Lemming Leadership

/

Sometimes this blogger stumbles across a phrase that begs to be used as the title for a blog post. Who better to be the subject of this one than the far-left climate extremists whose policies have led to higher energy prices, deindustrialization and job losses.

Start with Germany. Ryanair’s CEO Michael O’Leary recently described Germany as being run by “a government of idiots” because they followed the “stupid solutions” pushed by the Green Party. No doubt O’Leary’s perspective is the narrow one of the airline executive. He criticizes airport fees of over €50 per passenger which he believes will relegate Berlin to “a regional airport at best.”

Germany imposes some of the highest aviation taxes in Europe, partly to curb CO2 emissions. Lufthansa CEO Carsten Spohr agrees with O’Leary, commenting that, “More and more airlines are avoiding German airports or canceling important connections.”

More broadly, Europe’s energy policies are driving de-industrialization. The auto sector represents 7% of EU GDP, far higher than in the US. They’re having to build EVs the market doesn’t want using energy that’s priced too high. No wonder Volkswagen is planning factory closures, lay-offs and pay cuts.

Angela Merkel, German chancellor 2005-21, bares as much responsibility as anyone for these failures. She led the country to depend heavily on Russian natural gas and endorsed Green policies including shutting all their nuclear plants and diving headlong into windpower.

Appeasement of Russia following its 2014 annexation of Crimea led to the 2022 invasion and Germany’s current scramble to reinvigorate its military following decades of dependence on the US for defense.

But such poor leadership isn’t only across the Atlantic. Angela Merkel has her fans among the Democrat establishment in the US.

Five years ago Harvard awarded her an honorary degree, citing, “shrewd resolve and pragmatism” and sensible policies including the nuclear phaseout. She’s on a book tour and was recently feted by Barack Obama at an event in Washington, DC.

Merkel endorsed Kamala Harris for president, which for voters aware of Germany’s penchant for economic self-harm likely cemented the Democrat as too liberal.

Last month’s election sent a clear message against progressives on a range of issues including energy policy. America’s big enough to accommodate varying approaches to energy, so we can see which states are managing climate change without widespread collateral damage.

Texas is the biggest user of windpower and second in solar. Sunny Florida is third in solar. Both states are adding jobs, people and investment because they provide cheap, reliable energy in a regulatory environment that promotes new business formation.

California is #1 in solar and has expensive electricity provided on a creaky grid. Diablo Canyon, a nuclear power plant, was almost shut down prematurely due to pressure from environmental extremists.

German voters have been led lemming-like over the cliff into energy purgatory and economic malaise. American energy policies have generally been enlightened with a few exceptions such as liberal Massachusetts which imports LNG because it won’t allow gas pipeline infrastructure linking it to the Marcellus shale in Pennsylvania, and New York which forbids new natural gas hook-ups.

The Sierra Club and its peers have been an irritant but largely inconsequential, which is why the US economy continues to do so well.

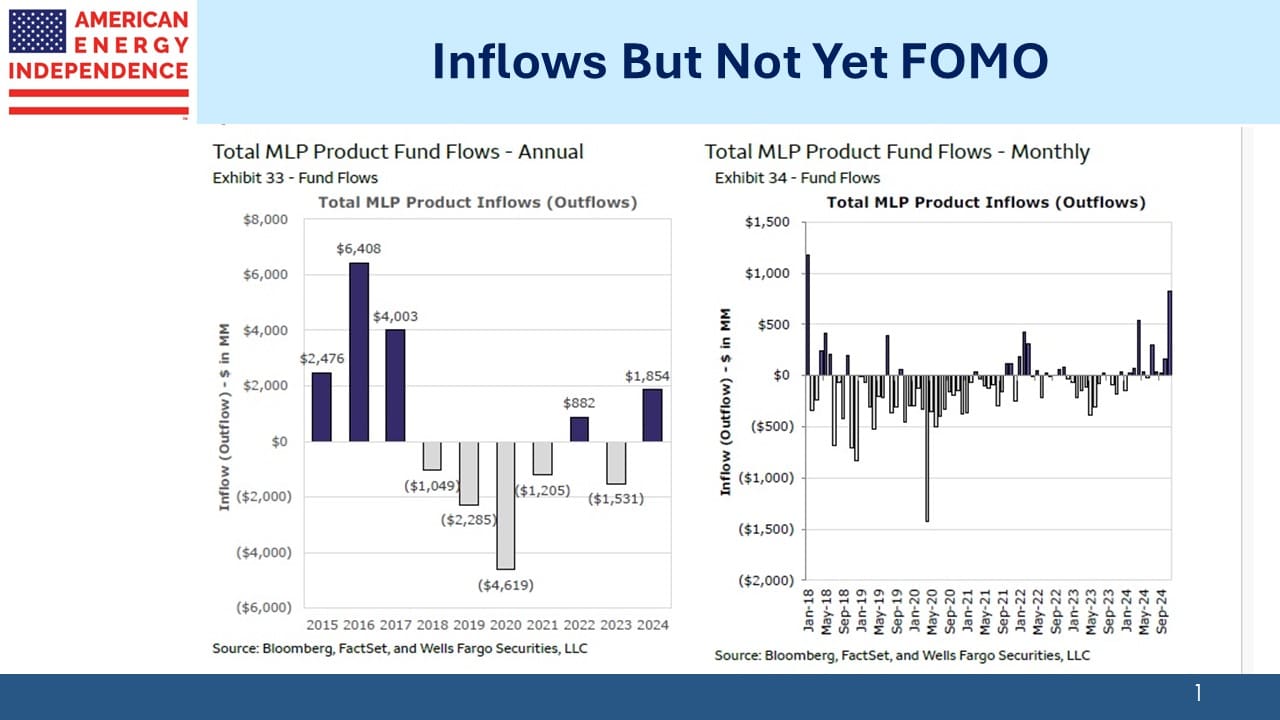

Fund flows into the MLP sector have been negative for years. From 2018-23 there were five years of outflows. For much of this year the pattern continued. Meanwhile equity funds have seen almost $140BN in inflows since the election as investors assessed the market’s prospects with generally less regulation.

My friends in Naples may not be fully representative of the overall electorate (ie wealthy, white, older and male). But they’re certainly cheered by the election and consequent market reaction.

Energy including midstream is a clearer election beneficiary than any other sector. In November MLP funds saw their strongest monthly inflows in almost eight years. 2024 is suddenly on track to be the best year since 2017. We do a lot of calls with clients and for that reason generally gain assets. But there’s still no FOMO, no irrational exuberance, at least among the new investors we talk to.

Wells Fargo noted that midstream’s correlation with crude oil prices has weakened significantly to 0.23 this year versus 0.53 over the past five years. During periods of market weakness this has been a common topic for clients wondering why their toll-model investments are moving lower with oil prices.

AI data center demand for natural gas has been an important driver of recent performance, but with leverage averaging around 3.3X Debt:EBITDA, pipeline businesses are just less risky than in the past. We think the low correlation with commodity prices will persist.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!