LNG Pause Will Boost Asian Coal Consumption

Criticism of the White house pause on LNG approvals continues. Williams Companies’ CEO Alan Armstrong said it would cause some countries contemplating the construction of new LNG import facilities to hesitate. The clearest result will be increased coal consumption since it’s cheap and widely available across Asia.

Shell expects LNG demand to increase by 50% through 2040. The biggest driver will be switching away from coal by China and other Asian countries. Even though Shell thinks overall natural gas demand could peak around then, they still expect LNG to continue growing.

The Energy Information Administration (EIA) provided one reason. They expect Indian consumption of natural gas to more than triple by 2050, with much of this increase coming from LNG imports.

Around half the gas consumed by India’s industrial sector is used to produce ammonia, which is then converted into urea, a fertilizer. Government policy is to produce more ammonia and therefore produce more urea domestically, thereby decreasing fertilizer imports.

Few climate extremists have given this much thought, but not every use of natural gas can be replaced with solar panels or windmills. Urea is produced from a series of chemical reactions at high temperatures. India’s population and per capita calorie consumption are growing. As living standards rise people eat higher quality food with more protein. If you’ve ever visited India, it’s unlikely you saw much obesity.

The EIA expects India’s primary consumption of energy to grow at a 3.9% annual rate through 2050, which means it’ll triple. They expect India’s economy to grow at 5% pa, more than 2X the global rate (China is 3.0% and the US 1.9%).

Even with annual growth in gas 2X China’s (4.4% vs 2.0% pa), by 2050 India will still be only around a third of China’s consumption and a quarter of the US. In other words, the EIA’s outlook for India doesn’t look excessively high.

It’s implausible that an emerging country like India will moderate its need for fertilizer just because US climate extremists think the world should phase out natural gas. If they’re unable to source enough gas elsewhere, they’re more likely to increase coal consumption in the power sector, freeing up more gas for urea production.

RBNEnergy published an interesting blog post reviewing the winners and losers from the Department of Energy pause on permits.

In other news, last week three of the G7 economies are now in recession. Japan reported -0.4% GDP for 4Q23 following a revised 3.3% decline in the previous three months. Their economy slipped to 4th biggest, replaced at third by Germany, even as they similarly reported two consecutive declines in GDP. The UK just did the same.

Japan has struggled with anemic growth for years hampered by the demographics of an aging population. But the other two are self-inflicted.

Germany has pursued economically ruinous energy policies even though at 2% of the world’s GreenHouse Gas (GHGs) emissions this effort is more about showing leadership than making a material change. Energy prices have become damagingly high for industry, prompting companies to cut back domestic production and relocate facilities elsewhere.

Last year Germany closed their last three remaining nuclear plants under a plan introduced by former chancellor Angela Merkel. The loss of Russian natural gas caused them to scramble for LNG imports as well as restart coal-burning power plants.

Germany’s emissions fell to their lowest since the 1950s last year, although this was driven in part by slower economic growth. The government wants to achieve a 65% reduction compared to 1990 within six years.

Few countries will find voters enthused about following Germany’s example, which is nonetheless rated “Insufficient” by Climate Action Tracker.

UK growth is being held back by Brexit, which has made it harder to trade with the rest of the EU. This won’t surprise the minority who voted against Brexit. Polls show most Britons now think Brexit was a mistake. The Conservative Party is struggling to show it was a good decision.

Both Germany and the UK are suffering the consequences of policy choices that were poorly advised, albeit ones that reflected the popular will. Democracies don’t always make good decisions.

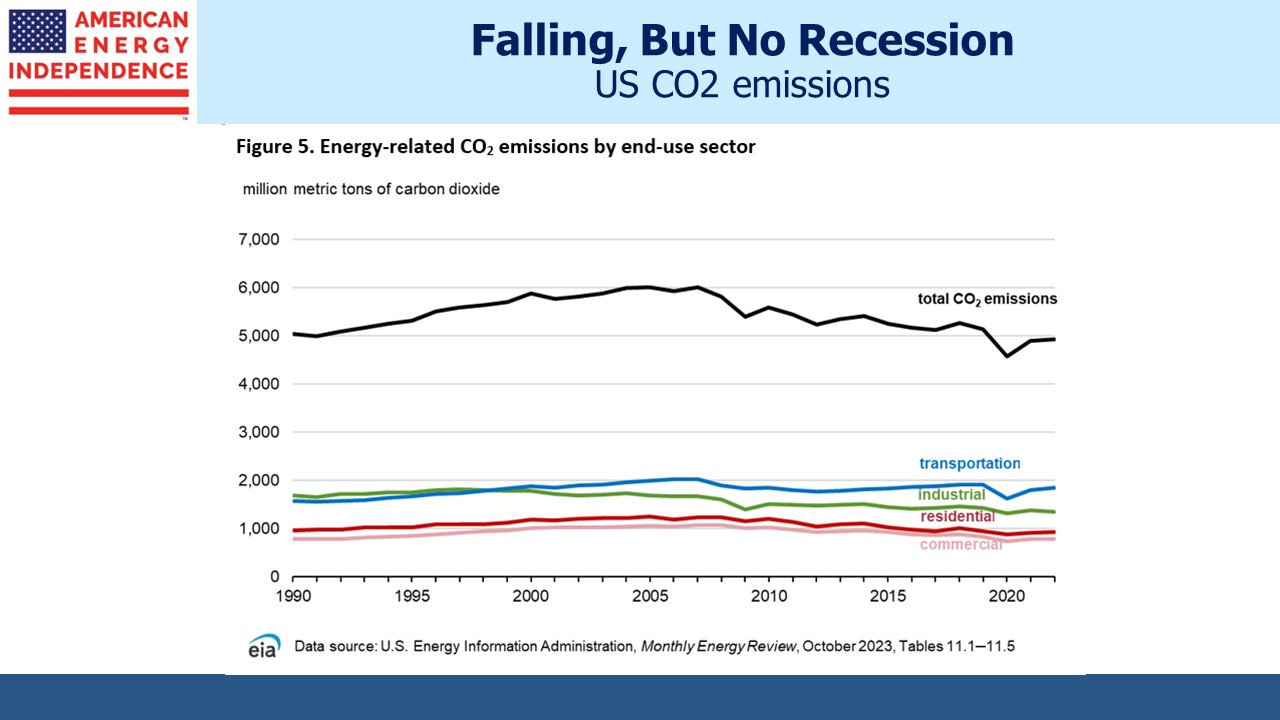

What a contrast with the US, where economic growth is barreling along at 3.3% and the 3.7% unemployment rate shows there are jobs for anyone who seriously wants one. And we’re reducing our GHG emissions, just without creating a recession.

US energy policy has been broadly right, albeit the White House’s recent pause on LNG export permits is wrongheaded. A few European countries would benefit from following the US example.

We have three have funds that seek to profit from this environment: