Why Electric Cars Help the Shale Revolution

A friend of mine recently returned from a trip to Texas and Louisiana, where he met with many contacts and friends in the energy infrastructure sector. In-person discussions and site visits can often leave a more powerful impression than reviewing events from a distance. My friend, an experienced investor, returned with his already optimistic view on the Shale Revolution strongly reaffirmed.

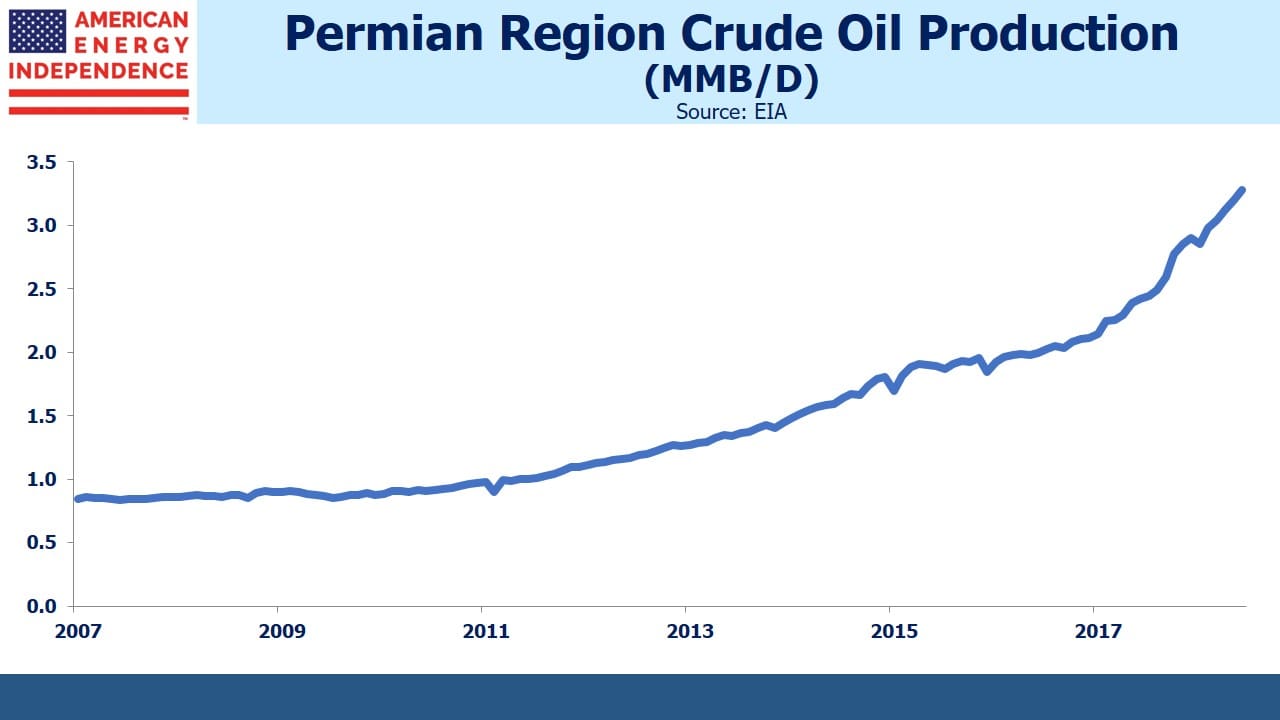

Some of the charts below illustrate why. Permian region oil output barely dipped in 2014-15 during the collapse in crude pricing. The widely described drilling efficiencies lowered break-evens (see America’s Path To Energy Independence: The Shale Revolution), and as the oil price recovered, so did production.

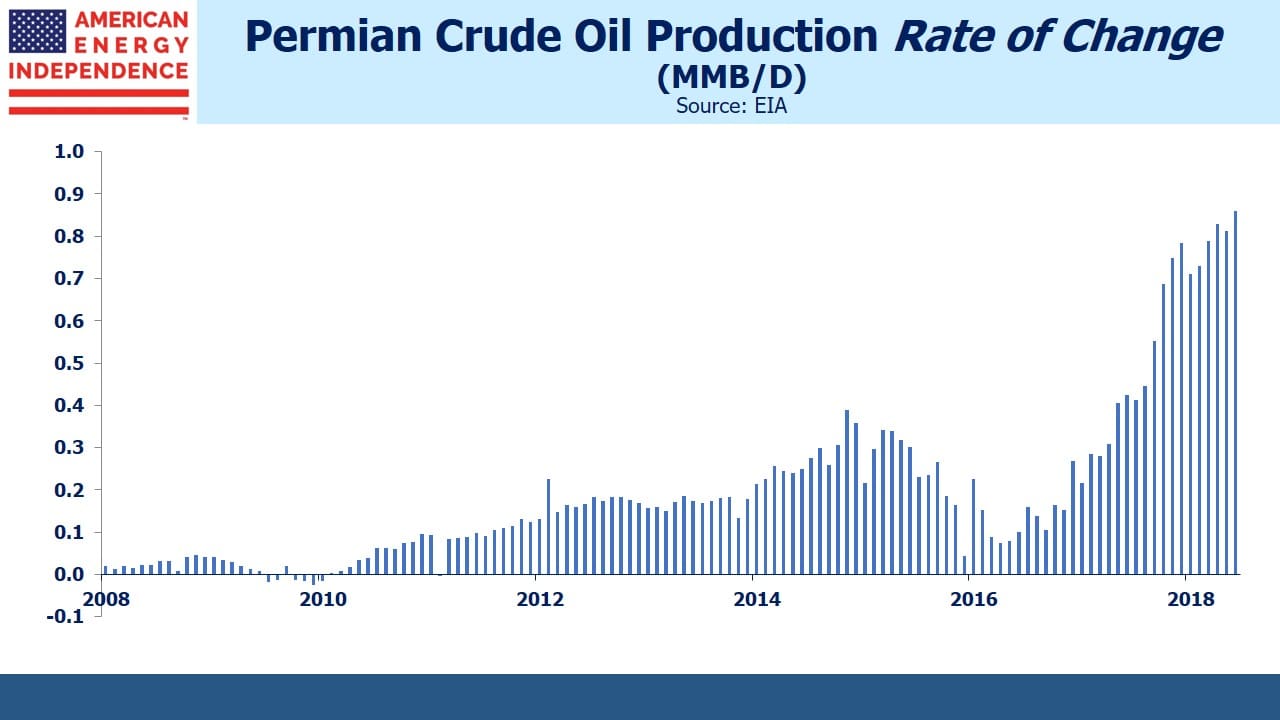

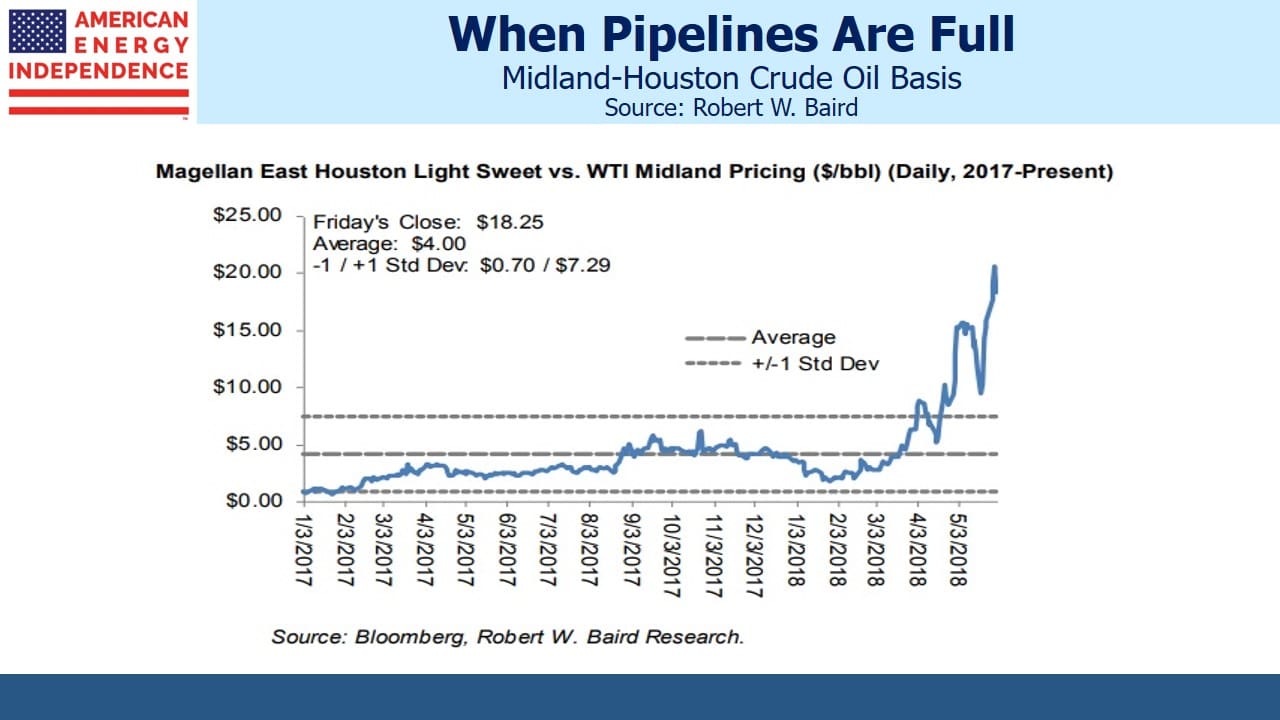

Today, Permian output is visually quite striking, rising at an increasing rate. This higher growth rate is what’s causing the infrastructure bottlenecks. Year-on-year increases of 0.8 Million Barrels per Day (MMB/D) were not obvious based on recent history and clearly few were ready. This is why the WTI basis between Midland, a collection hub for Permian crude, and Houston, recently reached $20 per barrel. There’s insufficient pipeline capacity to move the crude (pipeline tariffs are typically $1-$3 per barrel).

Clearly, even crude by rail (typically $7-$10 per barrel) can’t solve the problem, since the basis trades even wider than this, at the $20 cost of moving the marginal barrel. Trucks and truckers ($10-$20 per barrel or more) are in high demand, and because new pipelines are likely to be available late next year, large investments in truck fleets look unattractive given that the problem is temporary. Fortune Magazine’s Lone Star Rising provides a great feel for the local effects of the current oil boom.

Moving the associated natural gas that is often produced with crude oil in the Permian is also hitting infrastructure limitations. In fact, it’s likely that any moderation in crude output will be caused by waiting for the infrastructure to catch up. Permian natural gas is delivered to the Waha hub, and its basis versus the Henry Hub benchmark looks set to widen from $1 per Million Cubic Feet (MMCF) to $2. With natural gas trading at under $3, it’s not inconceivable that there may be no bid at Waha, a possibility mentioned more than once by energy executives at the Orlando MLP conference recently. Oil producers are hoping that regulators in Texas will allow more flaring of natural gas in the interim.

As a result, the U.S. has some of the cheapest natural gas in the world. Exports of Liquified Natural Gas (LNG) are currently 3.6 Billion Cubic Feet per Day (BCF/D). The U.S. Energy Information Administration expects LNG exports will rise sharply to 9.6 BCF/D by the end of 2019, reaching 13 BCF/D by mid-decade. The growing global trade is causing a shortage of specialized LNG tankers.

Although the Shale Revolution is a U.S. phenomenon, its impact is being felt around the world. Global crude oil demand of around 98 MMB/D is growing at 1.5 MMB/D annually. Less attention is given to depletion of existing oil fields, which is commonly estimated at 3-4%, or 3-4MMB/D. New supply needs to cover this shortfall as well as meet new demand, which means the world needs 4.5-5.5 MMB/D of additional output every year.

Wood Mackenzie recently forecast that decline rates would reach 6.3% for non-OPEC, non-U.S. shale, within three years. They expect U.S. production growth to be triple that of the next biggest country between now and 2025. However, even the most optimistic forecasts of U.S. output leave the world in need of other, conventional sources of supply to balance the market.

Global oil demand is expected to grow for at least the next couple of decades, albeit it at a slower rate, and it’s widely assumed that Electric Vehicles (EVs) will reduce overall demand. Forecasts from the EIA, the International Energy Agency, Exxon Mobil and Wood Mackenzie are all broadly similar in this regard.

An unusual view, but one persuasively made by my partner Henry Hoffman, is that EVs are a huge positive for the U.S. shale business – and not simply because their need for electricity will drive demand for natural gas. Since conventional oil projects take many years to return capital invested (they are “long-cycle”), their investment decisions needs to consider the evolution of EVs and how they might impact long term oil demand and pricing.

EV adoption rates are uncertain, and conventional oil projects are exposed to an EV upside case which will, in some instances, make pursuing them too risky. Shale producers need give little consideration to EVs, because the short-cycle nature of their pay-off is well short of the timeframe over which EVs may have an impact. Because shale wells return cash invested typically within a couple of years, production can be hedged in the futures market. Such wells have very sharp decline rates, so oil demand even five years in the future is barely relevant to today’s investment decision.

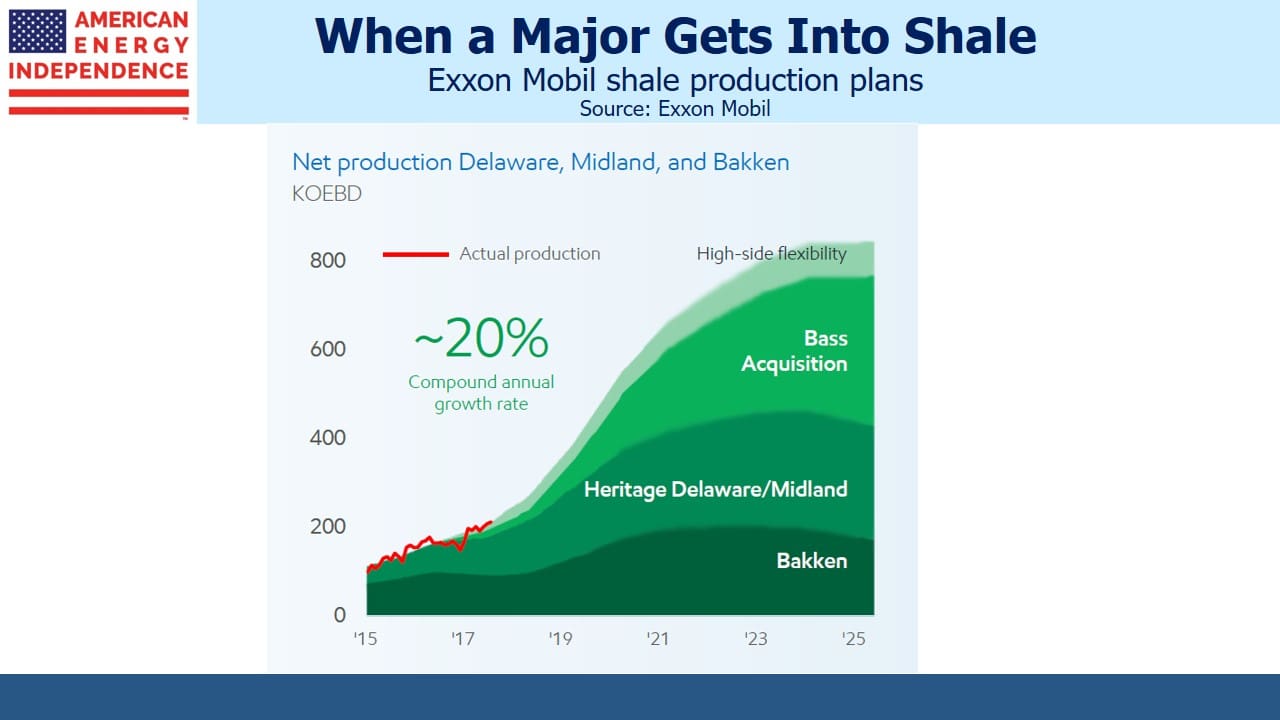

Uncertainty about the rate of improvement in EV technology clearly hinders 10-20 year oil investments, which plays to the advantage of the U.S. shale producer. This is not a view that’s widely held, yet it’s probably already having an effect (see Why Shale Upends Conventional Thinking). It strikes me as a really big idea, one that is likely to depress conventional exploration for many years, keeping crude prices higher and underpinning continued growth in U.S. shale. It was almost certainly a factor in Exxon Mobil’s (XOM) announcement earlier this year of a five year, $50BN investment in North American oil and gas production (see The Positives Behind Exxon Mobil’s Earnings). The entry of the biggest integrated oil companies into shale will lead to more predictable output since they won’t be as reliant on external financing. It also validates shale as a long term story.

Betting on higher crude has been a losing trade for hedge funds until recently (see WSJ: As Oil Soars, Few Hedge Funds Are Left to Profit), reflecting conventional wisdom that shale supply will act to rein in higher prices. By contrast, we think crude prices will trend higher over the medium term because of underinvestment in conventional supply. Shale investors should regard growing EV adoption as fundamentally supportive.

For more on America’s Energy Renaissance : The Shale Revolution, watch Simon Lack, Managing Partner of SL Advisors, discuss why he believes the Shale Revolution is the most fantastic American success story.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!