Unicorns Not Working

The rapid transition of WeWork from IPO in early September to almost bankrupt says something about the superficial due diligence of bankers prior to a roadshow. Reports suggest that co-founder Adam Neumann’s $1.7BN million payoff in exchange for much of his stock and his board seat will save him from having to file for personal bankruptcy. Like the late Aubrey McClendon when he ran Chesapeake, Neumann bet everything by borrowing heavily against his equity holdings. Meanwhile, Softbank has invested over $10BN into a company whose equity is now worth at $8BN. In January, WeWork was valued at $47BN. Another report suggested that layoffs were delayed because the company didn’t have the cash for severance payments.

Few will shed a tear for Neumann or Softbank. If you aim high and miss, down’s a long way. Founders and investors in a company can be expected to talk up its valuation.

But what about the bankers, who only a few weeks ago were out there pitching a hot growth stock that in reality was desperately in need of cash simply to stay afloat? We’re not natural IPO buyers, but doesn’t this company just sign long term property leases and then sub-lease for shorter terms?

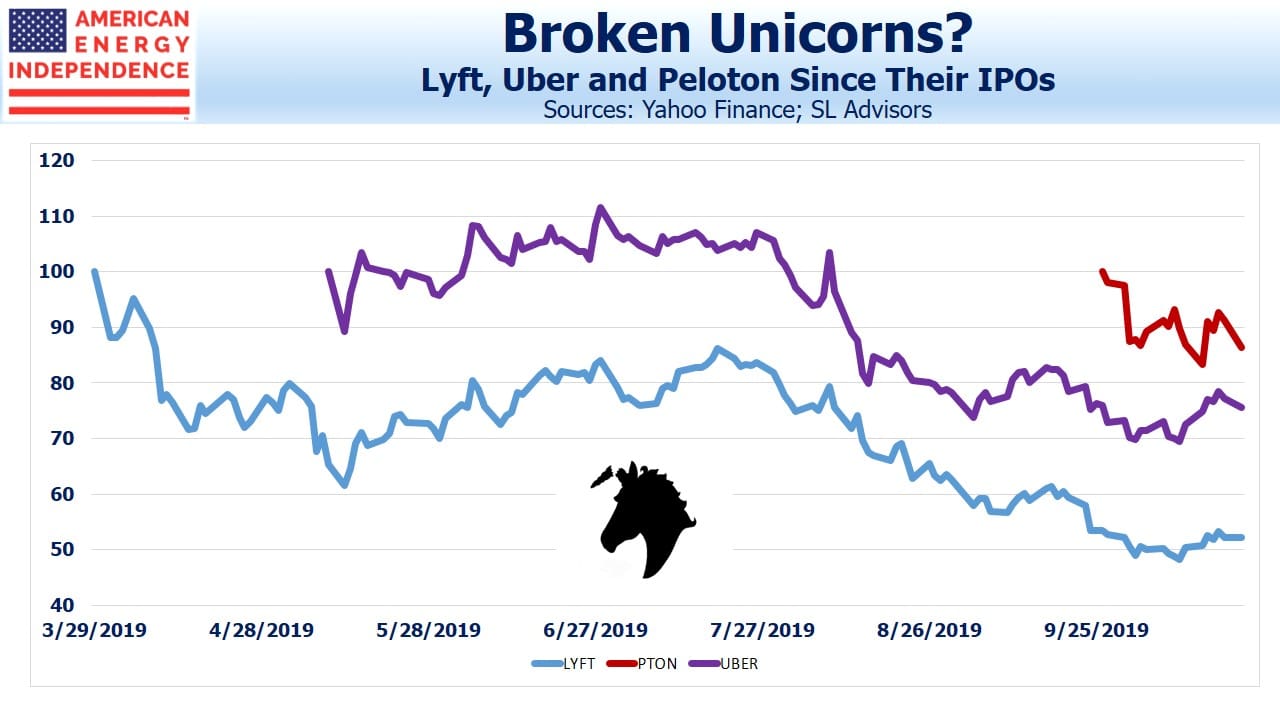

Stocks can dip after an IPO, but it’s rare for bankers to so misread investor sentiment that the deal is cancelled. Early this year there were over 300 high growth, private companies valued at over $1BN (“unicorns”). Some mutual funds sought to boost returns on their public equity portfolios with a sprinkling of unicorns. That strategy has recently backfired, as Uber, Lyft and Peloton all slumped following their recent IPOs.

Investors seem to be recovering a protective layer of cynicism.

A close family member is an astute investor with an age-appropriate, conservative portfolio. She allocates a small portion for interesting, risky ideas, and bought into Tilray (TLRY) in its Canadian IPO in July 2018. CFA charterholders shouldn’t bother looking at marijuana stocks. Farmers all over the world rely on enormous government subsidies, without which their businesses apparently couldn’t survive. This simple observation, along with TLRY’s stratospheric multiples, supported my advice to my wife not to follow our relative’s lead. TLRY quickly soared to almost six times its IPO.

Our family’s most ruthless trader sold enough near the high to cover her cost within three months, as one of the most beautiful short squeezes in recent years swept away those who had shorted TLRY based on fundamentals. It’s been an occasional topic in our house at breakfast, along the lines of “Do you know what I could have bought if you hadn’t told me to avoid that pot stock?” Responding that my wife doesn’t pay enough in fees to warrant an account review while I’m eating my cereal draws a predictable retort.

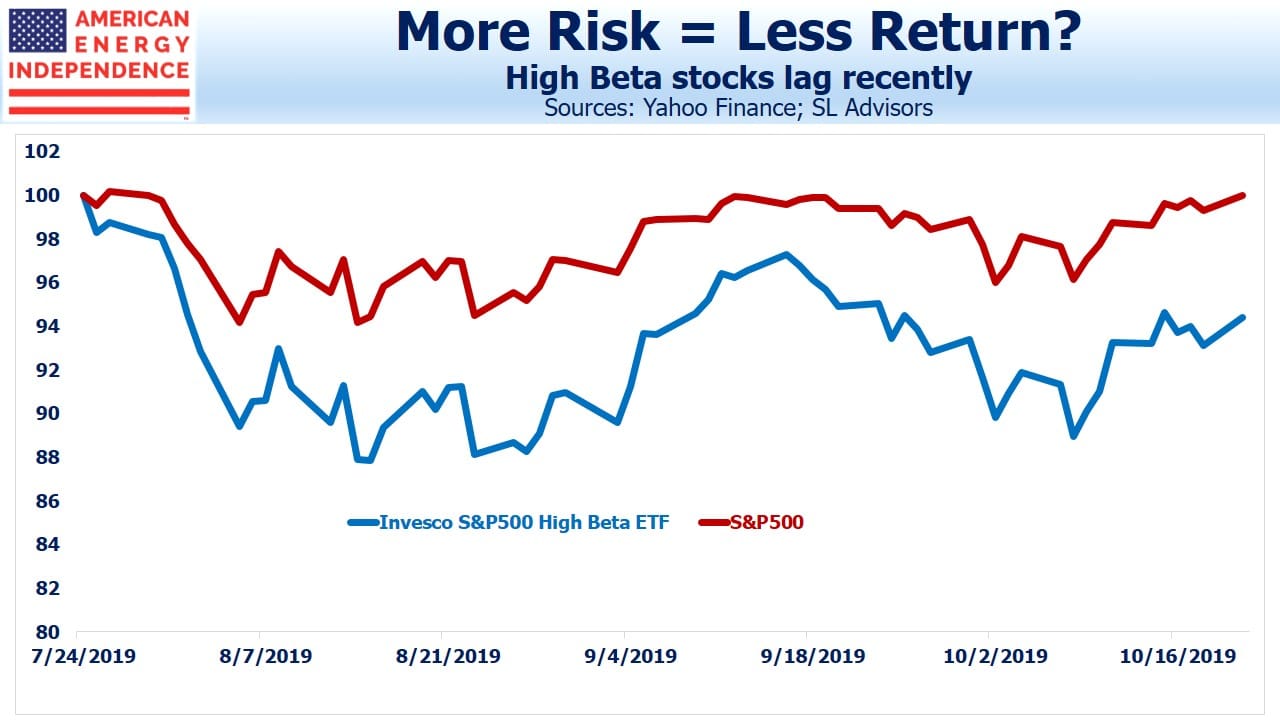

The time for frothy stocks has passed. In a year of strong equity returns, low volatility stocks are ahead, even though they’d be expected to lag at such times. The American Energy Independence Index, jammed full of cheap stocks and with nothing remotely unicorn-like, is keeping up the pace. Investors are turning towards tangible values with proven business models.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It is absolutely amazing that institutions will chase these investment but not provide capital to solid midstream infrastructure companies with long term take or pay or minimum volume commitments supporting their operations, but that’s what makes high yields available to us.