The Biden Put

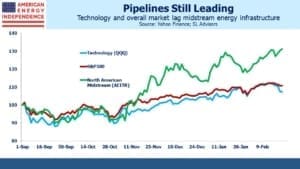

Inflation fears are percolating. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) had its biggest ever stretch of outflows over the past six weeks. There are plenty of warnings signs. Commodity prices are booming. This is happily driving up midstream energy infrastructure, with the American Energy Independence Index up 15% YTD, well ahead of the S&P500 at up 4%. Cyclical and value sectors are drawing renewed interest. Energy has been outperforming technology since November’s vaccine announcement.

M2 money supply is growing at 26% year-on-year, the fastest since records began. The link between inflation and money supply broke years ago. Money velocity is down sharply, which is why inflation isn’t surging. The Fed isn’t worried. They would be happy with inflation running above their 2% target for a while. For those of us whose careers include the 1980s, when inflation and interest rates peaked, this is quite an an adjustment.

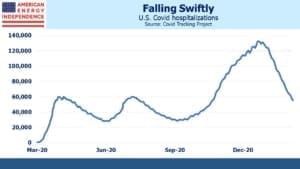

Covid figures are collapsing, which will likely unleash pent-up spending that interminable lockdowns have stifled for a year. The CDC counts 474K deaths involving Covid, less than the 500K figure seen elsewhere because the CDC waits for official death records to be uploaded by the states. This is without doubt a tragedy.

Over the same period, 3.3 million Americans died without Covid. They spent their last months or year alive constrained by all the restrictions we know so well. To pick one cohort, 99K people aged 65-74 died with Covid, but 631K of the same group died without it. 21K aged 45-54 died with Covid, reflecting their low risk profile, but 183K in this group died from other causes, while enduring pandemic restrictions like the rest of us. Even for those 85 and older, who are almost a third of all Covid fatalities, 87% of deaths in this group were non-Covid.

A friend of mine I’ve known since elementary school died on Saturday from a heart attack, which probably caused me to consider the figures in this way. The lost final year of life for the non-Covid fatalities denied the normalcy of dinners out, companionship with friends, travel and so on is another tragic element of the pandemic, but doesn’t get much attention. Do you know anyone who isn’t ready to get out there and live once more?

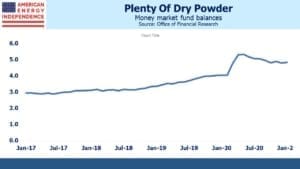

Money market funds hold around $5TN, a figure that’s slowly declining but still nonetheless $1TN higher than a year ago. This has low velocity while it’s sitting there but could easily be deployed in a recovery of consumer spending. Examples of rising prices include crude oil, copper and resins used to manufacture plastics. Pipelines, which move with commodity prices and reflect ownership in physical assets, offer more protection than most sectors in this environment.

Meanwhile, the Administration wants to spend $1.9TN on Covid relief – even if that figure is negotiated down, the vaccine rollout and falling hospitalizations suggest that the worst is behind us. A weekend article in the WSJ even suggested that the U.S. was nearing herd immunity. It’s predicated on an estimate that 0.23% of people who get infected die. Assuming that’s a reliable statistic and the 500K Covid fatalities is also accurate, it suggests 217 million Americans have been infected (500K divided by 0.23%). That’s approximately two thirds of the country. Add the growing vaccinations and you can see the country could be at 70-80%.

It’s a controversial assessment, and friends/readers who know more than us on the topic will be moved to respond. Fauci isn’t so optimistic. Virus mutations may cause a setback. But it’s not possible to definitively reject the optimistic conclusion, only to say it’s unclear.

Once the Covid relief plan is approved and money being sent out, Biden will turn to infrastructure – another $1TN. Climate change will justify at least that in addition. There are no longer any fiscal hawks (see Modern Monetary Theory Goes Mainstream).

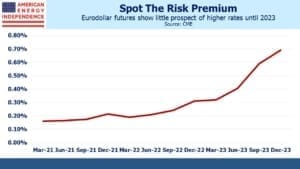

Although there are plenty of warning signs that inflation will rise, we’ve had almost three decades where it hasn’t. Many worried about the inflationary effects of Quantitative Easing when it was first deployed following the 2008 financial crisis. To Ben Bernanke’s credit, he knew it wouldn’t and he was right. The economists at the Fed are similarly confident today. They’re expected to keep short term rates low for at least the next couple of years.

Betting against the Fed is usually wrong. But today, betting with them doesn’t offer much upside. The eurodollar futures curve remains extremely flat, so an investor in two year securities will do scarcely better than holding overnight deposits for the same period of time. Fed chair Powell reiterated his cautiously optimistic outlook yesterday with no need to raise rates anytime soon.

The Federal government is pouring fiscal and monetary stimulus into the economy simultaneously. And if a virulent Covid mutation sets back the current path to re-opening, more $TNs will be forthcoming.

People used to refer to the Bernanke “put”, recognizing that the Fed would respond to sharp economic weakness by easing, giving equity investors effectively a put option on their holdings. Nowadays we have both the Powell Put and the Biden Put. Bond yields are too low to properly reflect the new reality.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Excellent Simon. Excellent.

The $1.9T pending legislation is not entirely (by a long shot) a Covid relief bill. In large measure it is a bill to ship money to Democrat favored institutions having nothing to do with Covid relief.

With regard to betting with or against the Fed regarding the possibility of a rising yield curve, I have a meaningful position in municipal bonds, some of which have been declining consistently for the last several trading days. As a hedge, I just bought a floating rate senior secured bond fund, and since my existing BDC portfolio (in my qualified plan accounts) is all based on floating rates–with a LIBOR floor–that is another hedge..

Your position in Municipal Bonds offers some positive opportunities that most investors are not aware of. I am happy to discuss this with you privately if you wish. Email to ihinc@bellsouth.net with subject Municipal Bonds.

Simon, thank you for sharing your insightful assessment. As usual, points well made.

Inflation should help to whittle away the massive debt held by many players in the midstream sector. Energy Transfer’s recent acquisition of Enable looks very smart in a world of higher inflation. Will a wave of consolidation now sweep the sector?