Hopes for a Trade Deal Slipping

Article I of the U.S. Constitution gives Congress the “…Power to lay and collect Taxes, Duties, Imposts and Excises…” Congressional control over tariffs has never been so strong since.

The Reciprocal Trade Agreement Act of 1934 granted President Roosevelt the authority to adjust tariffs and to negotiate bilateral trade agreements without prior congressional approval. Other legislation increased the Administration’s control over trade, including the Trade Act of 1974 which allowed the President to impose a 15% tariff if imports threatened national security. There’s much to recommend a single decision maker heading up such negotiations. It should lead to more predictable, less capricious discourse than one requiring congressional approval. For decades, it’s how the U.S. has conducted trade negotiations, and it’s broadly worked.

In recent months, President Trump has demonstrated the full range of options afforded a president to manage trade. Updates on the progress of negotiations with China have been responsible for much of the recent market volatility.

An interesting chart from Goldman Sachs divides the three year performance of the S&P500 into two periods – a steady uptrend that prevailed from Trump’s surprise election until the first imposition of steel tariffs early last year, followed by a modest rise punctuated by higher volatility.

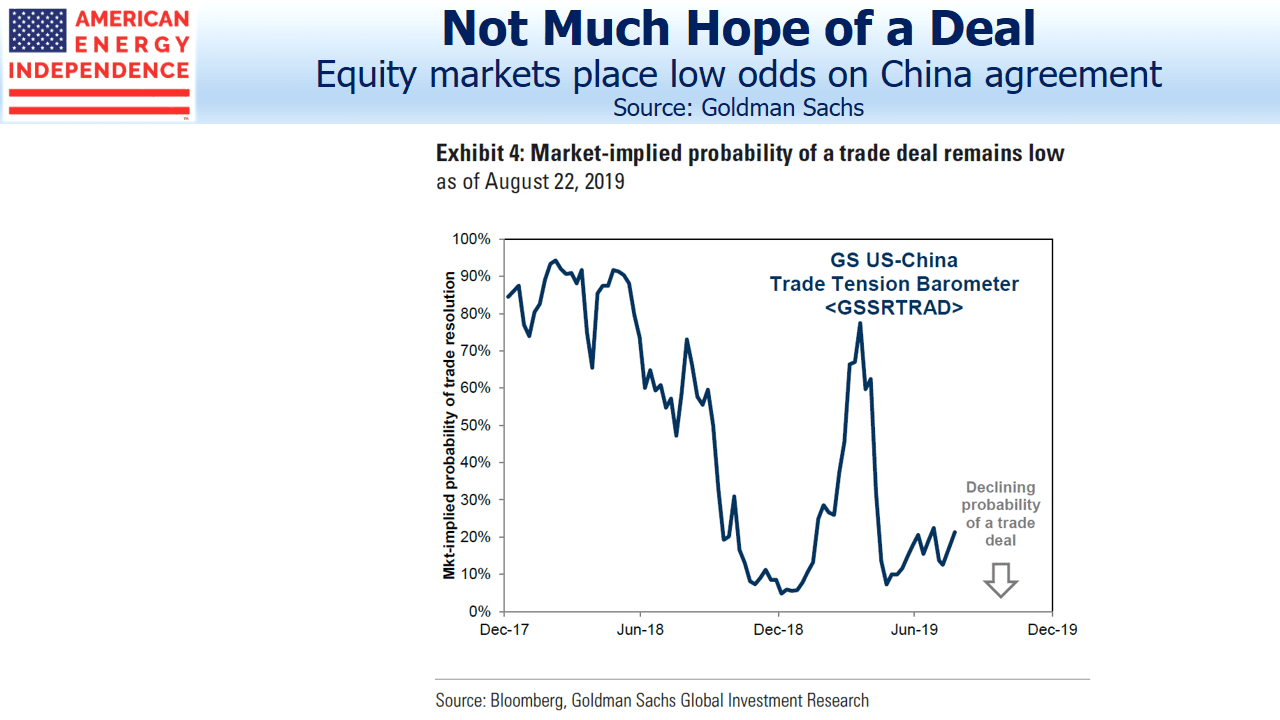

A second Goldman chart infers the market’s estimate of a trade deal by comparing baskets of stocks with sharply different exposure to China. Based on this, market expectations of a trade deal are low, and Goldman duly do not expect one before next year’s election.

Stocks are cheap relative to bonds (see Stocks Offer Bond Investors an Opening). It seems self-evident that Trump’s re-election prospects are better without trade disputes slowing growth, and therefore rational for him to seize a deal. The trade deficit with China is already falling (see Trade Wars: End in Sight), so the opportunity to declare victory and reach agreement is a real one.

Low expectations of an agreement coupled with relatively cheap stocks mean a big rally would follow.

But this analysis isn’t unique, and market participants are looking beyond it. Current pricing of no deal before the election either means Trump won’t seize one, or China will decline to offer a graceful exit from a negotiating strategy that hasn’t yet worked.

This brings us back to the issue of which arm of government should control trade negotiations. There’s much to be said for the current structure. Congress is an unwieldy negotiating partner, and myriad parochial interests could easily derail an almost perfect agreement.

If the low expectations of an agreement turn out to be accurate, calls to restore some of the power originally vested in Congress are likely to grow. Senators from both parties have begun advocating for such a change. If protracted trade uncertainty continues into next year, the odds of legislative action will rise.

Paradoxically, such an outcome could well be bullish if it removed much of the trade uncertainty we’re learning to live with. It’s just hard to assess how much intervening market volatility will be required to provoke lawmakers into action.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Any Congressional attempt to reduce the President’s authority to negotiate trade agreements will certainly be the subject of a Trump veto.