Joe Manchin Puts America First

Build Back Better (BBB) includes many provisions beyond the scope of energy and interest rates, the two topics this blog covers. But to the extent that Senator Joe Manchin (D-WVa) has torpedoed progressive goals on climate and $3TN in additional debt, he’s demonstrated better judgment than the rest of his party.

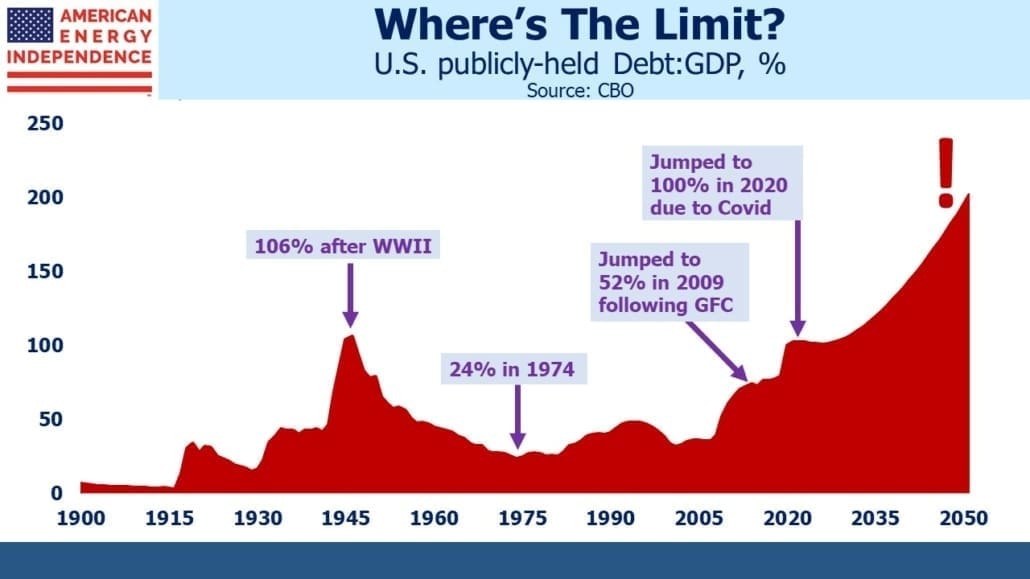

Start with the debt. The American Recovery Act passed in March was $1.9TN of deficit spending that wasn’t needed given the positive vaccine news five months earlier. It has contributed to the inflation that Manchin cited as one of his concerns. Had Congress and the White House been less impulsive, the dire fiscal outlook wouldn’t have made it quite so easy to criticize BBB. Modern Monetary Theory is already showing its limits.

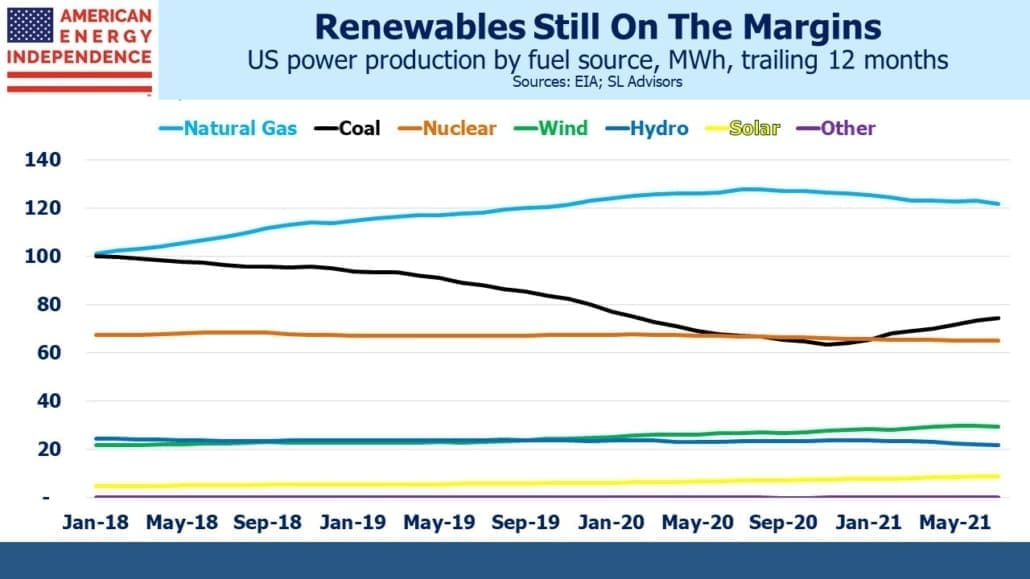

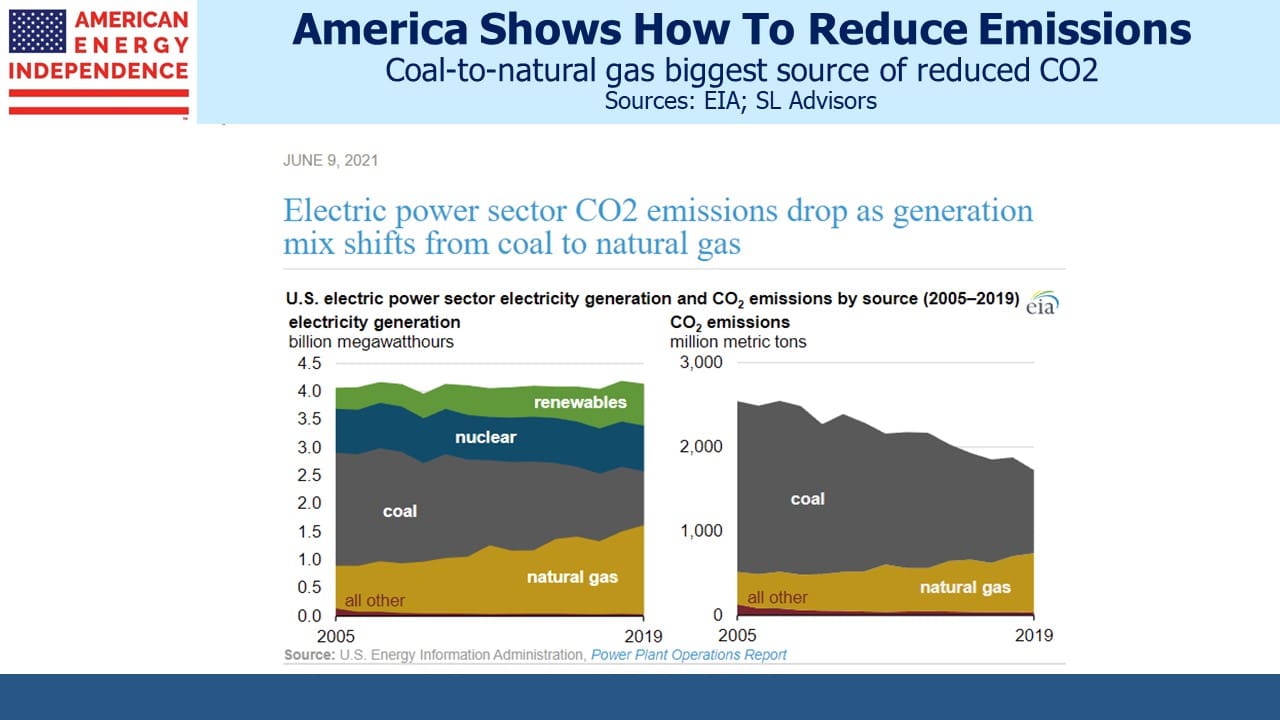

Now to the energy transition. America’s success in reducing emissions over the past decade has come from coal to natural gas switching for power generation. Solar and wind grab most of the headlines, but the data is clear. Renewables create most of the media noise but not the substance.

One piece of good news is China’s growing natural gas imports from America, which will help reduce their voracious coal appetite and help curb their emissions. Senator Elizabeth Warren, often short of policy insight, recently asked if big natural gas producers had, “considered cutting, suspending, or ending exports of natural gas to help ease spiking domestic prices.” Supplying China with natural gas helps reduce global CO2. Higher domestic prices, which still remain substantially below those in Europe and Asia, are a cost of the energy transition that she ought to be championing.

Cynics will point to Manchin’s fealty to West Virginia’s coal sector – and if he’s responding to his voters that seems more democratic than the opposite. But if BBB embraced more practical solutions such as sharply increasing nuclear power and supporting continued coal to natural gas switching, it would at least be more practical than the relentless focus on intermittent, weather-dependent energy.

Manchin added, “…if technology is not there, we got to make sure that we’re able still to rely on United States of America. We have been energy basically independent for the first time in many, many years, 67 years or more.”

The Shale Revolution may have been an investment bust, but it has created a degree of energy security in America that was previously unknown. It’s hard to see why we’d give that up. White House pleading with OPEC to lower gasoline prices represents a low point.

On Sunday’s talk show, Manchin correctly said, “The main thing that we need is dependability and reliability. If not, you’ll have what happened in Texas and what happens in California.” He might have added most of Europe as another example of energy policy gone awry. Trying to rely on windmills and solar panels before the technology is robust enough is not a viable strategy.

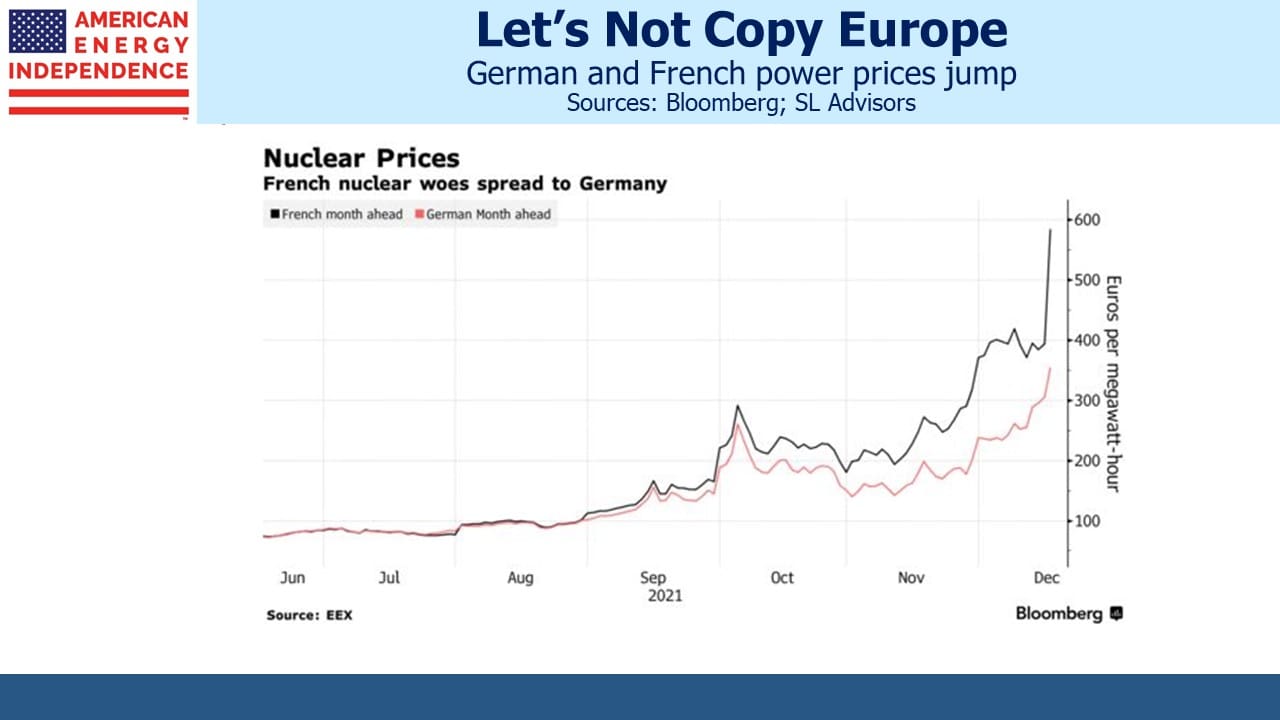

European wholesale electricity prices are at multiples of the US, because of poor planning, naivete about Russia’s intent to be a reliable natural gas supplier, and cold weather. Month ahead German power prices reached €350 per Megawatt Hour, and French prices almost €600.

German households were already paying about 3X US households for electricity a year ago, before the price spike. The German wholesale cost of power has jumped from €30 per MWh since then, an increase of 10X. Even though three quarters of the average German household’s monthly bill is distribution, fees and taxes, allowing the full increase to pass through to households would result in a tripling of bills. EU governments (i.e. taxpayers) are likely to absorb much of the increase.

US energy policy in many states remains far better than the European model. Manchin added, “…we should not have to depend on other parts of the world to give us the energy.” The energy transition will be expensive, and it may be worth it. The problem is politicans keep pretending it’s costless, while examples of its expense keep piling up. Intermittent power that’s 10X the cost in America isn’t how we’ll get there. And it makes more sense to start when the biggest emitters are signed up.

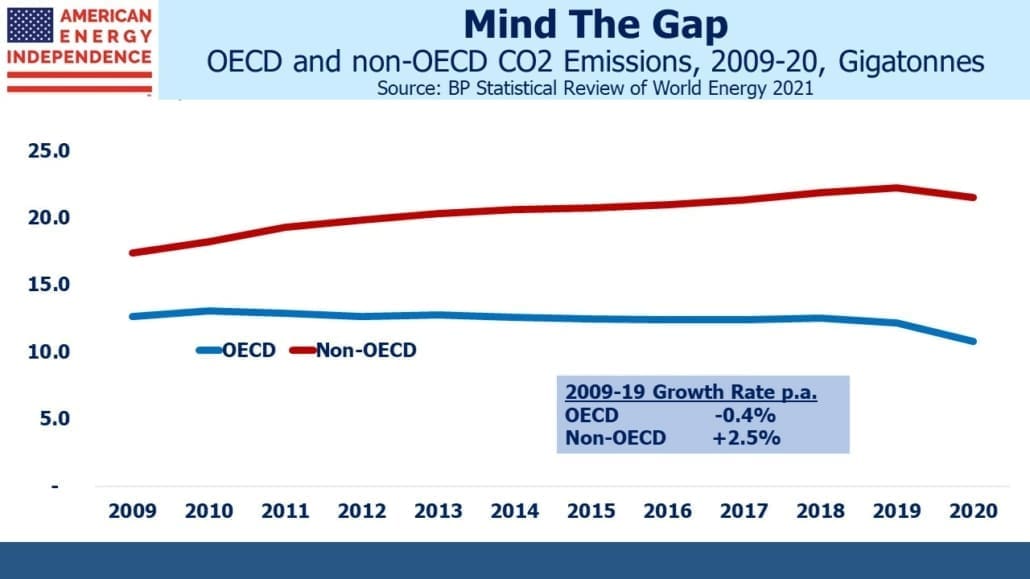

Until China, 28% of the world’s CO2 emissions and growing, is prepared to make actual cuts, it’s hard to see why OECD countries should. Until a solid majority of the world is aligned why should Americans pay more while Chinese and Indians just burn more coal?

Concern about climate change is broad, but its shallowness is betrayed by politicians’ reluctance to answer these questions. The failure of Build Back Better in its current form offers the chance of a more pragmatic energy transition that is less disruptive to growth and therefore better for the economy, including the energy sector.

The energy sector received a boost from Joe Manchin. Reducing emissions to deal with climate change will remain a focus of the sector, but rejecting the solutions of climate extremists will allow for a more pragmatic, durable approach.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!