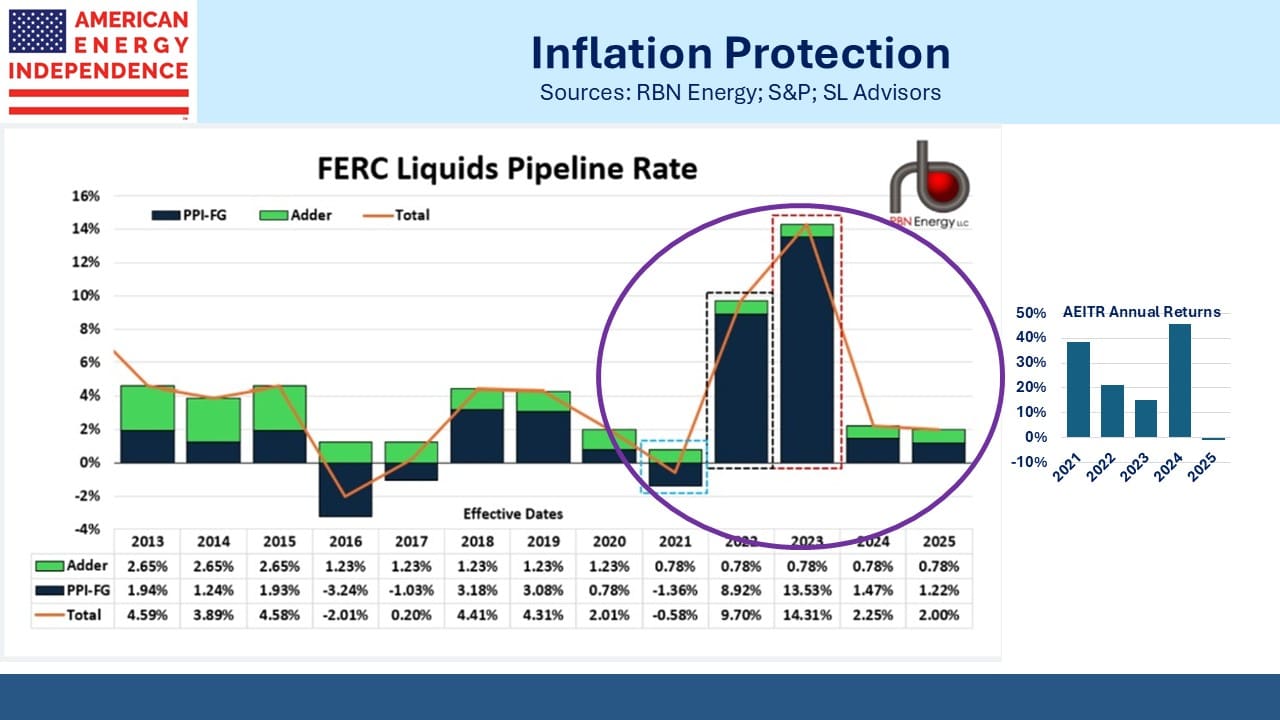

It’s generally estimated that around half the EBITDA of the midstream sector is subject to automatic price hikes linked to PPI plus a margin set every five years by the Federal Energy Regulatory Commission (FERC). The purpose is to ensure that pipeline owners can maintain an adequate profit margin that incentivizes continued investment in the sector.

The chart from RBN Energy shows the startling yet lucrative impact of this in 2022-23, which coincided with and partially drove some sparkling returns for the American Energy Independence Index (AEITR).

FERC sets an adjustment factor, which is usually positive, every five years. It was last set in 2020 at +0.78% when FERC was under Republican leadership. However, in 2022 when FERC was under Democrat leadership, the adjustment factor was changed from +0.78% to –0.21%.

The industry sued and last year the U.S. Court of Appeals for the D.C. Circuit vacated the order.

FERC is now under Republican leadership again, and next summer will set the adjustment factor for the five-year period beginning July 1, 2026. Pipeline companies are pressing for the adjustment factor to compensate for the two and a half years when it was incorrectly low. Pipeline customers understandably hold an opposing view.

If FERC does what the pipeline companies want, it will benefit liquids-focused companies, including names such as Oneok and Targa Resources, which have both been weak this year.

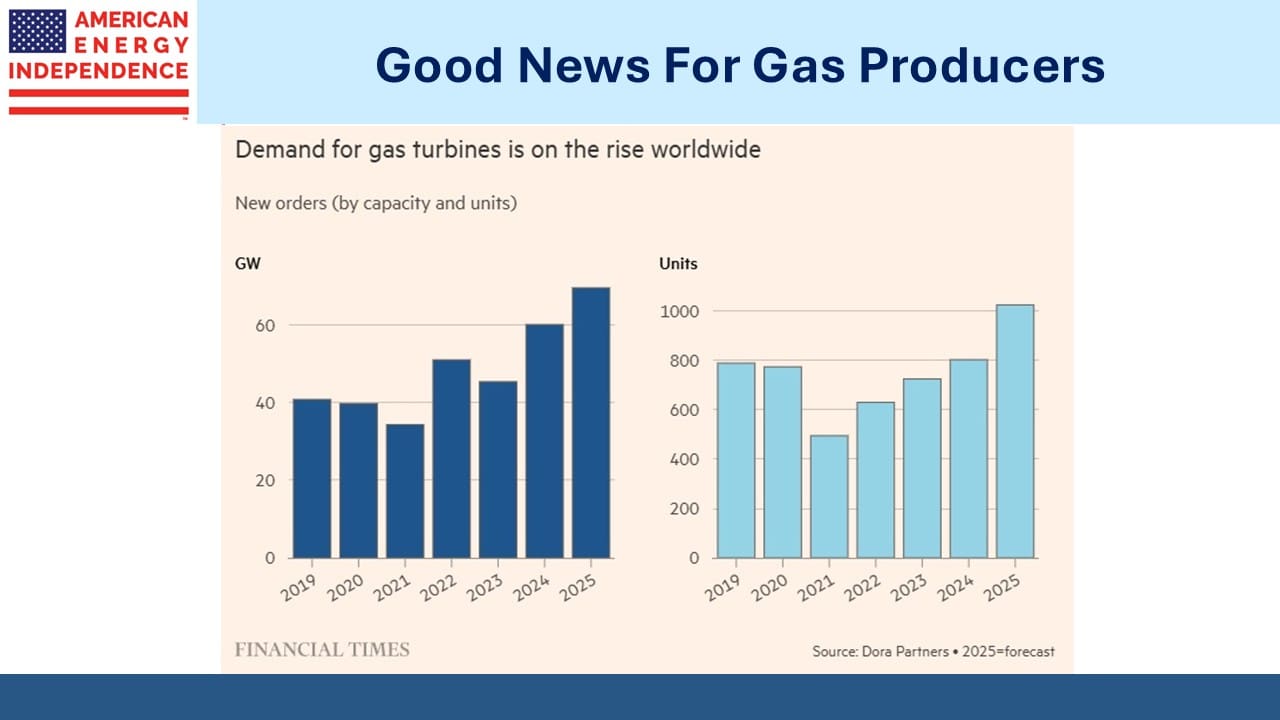

The twin drivers of demand for natural gas haven’t done much to help gas-oriented pipeline companies this year. The AI boom is so widely described as a speculative bubble that one must assume it’s not a secret. Goldman Sachs has estimated that generative AI needs to produce $1TN in annual revenue for the capital invested to earn an adequate return, roughly equal to our defense budget or interest on Federal debt.

Morgan Stanley thinks this could happen by 2028, up from $45BN last year.

Midstream companies providing Behind The Meter (BTM) direct hookups to gas supply for dedicated gas turbines aren’t exposed to the returns on equity earned by the data center owners. Buyers of gas turbines are facing a three-year backlog. A turbine is unlikely to be installed and not used, just as a gas pipeline is unlikely to be laid without a secure contract guaranteeing a return for the owner.

Williams Companies (WMB) announced a strategic LNG partnership with Australia’s Woodside Energy to own an interest in the Louisiana LNG facility. This is the project that Charif Souki originally launched with Tellurian, but it was sold to Woodside after Souki failed to obtain financing (see Tellurian Drifts Into Stronger Hands).

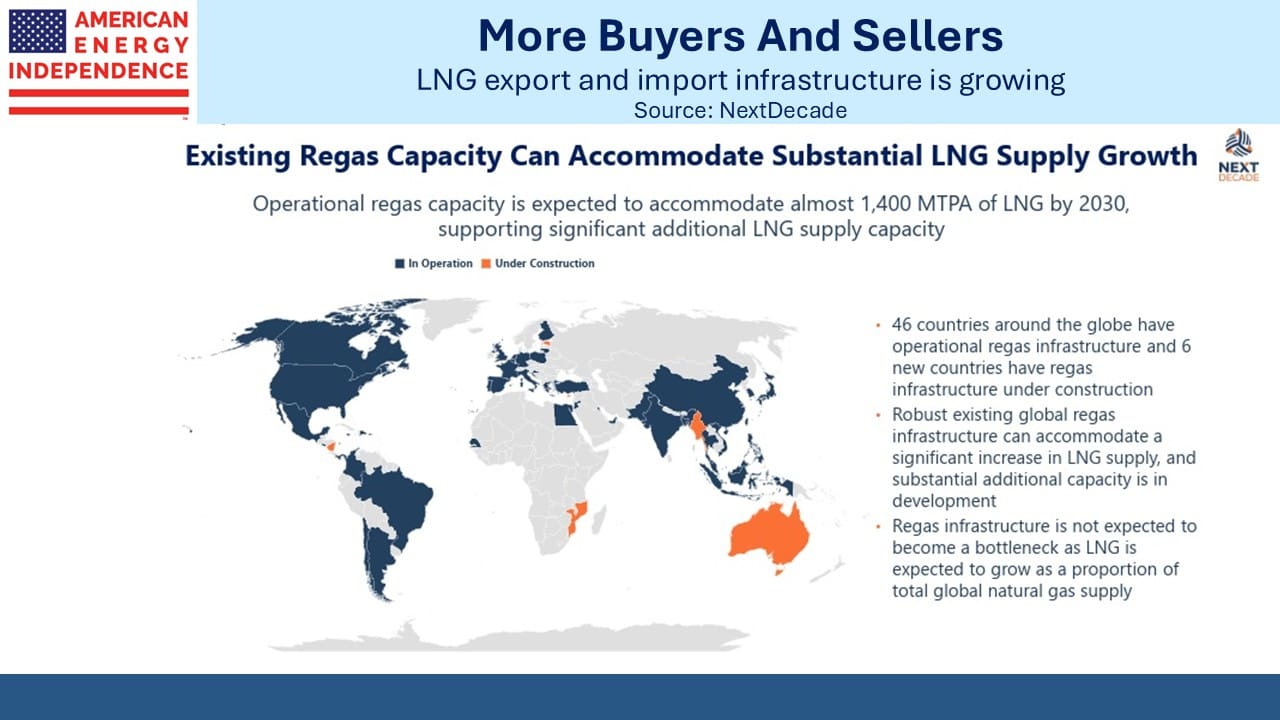

WMB’s stock dropped 5% on the news, confirming that the market fears a looming LNG glut and dislikes exposure to it. Total CEO Patrick Pouyanne has been warning of overcapacity among liquefaction terminals, with global capacity expected to rise from 425 Million Tonnes Per Annum (MTPA) to 600 MTPA by 2030.

Meanwhile, Total has restarted construction at its Mozambique LNG project after halting work in 2021 following a terrorist attack in nearby Palma town. If there is a glut they’ll be part of the reason. A slower build-out of competing facilities would suit Total.

New regasification continues to match the growth of liquefaction, maintaining a roughly 2X ratio between the receiving versus the sending side of LNG trade. The world’s buyers of LNG continue to prepare for increased shipments.

Although the precise terms of WMB’s investment with Woodside weren’t published, it’s likely that the perception of a glut would have been incorporated. In a form of vertical integration, WMB will be able to offer its customers gas transportation from its pipeline network and onto an LNG tanker. It looks like good timing on their part.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!