Coal Trade Is Growing

/

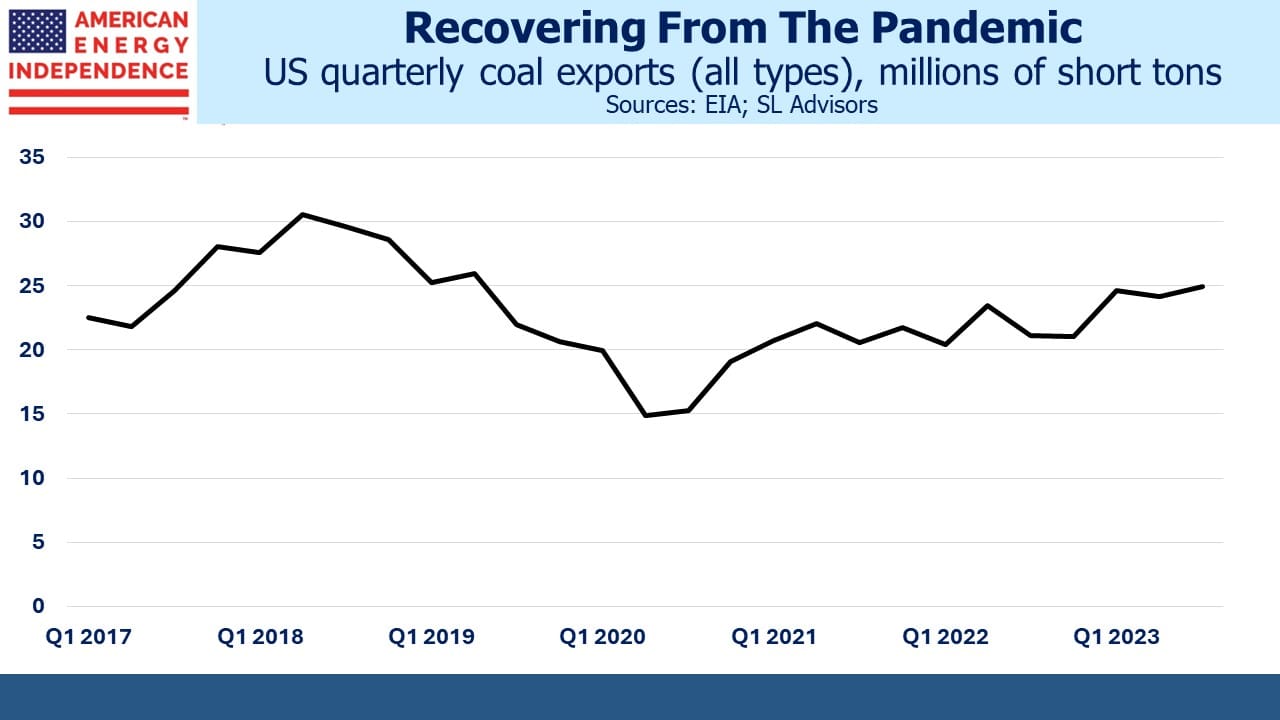

American coal exports are booming. Exports of thermal coal rose 26% last year, to 44 Million Metric Tonnes (MMTs). This is mostly burned to produce electricity. We also exported 46.5 MMTs of metallurgical coal, typically used in industrial processes such as steel manufacture.

Shipments of thermal coal to India doubled, to 14.1 MMTs, close to a third of such exports.

Coal is widely understood to generate roughly twice the Greenhouse Gas emissions (GHGs) as natural gas. In addition, local pollution causes respiratory problems for people living nearby.

US GHGs have fallen over the past 15 years primarily because we’ve been reducing coal-sourced power in favor of natural gas. Increased use of renewables has also contributed, but not as much.

A coherent White House climate policy would encourage developing countries, the main source of demand growth for energy, to follow the US example. This would mean increasing natural gas availability through LNG exports and reducing coal availability.

Instead, we’re doing the opposite. With coal exports reaching a record, the White House injected uncertainty into long term US LNG supply by pausing the approval of new export terminals.

Pakistan announced last year a quadrupling of coal-fired power generation in response to high global LNG prices. Japan recently broke off negotiations with Energy Transfer about buying LNG from their planned Lake Charles facility because of uncertainty over whether it will be built.

India is the second biggest consumer of coal, albeit way behind China who is 4X as big. A new round of Ukraine-related sanctions on Russia is intended to impede their exports of coal to India, which will presumably further boost their appetite for US shipments.

India plans to increase LNG imports so as to increase fertilizer production. This is needed to feed their growing population whose diets will include more protein as living standards rise (see LNG Pause Will Boost Asian Coal Consumption). Urea is a nitrogen-based fertilizer derived from natural gas via the Haber-Bosch process. It provides plants with nitrogen which promotes growth. Solar and wind power cannot produce fertilizers, other than providing heat energy to enable the chemical processes.

To put the export statistics in perspective, the 44 MMTs of thermal coal we exported, which will mostly be burned to generate power, have the same energy equivalent as 9.4 Billion Cubic Feet per Day (BCF/D) of LNG exports. We currently export 12-13 BCF/D of LNG, mostly to Asian buyers who use less coal as a result. This figure will double over the next four years or so as export terminals at various stages of construction reach completion. But the DOE pause on new approvals has cast uncertainty.

Nobody wants to sign a 20 year commitment to purchase LNG without knowing that the proposed facility will actually be built. According to the Energy Institute’s 2023 Statistical Review of World Energy, global coal trade grew at 0.6% pa over the past decade.

It’s fair to say that US climate policy is not closely aligned with trade policy as it relates to energy exports. We are encouraging purchases of the fossil fuel that generates the most GHGs while impeding its replacement with cleaner-burning LNG.

US climate extremists including TikTok boy Alex Haraus (see White House Adopts An Energy Policy Where Everyone Loses) have promulgated a flawed policy that will increase emissions by encouraging coal use.

When people disagree with you it’s tempting to question their intelligence. This is quicker than considering whether their alternate view holds some insight. It’s also intellectually lazy.

However, in the case of climate extremists I have concluded that factual analysis informs their views to an inconsequential degree. They exhibit a Pavlovian opposition to any form of reliable energy. They know little of how the world works. They think everything can run on solar and wind even though 80% of the world’s energy today comes from fossil fuels. Many of them even oppose nuclear power, so beholden by the purist belief in intermittent energy.

In short, climate extremists are not the smartest people you’ll meet.

Electoral enthusiasm is the lowest I can recall in over four decades living in the US. It’s why Biden grasped at the LNG permit pause as an opportunity to energize progressives. But it’s poor policy, and after the election if the current octogenarian occupant of the Oval Office wins, a more effective policy prescription will likely follow. This should include more gas and less coal.

Trump has already said he’ll lift the pause.

So the investor’s perspective should be to look past the current short term thinking and consider what a thoughtful policy will look like. Those who think hard about how the world can reduce GHGs expect climate extremists to be drowned out by pragmatic solutions.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!