Pushing Back On Climate Extremists

/

New York and much of the northeast US was shrouded in smoke from Canadian wildfires last week. Westfield, NJ is around 21 miles from lower Manhattan, which is normally visible if you’re at a high enough point. Last Wednesday it was not. Neither was the sun. Millions of Americans experienced air quality more usually associated with New Delhi.

Global warming gets blamed for most unusual weather events. Whenever it’s exceptionally wet/dry/cold/hot/windy it’s because humans are increasing CO2 levels. Regular readers know we are in favor of strategies to lower CO2. Substituting natural gas for coal is a practical solution already responsible for US success in reducing emissions. More nuclear power seems obvious. We’re not excited at the prospect of increased reliance on weather-dependent solar and wind.

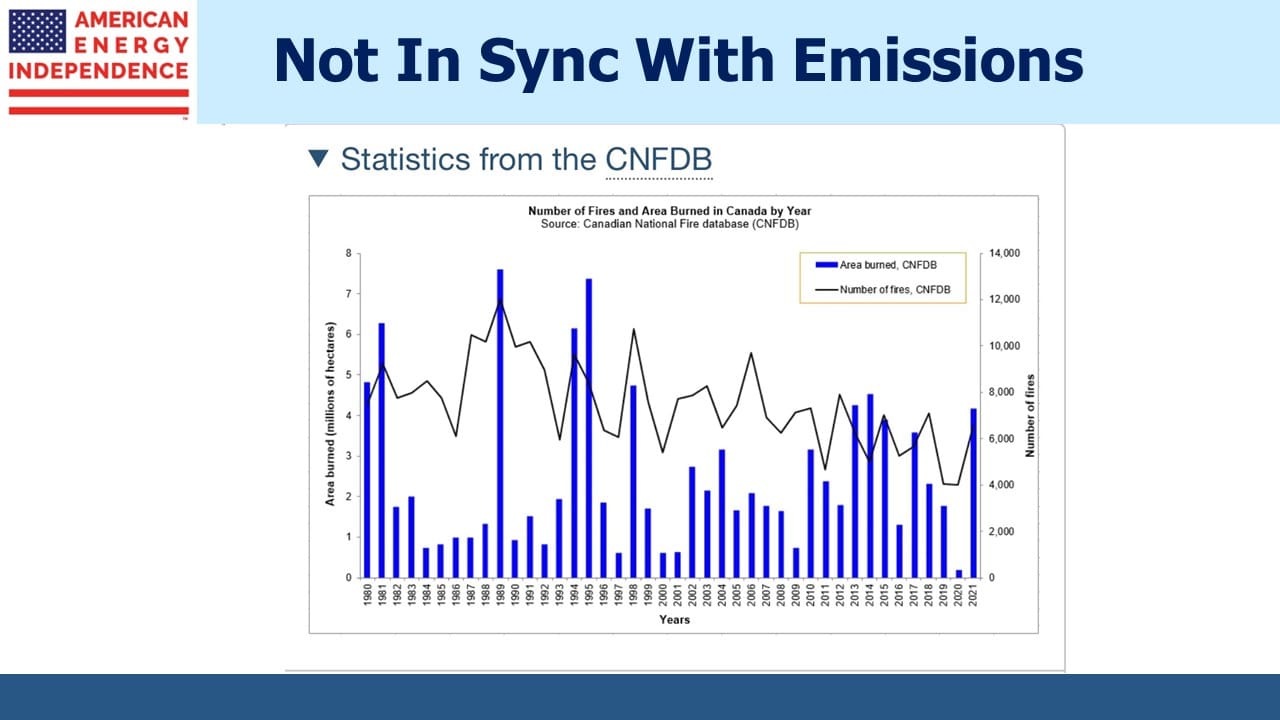

The New York Times duly reported that, “Human-caused climate change is a force behind extremes like these.” It fits the narrative. Except the data doesn’t support it. Over the past four decades the number of fires in Canada has been declining, and the worst years were in the 80s and 90s in terms of area burned. That’s not to say that lowering CO2 emissions isn’t good if pursued without impoverishing us all. Just that the smoke hanging over North America’s population centers isn’t evidence of a CO2 problem.

The world is beginning to tire of the shrill climate extremists intent on imposing economic devastation and austerity on the rest of us. In the UK the Just Stop Oil people have enjoyed extraordinary freedom to disrupt everyone else. Groups of them standing in the road blocking traffic are protected by police. There are several videos of irate drivers being arrested for trying to push the protesters out of the way.

The list of what makes America great is long. The absence of an American version of these protesters is somewhere in the middle of the list. They would be run over or perhaps even shot at. UK public opinion is asking why the wrong people are being arrested. Sometimes it looks like Little Britain.

In Germany, the Greens have long held outsized influence over policy because of their swing vote in the coalitions that typically form government. “Green getting too Brown” is a more severe criticism than it looks, referencing the brown shirts of the Nazi party. “Heizhammer” (heating hammer) is how many refer to plans pushed by the Greens to accelerate the adoption of expensive, energy efficient heat pumps.

Germany is a global leader in spending money on the energy transition, if not in results. Last year their CO2 emissions were unchanged because they increased coal use to replace Russian natural gas. This was in spite of a 4.7% drop in energy consumption, as industry responded to high prices by curtailing production and in some cases relocating to other countries, including America. Germany’s electricity prices are among the world’s highest. There’s little in their energy policies that others should wish to emulate.

German public opinion is shifting. The Greens now rank behind the far right AfD in polls.

US energy policies at the Federal level rely more on tax credits and other financial incentives. A few liberal states such as New York are making it harder to access reliable energy, by for example banning natural gas hookups to new buildings.

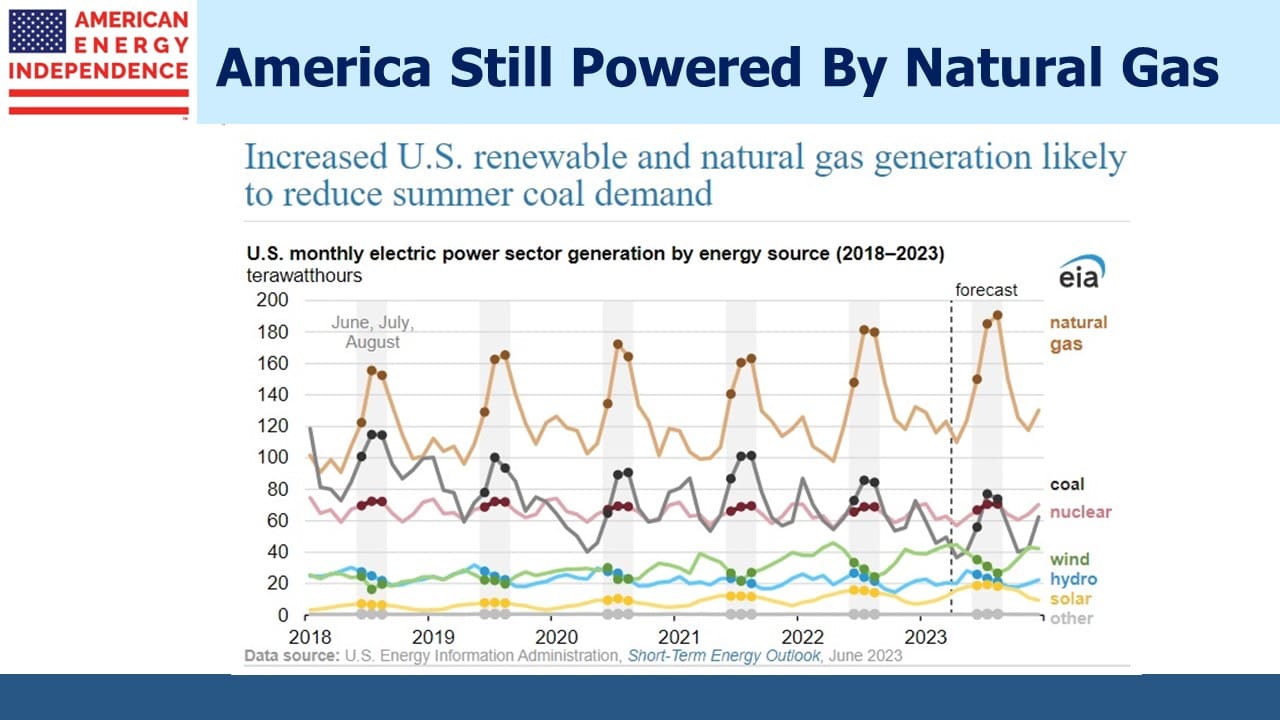

Nonetheless, domestic production continues to grow. Last year the Permian region in west Texas and New Mexico hit another record at 21 Billion Cubic Feet per Day (BCF/D). It’s second only to the Marcellus/Utica region (collectively Appalachia). The Energy Information Administration (EIA) reported that this past winter power generation from natural gas set a new record at 619 billion kilowatthours. Renewables are growing but America’s electricity still comes from natural gas.

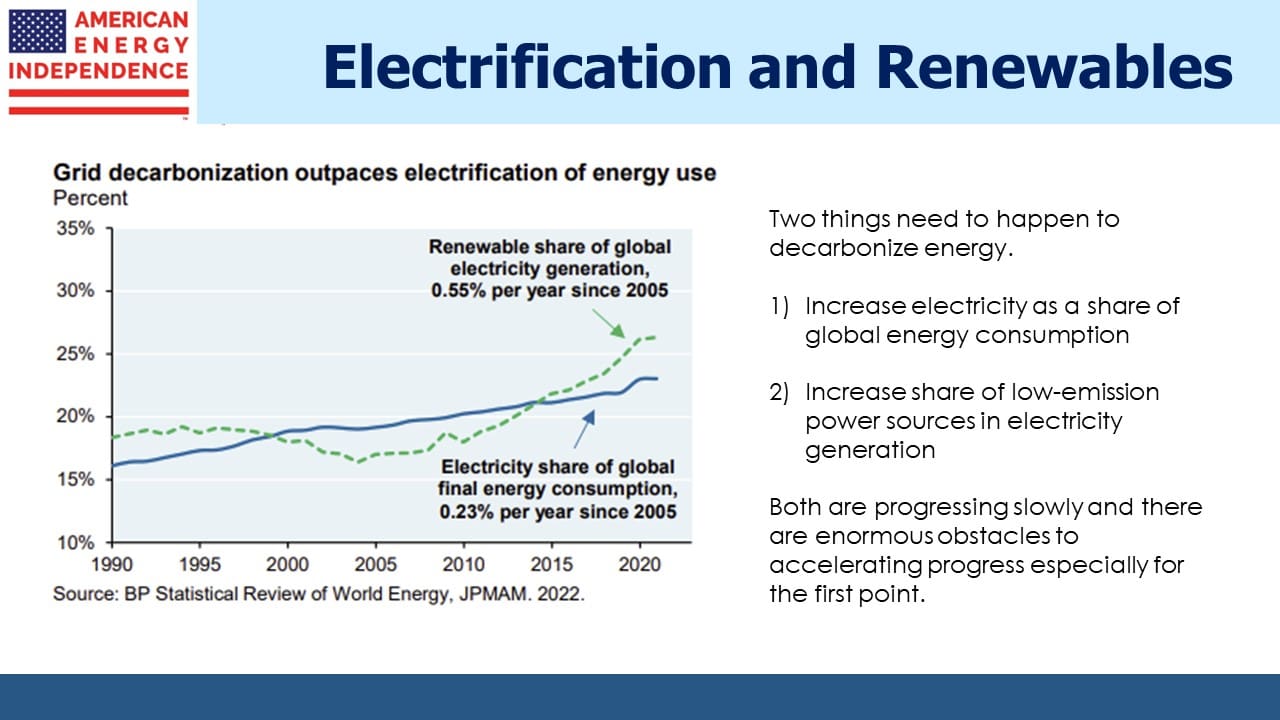

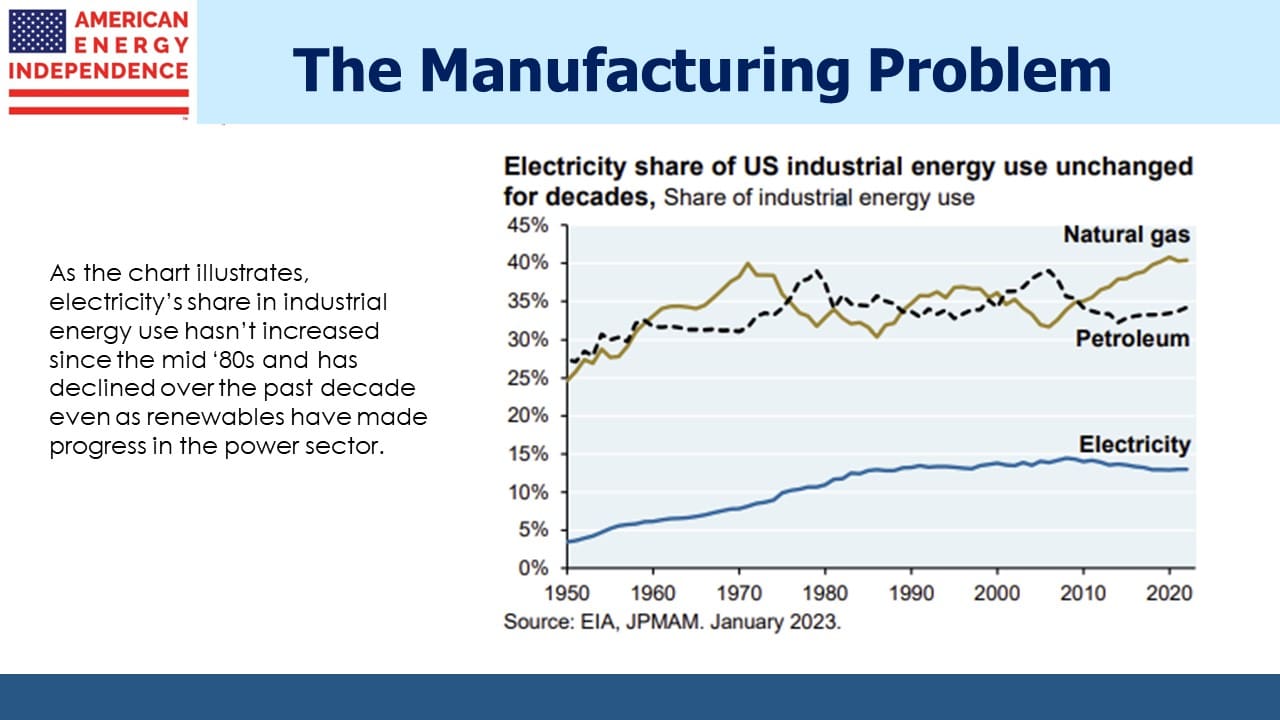

The focus on renewables overlooks the fact that electricity is around 23% of global final energy consumption. Within US manufacturing for example, electricity use has remained roughly unchanged at under 15% of energy use for decades. Natural gas use is growing and represents almost 3X electricity.

Because the US hasn’t followed extreme energy policies like Germany, reliable cheap energy is drawing manufacturing here. Germany felt good about their ability to reduce energy consumption last year, but in part it represented production facilities relocating because they were losing competitiveness.

China, consumer of half the world’s coal and the biggest determinant of global CO2 emissions, recently said non-fossil fuel energy sources exceed 50% of their total installed electricity generation capacity. The problem is you can’t believe anything the Chinese government says. So it may or may not be true.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!