Reaction to The Alerian Problem

Last week’s blog, The Alerian Problem, drew a bigger than average response. We reposted it on Seeking Alpha where you can see all the comments from readers. More interestingly, it led to a useful dialogue with sell-side analysts and investors.

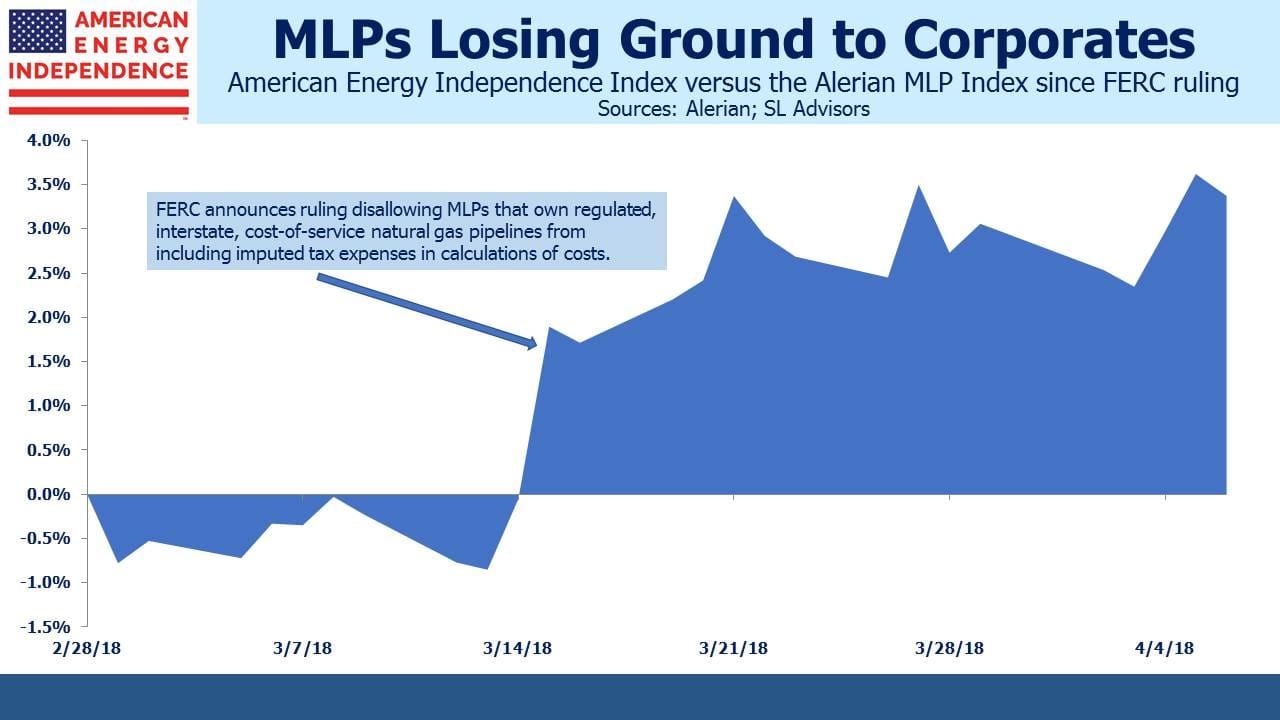

The shift from MLP to corporate ownership of energy infrastructure is becoming widely acknowledged. Since the FERC announcement in early March disallowing MLPs from including imputed tax expense in setting certain tariffs, corporates have handily outperformed MLPs. Although the near-term impact is likely minimal, the ruling will eventually impact some liquids pipelines as well as natural gas. It does seem likely to limit dropdowns of eligible assets from corporate owners to their MLP as well as hasten conversions to corporate ownership.

One analyst we’ve spoken to wrote of, “…strong evidence of the potential catalytic response available to partnerships that could convert…” from MLP to corporate ownership, citing the jump in Viper Energy Partners (VNOM) and Tallgrass (TEGP/TEP) since each abandoned the MLP structure.

The Alerian Problem, which specifically asks what MLP-dedicated mutual funds and ETFs will do as their index shrinks, has no easy answers. Weak relative MLP performance will not help flows which have in any case been flat for such funds, and redemptions will continue to weigh on prices, encouraging additional MLP->Corporate conversions.

MLP funds can continue to hold names that have converted to corporate status, and in conversations with investors we understand some have indicated they may do this. However, since such funds are already burdened with paying corporate taxes (see AMLP’s Tax Bondage), holding tax-paying corporate equities in a tax-paying corporate fund structure is going to strike many investors as absurd.

Therefore, such funds will be left with a choice between picking amongst a shrinking pool of names, or the nuclear option of switching indices since they’d then dump their MLPs. It’s probably best not to be the last tax-burdened MLP fund to make such a switch, nor the last fund investor to redeem from such a prospect.

One investor we spoke to last week found this sufficient reason to exit his remaining tax-burdened MLP funds in favor of a more efficient, RIC-compliant structure. In a sign other investors have already begun doing the same, the Alerian MLP Fund (AMLP) has seen its AUM drop from $10.3BN at year-end to $8.6BN, a 17% drop and substantially worse than its YTD performance of -11.6%.

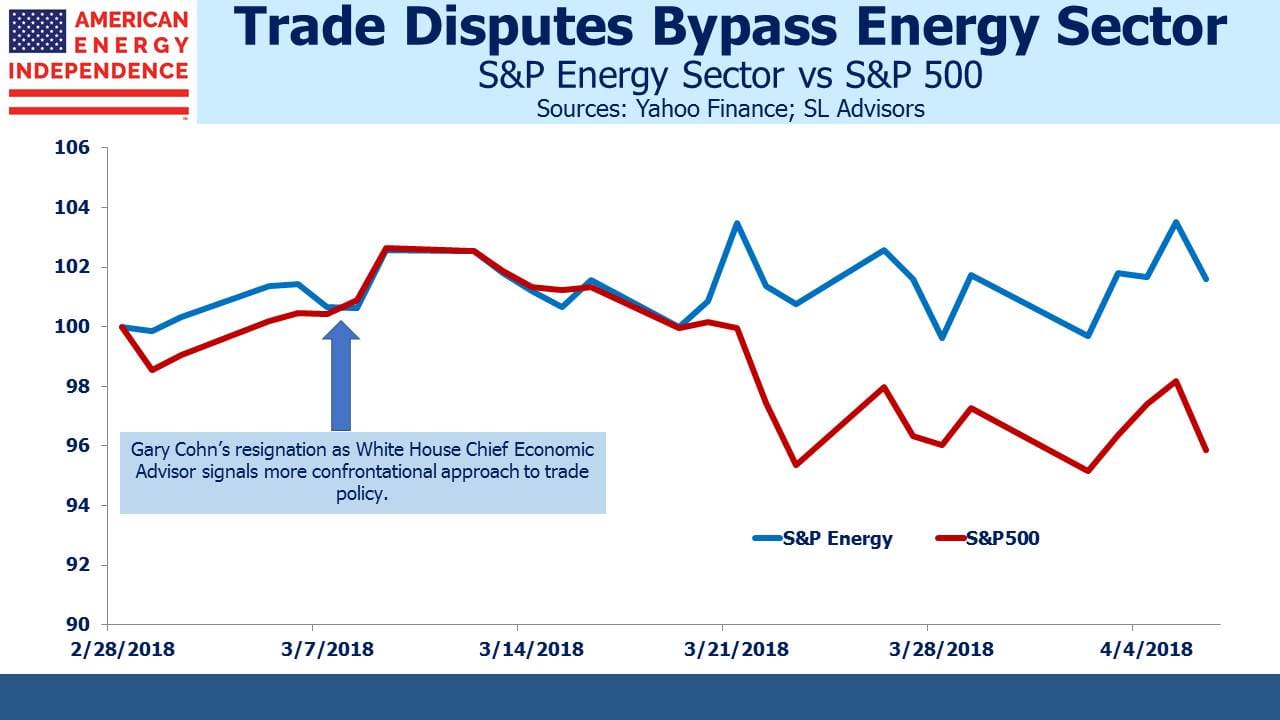

On a positive note, the recent ratcheting up of trade tensions has given investors a reason to own energy stocks. Tariffs on crude oil or Liquified Natural Gas are hard to imagine and probably impractical. Since Gary Cohn’s March 7th resignation signaling a more confrontational approach was ascendant on such issues, the S&P Energy sector has outperformed the broader market by 5%.

We are short AMLP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I invest significant amounts invested in MLPs because of the tax deferral of a large portion of their distributions. A large number of other investors do likewise.There will always remain a need for- and a retail interest in- such vehicles. And conversion into a C corporation penalizes with the heaviest taxation the most loyal of long term MLP investors, who have the lowest adjusted bases in their units. It would be helpful if you continued to support such investors as I, rather than carrying water for the Kinders.

Hi Elliot. I sympathize — I own MLPs too. I’m not defending what’s happening, simply pointing it out. Long-time MLP investors have been badly abused by management teams more focused on growth than honoring their distributions..KMI was the first of many. Wish it hadn’t turned out that way, but it has.