Shale Drillers Find Efficiency Isn't Rewarded

Master Limited Partnerships (MLPs) have been reporting earnings over the past couple of weeks. For the most part they have come in as expected, with few surprises in either direction. Crestwood (CEQP) and Tallgrass (TEGP) both reported system volumes slightly higher than expected; generally though, they were unremarkable, which is the sort of boring stability MLP investors like. Although most CEOs are pretty sure their stock is undervalued, TEGP CEO David Dehaemers is positively convinced this is the case. And since TEGP sports a 5.25% yield forecast to grow by 40% (not a misprint) in 2018, his case appears compelling to us.

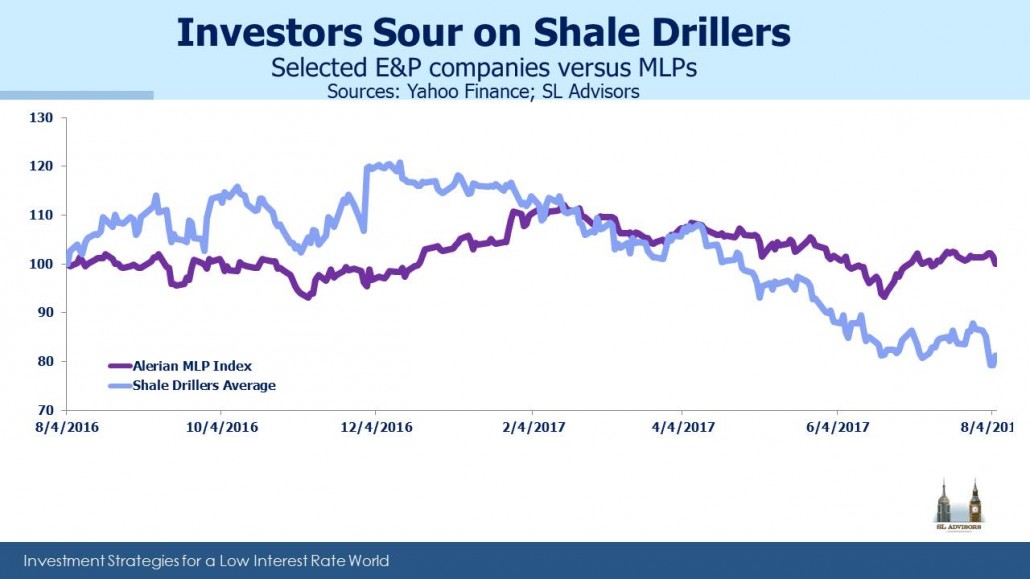

The real story of the past week is not MLPs but their customers, who we also follow closely. MLP investors may feel that their patience is being tested, as the sector gyrates with crude oil while persistently refusing to appreciate as its high yields imply it should. At least MLP investors are being rewarded to wait, with attractive quarterly distributions being paid in many cases during August. Even so, the trailing one year return on the Alerian Index of 2% seems paltry compared with the S&P500, whose one year return is 16%. MLP investors might feel unloved. In the classic British sitcom Fawlty Towers, manic hotel owner John Cleese is told not to worry, that there’s always someone else worse off. To which he replies, “Is there really. Well I’d like to meet him, I could do with a laugh.” You can see the clip here at the 18 minute mark.

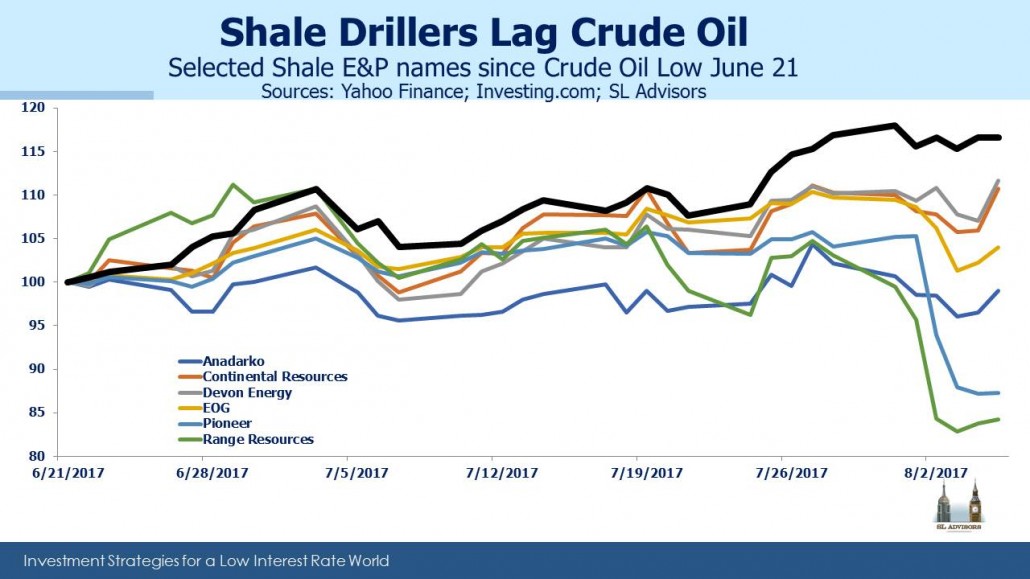

Therefore, the recent performance of U.S. shale drillers is worth considering, albeit with less shadenfreude than John Cleese. They are the customers of MLPs, and the regularly demonstrated efficiencies with which they extract hydrocarbons are not, of late, rewarding their investors. Over the past year, the six most active independent shale drillers have returned -21%. 2Q17 earnings reports over the past couple of weeks have hastened this slide, as future production growth has been guided down. The announced capex reductions across the exploration and production sector (see Financial Discipline Among MLP Customers) have helped boost crude prices by around $6 a barrel since June 21. However, lower guidance from the six names highlighted is in most cases due to specific technical challenges they’re encountering and resolving. They’re not reporting that margins are too tight. Nonetheless, in such a market investors want every name in the group except the ones they hold to produce less.

Weakness in the stock prices of shale drillers may be weighing on MLPs. Energy infrastructure inevitably trades with the sector it supports. Kinder Morgan (KMI) is in XLE, the energy sector ETF. Swings in sentiment inevitably move its price regardless of its fundamentals.

A piece of good news that didn’t receive much attention was Senate approval of two new commissioners to the Federal Energy Regulatory Commission (FERC). This will restore their quorum, and should allow a substantial backlog (estimated by RW Baird at $14BN) of infrastructure projects to receive approvals and proceed. Their completion will add incrementally to the cashflows of their owners and ultimately augment payouts to investors.

We are invested in CEQP, KMI ad TEGP