Inflation’s Upside Risk

If you weren’t able to join Thursday’s webinar, SL Advisors Midstream Energy and Inflation Outlook, you can watch a recording here.

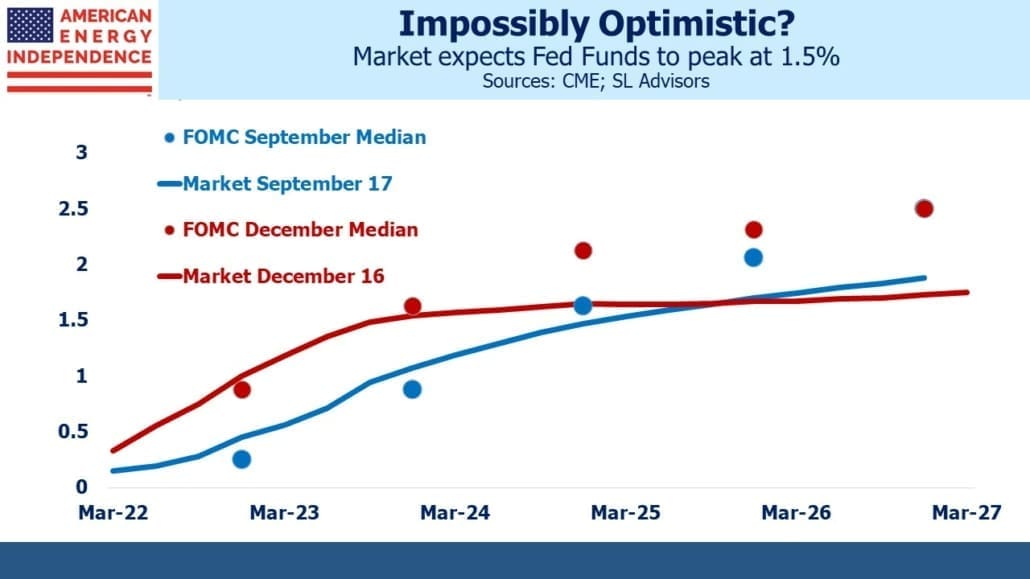

The media referred to the Fed’s “hawkish pivot” following Wednesday’s revised dot plot and faster taper. More accurate is that chair Jay Powell confirmed that the FOMC was following the market’s earlier revisions to the rate outlook. Eurodollar futures traders and the Fed are once more synchronized over the next couple of years in looking for the Fed Funds rate to reach around 1.5%. Forecasts diverge beyond that, with fixed income traders comfortable that rates will peak, whereas FOMC members expect continued increases. When it comes to forecasting even their own actions, history shows the Fed has much to be humble about.

The great penalty of inflation is suffered by fixed income investors, who conventionally demand a return at least as high to preserve purchasing power. Negative real yields on G7 sovereign debt are muting the market’s concern about value erosion. Persistently low bond yields that result are supporting risk assets such as equities. Buoyant bond and stock markets mean that there has been very little pressure on the Fed to act. The pleas for tighter policy have not come from financial markets, but from well-qualified observers such as former Treasury secretary Larry Summers and former NY Fed leader Bill Dudley. A handful of politicians have expressed concern about inflation, but Congressional enthusiasm for tighter policy will expire before the first rate hike.

The result is that financial markets regard today’s high inflation as relatively costless. Return-oriented investors in US government debt should demand high real rates as compensation for the dire fiscal outlook. But return-insensitive buyers (central banks; pension funds) dominate, and their acceptance of guaranteed value erosion is a subsidy that makes inflation more tolerable.

Five year inflation expectations derived from TIPs yields began the year at 2%, and reached 3.1% a month ago although have moderated recently. The Fed targets Personal Consumption Expenditures (PCE) Inflation whereas TIPs settle against CPI. Technical differences mean PCE inflation runs lower than CPI – about 0.5% since 2000 but 0.3% since 2008. The bond market’s long term inflation outlook is a little higher than the FOMC’s long term 2% forecast even adjusting for PCE/CPI differences.

The consensus interpretation of the yield curve is that raising short term rates to 1.5% will be sufficient to bring inflation back to the Fed’s 2% target. An alternative explanation is that financial markets, and therefore the Fed, will tolerate higher inflation.

The Fed and most analysts expect declining inflation next year. Criticism flows easily when inflation is rising, but if it moderates as expected next year the FOMC will draw a collective sigh of relief. They’ll still taper and normalize rates, but the pressure from opinion leaders will be off. If Owners’ Equivalent Rent (OER), the quixotic survey-based measure of the cost of shelter, increases expect the Fed to look past it as a non-cash expense.

The absence of financial market stress during the current inflationary spurt will lessen the urgency to follow the rate path they’ve laid out. A hint of economic weakness will embolden those wishing to pause normalization. The flat yield curve would steepen.

Spiraling Federal debt and fortuitously low (negative) real rates make moderately higher inflation in America’s interests. The resilience of financial markets affords the Fed flexibility in normalizing rates and tolerance for a slower return to 2% inflation – or indeed inflation settling at a somewhat higher level.

The “hawkish pivot” shouldn’t be confused with a hawkish Fed. They simply followed the market. Their tolerance for temporarily higher inflation in support of full employment, the revised interpretation of their mandate announced last year, represents a more dovish approach to monetary policy. It’s one they’ve been following faithfully ever since.

Midstream energy infrastructure, as we noted in Thursday’s webinar, still offers attractive yields with decent upside through real assets that should provide protection against inflation.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Inflation will be lower in 2022 only because it will be compared with the excessively risen rates of 2021.