POTUS Should Have Called in Sick

For those wondering how the election will affect the energy sector, Thursday’s presidential debate offered some clarification but also added some uncertainty. Following Biden’s stuttering performance, he’s a poor bet to return to the White House after November. It must be more likely than not that his party will find a way to dump him before their convention in August, since he’s leading his party to electoral disaster with countless down-ticket Democrat candidates now at risk.

Joe Manchin would be an interesting centrist choice that would scramble projections, but he’s repeatedly disavowed any interest. Biden’s best case to remain in the race is that the alternatives are so poor.

It’s pretty clear that Joe Biden’s too old and senile to be president for another four years. From an energy perspective, a more friendly administration with a lighter regulatory touch is likely.

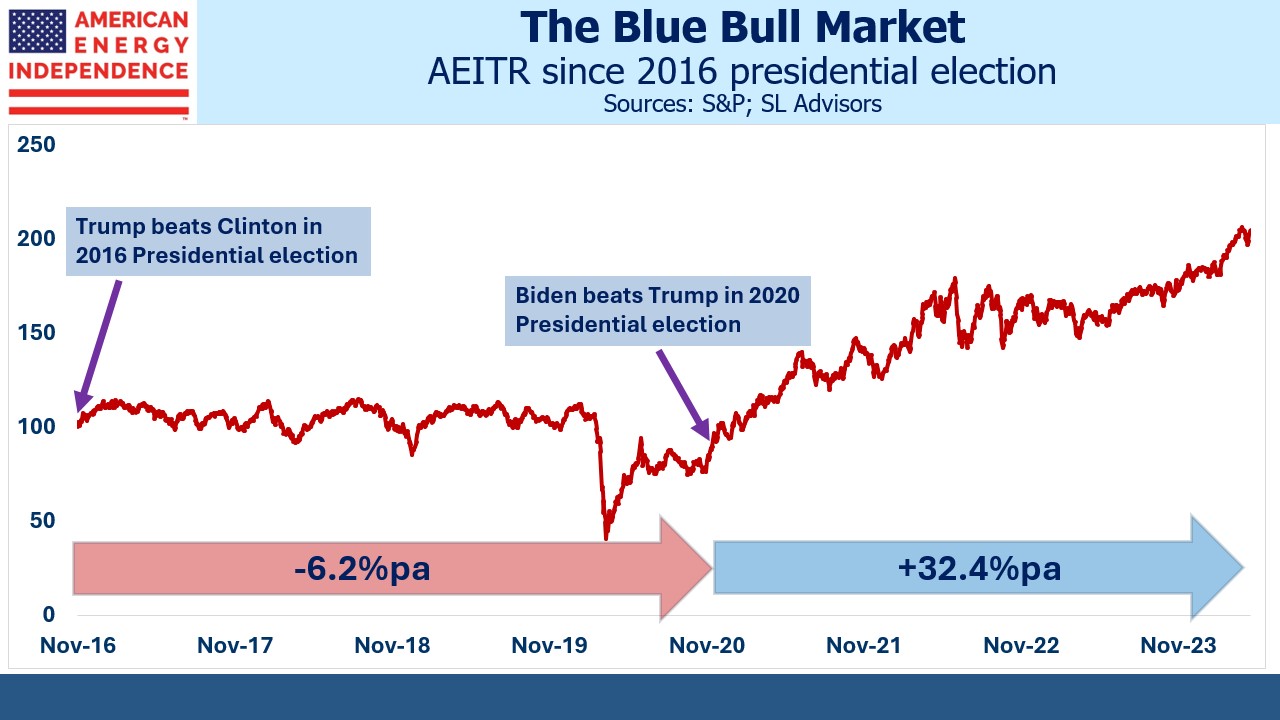

Republicans are associated with “Drill Baby, Drill” and it’s worth remembering that the last Trump presidency wasn’t kind to energy investors. The euphoria of a supportive government led to oversupply, depressing prices and returns. The pandemic didn’t help.

Energy companies embraced financial discipline, prioritizing per share returns over volumes. This took hold during Biden’s presidency and coupled with the continuing recovery from Covid returns have been very good.

When investors ask if we’re worried about a second Biden term, we often point to the “blue rally.” It must be endlessly frustrating to progressives that their political ascendancy has been so profitable for traditional energy despite their efforts to achieve the opposite.

While energy executives will welcome a more supportive administration, we don’t expect a return to euphoric production growth. Ample dividend coverage, buybacks and declining leverage continue to be rewarded by the market. The energy cycle is longer than four years. There seems little reason to expect substantial change in how companies allocate capital.

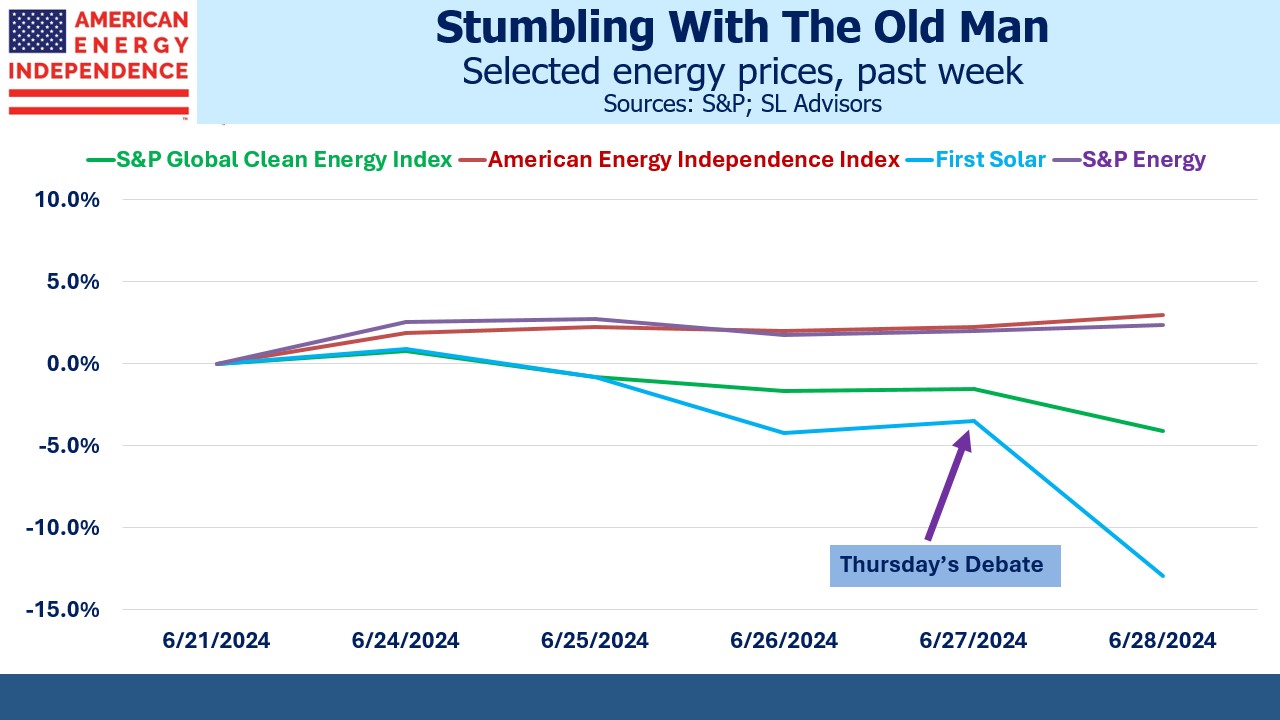

Betting markets immediately responded to Thursday’s debate, and financial markets soon followed. Energy was Friday’s strongest performer, but also notable was the S&P Clean Energy Index which lost 2.5%. First Solar lost 8%. Profits from renewables have been elusive for some time, which is why this sector has lost a quarter of its value over the past year. But it’s also pricing in the likelihood that Republicans will be returning to office.

The American Energy Independence Index finished the week +3%.

Friday morning’s Supreme Court ruling added to the constructive political news. They overturned a precedent from 1984 (Chevron v Natural Resources Defense Council, known as the Chevron Doctrine) which gave Federal agencies broad discretion in setting regulations where the underlying statute was unclear or silent. This has led to policy changes when the White House changes hands even when underlying laws have not been affected.

Generally, Democrat administrations have been more inclined to pursue an agenda via regulation. Under this ruling, a politically motivated regulatory interpretation of an ambiguous statute will be more easily challenged. This is a positive development for traditional energy since it favors less regulation.

One example concerns the EPA’s reliance on the Chevron Doctrine to recently issue a regulation requiring any new natural gas power plant to capture its CO2 emissions by 2034. The increase in power demand due to the AI boom was already expected to increase natural gas demand even with this added expense, which now may not be required. The Supreme Court ruling is positive for natural gas.

The pause in LNG permits that Biden announced earlier this year should be rescinded once Trump takes office. Some negotiations over long-term LNG supply had been halted due to uncertainty over when the permit pause would be lifted. Energy Transfer’s planned Lake Charles facility was one whose future was left in limbo. Japan’s energy minister publicly worried about the delay. Japan is the world’s second biggest LNG importer, and they’re attracted to cheap US prices.

It wouldn’t be surprising for the debate to reinvigorate some negotiations over long term LNG supply that had been stalled.

Making more US natural gas available to Asian buyers allows them to reduce their dependence on coal. Because gas burns with roughly half the CO2 emissions of coal, this is the most powerful way to reduce greenhouse gases and is the biggest factor driving US emissions lower.

Perversely given how progressives have pushed climate change policies, in lifting the LNG export pause a re-elected President Trump would be doing more to help the rest of the world lower emissions than anything the current administration has done.

And there will no longer be a US climate czar praising China’s progress on emissions, as John Kerry did. He regularly overlooked their growing fleet of coal burning power plants. Kerry also mistakenly regarded China’s renewables ambitions as reflecting concern for the planet whereas it’s part of their drive for energy security. They’re planning for eventual conflict over Taiwan.

Thursday night’s debate was painful to watch. A poorly advised old man was shown to be well past his political sell by date. We’ll learn how easily a presidential candidate can be dropped when his primary delegates have been pledged but not formally voted.

It was a lousy week for Democrats, but a good one for energy investors. It provided more certainty about the future political and regulatory environment we’ll face. If a strong replacement candidate for Biden does emerge, their chances will improve. But for now, reliable energy stocks are benefitting from slipping Democrat support.

There can be little debate about that.

We have three have funds that seek to profit from this environment: