Same Data, Different Conclusion

We’re not the first MLP investors to be puzzled by sector weakness in the face of growing oil and gas production. This was visible most clearly on Wednesday, when a sharp drop in crude following inventory numbers caused similar drops in many MLPs. Crude prices are weak precisely because of the success of technology in lowering costs, most obviously in the Permian in West Texas where most of the growth in output is occurring. Higher than expected U.S. production is mitigating the impact of OPEC’s production cuts. This ought to be bad for producers of conventional crude oil elsewhere in the world, and good for the owners of U.S. energy infrastructure handling greater volumes. So far, that hasn’t been the case.

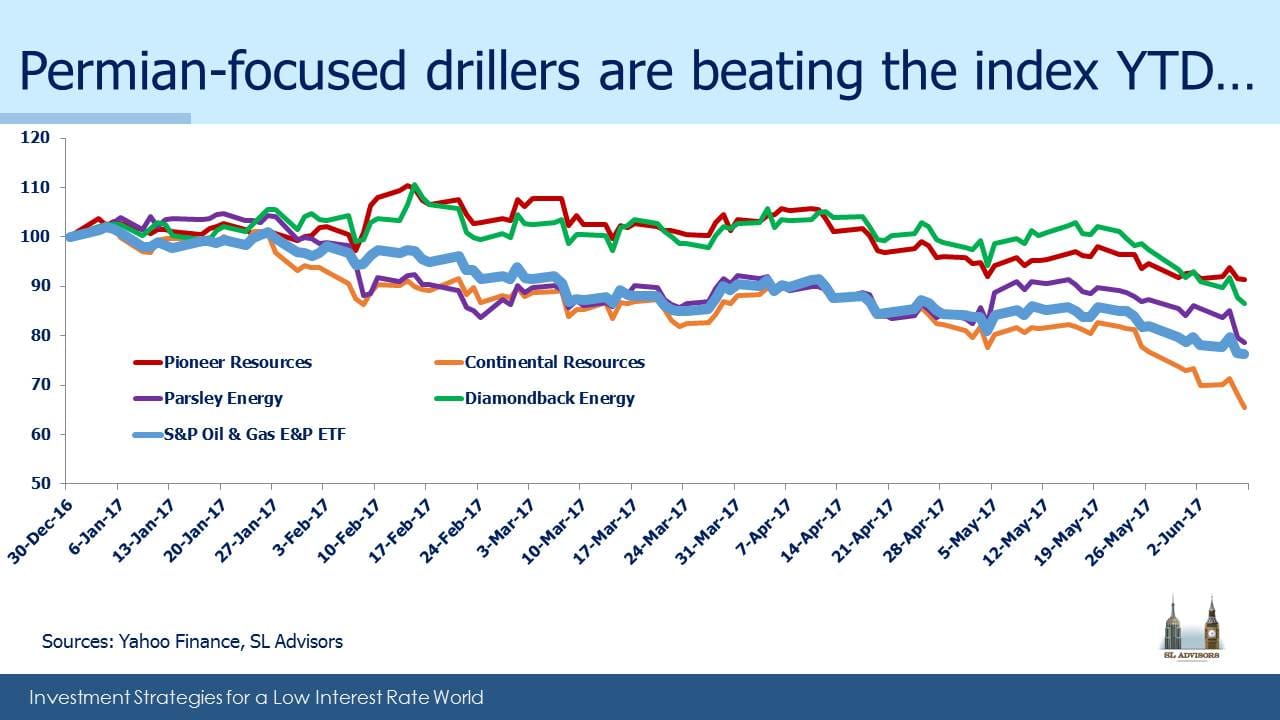

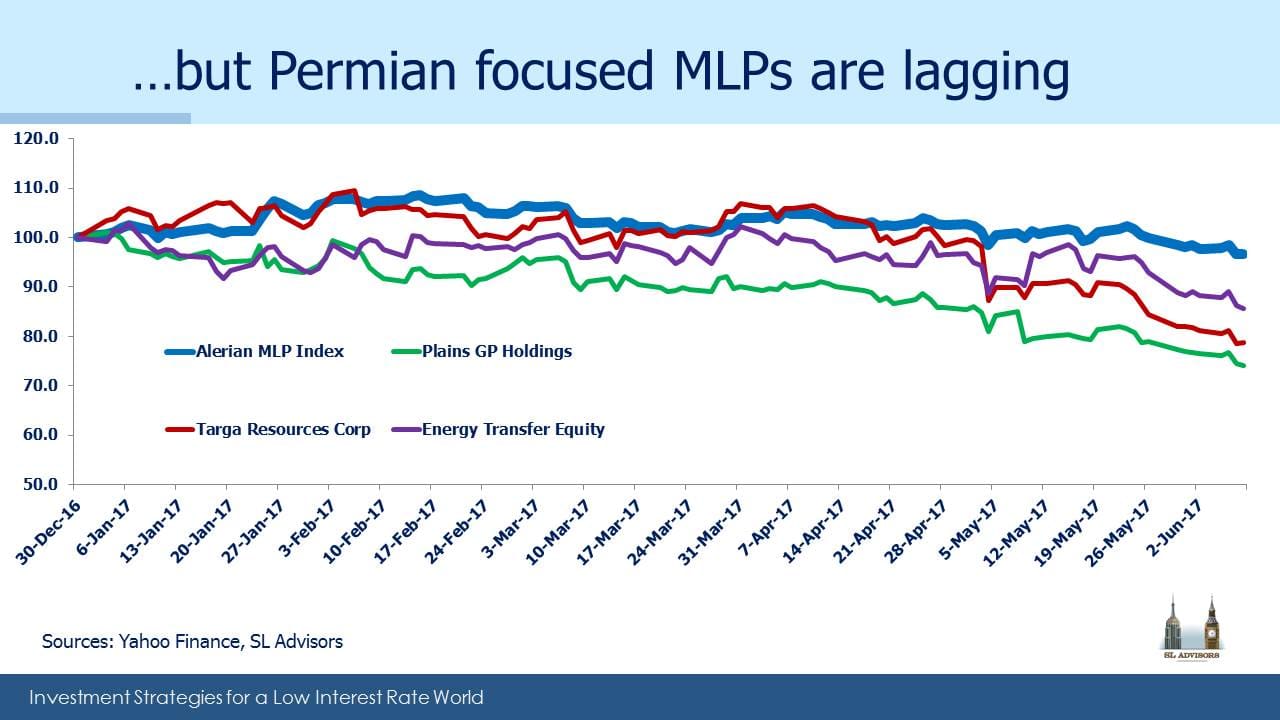

Moreover, Permian-exposed Exploration and Production (E&P) companies are faring better than the MLPs that service them. This year MLPs with Permian exposure have lagged the Alerian Index. With rising output depressing prices, one might conclude that investors regard any increased utilization of infrastructure assets as temporary. Low crude will eventually feed through to reduced production and commensurately less need for pipeline and storage capacity. At odds with this view, the U.S. Energy Information Administration recently raised its 4Q18 forecast of output to 10.2 Million Barrels a Day (MMB/D), up from their 9.4MMB/D forecast of only four months earlier.

MLP investors may not believe this will happen. And yet, within the E&P sector, those E&P companies with significant exposure to the Permian are outperforming the E&P index. Pioneer Resources (PXD) is outperforming all three MLPs we’ve highlighted, while Plains GP Holdings (PAGP) is underperforming all but one of the E&P names.

It seems that MLP investors and E&P investors are drawing sharply different conclusions from the same set of data on oil production. Or more precisely, potential MLP investors are declining to commit capital because they assess the outlook differently from E&P investors. At some point these views will have to reconcile, which we expect will result in higher MLP prices.

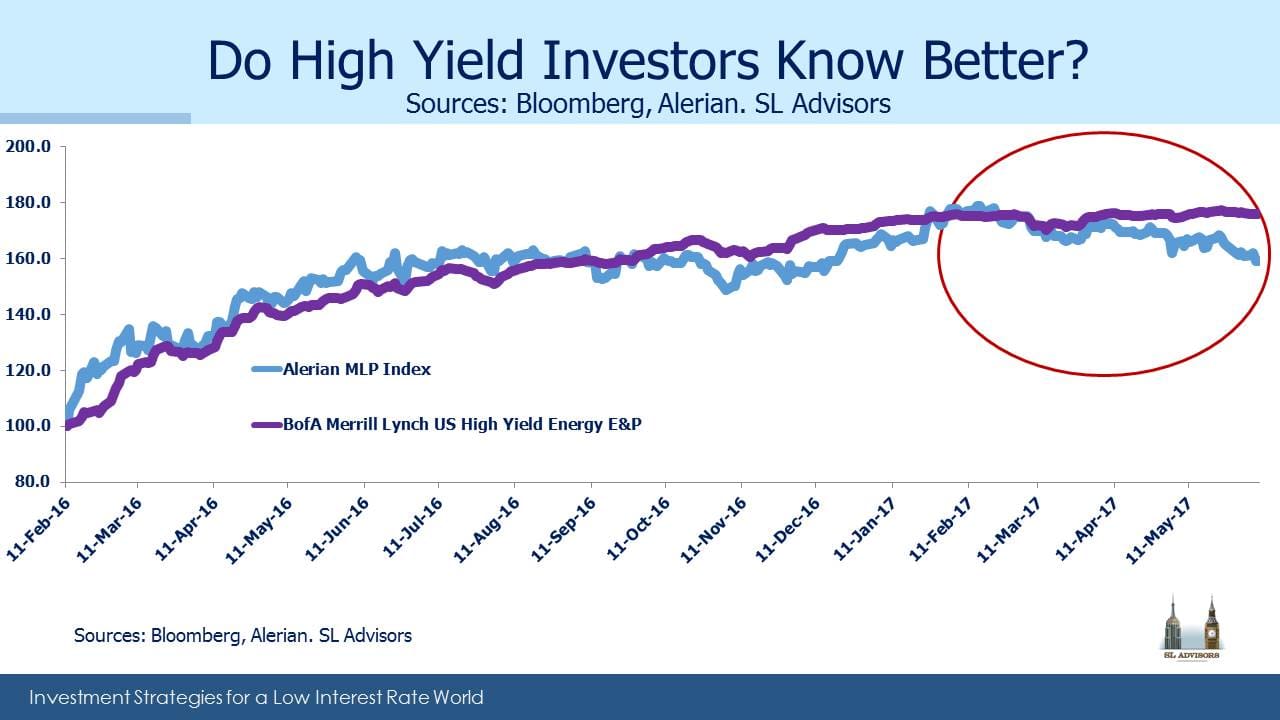

There’s a similar divergence with bonds. Since the low in the energy sector on February 11th last year, the High Yield E&P sector and MLPs have roughly kept pace with one another. Over the last few months they have diverged, with MLPs underperforming. Since E&P companies are generally MLP customers, it’s odd for the prospects of the customers to be improving without a positive knock-on effect for MLPs. But for now, that is what’s happening. The same data on output is supporting different conclusions by various investor types.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

One reason for this irrationality may be the lack of sophistication or at least analysis by the financial and popular press. They seem to believe that crude oil E & P and energy are synonymous. They don’t analyze the future of natural gas and its derivatives. They don’t consider that low prices means more consumption, and that more consumption means more need for, and use of, infrastructure provided by MLPs. Because the media don’t do any thoughtful analysis none is presented to the investing herds. That’s fine with me since I’m buying very high yields very cheaply.

Elliot, I think that’s well put.