The Coming Pipeline Cash Gusher

Pipeline company earnings are being scrutinized for capital investment plans. The energy sector’s pursuit of growth has been well covered. Investors would prefer less excitement and more return on capital through dividends and buybacks. Company management teams are for the most part grudgingly co-operating. Targa (TRGP) CEO Joe Bob Perkins defiantly described growth projects as “capital blessings”. TRGP promptly dropped 5%. Owners want more cash returned.

Distributable Cash Flow (DCF) is the cash return from existing assets. REIT investors know it as Funds From Operations (FFO), an equivalent measure. Because DCF excludes spending on new projects, it reflects steady-state cash earned before growth initiatives. This is why DCF or FFO are commonly used in evaluating businesses whose returns come from large fixed assets, such as infrastructure and real estate.

Free Cash Flow (FCF) is the net cash generated (or spent) after considering DCF, growth projects and any financings and asset sales (i.e. after everything). It’s common for companies that are investing heavily to have little or negative FCF. Investors in such stocks ultimately expect FCF commensurate with sums invested.

Exploiting the Shale Revolution has boosted growth capex by billions of dollars, both for upstream companies as well as the midstream infrastructure sector. It’s why FCF has substantially lagged DCF in recent years. Although today’s income statements don’t show it, a combination of slowing growth capex and rising DCF will cause pipeline companies to produce vastly more FCF.

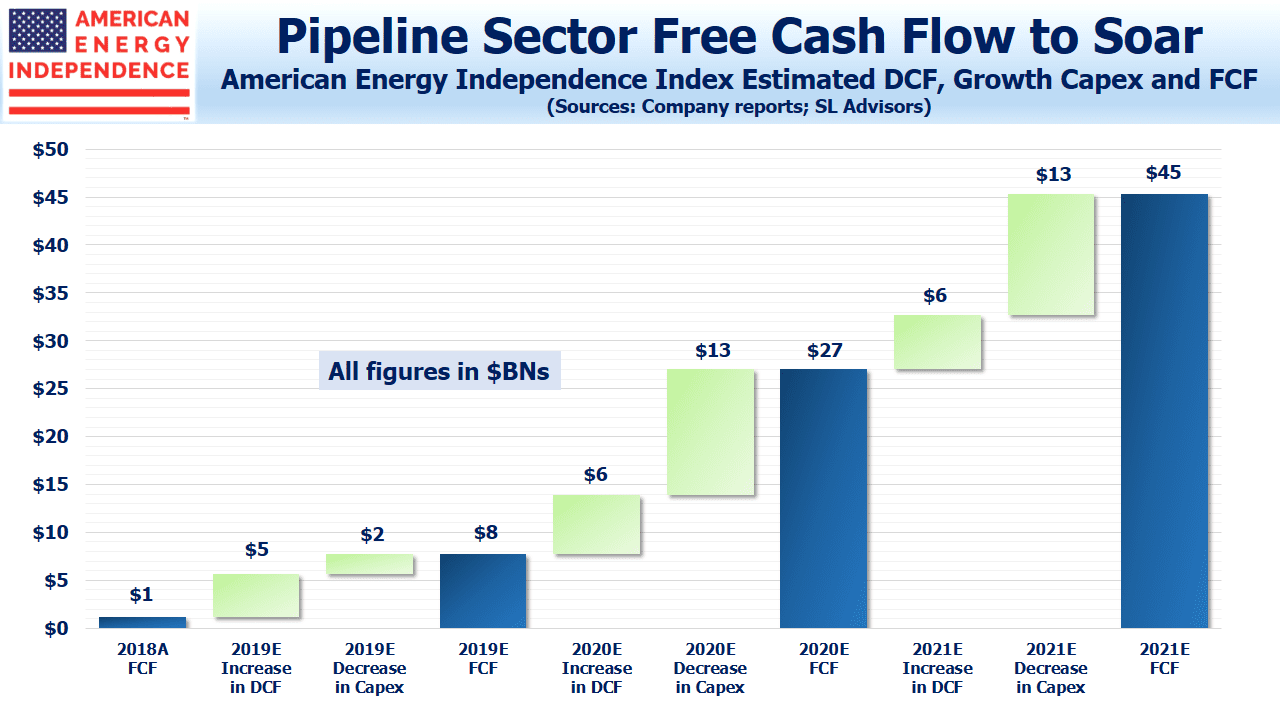

We examined all the names in the American Energy Independence Index (AEITR), which provides broad exposure to North American midstream corporations along with a few MLPs. On a bottom up basis, FCF was just over $1BN last year, a paltry figure given the industry’s $514BN market cap.

The need for growth capital broke the MLP model (see It’s the Distributions, Stupid!). Their narrow set of income-seeking investors wasn’t willing to support the growing secondary offerings of equity without higher yields. Companies needed to find the cash somewhere, so four years of distribution cuts followed – for example, the Alerian MLP ETF (AMLP) has cut its payout by 36% since 2014, reflecting reduced distributions by the names in its index.

The industry is over the hump of its spending on growth projects. Analysts look carefully for “capex creep” whereby annual guidance for new spending gets revised upward during the year. But based on current bottom-up guidance for the AEITR, we expect such spending to be down 4% this year, with >20% reductions in 2020 and 2021.

Recently completed projects are starting to show up in higher DCF, which we estimate will grow by 8% this year and 12% in 2020. A 90% completed pipeline isn’t much use, and multi-year construction projects only generate cash when they’re completed and paid for.

Making more money from existing assets, while spending less on new ones, is a potent combination. By 2021, FCF is set to be close to what DCF was in 2018. Moreover, much of today’s growth is internally funded, meaning little reliance on issuing equity. Based on current guidance, Transcanada (TRP) is the only company likely to tap the equity markets meaningfully, as construction of the perennially delayed Keystone XL gets under way.

As a result, last year’s sector-wide $1BN in FCF is set to jump eightfold this year, more than triple in 2020, and increase by two thirds again in 2021. It’s why dividend growth is back (see Pipeline Dividends Are Heading Up). Our analysis assumed no new debt issuance, which therefore assumes leverage will continue to decline. To the extent that the industry maintains current Debt:EBITDA ratios by issuing more debt, FCF will grow more than our forecast.

The “bridge” chart illustrates annual FCF 2018-21 with the changes in DCF and growth capex forming the bridge from each year’s FCF to the next.

The Shale Revolution has long been described as a huge boost for America, including on this blog. Investors often complain that it’s been a far better story than an investment. The strong start to the year has been a welcome surprise to many long-suffering holders. And yet, a substantial jump in FCF is still not widely expected. The sector has plenty of upside.

We are invested in TRGP and TRP. We are short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!