Renewables Are An Energy Footnote

/

Journalists love to write about fast growing renewables. It fits the narrative that solar and wind can eventually replace our traditional sources of energy. It allows the absence of any serious push towards nuclear power to go unanswered. It avoids the uncomfortable question of why China’s increasing emissions from coal are acceptable when in America California is a decade away from banning sales of gasoline-powered cars and NY forbids natural gas hook-ups to new buildings.

The Energy Institute’s 2024 Statistical Review of World Energy is a rich source of data on how the world obtains and uses energy. Careful analysis allows many energy shibboleths to be put to bed.

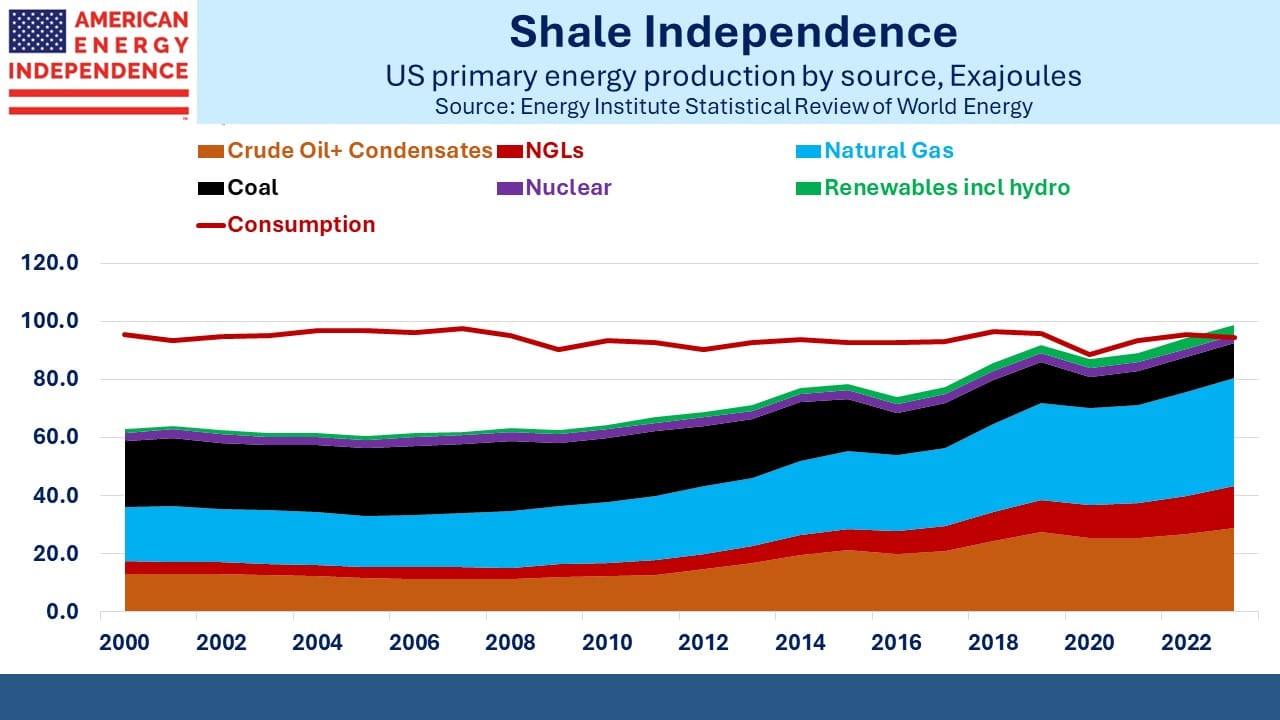

Start with America. The biggest energy story of the past decade is the growth in oil and gas output, which has in turn enabled a drop in coal. The shale revolution delivered mixed results to investors because at times executives were overly enthusiastic about the returns they could earn. But there’s no doubt that it was good for the US economy.

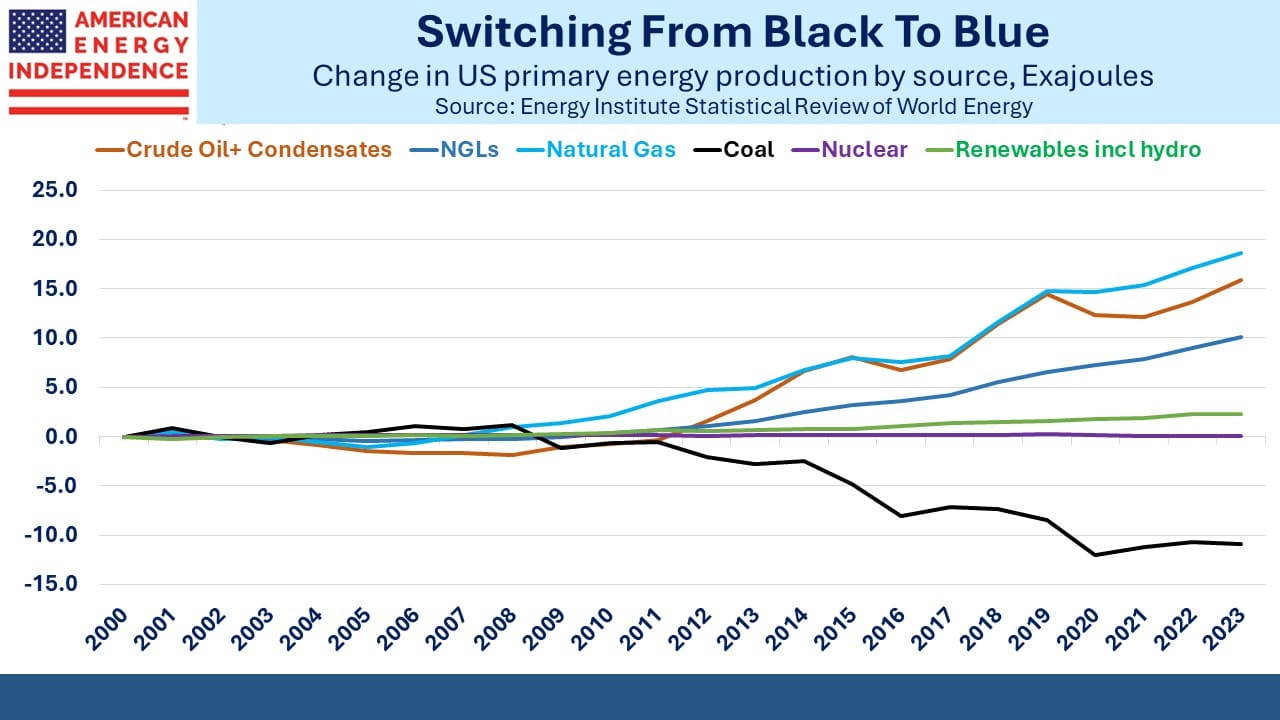

Since 2013 our total output of primary energy has grown at 3.3% pa, by 27.7 Exajoules (EJs). 49% of that increase came from natural gas, and 44% from crude oil and condensates. Together they provided 93% of increased production.

The typical liberal journalist hails the 6.3% pa growth in output from all renewables including hydro. It sounds impressive. But starting from a low base it’s an additional 1.6 EJs. Increased output of natural gas alone was 8X as much, supporting energy security, job growth and exports to our friends and allies. There should be 8X as much news coverage of this enormous success.

Few casual readers of energy news would be likely to guess anywhere near this 8X ratio if asked.

It’s fortunate that natural gas grew this much, because coal production fell at a 5.1% pa rate, or by 8.2EJs. This is 5X the increase in renewables. By reducing coal burned in power plants we have lowered our CO2 emissions along with other harmful pollution. Renewables were barely relevant to this success story. It was mainly achieved with natural gas.

Along the way we reached energy independence. In the popular imagination this refers narrowly to crude oil, when exports exceed imports. A broader measure compares energy production with consumption. America’s use of energy is flat over the past couple of decades.

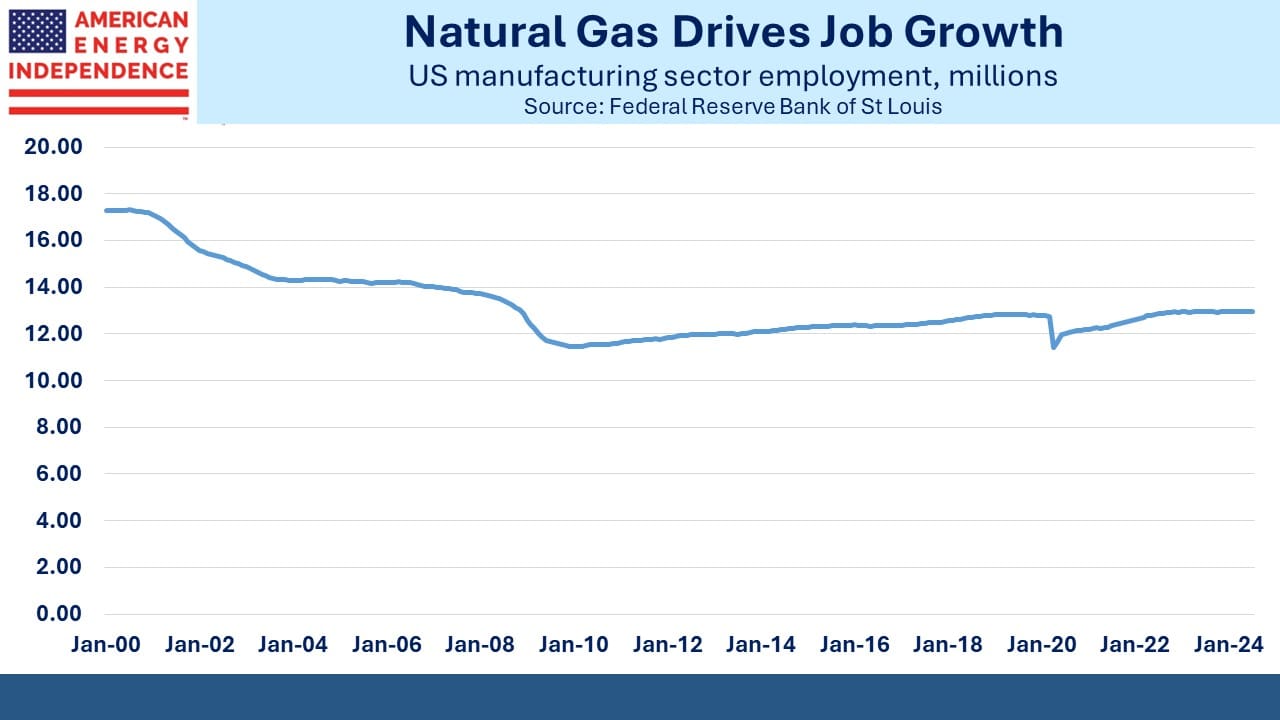

Our economy and population have grown, but we’ve become more energy efficient. Activity has also shifted to less energy-intense sectors – more services and less industrial output – although cheap natural gas has caused a resurgence in US manufacturing employment following decades of decline.

The bottom line is that renewables provide 3.5% of our primary energy output, up from 2.7% a decade ago.

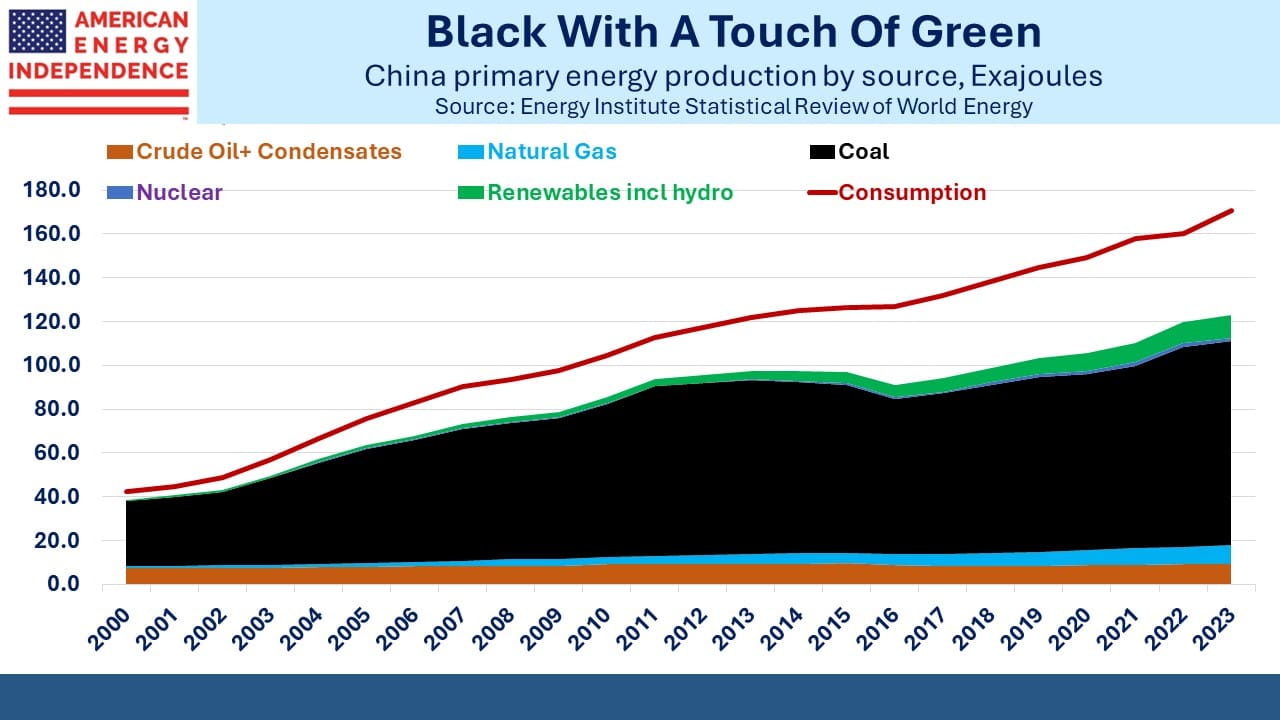

Turning to China, they recently reported hitting their renewables power target six years ahead of schedule. To the casual observer of energy news, it appears that the world is moving in lockstep to solar and wind. Some even worry that America is at risk of falling behind China’s ambitions on climate change.

Then there’s the facts.

China’s energy consumption has quadrupled this century, as the country began to make up for decades of socialist central planning. The biggest energy story in China is the yawning gap between energy production and consumption. China has a substantial energy deficit, at 48 EJs equal to approximately half of all US energy production.

It is a national security imperative for China to close this gap. It complicates any potential military steps against Taiwan. China’s growing EV market and renewables capacity must be seen in this light. They want to reduce their dependence on foreign oil.

China obtains 8.5% of its primary energy from renewables (10.4 EJs), substantially more than the US. It’s grown at 10.1% pa over the past decade. However, this is only 6.1% of China’s energy consumption since they have such a big deficit.

What the cheerleaders for China’s renewables ambitions overlook is that coal production has increased by 13.8 EJs over the past decade, over 2X the 6.5 EJs growth in renewables. Coal provides more than half of China’s primary energy. It’s down from 65% a decade ago, but only because their energy demand has risen faster than their ability to meet it domestically. Coal is13% of US primary energy production.

Energy reporting generally overstates the impact of renewables. It missed the enormous impact of increased US natural gas production. It gives China a free pass on their growing use of coal. It’s clearer when you look at the numbers. Many journalists overstate the impact of renewables and their ability to meet our energy needs. Natural gas is the world’s favorite energy.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!