Carbon Capture Gains Momentum

Recently Pembina and TC Energy announced a joint venture for Carbon Capture and Sequestration (CCS), aimed at CO2 emissions generated from Canada’s tar sands oil extraction activities. Canada has an ambivalent stance on climate change policies. Like all signatories to the Paris Accord, they claim to have set aggressive targets for emissions reductions. Canada also has a carbon tax, a sensible measure to place a price on emissions that has little support in the US.

But Canadians also have one of the highest per capita rates of energy consumption in the world – almost a third higher than Americans, who are often regarded as the world’s energy gluttons. A Canadian’s emissions are about the same as an American’s, because of their greater access to hydropower. But Canada’s emissions have been stable, not falling as in the US where coal to natural gas switching has been the main source of reductions in the past decade. 2020 emissions fell everywhere because of lockdowns, but are rebounding.

Part of Canada’s struggle with emissions is a result of its long winters. But tar sands oil production is another. This is an energy-intensive process that involves heating bitumen with natural gas to separate out the crude oil. It’s fair to say that Albertan energy workers are less concerned about climate change than their liberal neighbors in Ontario and Quebec, even though western Canada supplies eastern provinces and generates substantial tax revenues.

Images of tar sands production facilities were sufficiently emotive to sustain extremist opposition to the proposed Keystone XL pipeline for a decade, until Biden finally killed it off last month.

Canada will continue to produce oil from tar sands, even though transportation to market has become a chronic problem. Its crude will move by rail, instead of cheaper and safer pipelines. But the Canadians recognize they have an image problem, hence the recent announcement on carbon capture.

The Alberta Carbon Grid (ACG) will initially capture CO2 generated from the extraction of crude from tar sands. But there are also plans to connect with areas of industry elsewhere in the province and to power plants as well. It will use existing oil pipelines that will be retrofitted to transport CO2, and will add new infrastructure on to it.

Estimates are that the initial system will capture and sequester underground 60-80,000 metric tonnes (hereafter “tons”) of CO2 daily. One advantage of Canada’s cool climate is that it’s easier to inject the CO2 underground into porous rock when daytime summer highs are typically in the 60s. The JV has identified an underground reservoir near Saskatchewan with capacity to eventually store over 2 Gigatons of CO2, which will take several decades to fill.

The projected annual volumes equate to around 4% of Canada’s total 2019 CO2 emissions of 730 tons, which seems quite impressive for a single project. By contrast, Exxon Mobil’s planned CCS in Texas is projected to sequester 50 million tons annually beneath the Gulf of Mexico. This is 60% bigger than the ACG but less than 1% of US 2019 emissions.

CCS is drawing more attention. Its appeal to the fossil fuel industry is that it offers a way to continue today’s energy mix while reducing emissions. Climate extremists oppose such thinking because they’re passionate about a world of solar panels and windmills. But when you work through the math, the cost of capturing all the CO2 emitted from the combustion of natural gas is not an insurmountable figure. Its implementation is also much more plausible than carpeting the landscape with intermittent renewables along with the extensive high voltage power lines required to move it from rural areas to population centers. Massachusetts can’t even buy hydro-electric power from Quebec because New Hampshire won’t allow the necessary power lines to be built in their state.

The tax code already pays a $50 per ton credit for permanently sequestered CO2. The Clean Air Task force thinks it should be higher, and has estimated the cost of capturing CO2 from different sources – ranging from as little as $39 per ton for CO2 produced in gas processing to $100 per ton in cement production. Industrial emissions with more concentrated CO2 allow for cheaper separation of the CO2.

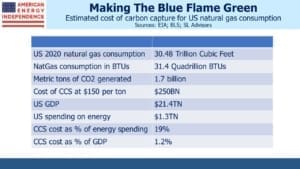

The table shows that even at a substantially higher cost of $150 per ton, the CO2 emitted from burning natural gas could be captured with an increase in our overall energy spend of less than 20%. A new CCS industry would create jobs just as the president promises ramping up renewables would. Anyone truly worried about global warming and not simply proselytizing for renewables would surely embrace this as worth the cost.

The energy transition is about economics, not technology. The solutions are mostly known. Costs can be reduced through scale and innovation continues, but it’s about society’s willingness to pay for the cost. The point of the table is not to try and persuade climate extremists, but to show that substantial emissions reductions are possible without our power supply failing us when most needed, as in California for example.

Today’s energy companies have a lot riding on the outcome, which is why CCS is gaining more attention. As their solutions become more visible, the sector will continue its recovery.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!