COP27 Realism Is Good For Gas

/

The COP27 ended with an agreement by rich countries to make increased payments to poor ones, but a commitment to phase out all fossil fuels failed to gather unanimous support. The holdouts included Saudi Arabia and Russia, who supply substantial volumes of oil and gas to willing buyers but don’t rank highly on the list of global emitters. Developing countries were also reluctant to make such a pledge, because they’re trying to raise living standards which requires more energy.

The EU and several OECD nations regarded the missing phase-out of fossil fuels as a failure. Climate change negotiations remain hobbled by two incongruities: the first is that developing nations who are most exposed to rising sea levels are less enthusiastic about steps to prevent this than the rich world.

The second is that suppliers of reliable energy are constantly pressured to reduce output while consumers face little incentive to curb demand. Rich countries could adopt policies that force their citizens to stop buying fossil fuels, but it would be too disruptive.

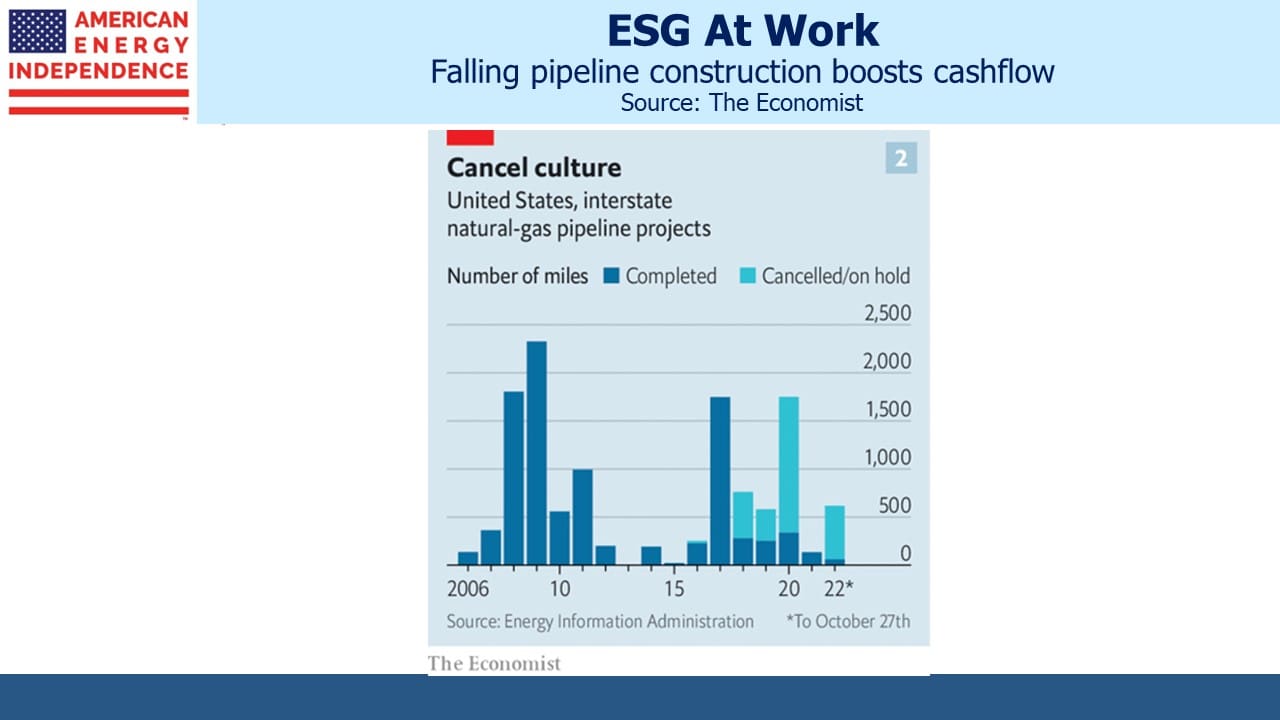

Unable to persuade voters that they should reject anything made with reliable energy, policymakers are left with forcing supply scarcity. The ESG movement and climate extremists have caused reduced capex which has raised prices, but there’s little sign of a demand response. Instead, they’ve made energy the best performing sector in the S&P500.

Some observers regarded COP27 as a failure. But the uneven support for phasing out fossil fuels forced the first incongruity noted above into the open. Namibia’s Maggy Shino said, “Africa wants to send a message that we are going to develop all of our energy resources for the benefit of our people because our issue is energy poverty.”

The Inflation Reduction Act (IRA) that President Biden signed on August 16th improved the viability of carbon capture via increaseed 45Q tax credits. Energy executives have figured out that more CO2 buried underground means reduced emissions and less pressure to phase out natural gas. 3Q earnings calls were sprinkled with references to carbon. It was mentioned 25 times on Occidental’s call, where they reported, “we broke ground on the world’s largest direct air capture plant in Ector County, Texas.”

Exxon Mobil plans to share more details about their “low-carbon solutions business” in December.

Among pipeline companies, Kinder Morgan’s CEO Steve Kean said the IRA, “has made more sources of CO2 economic for capture.”

Energy Transfer plans to sequester (ie bury) CO2 emissions from its planned Lake Charles LNG export facility.

Enbridge CEO Al Monaco said the IRA, “is providing a real catalyst for low-carbon investments.”

Jim Teague, Enterprise Products’ Partners co-CEO, said, “Asia continues to make no bones about their long-term appetite for our energy. We at Enterprise have been emphatic that it’s going to take all of the above in order to meet the world’s growing energy needs. That’s why in addition to traditional midstream services, we’re also focused on investments in lower carbon projects like carbon capture and sequestration and providing blue ammonia into export markets.”

Midstream energy infrastructure has an important role to play in the energy transition.

Demonstrating Asia’s willingness to make long term natural gas commitments, Qatar signed a 27 year deal with China’s Sinopec for 4 million tonnes per annum, Qatar is playing in their first World Cup and became the only host nation in history to lose its opening game. Having watched it, betting on three straight losses seems safe. But on the world’s LNG stage they are top three (with the US and Australia).

EU climate policy chief Frans Timmermans thinks compared with coal and oil, natural gas, “is a different situation for which I have some understanding, especially if you combine that with infrastructure that is prefitted to also carry gases with other densities, such as green hydrogen or green ammonia in the future.”

European buyers continue to shun long term LNG contracts, preferring to buy as needed on the spot market at prevailing prices. The coming northern hemisphere winter is a swing factor for global LNG prices over the next several months. But over the next three years, Japan’s trade ministry warned that competition for supplies will intensify, with no new contracts available before 2026.

Many investors often note the correlation between midstream and crude oil. This month the sharp drop in oil has not been reflected in the pipeline sector which is roughly flat MTD. We think the continued growth in free cash flow and decreasing leverage are allowing a decoupling from commodity prices. If so, investors will welcome it.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!