Ten Reasons To Consider Buying Midstream Now

Last week an investor asked us for ten reasons why they should commit funds to midstream energy infrastructure now. Typically, three or four bullet points will suffice to make the case, but in this case the request was for ten. Believe it or not, we were up to the challenge!

Here they are:

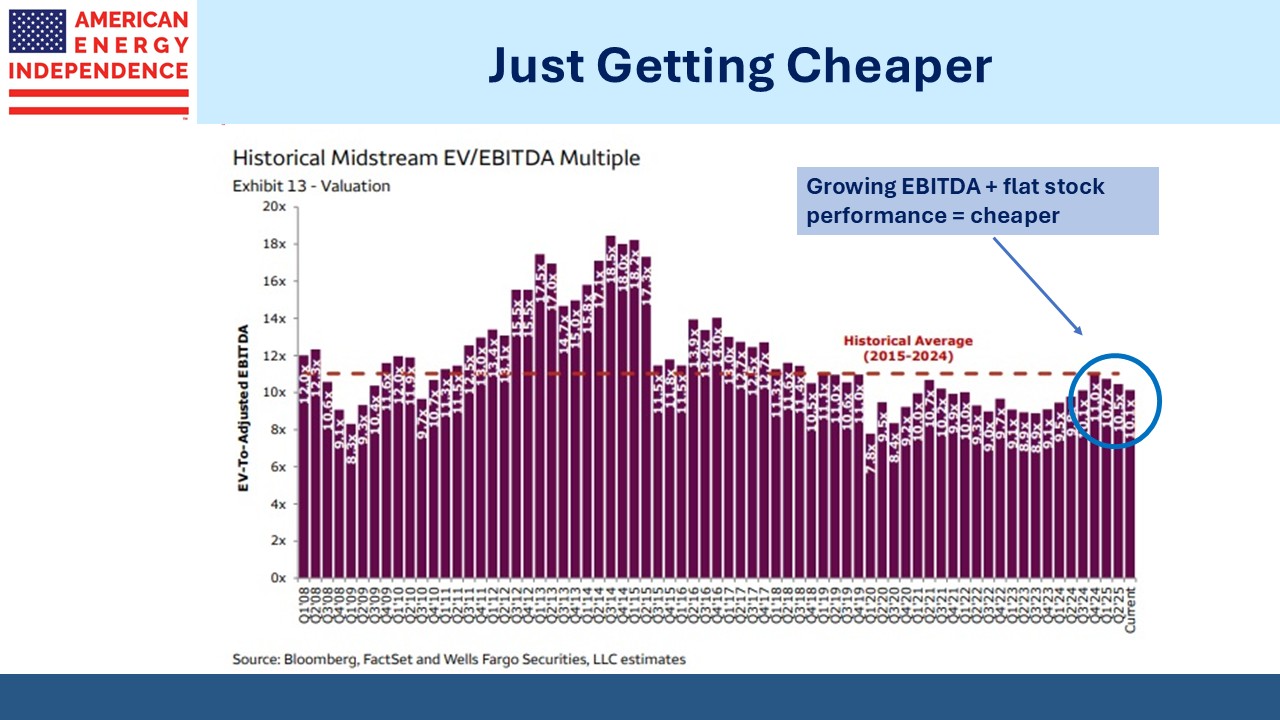

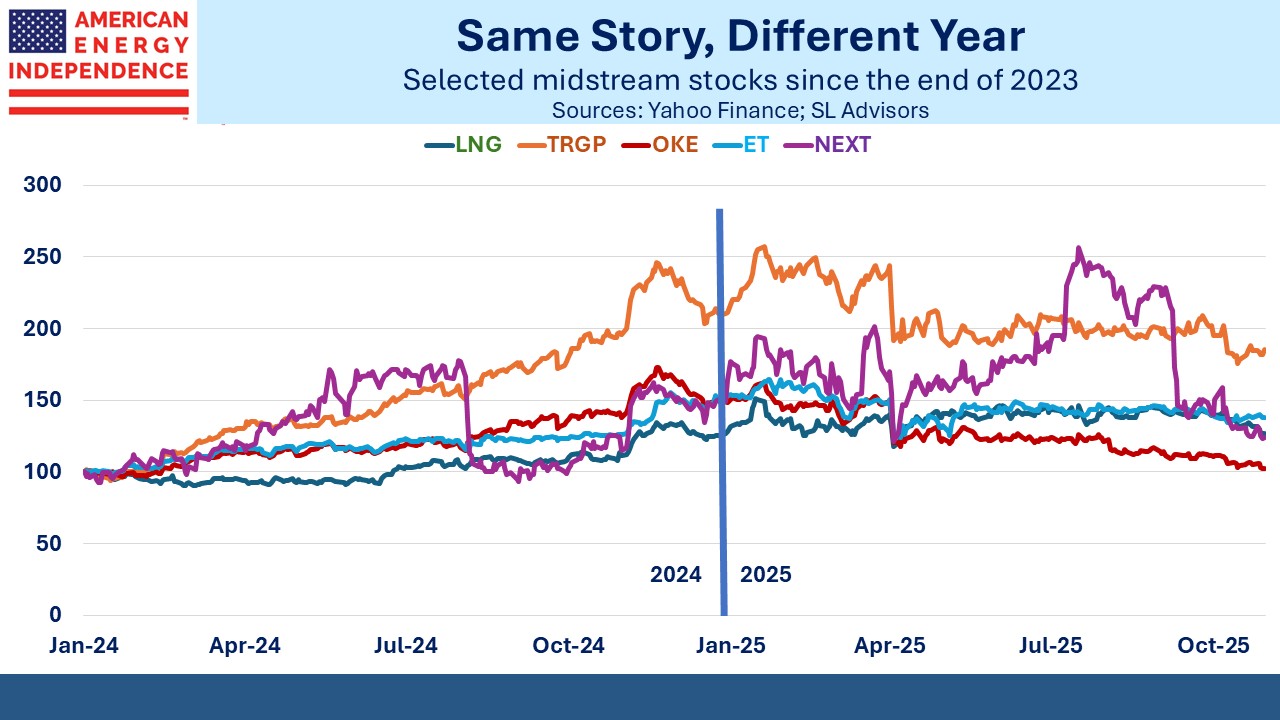

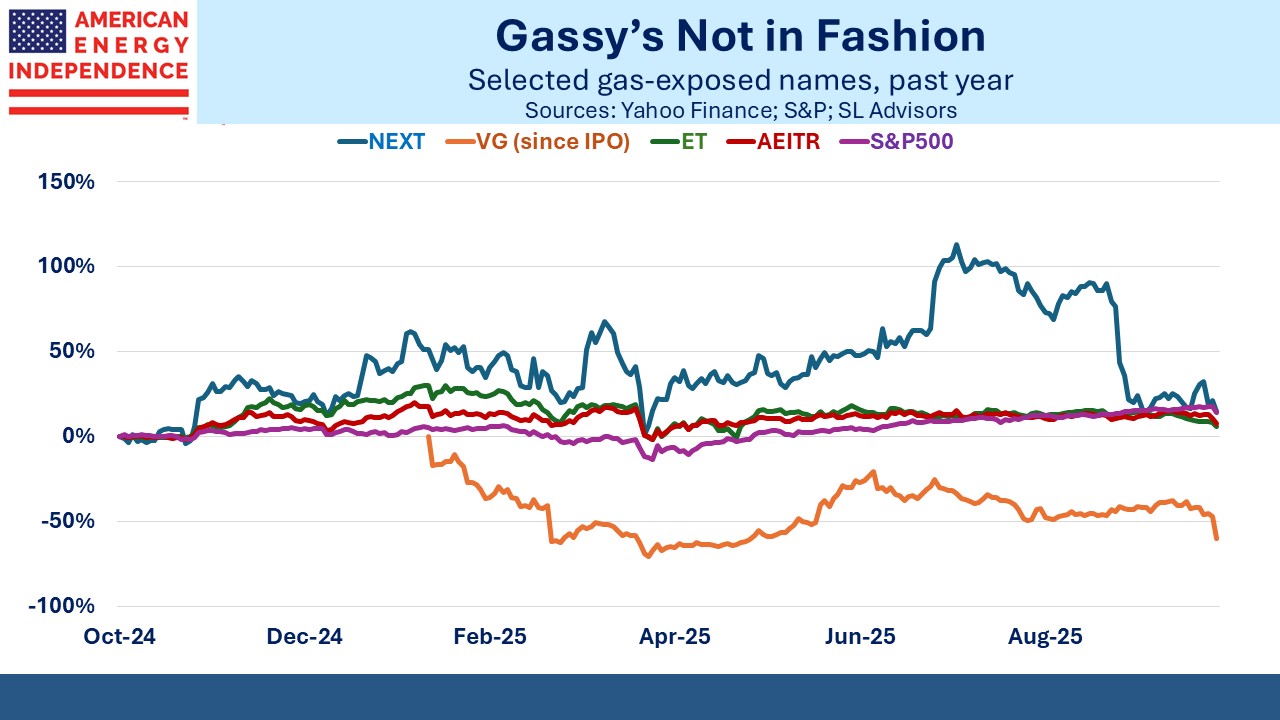

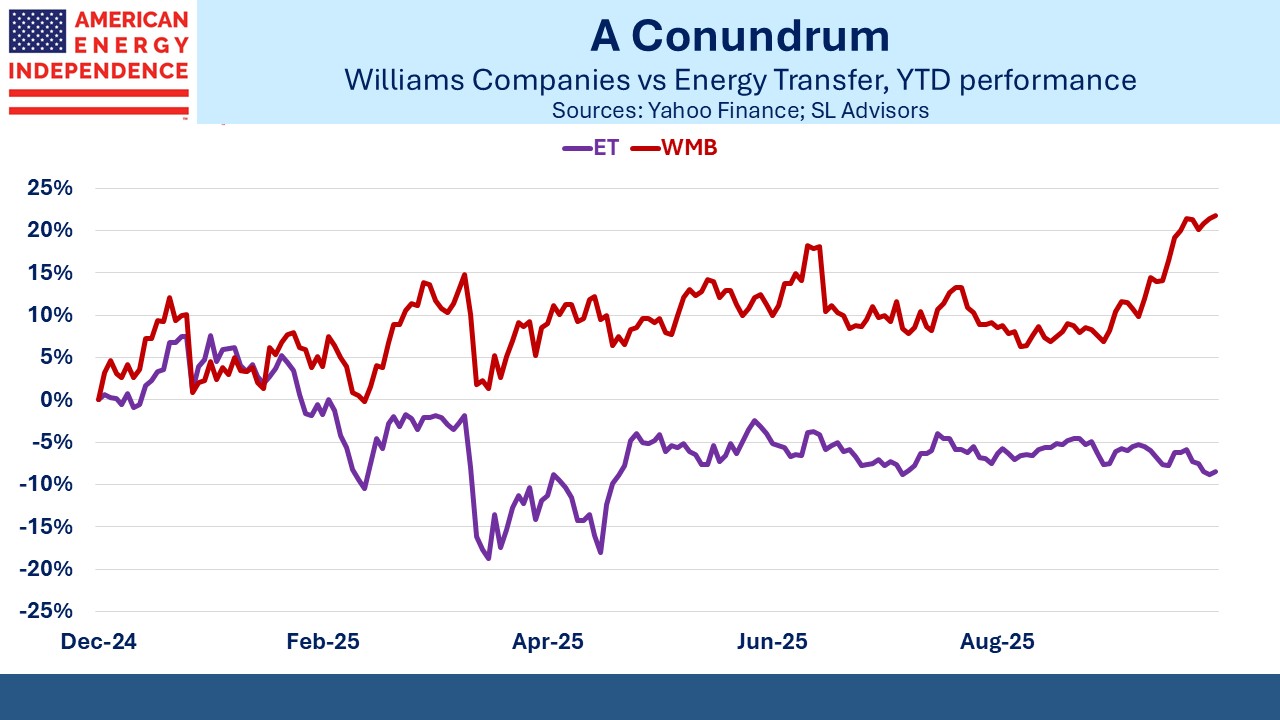

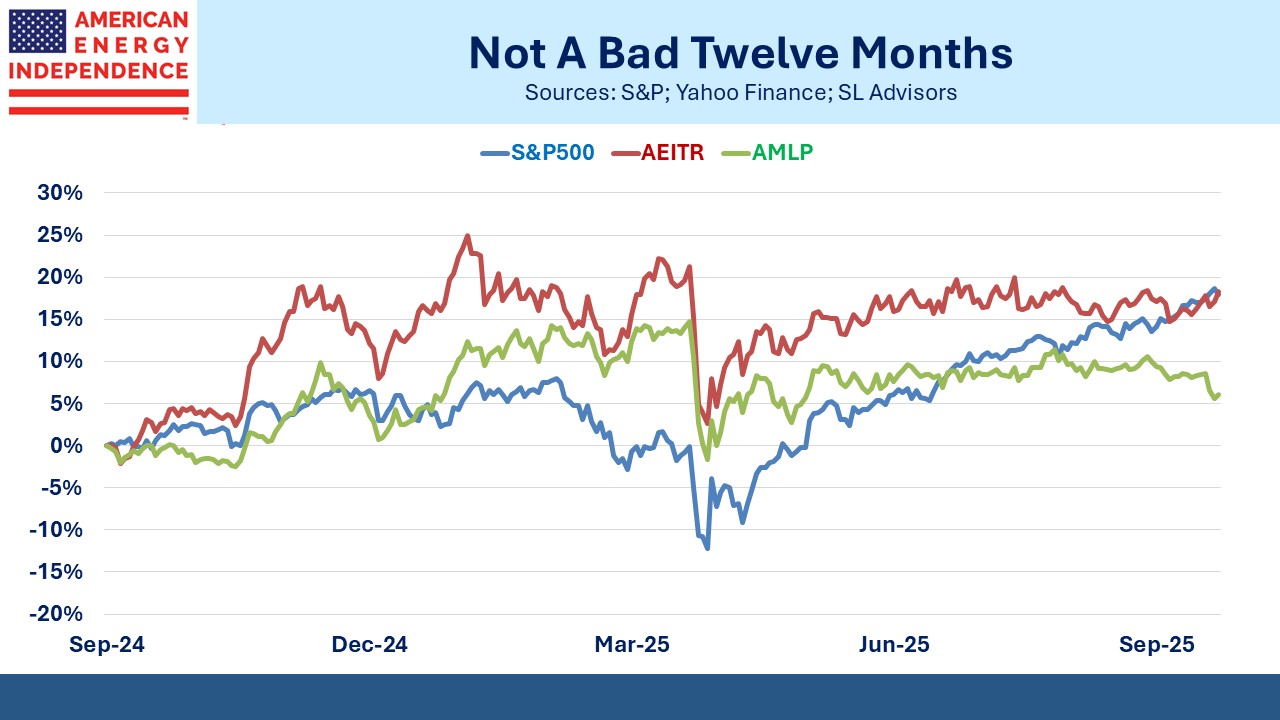

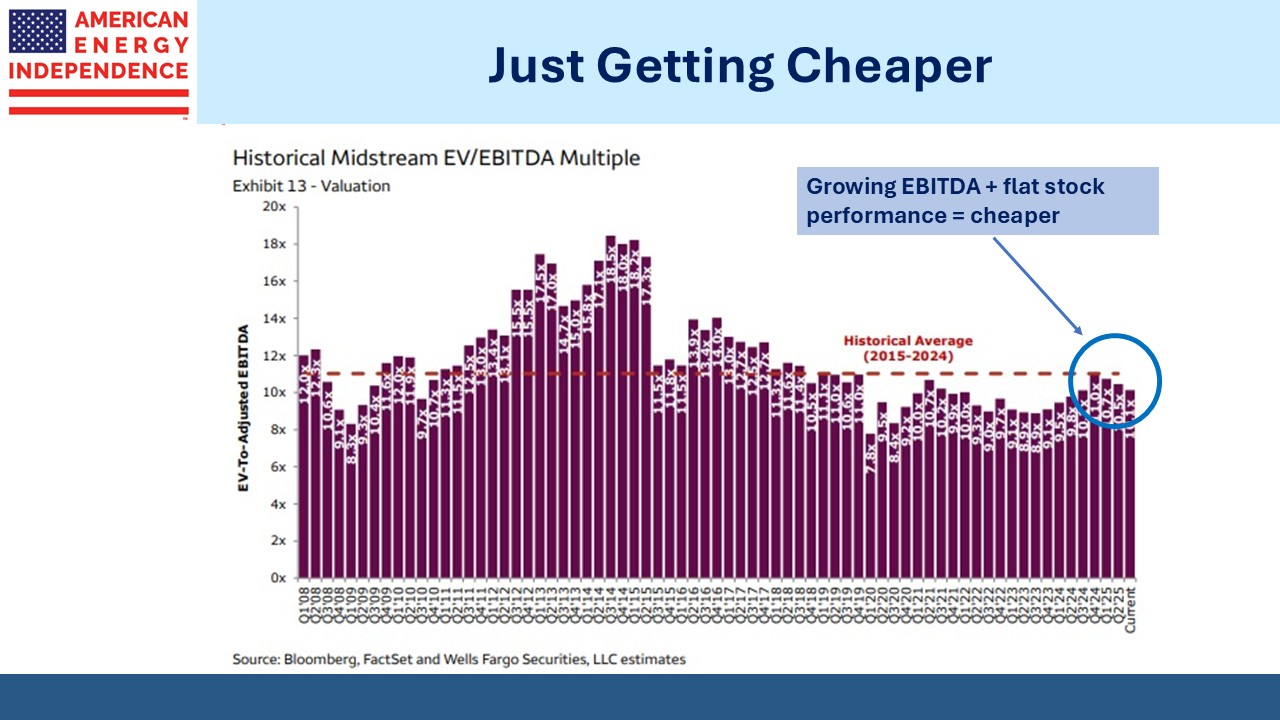

- Valuations are attractive. Enterprise Value/EBITDA is 10X, below the ten year average of 11X. Wells Fargo regularly produces the corresponding chart. This year, EBITDA has grown while stock prices have languished or dipped. Price performance bears little relationship to operating results, but the explanation lies mostly in the current fixation on growth stocks although that is starting to wobble. In our opinion, given the list of positives below, the sector should trade at a premium to long term valuations, not a discount (see Getting Cheaper By Moving Sideways).

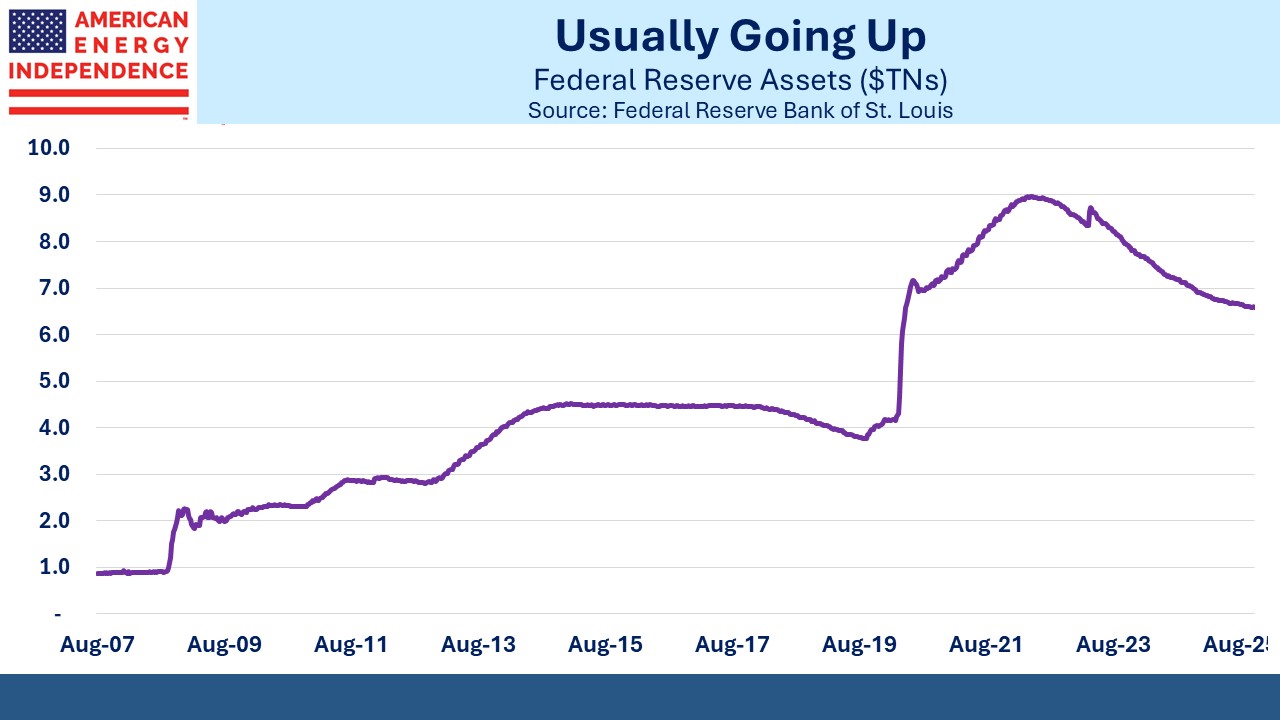

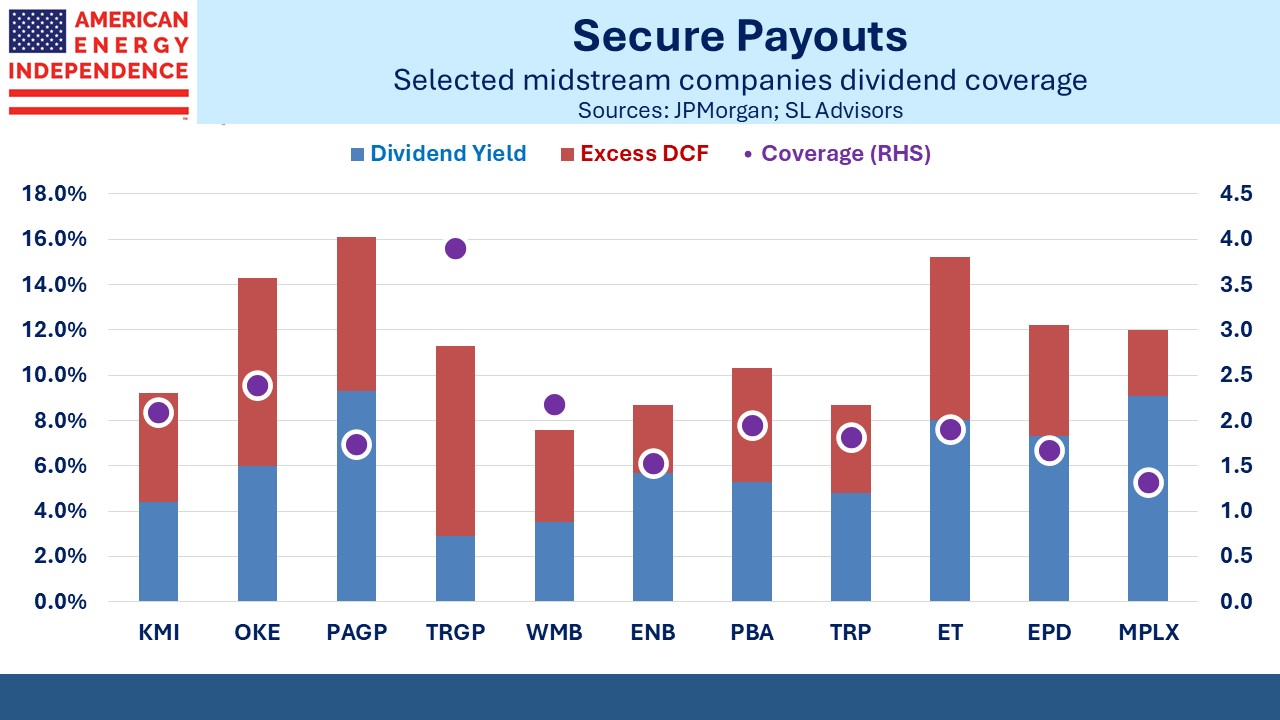

- Dividend yields of 5% are attractive and will become more so as the Fed continues to cut rates. Not that many years ago, investors were drawn to midstream for the income. Easier monetary policy will help (see MLP Yields Look Better Than Cash).

- Dividends are well covered by Distributable Cash Flow (DCF) and are generally growing. Gone are the days when the MLP structure dominated and 90% or more of DCF was paid out in distributions. Midstream companies today are mostly structured as c-corps, with lower payout ratios that make dividends more secure (see Pipeline Earnings Or Cashflow?).

- Balance sheet leverage has been declining for years and is now generally 3-3.5X Debt/EBITDA compared with the 4-5X that prevailed 5-10 years ago. Kinder Morgan even argued to rating agencies that their diverse businesses deserved a multiple of 5-6X, although few were convinced. The widespread adoption of lower leverage targets has lowered the sector’s correlation with energy prices. It’s no longer the case that oil drags pipelines lower. Last year was a perfect example, with strong midstream performance coinciding with a bear market in crude (see Picking The Top Pipeline).

- Companies such as Cheniere are buying back stock — $1BN in 3Q25 and an additional $300MM in October. Buybacks have become increasingly common as a way to return cash to shareholders – very different from the old MLP model that routinely did secondary offerings to finance growth projects. Targa Resources, Enterprise Products Partners, MPLX and Oneok are among those that have repurchased shares this year (see Notes From The Midstream Industry Conference).

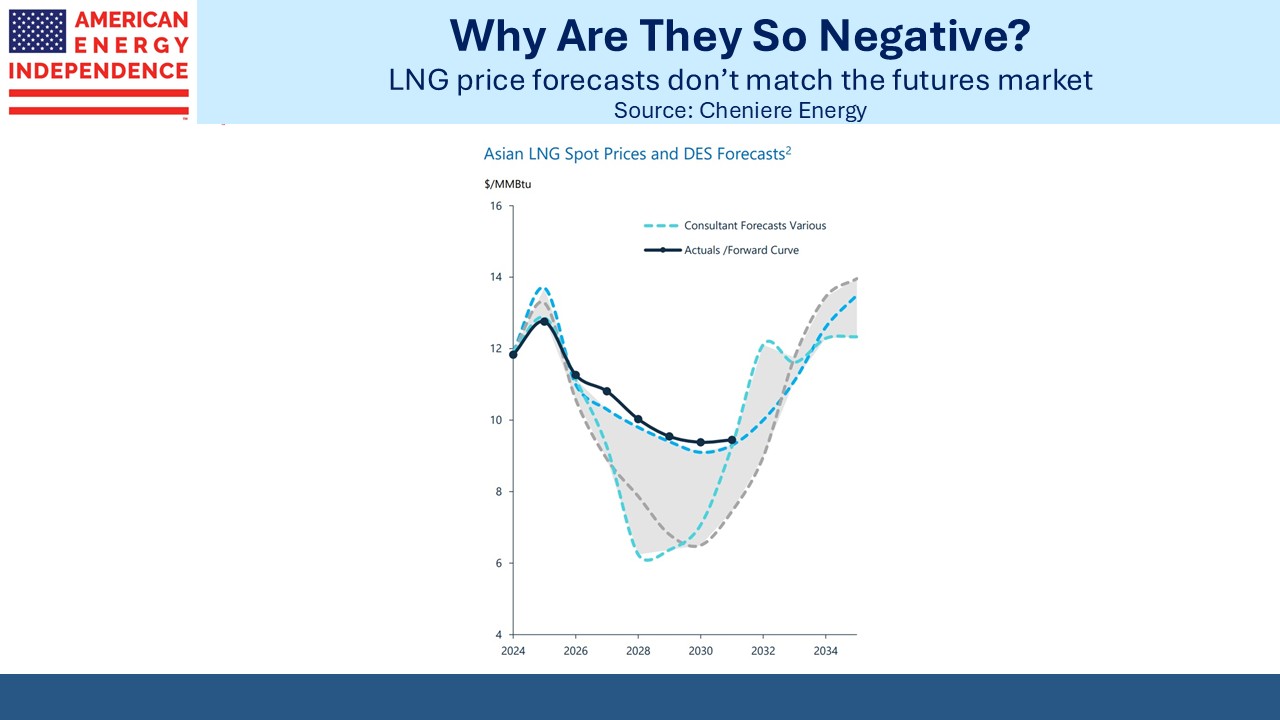

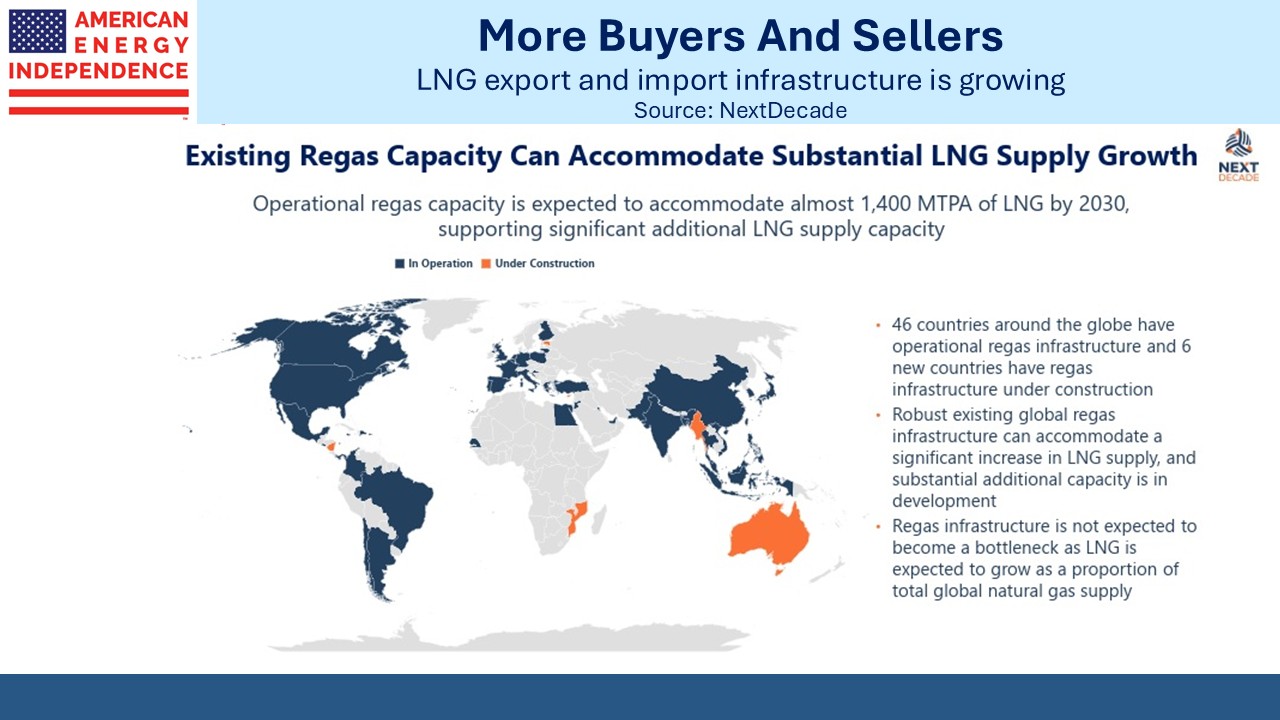

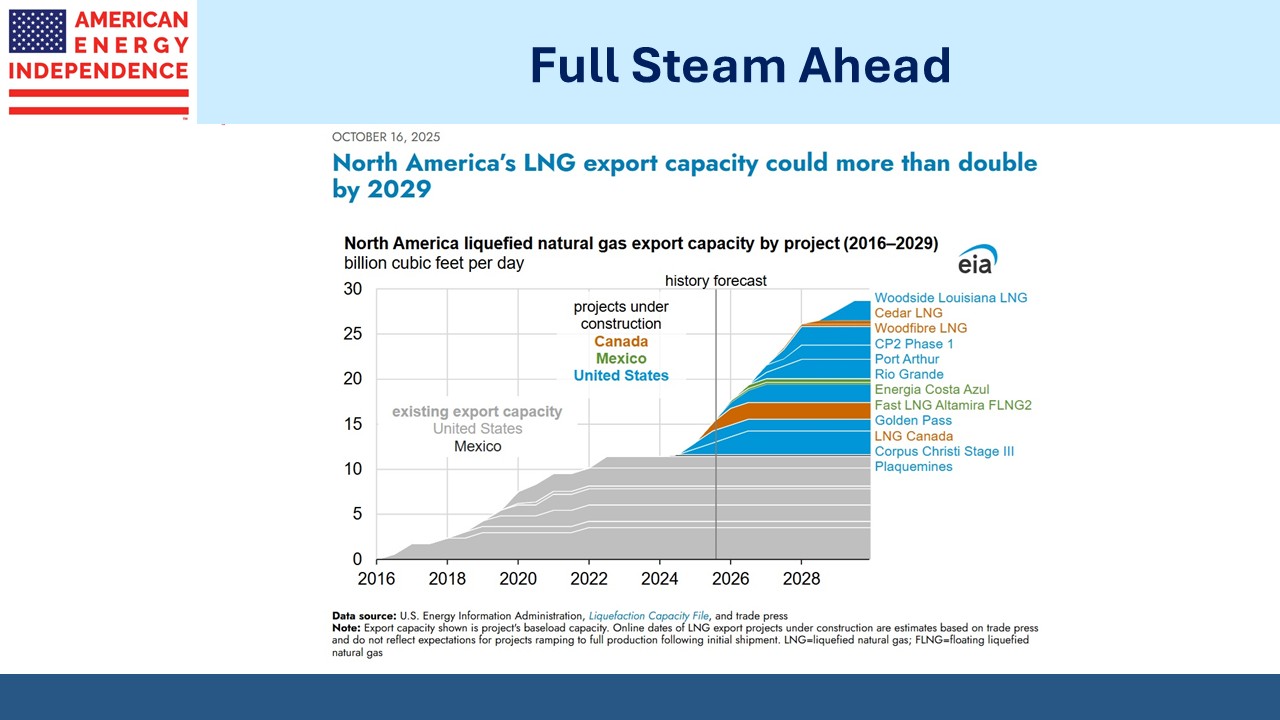

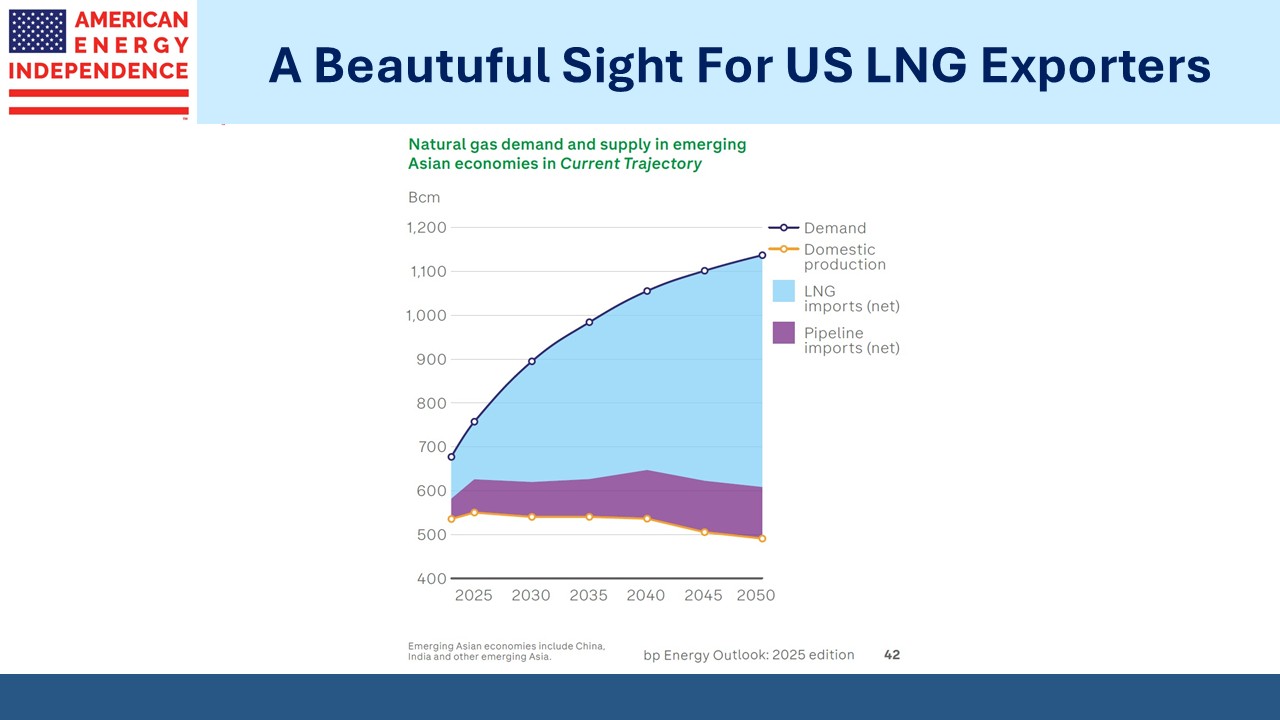

- Exports of Liquefied Natural Gas (LNG) continue to grow, currently around 15 Billion Cubic feet per day (BCF/D) and likely to reach 30 BCF/D by 2030. Because LNG export terminals take years to build, it’s possible to project out the annual increases in capacity. LNG trade is growing much faster than inter-regional pipeline connections because of the flexibility it allows both consumer and supplier. The US is the world’s biggest exporter of LNG (see LNG Keeps Growing).

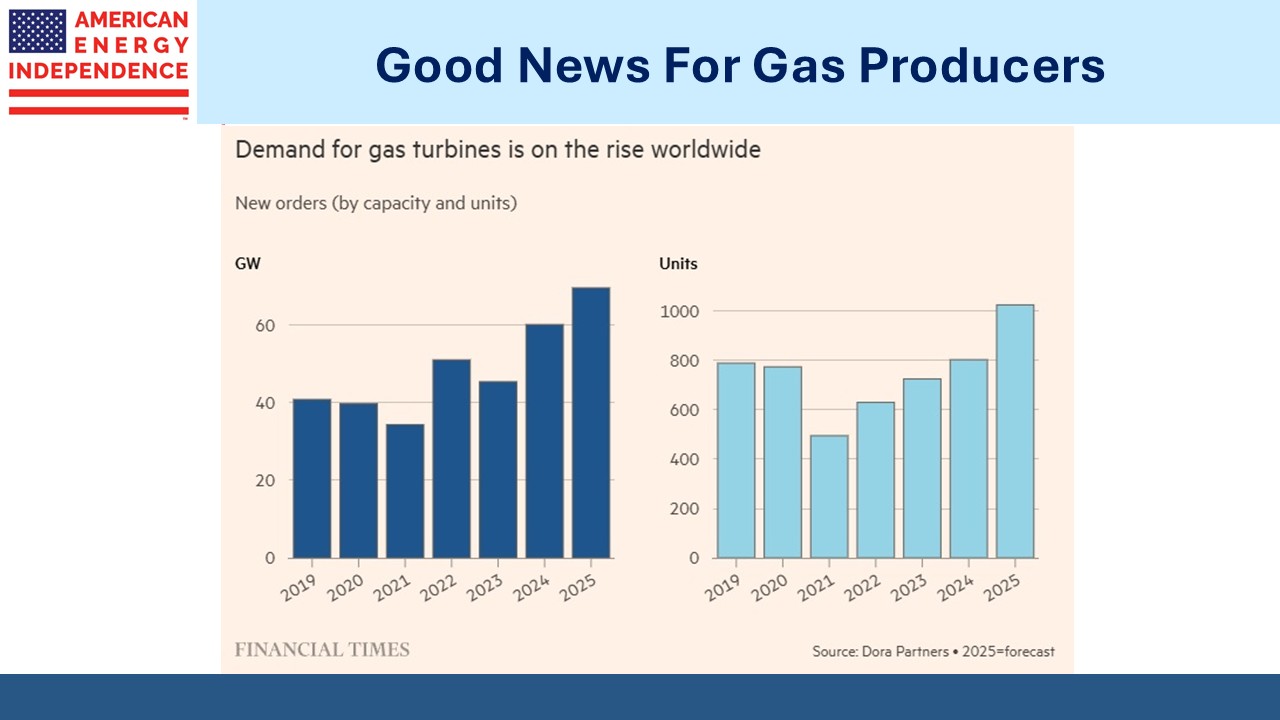

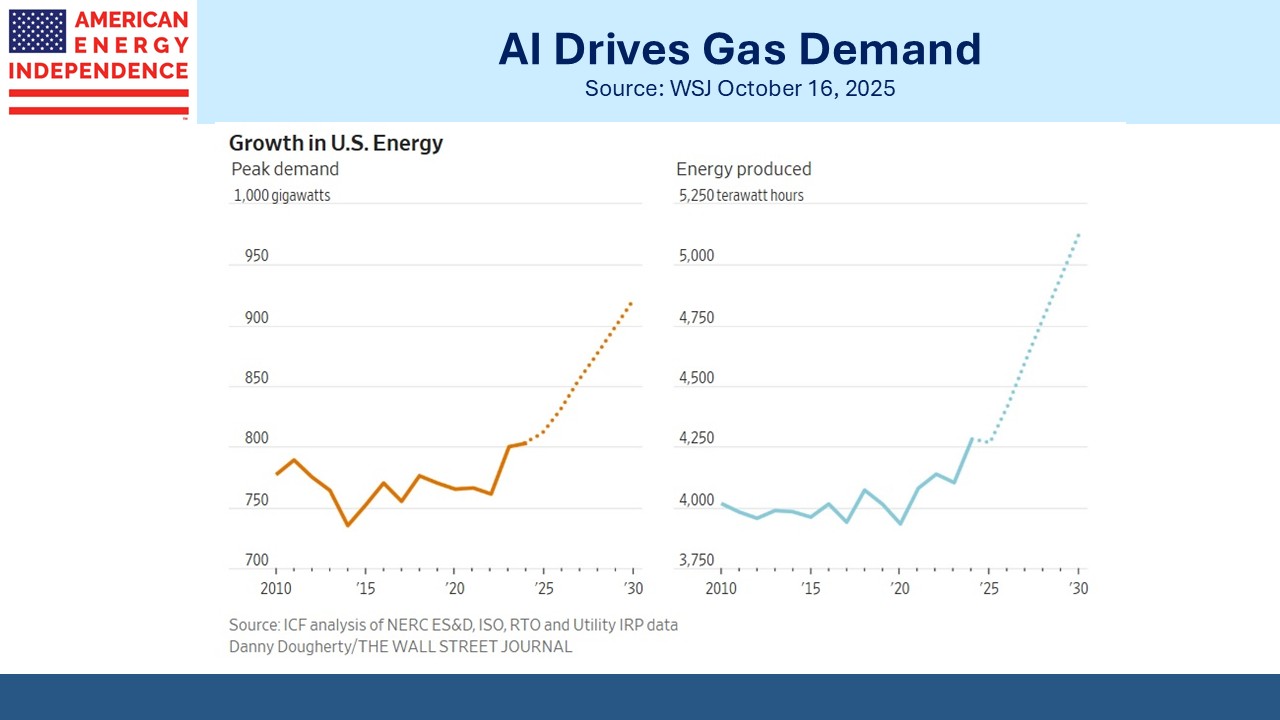

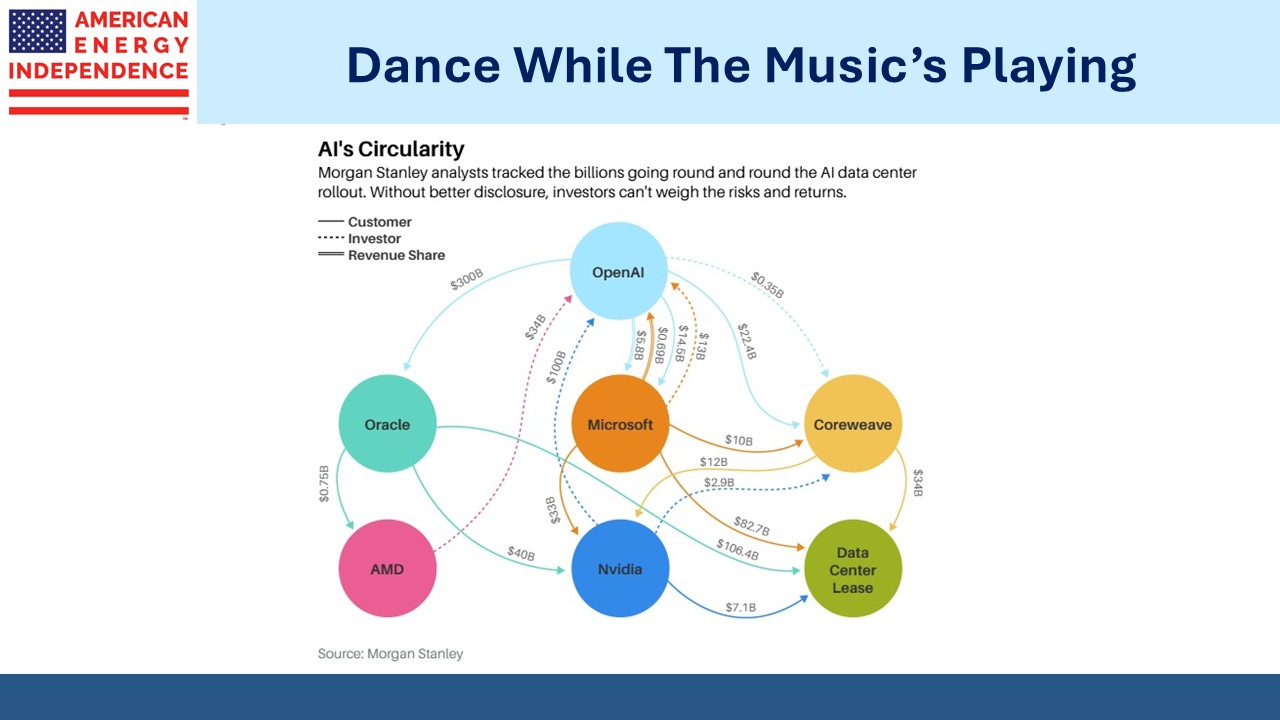

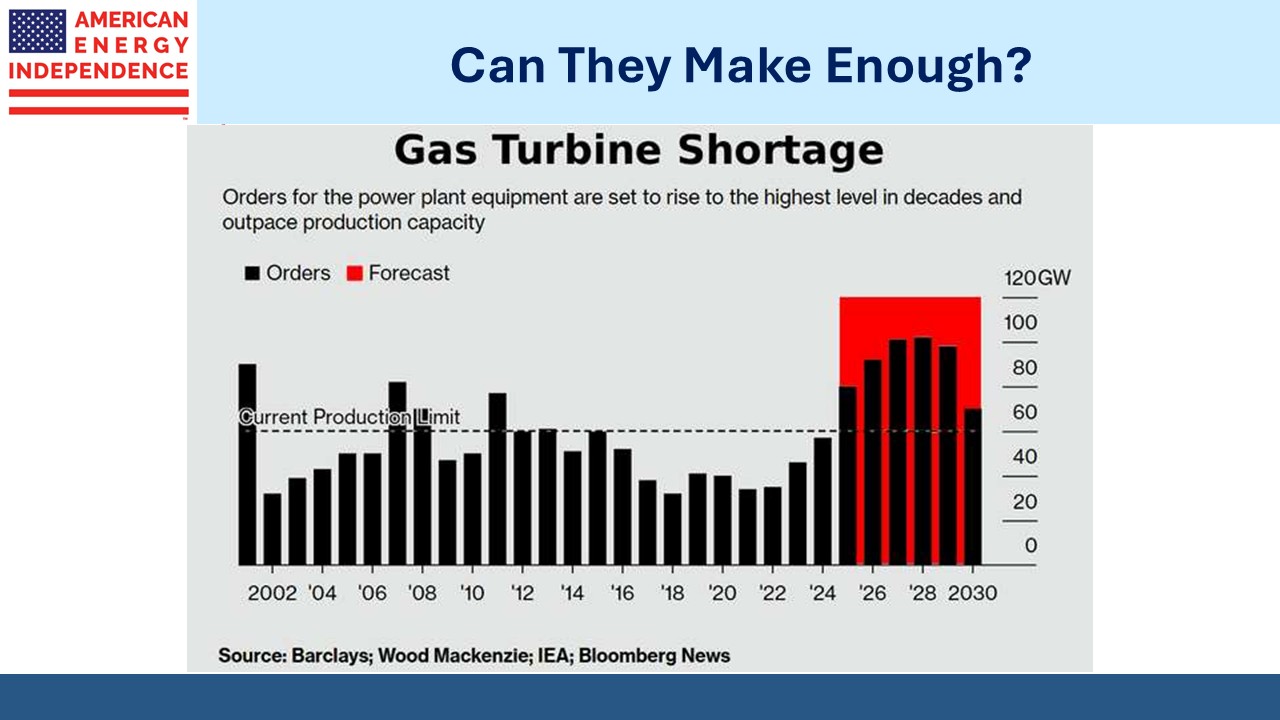

- Power demand from data centers is driving domestic natural gas demand higher, since gas provides quick, reliable electricity. Behind the meter solutions which rely on a dedicated power plant and avoid the grid are increasingly popular. Nuclear remains a long term solution but is more costly and still many years away (see Bullish News On Gas).

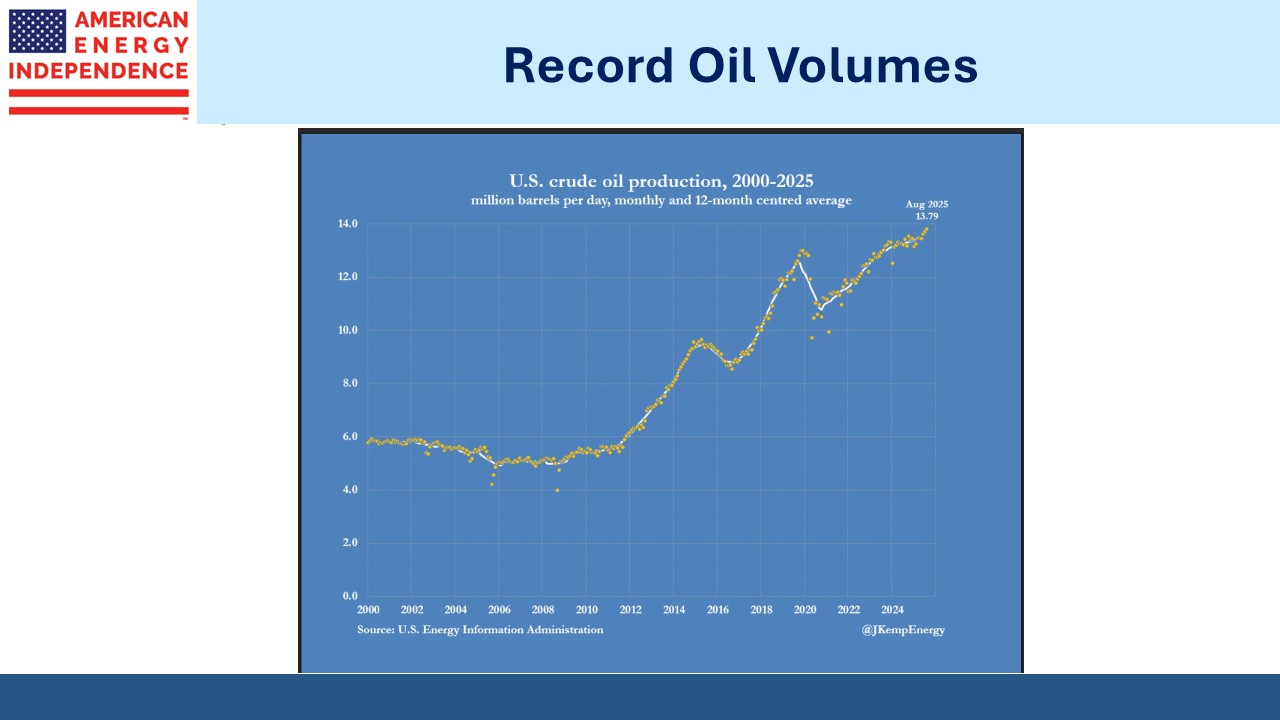

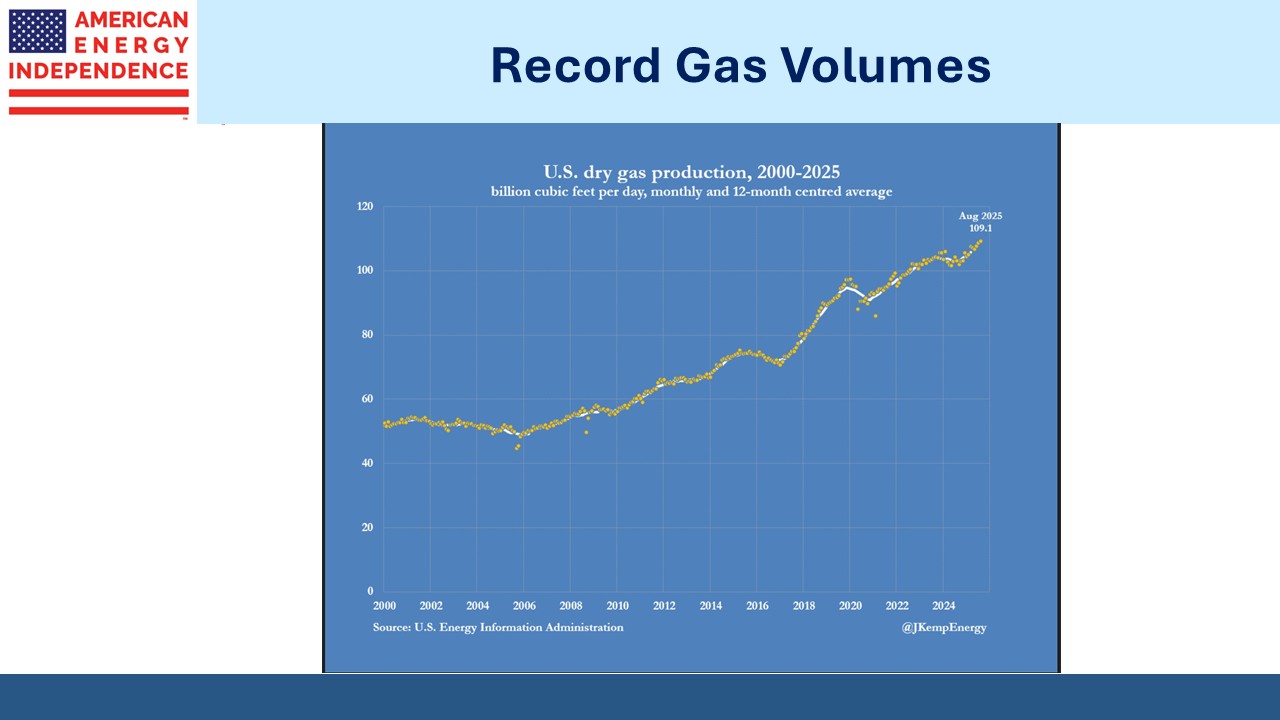

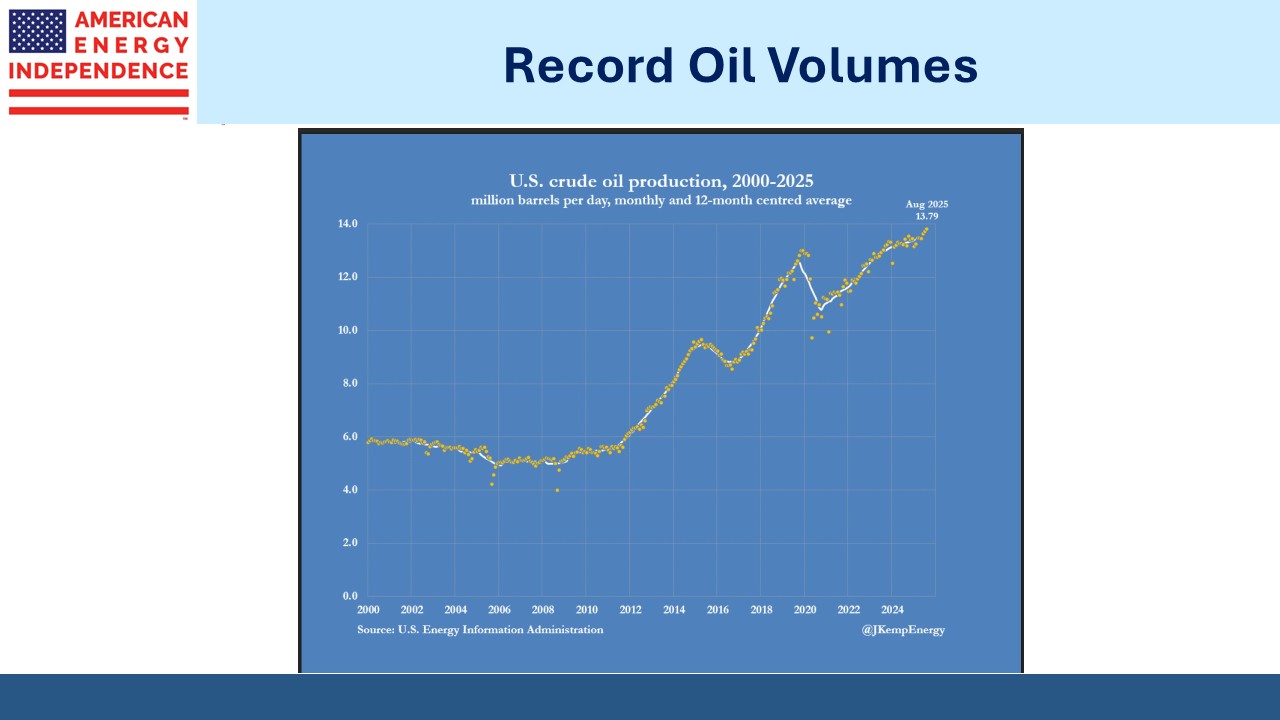

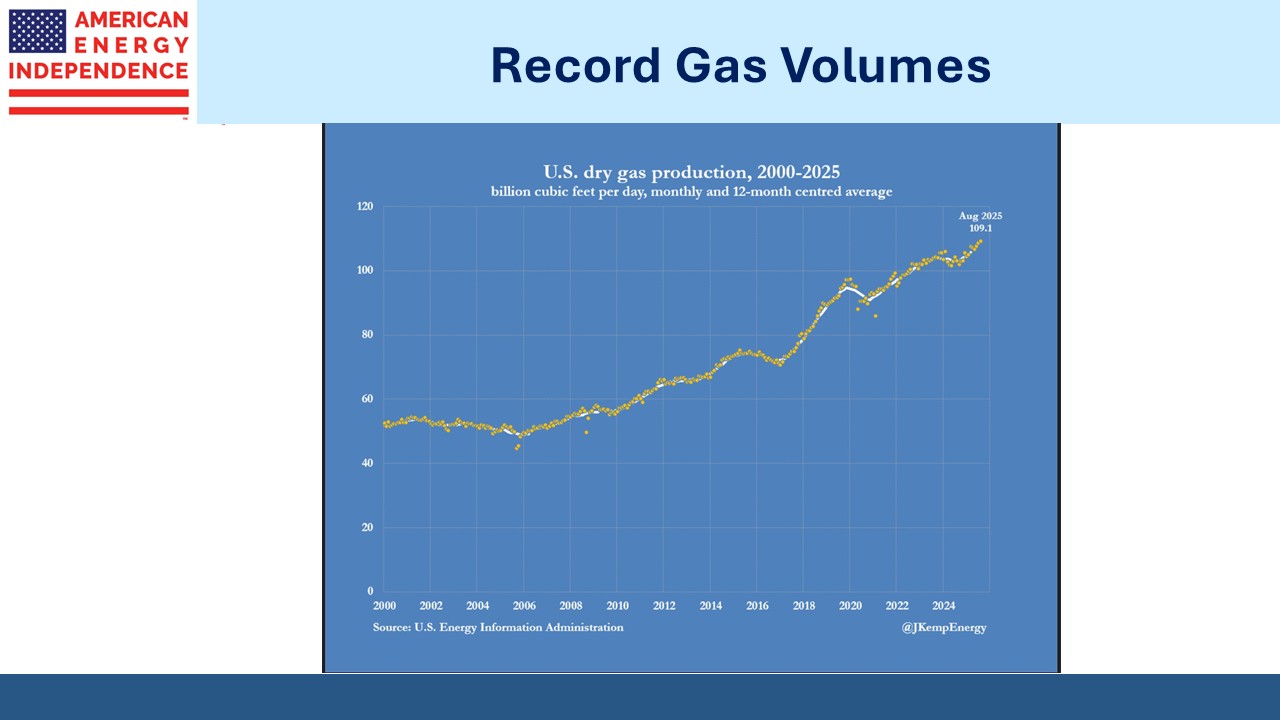

- Oil and gas production reached new records in August, the most recent data available due to the government shutdown. It’s especially hard to reconcile this year’s weakness in pipelines with the volume growth in hydrocarbon output. AI stocks have been exciting, but we find steadily growing cashflows preferable (see Why Lower Oil Prices Will Boost Natural Gas).

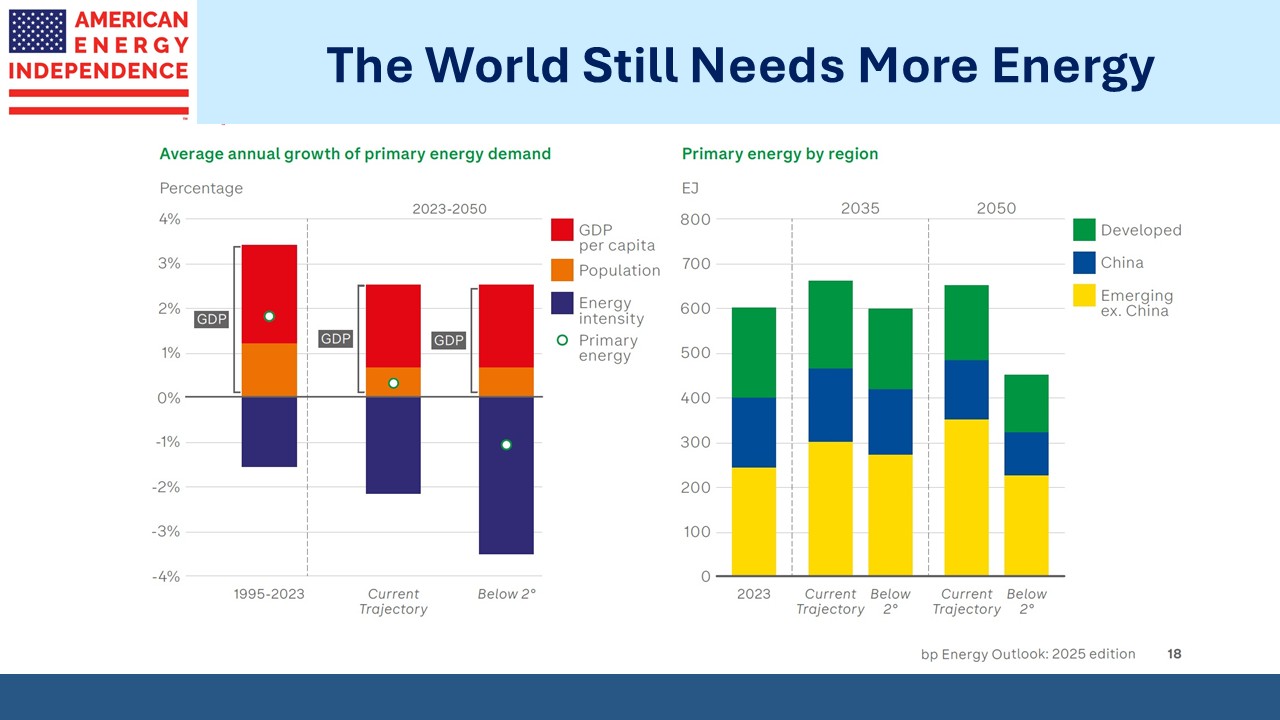

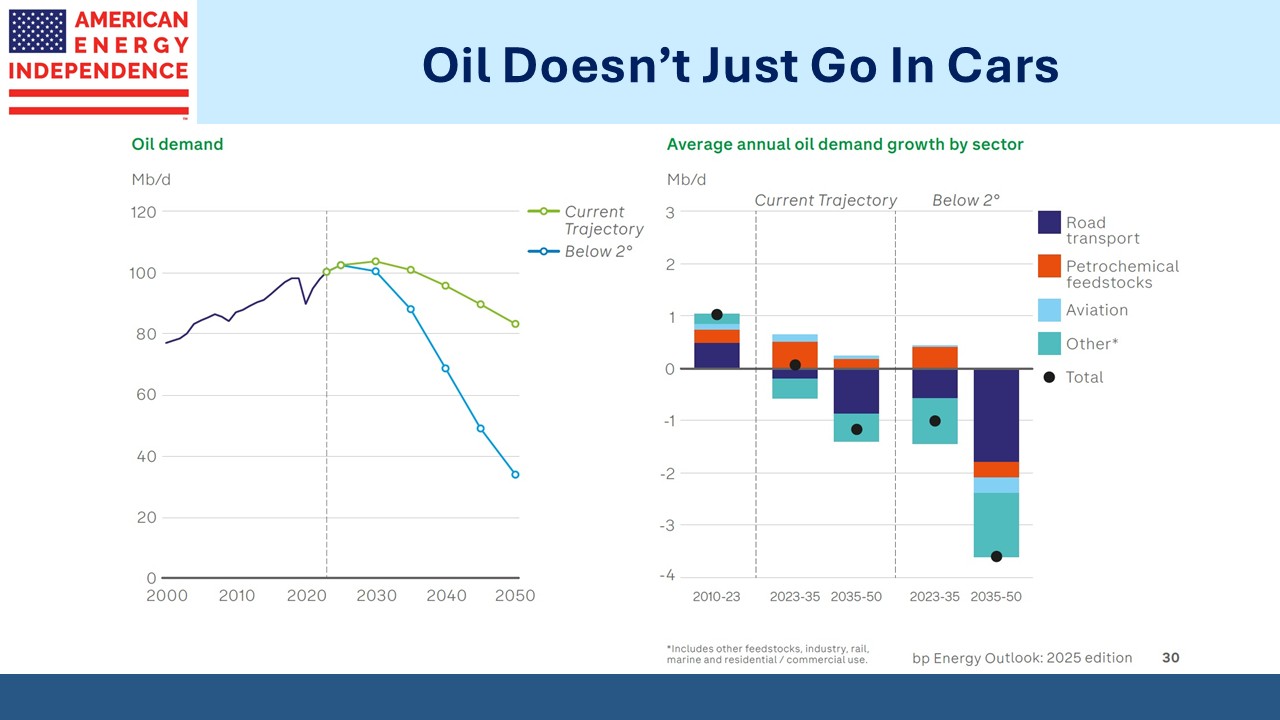

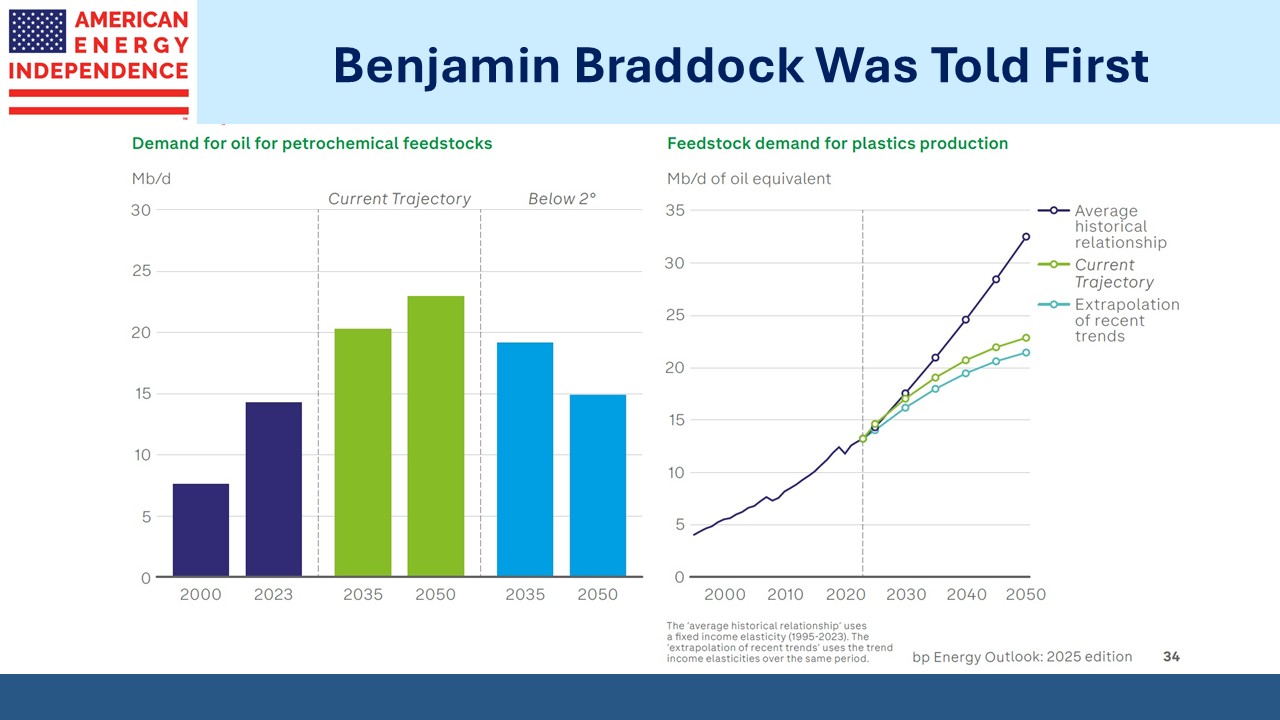

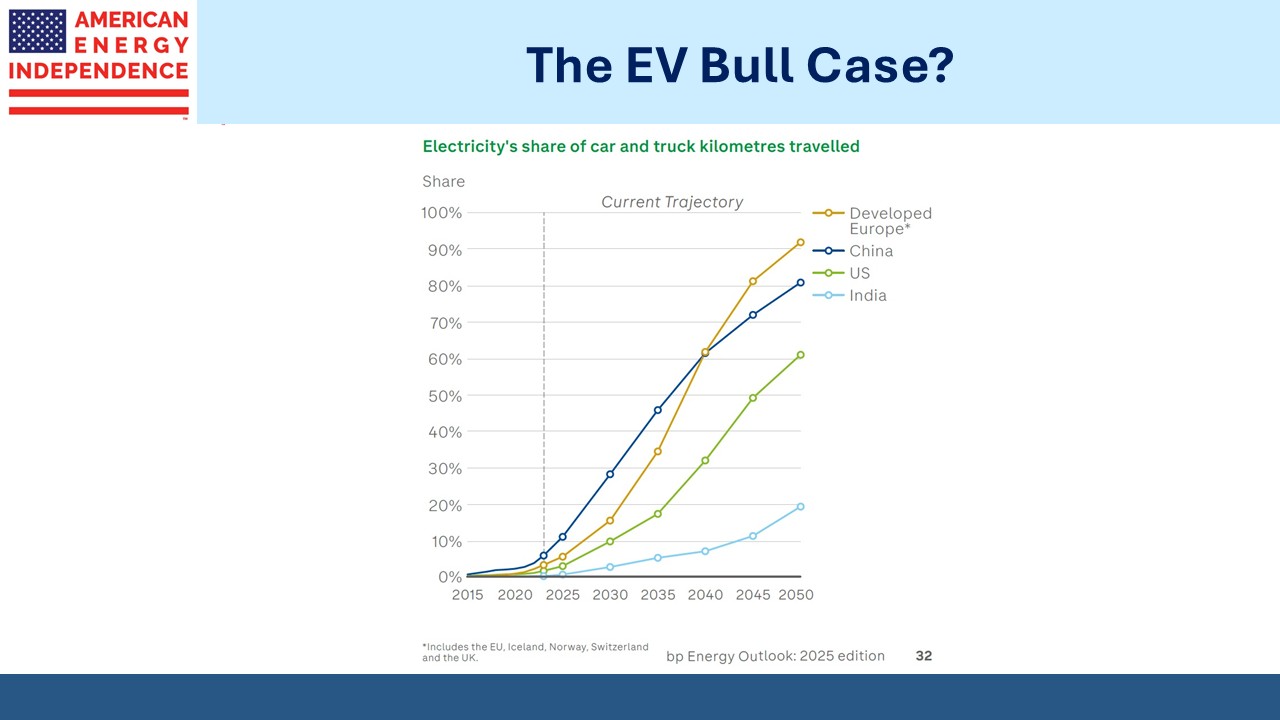

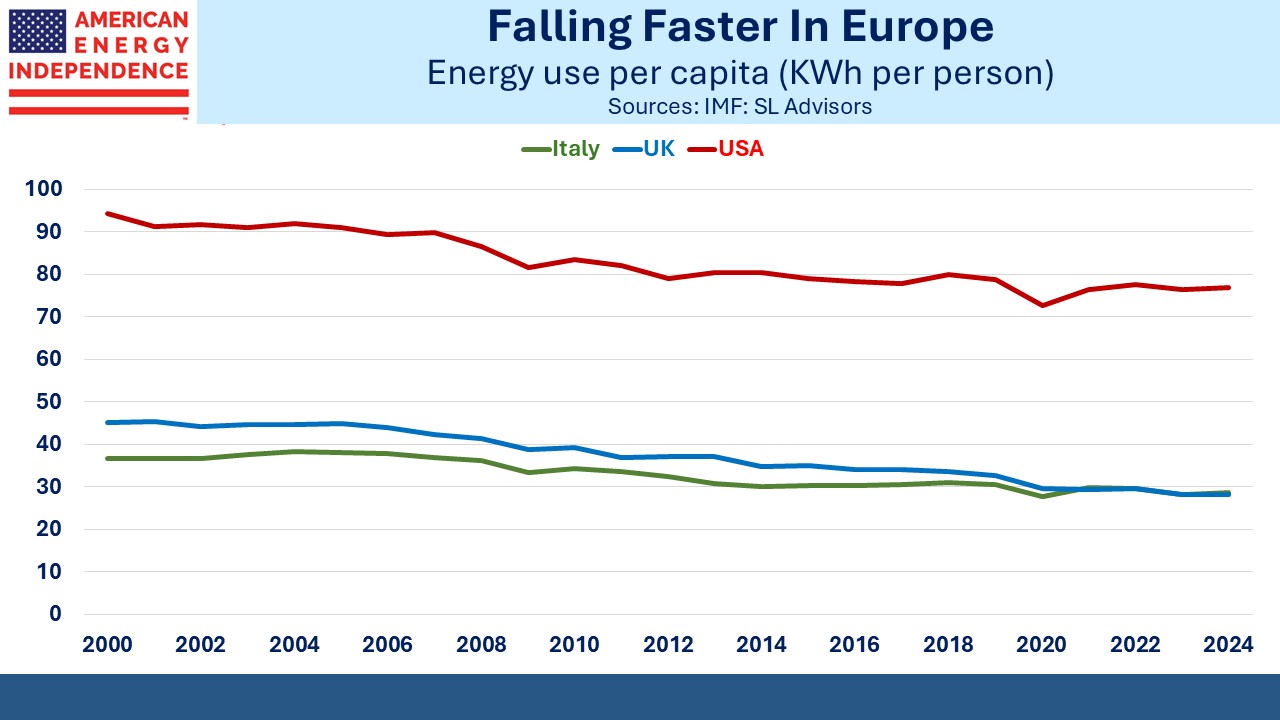

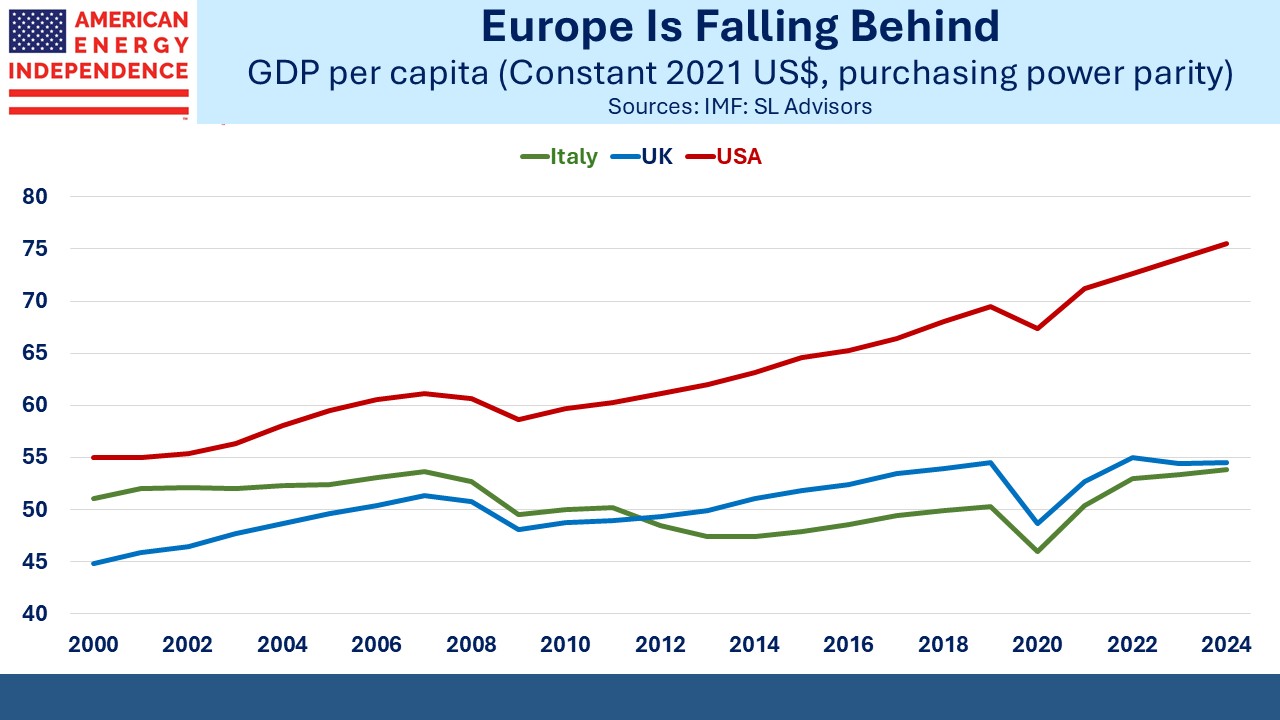

- The International Energy Agency (IEA) recently forecast growing global oil and gas consumption for 25 years, more realistic and positive than prior forecasts. In recent years the IEA became a left-wing cheerleader for renewables. They moved away from objective forecasts, and as a result their work became less useful. Although Executive Director Fatih Biroh claims that their recent more positive outlook doesn’t reflect a change in philosophy, I just don’t believe him. The US quite rightly threatened to pull its funding which is 14% of the IEA’s budget. It helped. (see Drama-Free Energy Stocks).

- It is the White House’s favorite sector — Trump routinely seeks increased US energy exports as a solution to bilateral trade deficits. Energy Secretary Chris Wright was a great choice. Industry satisfaction with the improved regulatory environment is only tempered by the softer oil prices that have followed. Trump’s policies are designed to produce lower gasoline prices. Energy executives are unlikely to vote Democrat, and the higher volumes are clearly good for midstream if less so for E&P companies. (see Midstream Is Better Under Trump 2.0).

We could have added seasonals – for years MLPs have followed a pattern of strong performance early in the year (see The MLP Yuletide Spirit). Pipeline c-corps are less responsive to the calendar, but it remains the case that purchases made late in the year are generally done at better prices than those done in the new year. There are eleven reasons to invest in pipelines today, and probably more.

We have two have funds that seek to profit from this environment: