A Reactive Federal Reserve

The other morning a CNBC guest was able to share an insight not normally found on TV. The need for ten-second ideas greatly limits the ability of otherwise intelligent people to share much wisdom. R.J. Gallo, whose Christian names are apparently only initials, trades municipal bonds for Federated Investors. He suggested that rates can rise slowly because people expect no worse.

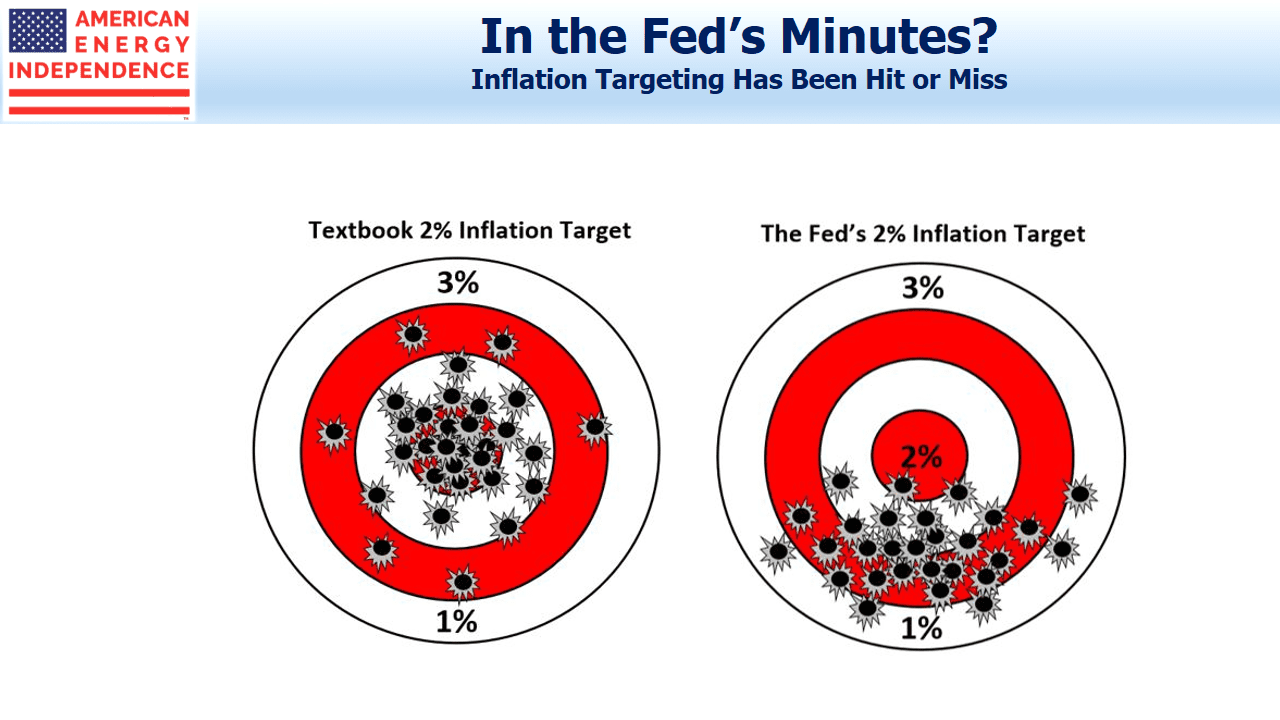

More precisely, Gallo said that because inflation expectations are so well anchored at around 2%, the Fed can wait until actual inflation rises. Gallo noted that, “The Fed has been unable to structurally hit their inflation target for many years.” He went on, “The Fed is not totally sure how the inflation process works”

This makes a lot of sense. The reason the Fed has maintained a Fed Funds forecast that’s too high is because they’ve incorrectly expected rising inflation. They’ve struggled at times to even get the Personal Consumption Expenditure price index (their preferred measure) to reach their 2% target.

The high inflation of the 1980s, which afflicted most developed economies, is more history than a memory for most market participants. “Almost a generation of people… have seen very low inflation for (a) very long (time).”

Gallo therefore argues that we’re, “moving to an era where the Fed is allowed to be reactive.”

That would represent a substantial shift in thinking. Fed chair from 1951-70 William McChesney Martin famously said, “The job of central bankers is to take away the punch bowl just as the party gets going.”

Successive Fed chairs have ever since operated with the expectation that they were party poopers, although it’s probably a couple of decades since one acted that way.

Ten year treasury yields at 2.5% show there is little fear of rising inflation. This, combined with the Fed’s inability to identify the circumstances that will cause inflation, lead to the insight that the Fed is moving from proactive to reactive. They understand less than they used to. Or, given their more transparent decision making process, we now know that they always understood less than we thought (see Bond Market Looks Past Fed).

The conclusion for bond investors is that Fed policy on short term rates will follow bond yields, which is probably as it should be. Fed policy has been more accurately forecast by expectations embedded in the yield curve. Collective expectations of inflation are as good as the Fed’s best analysis, and perhaps better.

It’s a natural progression for short term rate policy to be increasingly set by bond investors. An inverted curve (as was briefly the case earlier this year) caused some fears that the Fed would cause a recession. The correct conclusion was that the path of policy rates was wrong. Fed chair Powell duly put this right (see Bond Market Corrects Fed).

Rising bond yields will be a necessary requirement for the Fed to push short term rates higher. Until that happens, investors can remain comfortable that the Fed is still on hold, which continues to favor stocks.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Why does there have to be a 2% inflation level? Why can’t it be Zero? Who ever set that 2% level. With the global economy, it is hard to get a large inflation number. Our President wants the Fed to EASE by 1% and go back to quantitative easing. What would be the curse in doing so? It seems to have worked for the past 11 years. I agree with you, the Fed has NOT figured out this inflation “thing”.