POTUS Should Have Called in Sick

/

For those wondering how the election will affect the energy sector, Thursday’s presidential debate offered some clarification but also added some uncertainty. Following Biden’s stuttering performance, he’s a poor bet to return to the White House after November. It must be more likely than not that his party will find a way to dump him before their convention in August, since he’s leading his party to electoral disaster with countless down-ticket Democrat candidates now at risk.

Joe Manchin would be an interesting centrist choice that would scramble projections, but he’s repeatedly disavowed any interest. Biden’s best case to remain in the race is that the alternatives are so poor.

It’s pretty clear that Joe Biden’s too old and senile to be president for another four years. From an energy perspective, a more friendly administration with a lighter regulatory touch is likely.

Republicans are associated with “Drill Baby, Drill” and it’s worth remembering that the last Trump presidency wasn’t kind to energy investors. The euphoria of a supportive government led to oversupply, depressing prices and returns. The pandemic didn’t help.

Energy companies embraced financial discipline, prioritizing per share returns over volumes. This took hold during Biden’s presidency and coupled with the continuing recovery from Covid returns have been very good.

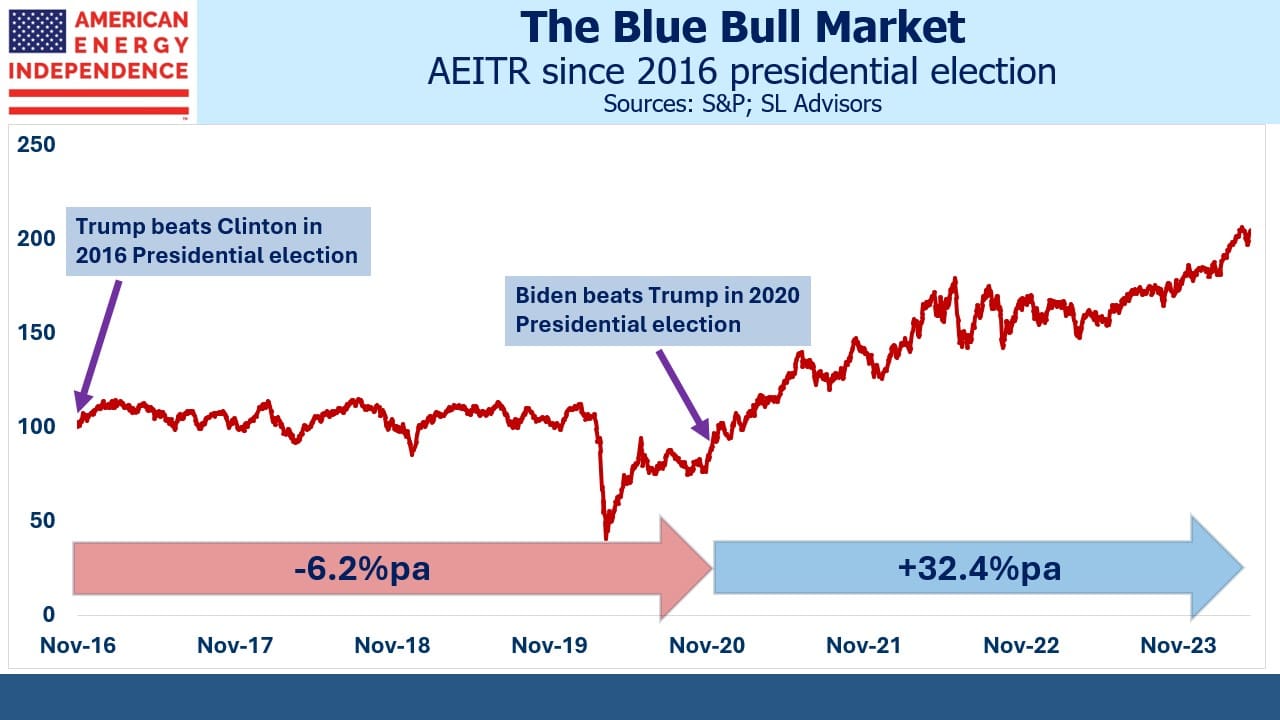

When investors ask if we’re worried about a second Biden term, we often point to the “blue rally.” It must be endlessly frustrating to progressives that their political ascendancy has been so profitable for traditional energy despite their efforts to achieve the opposite.

While energy executives will welcome a more supportive administration, we don’t expect a return to euphoric production growth. Ample dividend coverage, buybacks and declining leverage continue to be rewarded by the market. The energy cycle is longer than four years. There seems little reason to expect substantial change in how companies allocate capital.

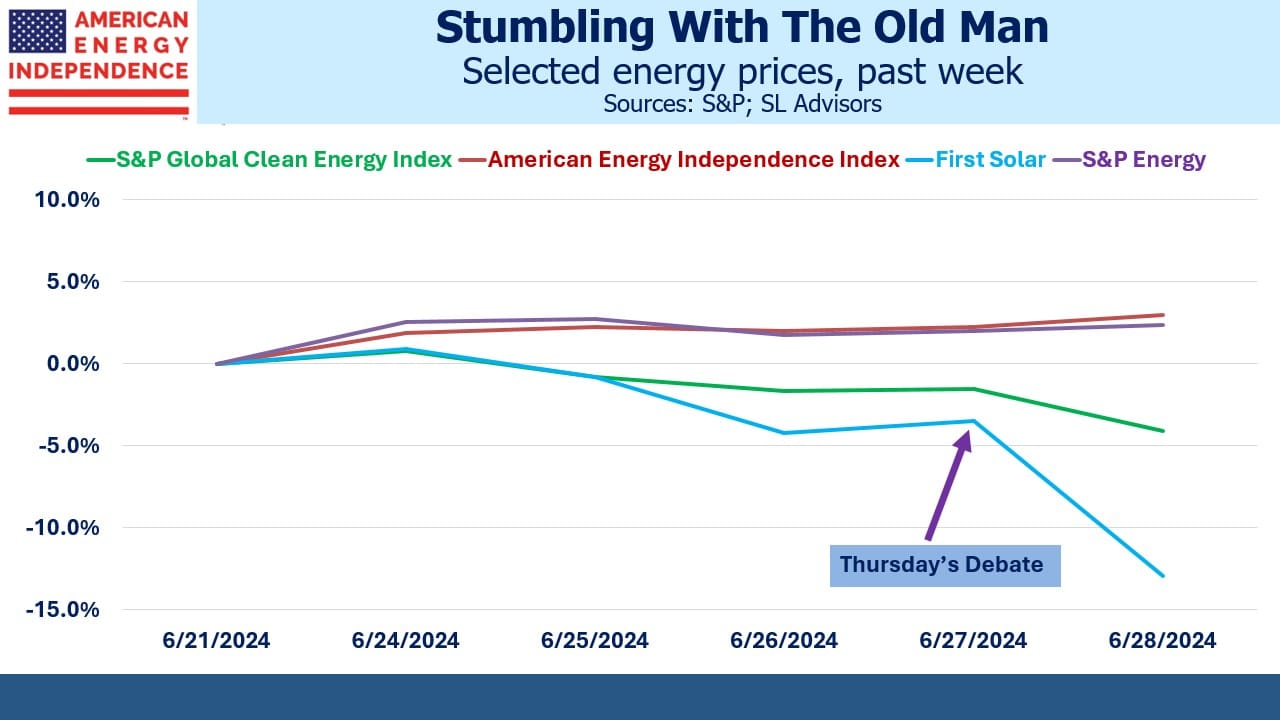

Betting markets immediately responded to Thursday’s debate, and financial markets soon followed. Energy was Friday’s strongest performer, but also notable was the S&P Clean Energy Index which lost 2.5%. First Solar lost 8%. Profits from renewables have been elusive for some time, which is why this sector has lost a quarter of its value over the past year. But it’s also pricing in the likelihood that Republicans will be returning to office.

The American Energy Independence Index finished the week +3%.

Friday morning’s Supreme Court ruling added to the constructive political news. They overturned a precedent from 1984 (Chevron v Natural Resources Defense Council, known as the Chevron Doctrine) which gave Federal agencies broad discretion in setting regulations where the underlying statute was unclear or silent. This has led to policy changes when the White House changes hands even when underlying laws have not been affected.

Generally, Democrat administrations have been more inclined to pursue an agenda via regulation. Under this ruling, a politically motivated regulatory interpretation of an ambiguous statute will be more easily challenged. This is a positive development for traditional energy since it favors less regulation.

One example concerns the EPA’s reliance on the Chevron Doctrine to recently issue a regulation requiring any new natural gas power plant to capture its CO2 emissions by 2034. The increase in power demand due to the AI boom was already expected to increase natural gas demand even with this added expense, which now may not be required. The Supreme Court ruling is positive for natural gas.

The pause in LNG permits that Biden announced earlier this year should be rescinded once Trump takes office. Some negotiations over long-term LNG supply had been halted due to uncertainty over when the permit pause would be lifted. Energy Transfer’s planned Lake Charles facility was one whose future was left in limbo. Japan’s energy minister publicly worried about the delay. Japan is the world’s second biggest LNG importer, and they’re attracted to cheap US prices.

It wouldn’t be surprising for the debate to reinvigorate some negotiations over long term LNG supply that had been stalled.

Making more US natural gas available to Asian buyers allows them to reduce their dependence on coal. Because gas burns with roughly half the CO2 emissions of coal, this is the most powerful way to reduce greenhouse gases and is the biggest factor driving US emissions lower.

Perversely given how progressives have pushed climate change policies, in lifting the LNG export pause a re-elected President Trump would be doing more to help the rest of the world lower emissions than anything the current administration has done.

And there will no longer be a US climate czar praising China’s progress on emissions, as John Kerry did. He regularly overlooked their growing fleet of coal burning power plants. Kerry also mistakenly regarded China’s renewables ambitions as reflecting concern for the planet whereas it’s part of their drive for energy security. They’re planning for eventual conflict over Taiwan.

Thursday night’s debate was painful to watch. A poorly advised old man was shown to be well past his political sell by date. We’ll learn how easily a presidential candidate can be dropped when his primary delegates have been pledged but not formally voted.

It was a lousy week for Democrats, but a good one for energy investors. It provided more certainty about the future political and regulatory environment we’ll face. If a strong replacement candidate for Biden does emerge, their chances will improve. But for now, reliable energy stocks are benefitting from slipping Democrat support.

There can be little debate about that.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!