COP27 Realism Is Good For Gas

The COP27 ended with an agreement by rich countries to make increased payments to poor ones, but a commitment to phase out all fossil fuels failed to gather unanimous support. The holdouts included Saudi Arabia and Russia, who supply substantial volumes of oil and gas to willing buyers but don’t rank highly on the list of global emitters. Developing countries were also reluctant to make such a pledge, because they’re trying to raise living standards which requires more energy.

The EU and several OECD nations regarded the missing phase-out of fossil fuels as a failure. Climate change negotiations remain hobbled by two incongruities: the first is that developing nations who are most exposed to rising sea levels are less enthusiastic about steps to prevent this than the rich world.

The second is that suppliers of reliable energy are constantly pressured to reduce output while consumers face little incentive to curb demand. Rich countries could adopt policies that force their citizens to stop buying fossil fuels, but it would be too disruptive.

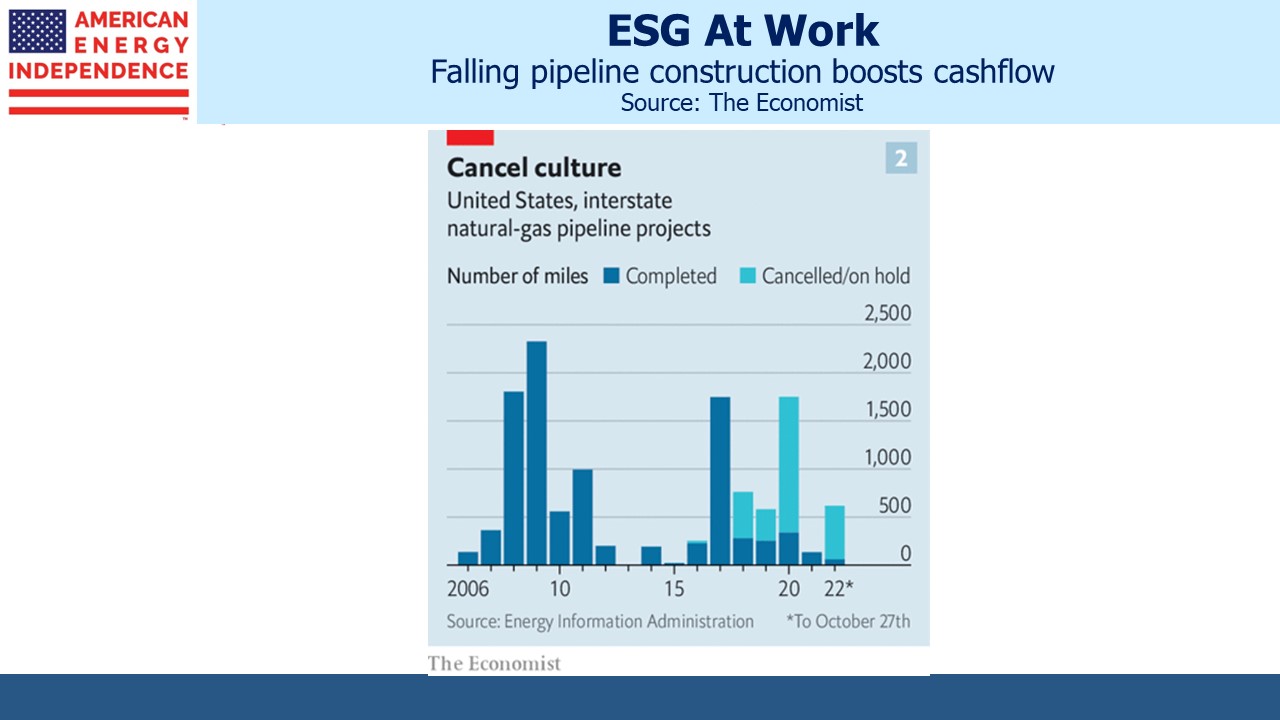

Unable to persuade voters that they should reject anything made with reliable energy, policymakers are left with forcing supply scarcity. The ESG movement and climate extremists have caused reduced capex which has raised prices, but there’s little sign of a demand response. Instead, they’ve made energy the best performing sector in the S&P500.

Some observers regarded COP27 as a failure. But the uneven support for phasing out fossil fuels forced the first incongruity noted above into the open. Namibia’s Maggy Shino said, “Africa wants to send a message that we are going to develop all of our energy resources for the benefit of our people because our issue is energy poverty.”

The Inflation Reduction Act (IRA) that President Biden signed on August 16th improved the viability of carbon capture via increaseed 45Q tax credits. Energy executives have figured out that more CO2 buried underground means reduced emissions and less pressure to phase out natural gas. 3Q earnings calls were sprinkled with references to carbon. It was mentioned 25 times on Occidental’s call, where they reported, “we broke ground on the world’s largest direct air capture plant in Ector County, Texas.”

Exxon Mobil plans to share more details about their “low-carbon solutions business” in December.

Among pipeline companies, Kinder Morgan’s CEO Steve Kean said the IRA, “has made more sources of CO2 economic for capture.”

Energy Transfer plans to sequester (ie bury) CO2 emissions from its planned Lake Charles LNG export facility.

Enbridge CEO Al Monaco said the IRA, “is providing a real catalyst for low-carbon investments.”

Jim Teague, Enterprise Products’ Partners co-CEO, said, “Asia continues to make no bones about their long-term appetite for our energy. We at Enterprise have been emphatic that it’s going to take all of the above in order to meet the world’s growing energy needs. That’s why in addition to traditional midstream services, we’re also focused on investments in lower carbon projects like carbon capture and sequestration and providing blue ammonia into export markets.”

Midstream energy infrastructure has an important role to play in the energy transition.

Demonstrating Asia’s willingness to make long term natural gas commitments, Qatar signed a 27 year deal with China’s Sinopec for 4 million tonnes per annum, Qatar is playing in their first World Cup and became the only host nation in history to lose its opening game. Having watched it, betting on three straight losses seems safe. But on the world’s LNG stage they are top three (with the US and Australia).

EU climate policy chief Frans Timmermans thinks compared with coal and oil, natural gas, “is a different situation for which I have some understanding, especially if you combine that with infrastructure that is prefitted to also carry gases with other densities, such as green hydrogen or green ammonia in the future.”

European buyers continue to shun long term LNG contracts, preferring to buy as needed on the spot market at prevailing prices. The coming northern hemisphere winter is a swing factor for global LNG prices over the next several months. But over the next three years, Japan’s trade ministry warned that competition for supplies will intensify, with no new contracts available before 2026.

Many investors often note the correlation between midstream and crude oil. This month the sharp drop in oil has not been reflected in the pipeline sector which is roughly flat MTD. We think the continued growth in free cash flow and decreasing leverage are allowing a decoupling from commodity prices. If so, investors will welcome it.