Absurdity Abounds In The Energy Sector

Williams Companies (WMB) announced 2Q21 earnings on Monday. Results were largely in-line with expectations; Adjusted EBITDA came in at $1,317MM, $11MM ahead of forecasts reflecting the stability of their business. Their dividend is +2.5% YoY and is now expected to be 1.9X covered by Available Funds From Operations (analogous to the Distributable Cash Flow metric often used in the past by MLPs). The $1.64 dividend yields 6.6%. Under the old ~90% payout regime MLPs used to follow, WMB would yield over 11%.

6.6% is an attractive yield by any measure. Transco, WMB’s extensive pipeline network running along the eastern US, has investment grade bonds outstanding to 2050 that yield 3.06%. The equanimity with which bond investors accept equity-type risk for comparatively little is not unique to the pipeline sector. Rigid investment mandates partly explain the bifurcated market for WMB’s securities, and emphasize the continuing opportunity for equity buyers. Leverage (Net Debt:EBITDA) is expected to reach 4.2X by year-end, down from 4.35X the prior year.

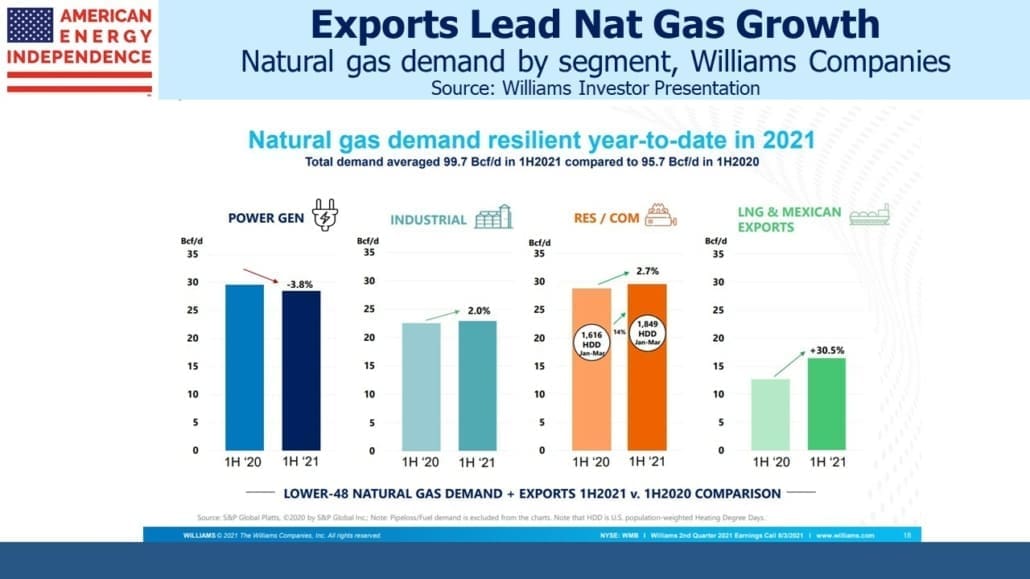

The energy transition notwithstanding, natural gas volumes passing through WMB’s pipeline network showed continued healthy growth. Of particular note was the 30% jump in natural gas for export, either as Liquified Natural Gas (LNG) or via pipeline to Mexico.

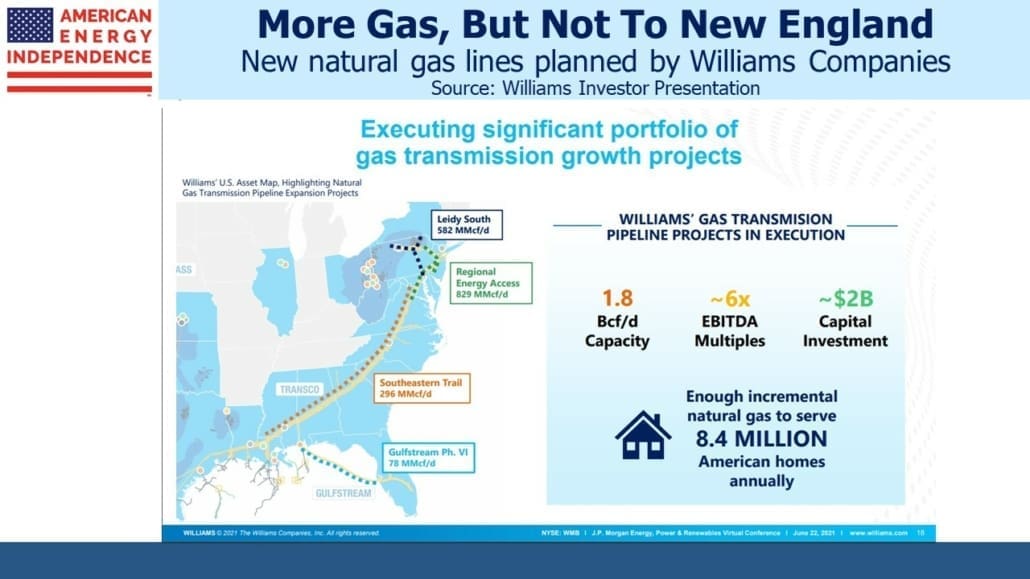

WMB is planning to invest $2BN to bring an additional 1.8 Billion Cubic Feet per Day (BCF/D) of natural gas to customers, mainly in the northeast. Careful examination of the map shows that the expansion only reaches as far as NJ and Pennsylvania. Massachusetts, which could surely use more natural gas, is currently debating whether to require that new construction omit natural gas connections (see Towns Trying to Ban Natural Gas Face Resistance in Their Push for All-Electric Homes). All-electric homes don’t sell as quickly as regular ones, reflecting a market push-back against the imposition of new regulations.

Residential power supplies are already prone to outages during bad weather, so it’s understandable that the prospect of becoming fully reliant on electricity even while utilities add intermittent renewables is not appealing. Natural gas never goes down.

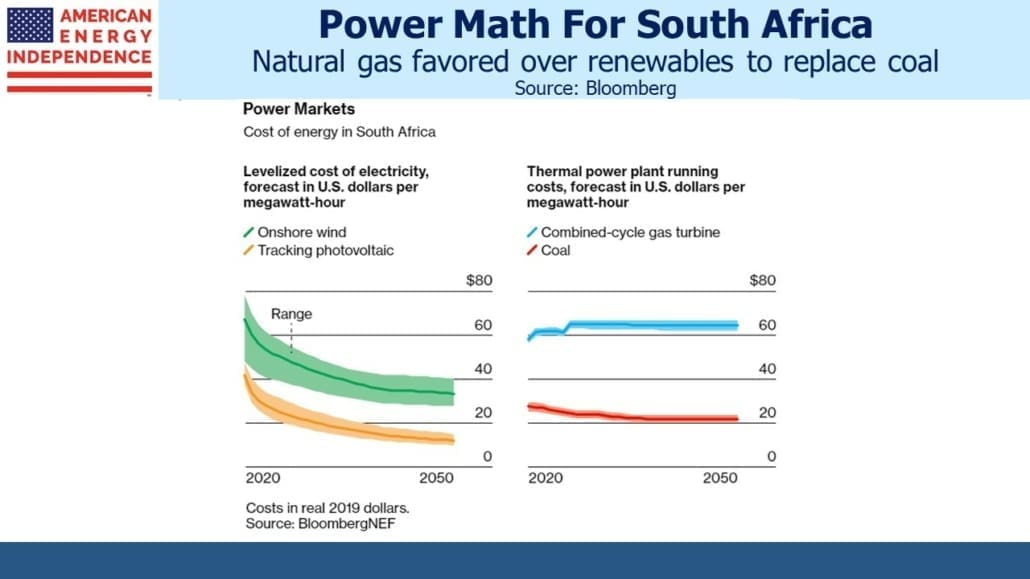

Meanwhile, South Africa is sensibly looking to natural gas as a way to reduce its CO2 emissions (see Coal-Reliant South Africa Is Turning to Gas Power). They estimate electricity produced using natural gas will cost 3X as much as from the coal plants that are nearing the end of their useful lives. Renewables may even be cheaper, but tellingly South Africa is willing to spend more for reliability.

In preparation for the COP26 UN meeting in Glasgow in November, environment ministers have been discussing the level of financial support OECD countries should be willing to provide to emerging economies to help them pay for the energy transition. It’s a valid debate, but not one that has yet caught the public’s imagination. South Africa’s Environment Minister recently suggested that $750BN per year would be needed in financial support from rich world countries. Assuming this burden was shared according to each OECD country’s share of OECD GDP, the US would be on the hook for about a third.

The prospect of the US paying $250BN per year to poor countries to speed their energy transition is sharply at odds with Joe Biden’s message that it was all about well-paid union jobs. There’s zero prospect that Congress would approve anything like this – but the fact that such figures are floated exposes the gulf between practical solutions and underlying political support. OECD countries have already failed to meet a $100BN pledge for 2020.

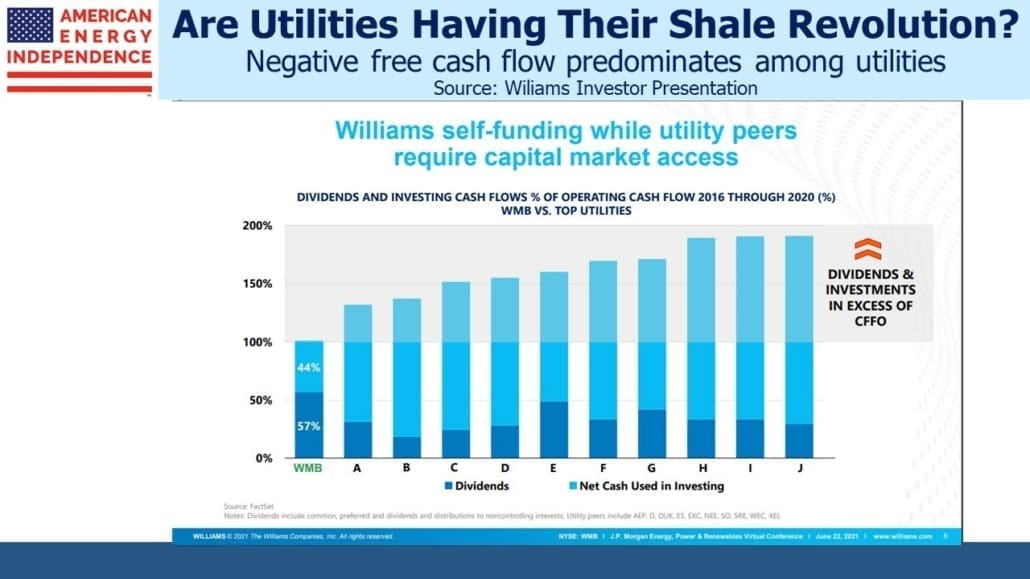

Returning to WMB, like most pipeline companies they self-funds their growth plans. Cash generated now goes to dividends and capex. Rising EBITDA reduces leverage and investors do not expect any dilutive secondaries.

This is in marked contrast to many utilities, which are spending $BNs on renewables and delivering negative Free Cash Flow (FCF) in the process. Today’s market forgives them because they’re investing in green projects. But battle-scarred US energy investors will recall the same willingness of Wall Street to overlook negative FCF during the early years of the Shale Revolution.

Germany has demonstrated that too much reliance on renewables leads to much more expensive electricity. California has managed to combine high prices with unreliability. Many of the utilities currently outspending their cash flow may find that expensive intermittency isn’t highly valued if they go too far, at which point the years of negative FCF will not look so smart.

Banning new natural gas hookups, outspending cash flow to build renewables and poor countries demanding GDP-sized payments to help reduce emissions; the energy sector is witnessing much that is absurd. Fortunately, natural gas pipeline transmission continues to grow reliably.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Another market absurdity is the irrational;y high tax deferred yields from credit worthy MLPs (MLPs still exist, contrary to the implication that DCF was a metric of the “past”) whose revenues, EBITDA and gross operating margins are 75% or greater based on natural gas and its derivatives.No conceivable rationale justifies the tax deferred yields of from 7.5% to 10% from strong, credit worthy natural gas and gas derivative based companies such as EPD, CEQP, MPLX and others similarly situated, yet the market continues to provide them to those of us smart enough to take advantage of their availability.

And yet, the prices go down every day. I guess market does not believe “this time will be different” since for the past 5 years every time oil goes down a round of div cuts follows from the MLP sector. It sure looks to be different this time given high FCF generation as Mr Lack has noted, but I think we have all said that before… will it be different this time? Are we sure?