Markets Glimpse Light

As our response to Coronavirus shifts from purely medical to political, markets have seen a glimmer of light. So far, decisions have been made, whether right or wrong, based on advice from epidemiologists. But as the economic cost has exploded, it’s provoked the obvious question: if the most vulnerable cohorts are identifiable, and the vast majority unlikely to require hospitalization, does everyone need to be at home?

Comparing fatalities with lost jobs seems crass; but something this big is a political issue that considers the overall impact to the country. A study from Oxford University suggested that up to half the UK population may already be infected. This would imply a very low fatality rate and very limited hospitalization, a huge positive if it turns out to be accurate.

When Thomas Friedman of the New York Times and Donald Trump agree that we need some certainty about when restrictions on life will be lifted, you know where the debate is headed. Coronavirus remains most importantly an issue of science, and we won’t offer any amateur views. But decisions are likely to reflect not only medical input from here. Barring a sudden deterioration, we expect governors such as New York’s Andrew Cuomo to soon define a timeframe that will see many people return to work.

Pipeline investors care about volumes. Weekly data from the Energy Information Administration shows little impact so far on natural gas demand. Residential/Commercial is down – mild winter weather has probably depressed Residential, and Commercial may also be lower. But overall the figures look stable.

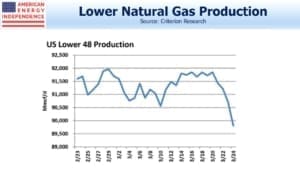

EIA supply figures look similarly stable, although the chart from Criterion Research is a few days more current and shows a sharp drop. Ultimately though, if demand stays flat supply will recover.

Gasoline demand hadn’t yet dropped, based on this chart through Monday. Drivers filling their tanks in case of distribution problems probably helped, but demand is obviously going to fall with most of us at home.

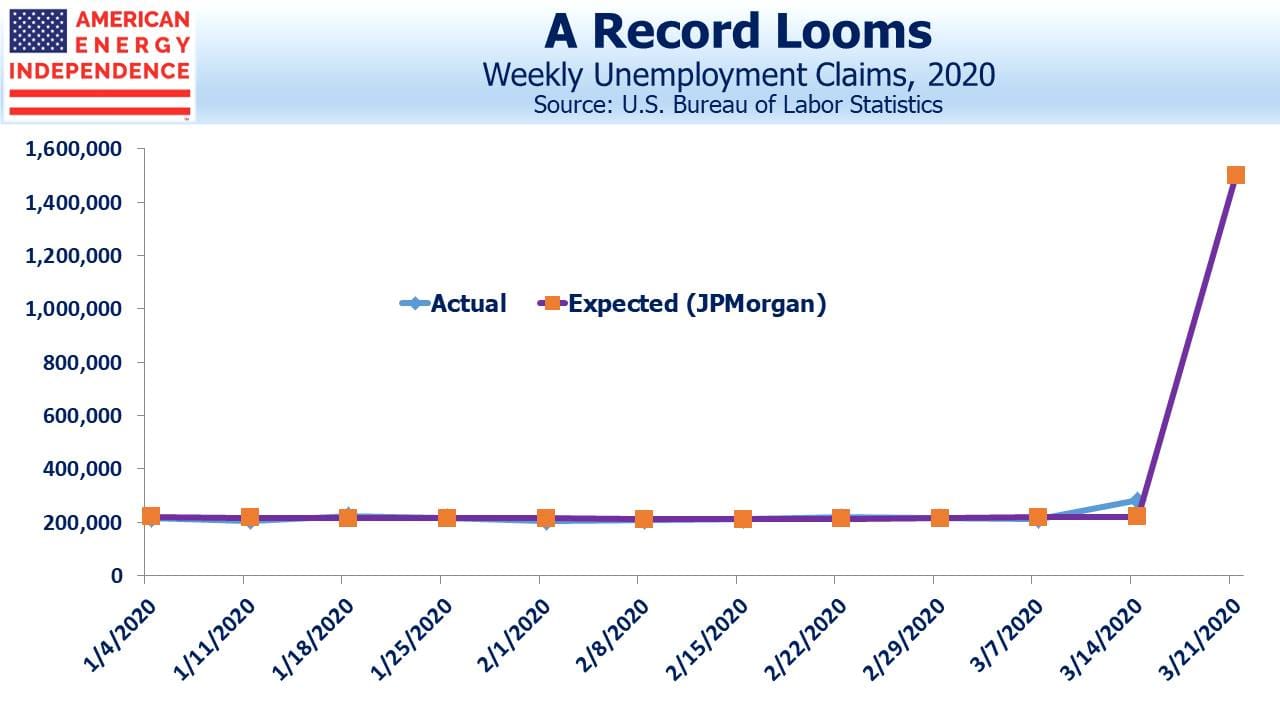

Unemployment claims on Thursday will be important. JPMorgan is forecasting a 6X jump from last week, to 1.5 million. The highest forecast is for 4 million. For reference, on October 2, 1982 the figure was 695,000. In the depths of the financial crisis on March 28, 2009, we hit 665,000. So we’re likely to see the biggest figure in history.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!