LNG Pause Will Boost Asian Coal Consumption

/

Criticism of the White house pause on LNG approvals continues. Williams Companies’ CEO Alan Armstrong said it would cause some countries contemplating the construction of new LNG import facilities to hesitate. The clearest result will be increased coal consumption since it’s cheap and widely available across Asia.

Shell expects LNG demand to increase by 50% through 2040. The biggest driver will be switching away from coal by China and other Asian countries. Even though Shell thinks overall natural gas demand could peak around then, they still expect LNG to continue growing.

The Energy Information Administration (EIA) provided one reason. They expect Indian consumption of natural gas to more than triple by 2050, with much of this increase coming from LNG imports.

Around half the gas consumed by India’s industrial sector is used to produce ammonia, which is then converted into urea, a fertilizer. Government policy is to produce more ammonia and therefore produce more urea domestically, thereby decreasing fertilizer imports.

Few climate extremists have given this much thought, but not every use of natural gas can be replaced with solar panels or windmills. Urea is produced from a series of chemical reactions at high temperatures. India’s population and per capita calorie consumption are growing. As living standards rise people eat higher quality food with more protein. If you’ve ever visited India, it’s unlikely you saw much obesity.

The EIA expects India’s primary consumption of energy to grow at a 3.9% annual rate through 2050, which means it’ll triple. They expect India’s economy to grow at 5% pa, more than 2X the global rate (China is 3.0% and the US 1.9%).

Even with annual growth in gas 2X China’s (4.4% vs 2.0% pa), by 2050 India will still be only around a third of China’s consumption and a quarter of the US. In other words, the EIA’s outlook for India doesn’t look excessively high.

It’s implausible that an emerging country like India will moderate its need for fertilizer just because US climate extremists think the world should phase out natural gas. If they’re unable to source enough gas elsewhere, they’re more likely to increase coal consumption in the power sector, freeing up more gas for urea production.

RBNEnergy published an interesting blog post reviewing the winners and losers from the Department of Energy pause on permits.

In other news, last week three of the G7 economies are now in recession. Japan reported -0.4% GDP for 4Q23 following a revised 3.3% decline in the previous three months. Their economy slipped to 4th biggest, replaced at third by Germany, even as they similarly reported two consecutive declines in GDP. The UK just did the same.

Japan has struggled with anemic growth for years hampered by the demographics of an aging population. But the other two are self-inflicted.

Germany has pursued economically ruinous energy policies even though at 2% of the world’s GreenHouse Gas (GHGs) emissions this effort is more about showing leadership than making a material change. Energy prices have become damagingly high for industry, prompting companies to cut back domestic production and relocate facilities elsewhere.

Last year Germany closed their last three remaining nuclear plants under a plan introduced by former chancellor Angela Merkel. The loss of Russian natural gas caused them to scramble for LNG imports as well as restart coal-burning power plants.

Germany’s emissions fell to their lowest since the 1950s last year, although this was driven in part by slower economic growth. The government wants to achieve a 65% reduction compared to 1990 within six years.

Few countries will find voters enthused about following Germany’s example, which is nonetheless rated “Insufficient” by Climate Action Tracker.

UK growth is being held back by Brexit, which has made it harder to trade with the rest of the EU. This won’t surprise the minority who voted against Brexit. Polls show most Britons now think Brexit was a mistake. The Conservative Party is struggling to show it was a good decision.

Both Germany and the UK are suffering the consequences of policy choices that were poorly advised, albeit ones that reflected the popular will. Democracies don’t always make good decisions.

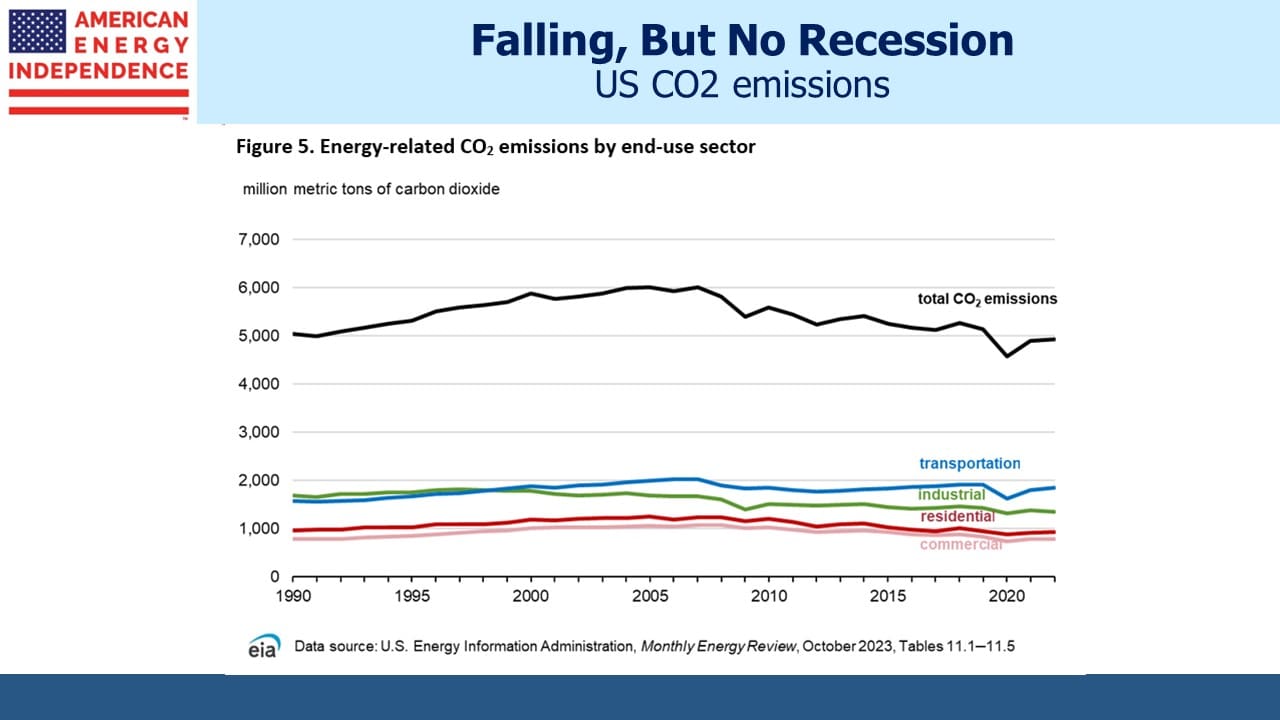

What a contrast with the US, where economic growth is barreling along at 3.3% and the 3.7% unemployment rate shows there are jobs for anyone who seriously wants one. And we’re reducing our GHG emissions, just without creating a recession.

US energy policy has been broadly right, albeit the White House’s recent pause on LNG export permits is wrongheaded. A few European countries would benefit from following the US example.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It is overly optimistic to expect rationality on this subject from the White House