America Dodges The Energy Crisis

/

US households are learning to cope with inflation in basic necessities, such a food and energy. Even though the recent CPI report was encouraging, the rising cost of living is a political issue. Fawlty Towers, the brilliant twelve episode British comedy series with John Cleese as the eponymous hotel owner Basil Fawlty, has a scene where a contractor who has mistakenly walled off the entrance to the dining room tries to console his irate customer by saying, “Mr. Fawlty, there’s always someone worse off than yourself.” To which Basil shoots back “Well I’d like to meet him…I could use a laugh.”

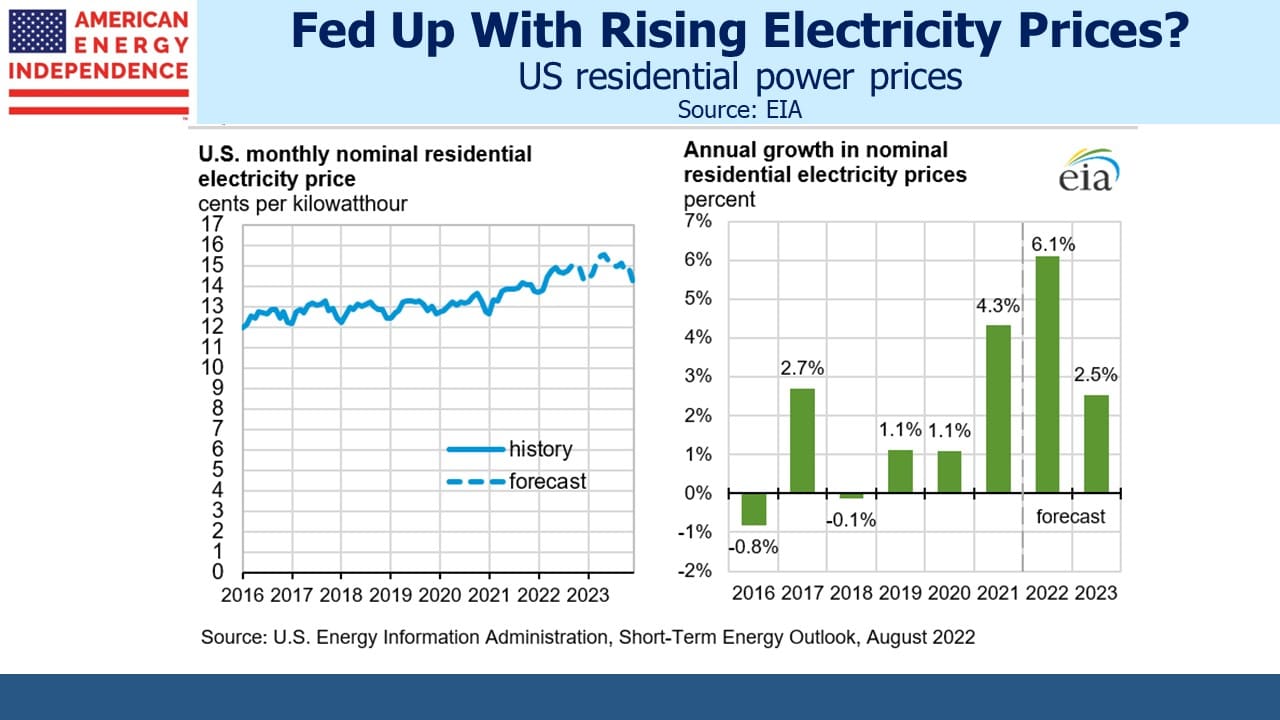

Schadenfreude may not be widely felt amongst middle class American households struggling with elevated energy prices, but the impact of the global energy crisis is highly uneven. The two charts below offer a vivid comparison.

US residential electricity prices are forecast to be up 6.1% this year and 2.5% next year, a notable increase compared with the trend of recent years. Natural gas provides 38% of US power, and Americans are fortunate we are more than self-sufficient because it’s left us relatively unscathed by the run up in prices globally.

The Dutch natural gas TTF futures contract currently trades at around €210 per Megawatt Hour (Mw/H), over 6X the equivalent US price. European electricity prices were already substantially higher than the US before Russia invaded Ukraine. The gap has widened since.

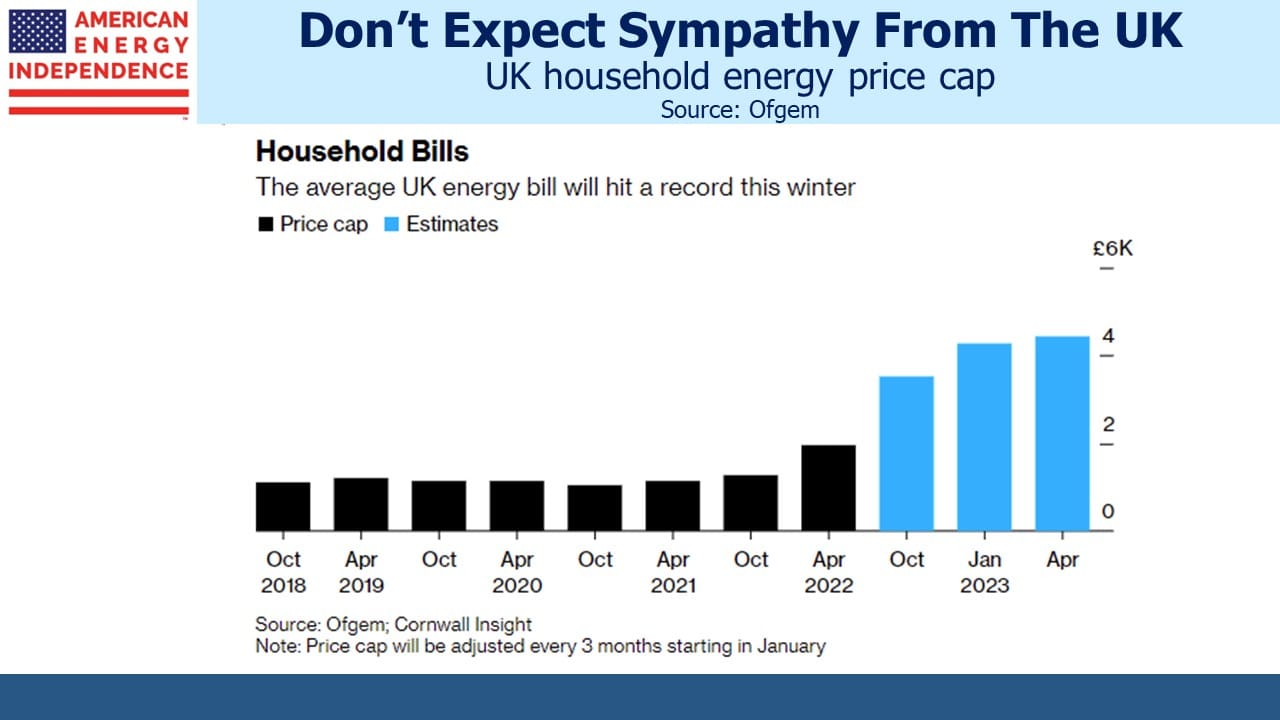

The UK regulator Ofgem sets a cap on energy prices for the typical UK household. Comparing US residential electricity with UK household energy isn’t a perfect match, but the looming price increase is nonetheless jaw-dropping.

Ofgem has had to keep raising the cap to avoid bankrupting UK energy providers. As a result, by next April the cap is likely to be set at 4X its level of two years earlier. The typical British household will go from spending £1,100 to £4,400 per year on energy.

Median per capita British income is $15K, versus $19K in the US. Assuming 2.2 resident per household and a $1.20 exchange rate, this means energy will consume 16% of the typical British household’s income, up from 4% two years ago.

This is a huge failure of public policy. Britain didn’t create a fatal reliance on Russian natural gas the way Germany did, but they’re not immune from the leap in prices and their pursuit of renewables clearly hasn’t offered any protection.

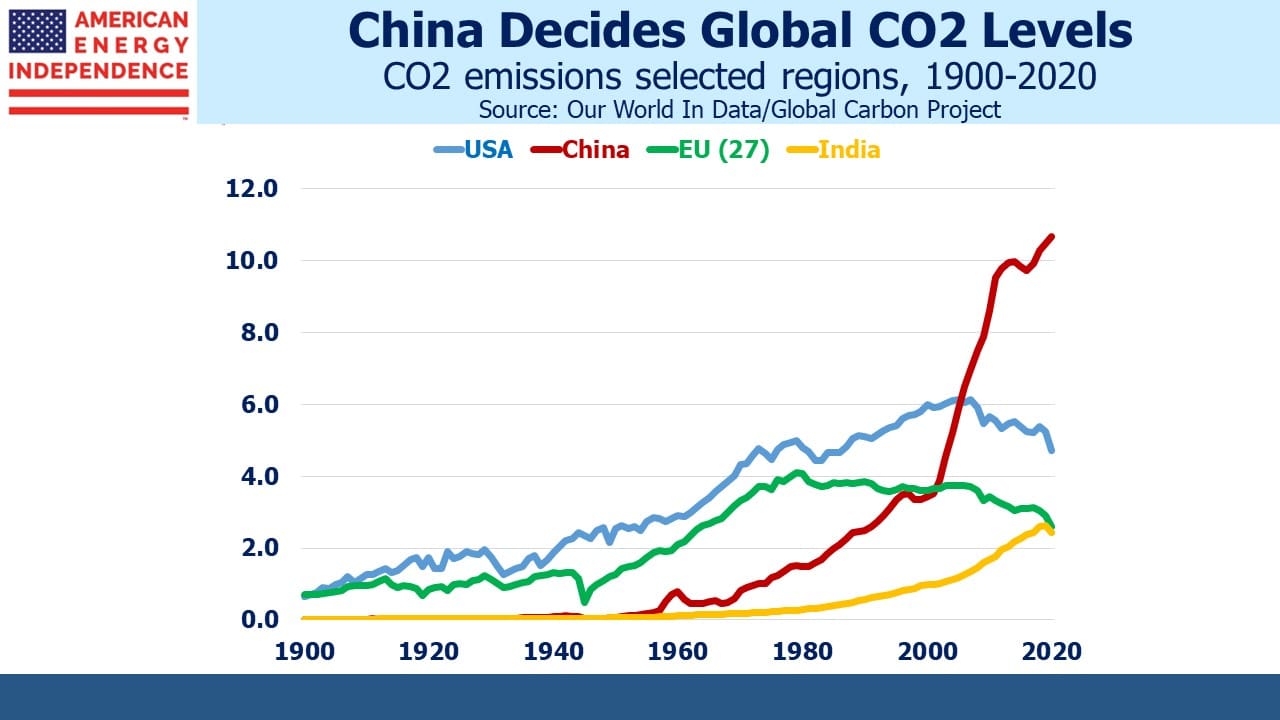

The EU and notably Germany has been the global leader in pursuing the energy transition. Reducing EU CO2 emissions is good, but only to the extent that it convinces China to follow suit. China’s CO2 emissions are now more than 3X the EU’s and 2X the US. We can set a good example, but the mathematical reality is that China’s choices matter more than ours.

OECD countries, which include the US and most of the EU, are richer than developing countries and therefore better equipped to deal with rising sea levels and other possible consequences of heightened CO2 levels. In other words, policymakers are embracing the energy transition in part to help poorer nations.

Therefore, it was illuminating to see China recently suspend climate talks with the US following Nancy Pelosi’s ill-advised visit to Taiwan. In doing so, China showed that they regard such negotiations as more beneficial to the US than to China. Our climate negotiators at the UN have performed so poorly that China somehow thinks it has less to lose from rising CO2 emissions than we do.

Such a view is perpetuated by western policymakers who pursue increased use of renewables at great expense to their populations without ensuring commensurate commitments from nations more vulnerable to the more extreme outcomes some climate scientists warn are coming.

The high costs of European energy policy show there’s nothing to emulate. We can’t want reduced emissions more than China does. Otherwise they’ll free-load on our efforts and continue to push back the date when their CO2 emissions will begin to fall. It’s currently set for 2030, but China’s most recent five year plan removed limits on coal consumption and its share of primary energy generation.

The US is still energy independent in spite of the best efforts of Democrat leaders to pursue the failing policies we see in Europe. Natural gas remains critical to a future of affordable energy and continues to offer the world’s best chance to meaningfully reduce CO2 emissions by replacing coal. Left wing energy policies risk introducing left wing, European prices.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon,

With the new Inflation fighting, Green-Tree Hugger tax waiting to take affect, do you think MLPs. LPs may in the long run now be a better play than Corps even having to deal with K-1s, or will most of the Midstreams just spend more $ on Capex if necessary?

Thanks