Political and Energy Independence

As we all take a break to celebrate America’s political Independence, it’s worth contemplating how Energy Independence has become attainably within sight over only the past couple of years. In 2015 oil production and energy sector prices were falling as many worried OPEC would bankrupt large swathes of domestic production. In October 2016 the pain of lower prices became too much (see OPEC Blinks). They abandoned their strategy of low prices in favor of production cuts, and altered the future of the U.S. energy sector.

It reminds of past titanic struggles; the 1940 Battle of Britain, when the German Luftwaffe gave up trying to destroy the RAF’s airfields because of persistent aircraft losses. Or even the end of the Cold War when America’s economic might supported military spending beyond the capability of the Soviet Union to keep up, leading to its collapse. Capitalism, technological excellence, relentless productivity improvements and a drive to win are all American strengths that were tested by OPEC and found more than up to the challenge. There may not have been a ticker tape parade down Broadway to mark the victory, but it will turn out to be as consequential for America as some past military exploits. We have much to celebrate, and add the Shale Revolution to that list.

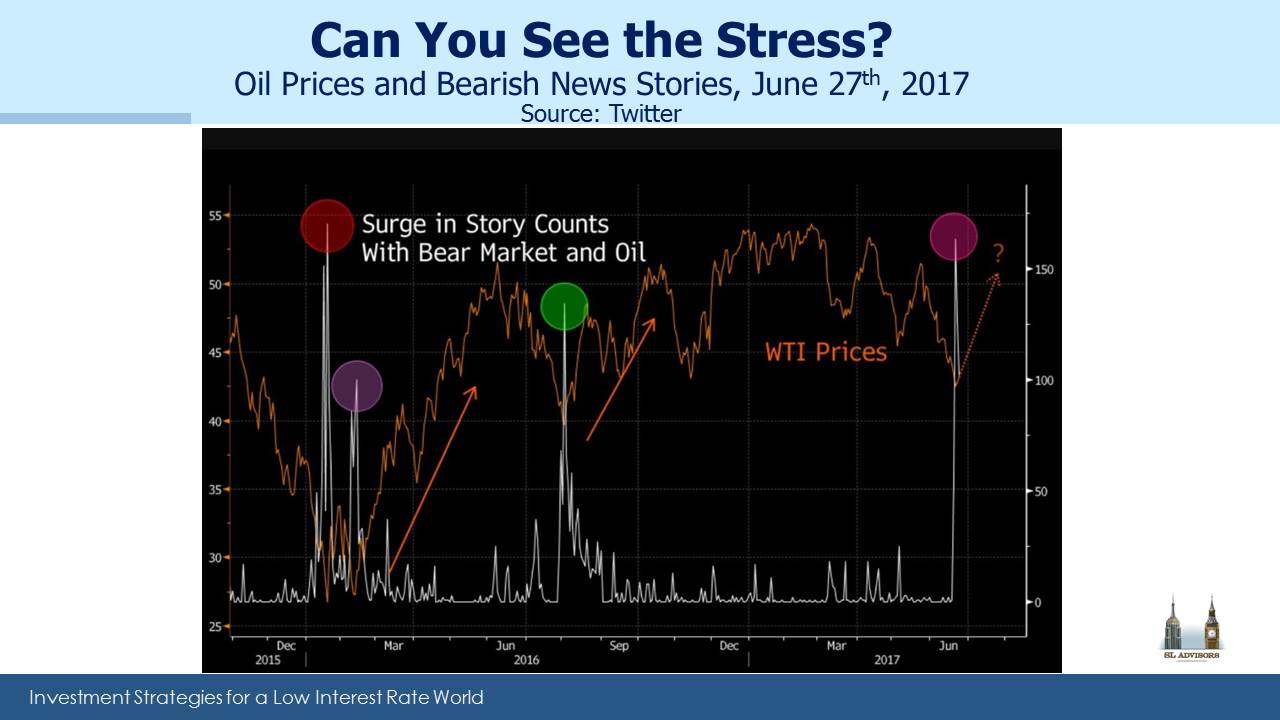

MLPs performed unusually well last week. Our volume of nervous incoming calls peaked with the incidence of bearish crude oil comments in the media. The chart below shows sentiment visually reaching an extreme. No amount of typing by this blogger can shake the solid relationship between crude oil and energy infrastructure. It may be a volume driven, gas-focused industry, but holders of AMLP often think like oil traders which becomes self-fulfilling. Consequently, an over-abundance of bearish stories predictably caused a recovery. MLPs didn’t dissociate from crude, they rebounded with it.

We naturally watch crude movements closely since some client discussions involve tactical thinking, but there were other sources of research and news that were more interesting last week.

John Mauldin’s widely read blog Outside the Box featured an interesting piece on the geopolitical consequence of American energy independence (see Shale Oil: Another Layer of US Power). It includes some startling estimates, such as that the U.S. now has the world’s largest recoverable oil reserves (Rystad Energy), or that 60 percent of all crude reserves that are economically viable at $60 per barrel or less are located in U.S. shale reserves (Wood Mackenzie). Acknowledging the substantial improvements in productivity, the blog notes, “A shale oil driller in the United States, moreover, doesn’t need to be more profitable than Saudi Arabia to drill new wells; the driller just needs to fetch a sufficient return on invested capital. When prices are low, drillers simply forgo exploration and concentrate on the completed wells that produce enough oil to justify their existence.” This last point refers to “short-cycle” projects, which are the essence of shale production. Capital invested is returned within several quarters with output hedged. There’s less focus on Exploration and more on Production.

Saudi Arabia and Russia both require oil prices at least $25 per barrel higher to balance their budgets. It’s unclear how this Math will resolve itself, but it’s likely to highlight America’s strengthening energy position, through higher prices or the benefits of energy security.

Goldman Sachs also produced some thoughtful research. They expect shale production to continue increasing over the next decade before peaking in the late 2020s. They note the benefits of mergers between Exploration and Production (E&P) companies with adjacent fields as such combinations allow for longer laterals that straddle previous separately owned acreage. EQT’s recent acquisition of Rice Energy is an example. There is increasing use of Machine Learning and Artificial Intelligence to optimize drilling techniques. Many private companies unheard of outside the energy industry provide vital services relying on new technology. Biota, a biotechnology start-up founded in 2013, applies DNA sequencing to microbes in the earth’s subsurface. The analysis helps identify sweet spots for drilling. Welldog supplies a fiber optic down-hole monitoring system. Spitfire provides software tools for faster data analysis. EOG has been collecting real time data on every rig and well they control so as to make it available to decision makers in the field. Public policy is solidly behind Energy Independence. On Thursday, the President said, “The golden era of American energy is now underway.”

These are some of the reasons that in Shale, America is the only game in town.

Enjoy Independence Day weekend.