Lemming Leadership

Sometimes this blogger stumbles across a phrase that begs to be used as the title for a blog post. Who better to be the subject of this one than the far-left climate extremists whose policies have led to higher energy prices, deindustrialization and job losses.

Start with Germany. Ryanair’s CEO Michael O’Leary recently described Germany as being run by “a government of idiots” because they followed the “stupid solutions” pushed by the Green Party. No doubt O’Leary’s perspective is the narrow one of the airline executive. He criticizes airport fees of over €50 per passenger which he believes will relegate Berlin to “a regional airport at best.”

Germany imposes some of the highest aviation taxes in Europe, partly to curb CO2 emissions. Lufthansa CEO Carsten Spohr agrees with O’Leary, commenting that, “More and more airlines are avoiding German airports or canceling important connections.”

More broadly, Europe’s energy policies are driving de-industrialization. The auto sector represents 7% of EU GDP, far higher than in the US. They’re having to build EVs the market doesn’t want using energy that’s priced too high. No wonder Volkswagen is planning factory closures, lay-offs and pay cuts.

Angela Merkel, German chancellor 2005-21, bares as much responsibility as anyone for these failures. She led the country to depend heavily on Russian natural gas and endorsed Green policies including shutting all their nuclear plants and diving headlong into windpower.

Appeasement of Russia following its 2014 annexation of Crimea led to the 2022 invasion and Germany’s current scramble to reinvigorate its military following decades of dependence on the US for defense.

But such poor leadership isn’t only across the Atlantic. Angela Merkel has her fans among the Democrat establishment in the US.

Five years ago Harvard awarded her an honorary degree, citing, “shrewd resolve and pragmatism” and sensible policies including the nuclear phaseout. She’s on a book tour and was recently feted by Barack Obama at an event in Washington, DC.

Merkel endorsed Kamala Harris for president, which for voters aware of Germany’s penchant for economic self-harm likely cemented the Democrat as too liberal.

Last month’s election sent a clear message against progressives on a range of issues including energy policy. America’s big enough to accommodate varying approaches to energy, so we can see which states are managing climate change without widespread collateral damage.

Texas is the biggest user of windpower and second in solar. Sunny Florida is third in solar. Both states are adding jobs, people and investment because they provide cheap, reliable energy in a regulatory environment that promotes new business formation.

California is #1 in solar and has expensive electricity provided on a creaky grid. Diablo Canyon, a nuclear power plant, was almost shut down prematurely due to pressure from environmental extremists.

German voters have been led lemming-like over the cliff into energy purgatory and economic malaise. American energy policies have generally been enlightened with a few exceptions such as liberal Massachusetts which imports LNG because it won’t allow gas pipeline infrastructure linking it to the Marcellus shale in Pennsylvania, and New York which forbids new natural gas hook-ups.

The Sierra Club and its peers have been an irritant but largely inconsequential, which is why the US economy continues to do so well.

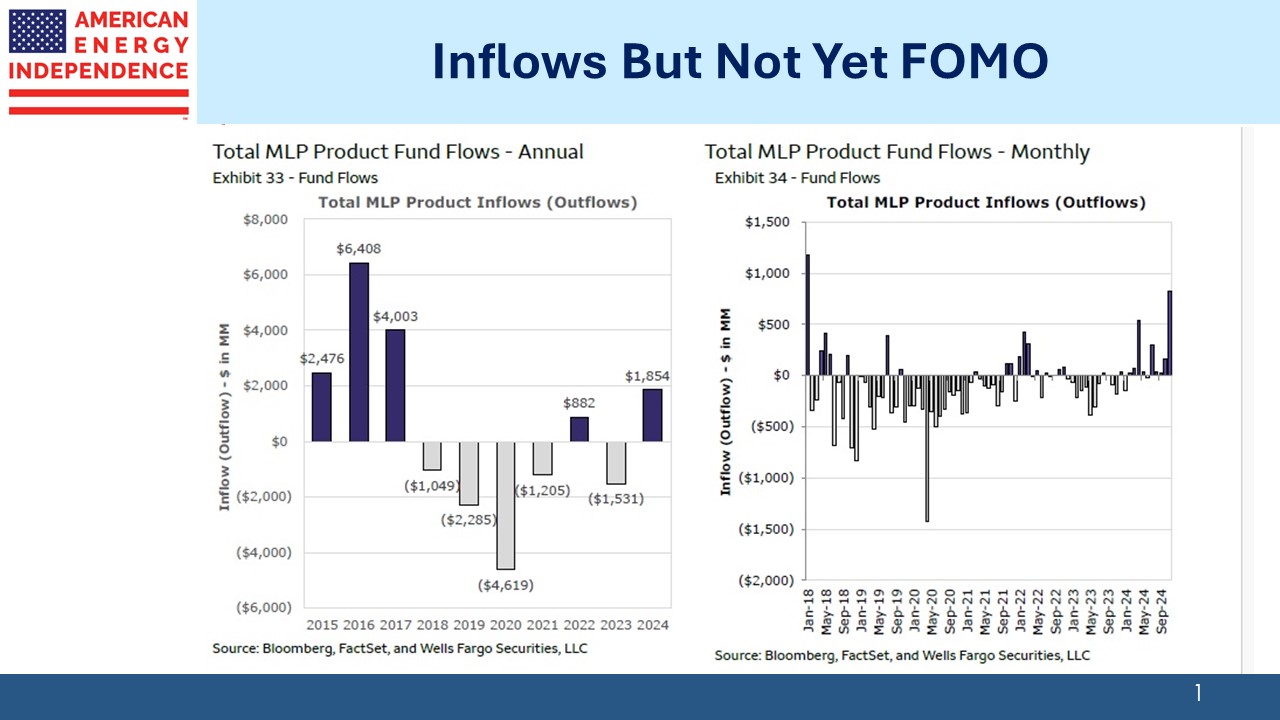

Fund flows into the MLP sector have been negative for years. From 2018-23 there were five years of outflows. For much of this year the pattern continued. Meanwhile equity funds have seen almost $140BN in inflows since the election as investors assessed the market’s prospects with generally less regulation.

My friends in Naples may not be fully representative of the overall electorate (ie wealthy, white, older and male). But they’re certainly cheered by the election and consequent market reaction.

Energy including midstream is a clearer election beneficiary than any other sector. In November MLP funds saw their strongest monthly inflows in almost eight years. 2024 is suddenly on track to be the best year since 2017. We do a lot of calls with clients and for that reason generally gain assets. But there’s still no FOMO, no irrational exuberance, at least among the new investors we talk to.

Wells Fargo noted that midstream’s correlation with crude oil prices has weakened significantly to 0.23 this year versus 0.53 over the past five years. During periods of market weakness this has been a common topic for clients wondering why their toll-model investments are moving lower with oil prices.

AI data center demand for natural gas has been an important driver of recent performance, but with leverage averaging around 3.3X Debt:EBITDA, pipeline businesses are just less risky than in the past. We think the low correlation with commodity prices will persist.

We have two have funds that seek to profit from this environment: