America Dodges The Energy Crisis

US households are learning to cope with inflation in basic necessities, such a food and energy. Even though the recent CPI report was encouraging, the rising cost of living is a political issue. Fawlty Towers, the brilliant twelve episode British comedy series with John Cleese as the eponymous hotel owner Basil Fawlty, has a scene where a contractor who has mistakenly walled off the entrance to the dining room tries to console his irate customer by saying, “Mr. Fawlty, there’s always someone worse off than yourself.” To which Basil shoots back “Well I’d like to meet him…I could use a laugh.”

Schadenfreude may not be widely felt amongst middle class American households struggling with elevated energy prices, but the impact of the global energy crisis is highly uneven. The two charts below offer a vivid comparison.

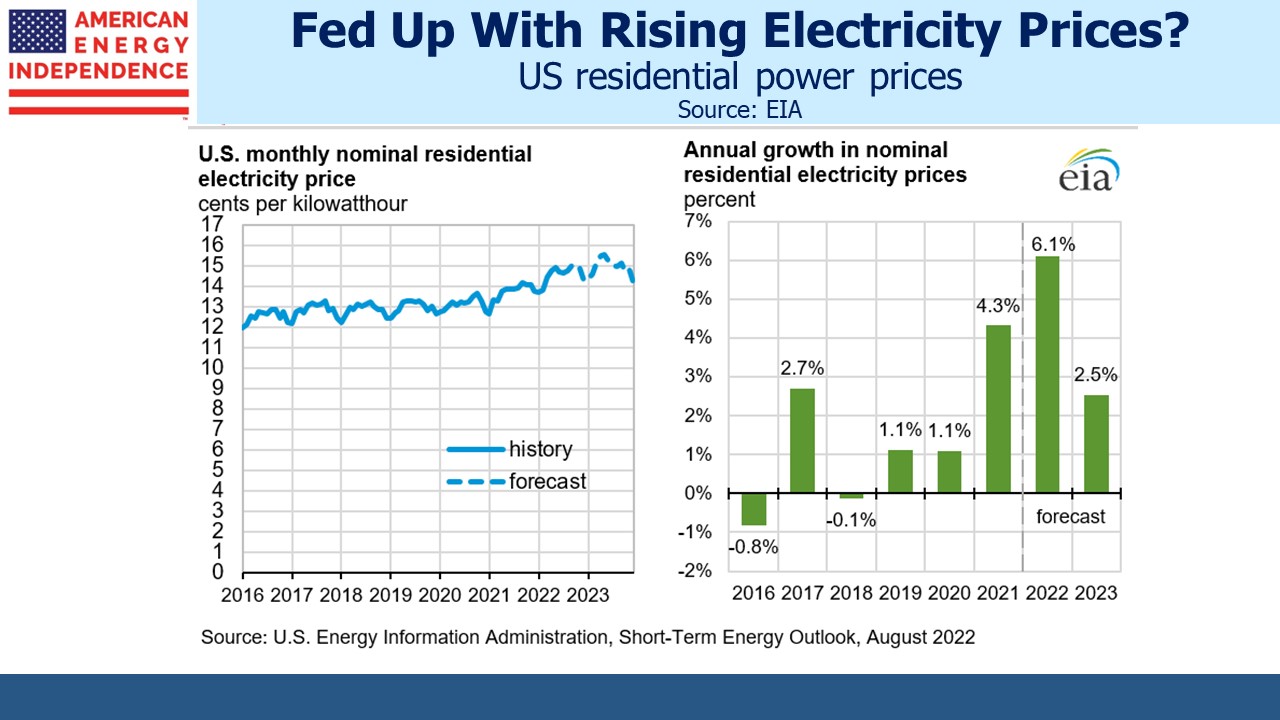

US residential electricity prices are forecast to be up 6.1% this year and 2.5% next year, a notable increase compared with the trend of recent years. Natural gas provides 38% of US power, and Americans are fortunate we are more than self-sufficient because it’s left us relatively unscathed by the run up in prices globally.

The Dutch natural gas TTF futures contract currently trades at around €210 per Megawatt Hour (Mw/H), over 6X the equivalent US price. European electricity prices were already substantially higher than the US before Russia invaded Ukraine. The gap has widened since.

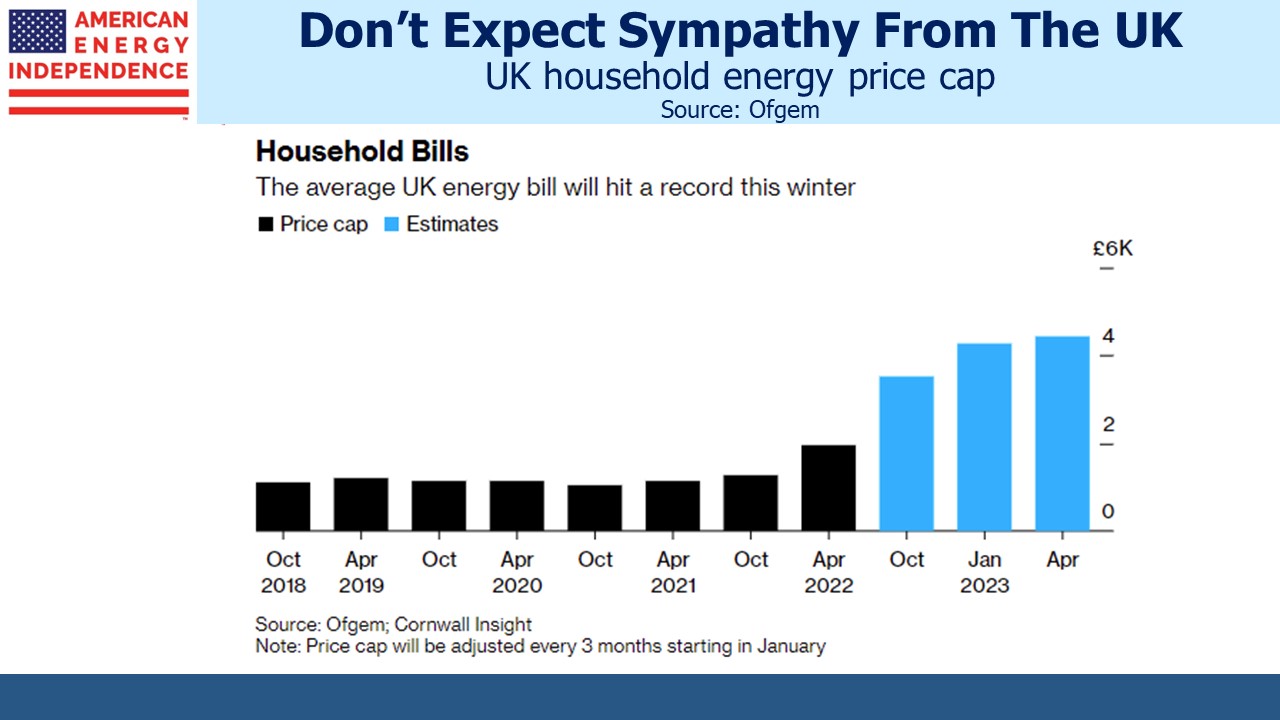

The UK regulator Ofgem sets a cap on energy prices for the typical UK household. Comparing US residential electricity with UK household energy isn’t a perfect match, but the looming price increase is nonetheless jaw-dropping.

Ofgem has had to keep raising the cap to avoid bankrupting UK energy providers. As a result, by next April the cap is likely to be set at 4X its level of two years earlier. The typical British household will go from spending £1,100 to £4,400 per year on energy.

Median per capita British income is $15K, versus $19K in the US. Assuming 2.2 resident per household and a $1.20 exchange rate, this means energy will consume 16% of the typical British household’s income, up from 4% two years ago.

This is a huge failure of public policy. Britain didn’t create a fatal reliance on Russian natural gas the way Germany did, but they’re not immune from the leap in prices and their pursuit of renewables clearly hasn’t offered any protection.

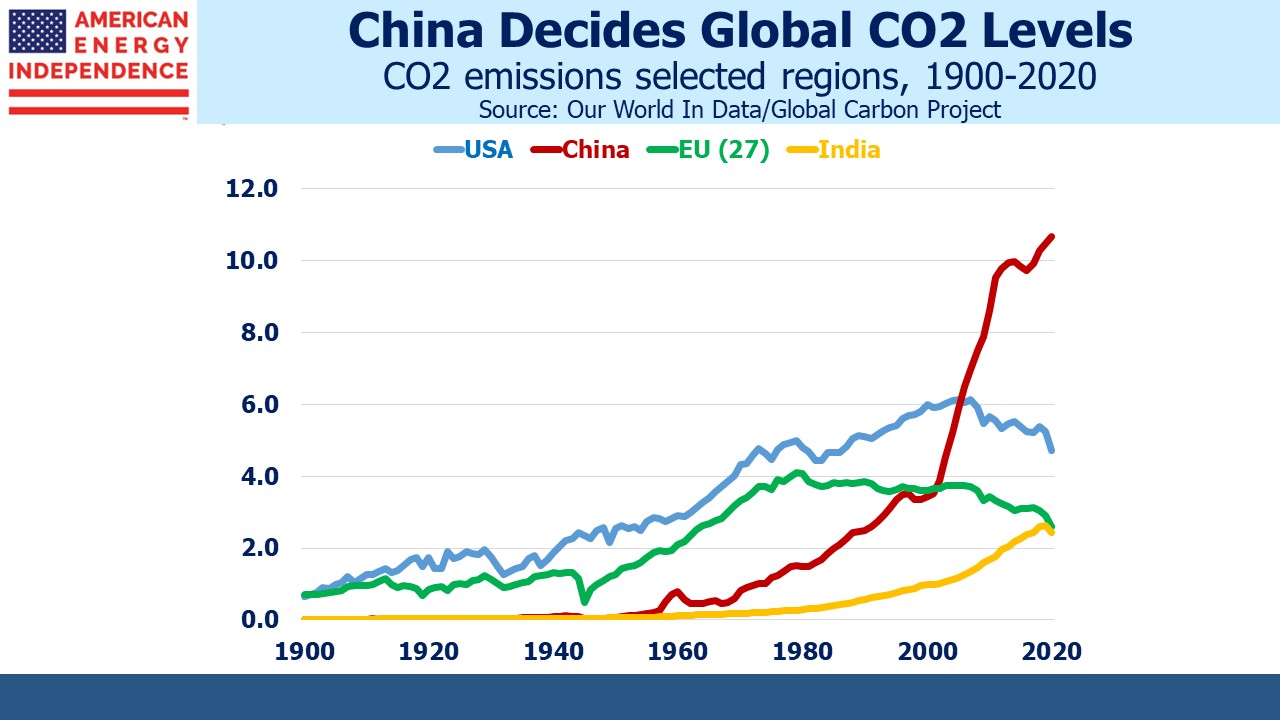

The EU and notably Germany has been the global leader in pursuing the energy transition. Reducing EU CO2 emissions is good, but only to the extent that it convinces China to follow suit. China’s CO2 emissions are now more than 3X the EU’s and 2X the US. We can set a good example, but the mathematical reality is that China’s choices matter more than ours.

OECD countries, which include the US and most of the EU, are richer than developing countries and therefore better equipped to deal with rising sea levels and other possible consequences of heightened CO2 levels. In other words, policymakers are embracing the energy transition in part to help poorer nations.

Therefore, it was illuminating to see China recently suspend climate talks with the US following Nancy Pelosi’s ill-advised visit to Taiwan. In doing so, China showed that they regard such negotiations as more beneficial to the US than to China. Our climate negotiators at the UN have performed so poorly that China somehow thinks it has less to lose from rising CO2 emissions than we do.

Such a view is perpetuated by western policymakers who pursue increased use of renewables at great expense to their populations without ensuring commensurate commitments from nations more vulnerable to the more extreme outcomes some climate scientists warn are coming.

The high costs of European energy policy show there’s nothing to emulate. We can’t want reduced emissions more than China does. Otherwise they’ll free-load on our efforts and continue to push back the date when their CO2 emissions will begin to fall. It’s currently set for 2030, but China’s most recent five year plan removed limits on coal consumption and its share of primary energy generation.

The US is still energy independent in spite of the best efforts of Democrat leaders to pursue the failing policies we see in Europe. Natural gas remains critical to a future of affordable energy and continues to offer the world’s best chance to meaningfully reduce CO2 emissions by replacing coal. Left wing energy policies risk introducing left wing, European prices.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.