Power Auctions Are Getting Interesting

/

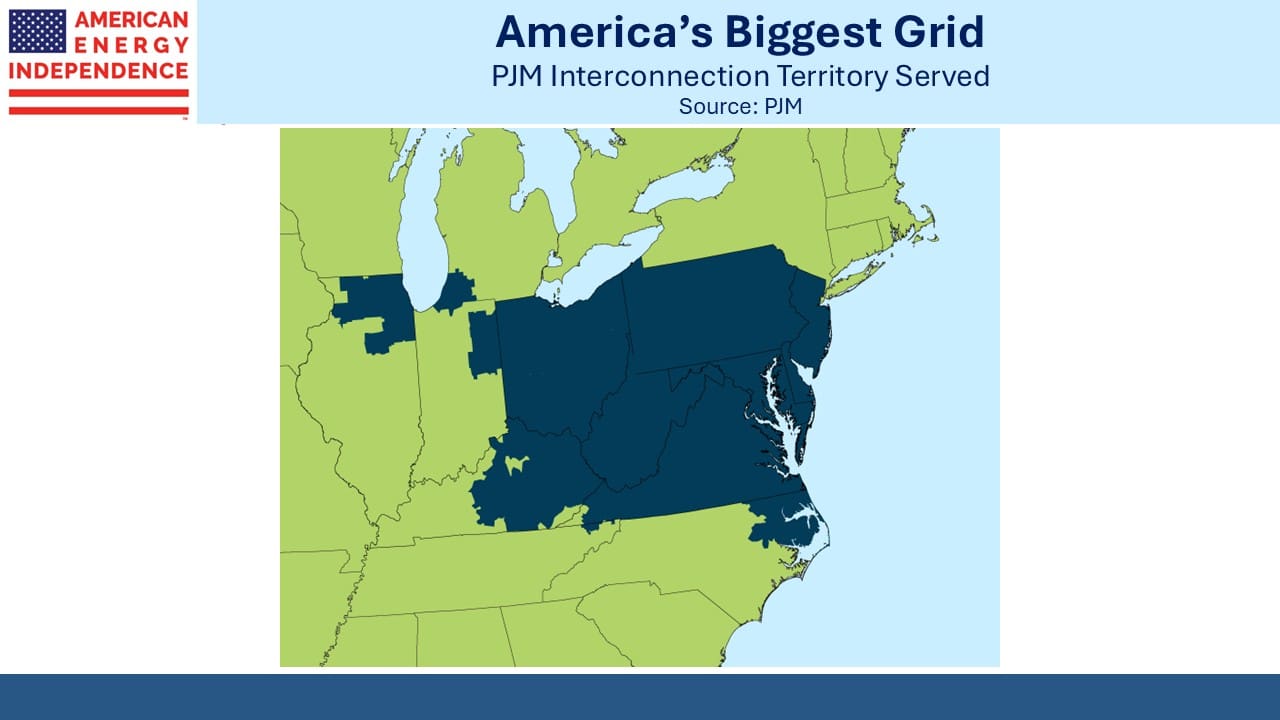

Last Wednesday PJM Interconnection began their Capacity Auction. PJM runs the largest electricity grid in the US, extending from the east coast as far west as Illinois. The auction sources commitments for surge capacity, to ensure that even during times of high demand the system can meet the need for power.

Capacity auctions haven’t historically drawn much attention. But last year the auction cleared at $269.92 per Megawatt-Day, more than 9X the prior year’s figure of $28.92. That drew news coverage, along with warnings that this would increase electricity rates for millions of households (see The Coming Fight Over Powering AI).

PJM has 65 million customers.

The jump in price is generally regarded as being due to increased demand, especially from data centers, and declining supply as coal plants are retired, but new renewables capacity is added too slowly.

Power supply across PJM’s region has a complex structure. PJM operates the grid, but customers deal with a local utility. In our part of New Jersey it’s PSE&G. The point of a regional grid is that electricity can be transmitted across state lines where it is needed to balance supply and demand. This makes it hard to hold politicians accountable if things go wrong.

Electricity prices are about to become a political issue, especially in New Jersey which will elect a new governor later this year. Partly because of last year’s auction, prices are apparently going up by 17%. I examined my own electricity bill, which is worth doing from time to time.

The hike in rates must vary. We’re now paying 30 cents per KwH, up from 22 cents. This is among the highest in the country, almost as high as California at 32 cents. Our most recent bill is up 15% year-on-year, and we used 15% less, a 35% hike.

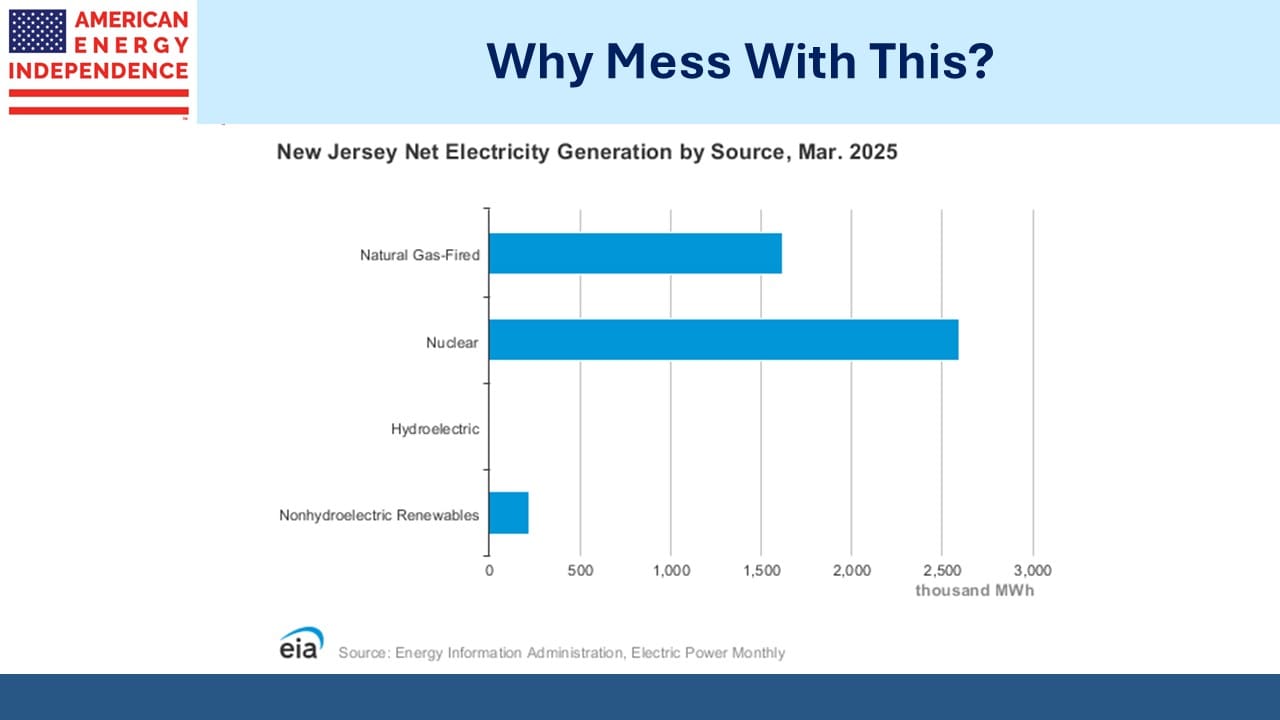

Outgoing Democrat governor Phil Murphy has mandated that 100% of electricity must be renewable by 2035. New Jersey currently has a splendid mix of power generation, which is almost all nuclear and natural gas. Renewables with their weather dependency are, for now, not interfering. But there’s not much point in building a new natural gas power plant, given current policy.

Because solar and wind are opportunistic, each new addition requires an engineering study to make sure grid operators fully understand the impact. Solar and wind typically work 20-40% of the time.

Left wing policies that push for 100% solar and wind are part of the problem, exacerbated by incorrect claims that natural gas is unreliable.

As they’re added to a grid, renewables increase the need for dispatchable power that can be turned on when it’s not sunny or windy. That usually comes from natural gas power plants, since their output can most easily be varied on short notice as needed.

Williams Companies, a large natural gas pipeline operator, has reported that renewables create additional natural gas demand to compensate for their inadequacy.

Josh Shapiro, the governor of Pennsylvania (the “P” in PJM) is so upset he’s threatened to withdraw his state from the PJM network. The Keystone state is the biggest exporter of electricity to the rest of the PJM system. It’s unclear how they would withdraw, but if they did, it would presumably not help the supply shortage.

What’s clear is that Democrat politicians within the PJM region are starting to realize that poorly conceived energy policies aimed at their primary voters are about to collide with Main Street.

Increased demand from data centers is part of the problem. By 2030 PJM expects 32 gigawatts of additional demand, with 30 from data centers. But they also blame insufficient new supply, including state policies that closed fossil fuel plants prematurely.

This is where assigning blame gets messy. Three years ago PJM stopped processing new applications for power plant connections after it was overloaded with more than 2,000 requests from renewable power projects.

The US Department of Energy believes Grid Growth Must Match Pace of AI Innovation in a report on grid stability published recently. They use terms like the “AI arms race” and warn that inadequate power supplies to data centers risk jeopardizing our economic and national security.

That suggests that even though data centers don’t create many jobs, they’ll have a powerful backer in the Federal government. The acceptable downtime of new data centers is around 3 seconds per year. This makes intermittent power a non-starter. Powering them will overwhelmingly rely on natural gas, and public policy will be behind them.

The results of the latest PJM Capacity Auction will be released on July 22nd. They’ll be more keenly awaited than in the past.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!