Blue State Energy Policies

/

Oregon is typical of many liberal states in that it is reviewing the infrastructure plans of the utilities it regulates. The concern is that too much capital will be invested in new natural gas infrastructure that will subsequently result in “stranded assets” as renewables reduce natural gas demand. The fear is that poor capex decisions will saddle future ratepayers with the cost of un-needed infrastructure as cheap solar and wind gain share.

Renewables aren’t cheaper – that theory has been debunked by the rising price of electricity over the past couple of years (see The Inflationary Energy Transition). There’s a case that reducing CO2 emissions is a desirable public policy goal and pursuing it is worth more expensive electricity. Liberals rarely make this case, preferring instead to claim that weather-dependent power costs less in defiance of evidence to the contrary.

So the Oregon Public Utilities Commission is challenging assumptions about future natural gas demand, which they deem “unreasonably optimistic.”

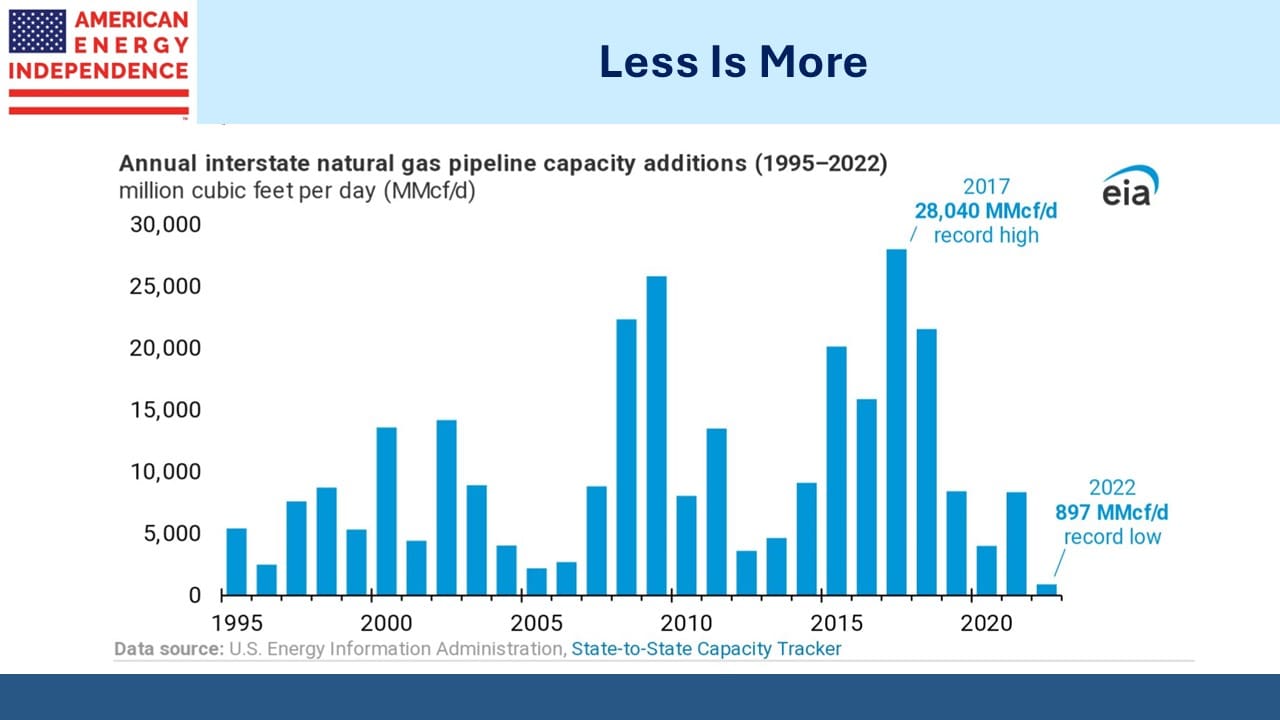

Additions to US natural gas pipeline capacity were a record low in 2022, down 97% from the high five years earlier. It’s helping boost cashflow at pipeline operators because their capex is down but may not always be in the public interest.

By contrast, India’s PM Narendra Modi is pushing to turn India into a “gas-based economy.” The country’s largest steel mill is planning to invest $1BN to help it switch to natural gas, which will reduce its coal consumption and therefore India’s CO2 emissions.

The Indian Oil Corporation recently signed a long-term LNG deal with TotalEnergies, a key investor in NextDecade.

The White House pause on new LNG export permits impedes India’s energy objectives even though they’re in everyone’s interests. India’s JSW Steel is not going to use solar and wind to make steel.

This is why it’s correct to bet on continued growth in demand for US natural gas. The world is shifting to a more realistic energy transition which acknowledges it’ll take generations and that reducing coal consumption anywhere and everywhere is good. As policymakers and businesses adopt practical solutions, the US is well positioned to lead.

Several major European power companies are scaling back their renewables’ targets. Italian, Spanish and Portuguese electricity prices may be among the highest in the world, but they aren’t high enough to make such investments profitable.

“There has been a big reality check around renewables growth,” said Norman Valentine, head of renewables research at consultancy Wood Mackenzie.

It is against this backdrop that your blogger is replacing an old oil furnace with a new gas one. This requires the local gas company to upgrade our existing gas line to higher capacity, work that is mercifully still permissible in blue New Jersey. In New York, Con Edison requires anyone with a gas service request to accept the “Acknowledgement of the Climate Leadership and Protection Act” which sounds as if they’d rather you didn’t make such a request in the first place.

Heat pumps have outsold natural gas furnaces for the past two years. This doesn’t mean that more homes are installing heat pumps, because some homes may be using more than one unit. For example, we already have one natural gas furnace so will be adding a second.

Heat pumps, which run on electricity, use less energy and are cheaper to operate. This should mean they’ll eventually displace natural gas furnaces. However, their installation is complex and expensive. They also don’t work well with the cast iron radiators in our almost century-old home, which require large volumes of very hot water to operate effectively.

Heat pumps reportedly run less efficiently as it gets cold, when they rely on a backup heating element which is much less efficient. I’d be concerned that they wouldn’t keep the house as warm as I’d like – I have little tolerance for being cold, which is why I spend much of the winter in south Florida.

Unlike our gas furnace, a heat pump would be placed outside where it would be vulnerable to ice formation. Defrosting it would reduce the heat available for the house, probably just when it is most needed. They’re apparently also noisy. They use a longer operating cycle than gas furnaces which means they’re running more of the time.

The added gas infrastructure that will enable our additional gas furnace will not be stranded for at least as long as we’re living here. My criteria for a heating system begins with whether it will keep us warm enough. There’s no efficiency or cost benefit that would compensate for being cold. And any reduced emissions would be offset by one of China’s new coal-burning power plants within a few moments, so that doesn’t factor in at all.

I don’t want to be forced to rely on a heat pump in the future if I don’t think it’ll meet my needs.

Ray Dalio sees political polarization in America causing people to, “…move to different states that are more aligned with what they want.”

Energy policy in liberal states is one reason why.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!