Drama-Free Energy Stocks

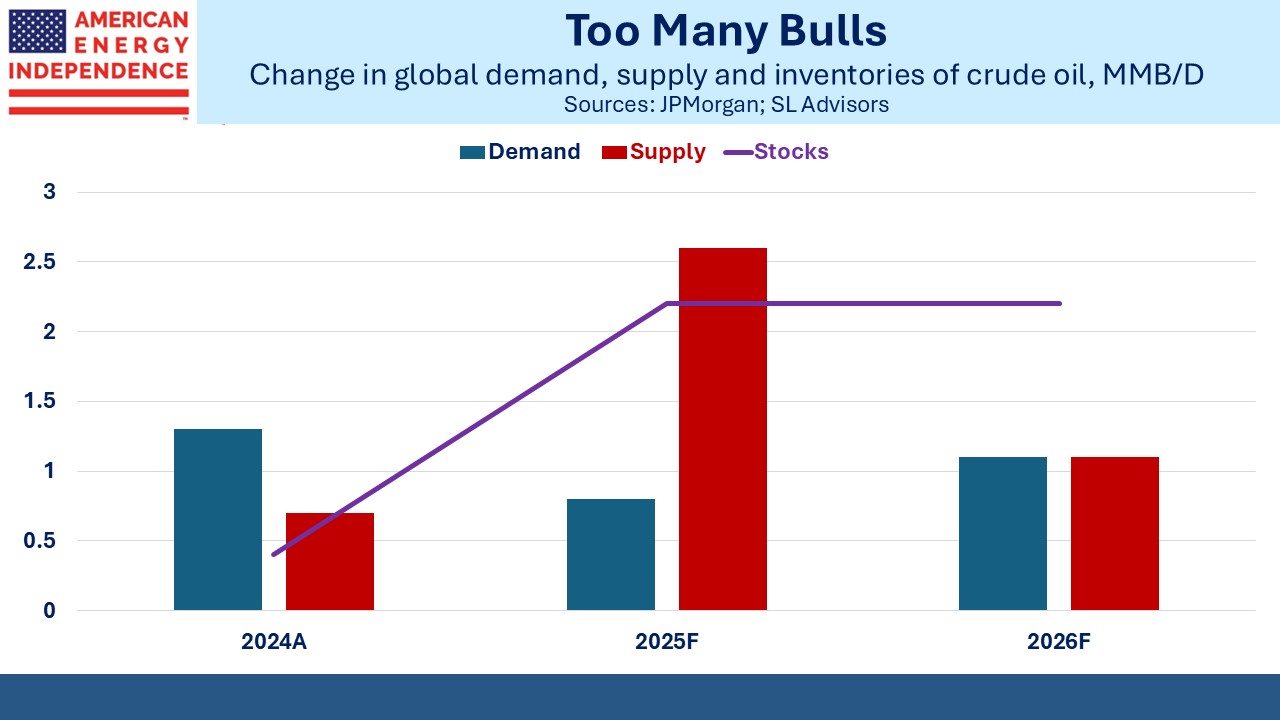

Supplies of crude oil were already set to increase by 2.6 Million Barrels per day (MMB/D) year-on-year before the OPEC+ announcement on Monday. Demand is growing in emerging economies across Asia, Africa and South America, but not fast enough. This has led to forecasts of stocks increasing by 2 MMB/D this year.

Last year we noted that the International Energy Agency (IEA) was consistently promoting a politically motivated outlook for global energy based on strong growth in renewables (see Serious Energy Forecasts Are Rare). They expect an 8 MMB/D imbalance between supply and demand in 2030.

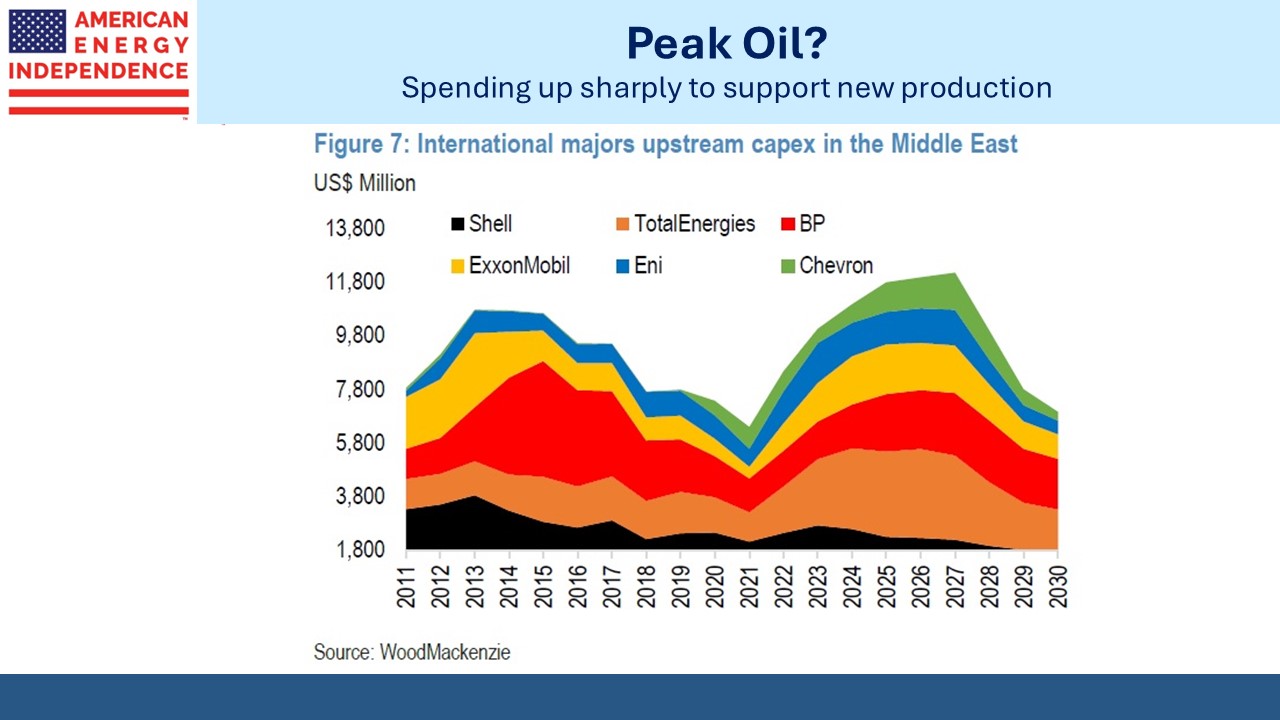

Meanwhile the world’s producers of oil expect the opposite and have been increasing output. Spending by international majors on upstream capex in the Middle East this year is likely to be double the low hit during the pandemic, led by TotalEnergies and Exxon. The UAE will add 0.4 MMB/D of capacity over the next couple of years and Iraq 0.3 MMB/D.

North American output is also increasing, with US production forecast to rise around 0.3 MMB/D and Canada by 0.2 MMB/D. However, the enthusiasm with which energy executives received Trump’s win in November is moderating with lower prices, and forecasts of US output will likely be trimmed. In a sign E&P companies are becoming more cautious about capital allocation, Chevron cut 2Q25 stock buybacks by around a third versus the previous quarter. Shale operator Diamondback Energy just cut their output forecast.

Drill baby, drill isn’t resonating. Lower prices are needed to bring the market back into balance, and this will further stimulate demand.

The contrast between the oil and gas business is striking. Because crude oil is a global market, its price reflects energy sentiment around the world. Oil is relatively easy to transport and the cost of doing so is a small percentage of the value of the commodity.

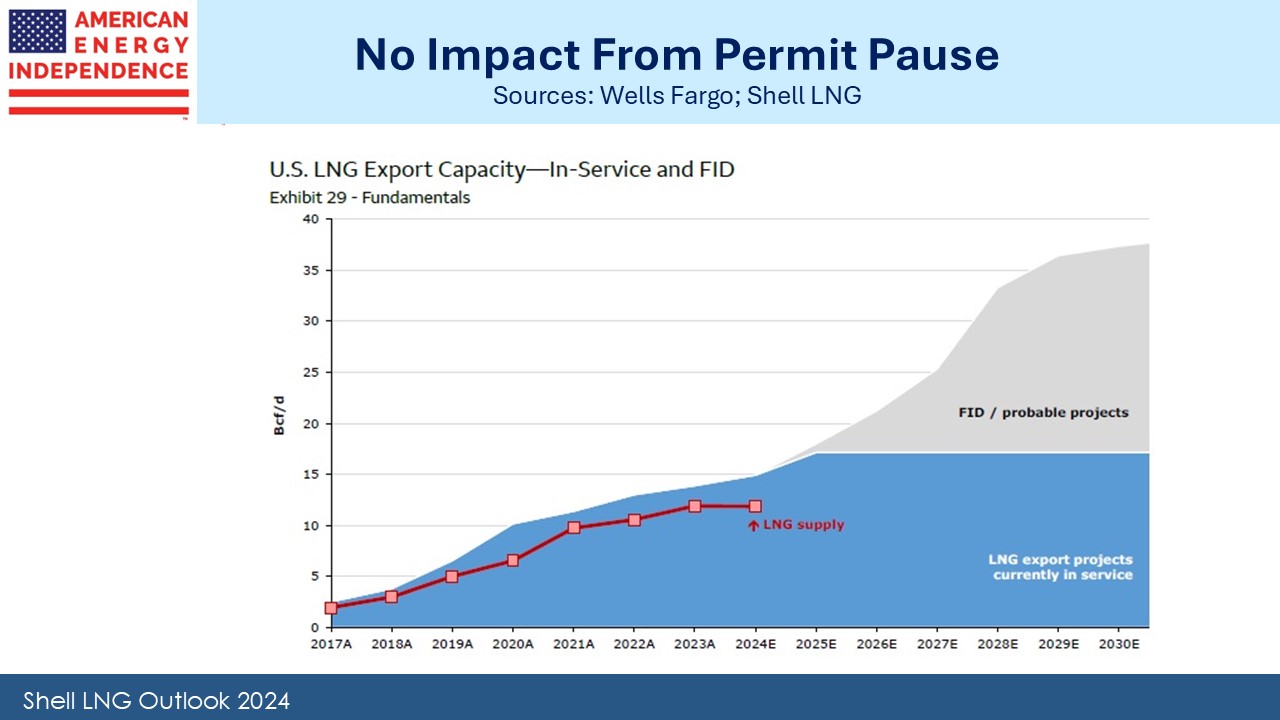

Natural gas moves through pipelines or on an LNG tanker if going overseas. The combined cost of liquefaction and transport can exceed the cost of the gas, which is why it’s around $4 per Million BTUs (MMBTUs) in the US and $11 in Europe. That gas can be shipped to Europe for much less than the $7 difference is driving the sharp rise in US LNG export capacity.

Natural gas trades as regional markets because it’s so difficult to transport. Its price moves rarely reflect any change in sentiment by energy investors. At times crude oil and pipeline stocks have been correlated, although declining company leverage has weakened the relationship. Last year was a good example, with oil down and midstream up strongly. Gas prices rarely share any relationship with pipelines

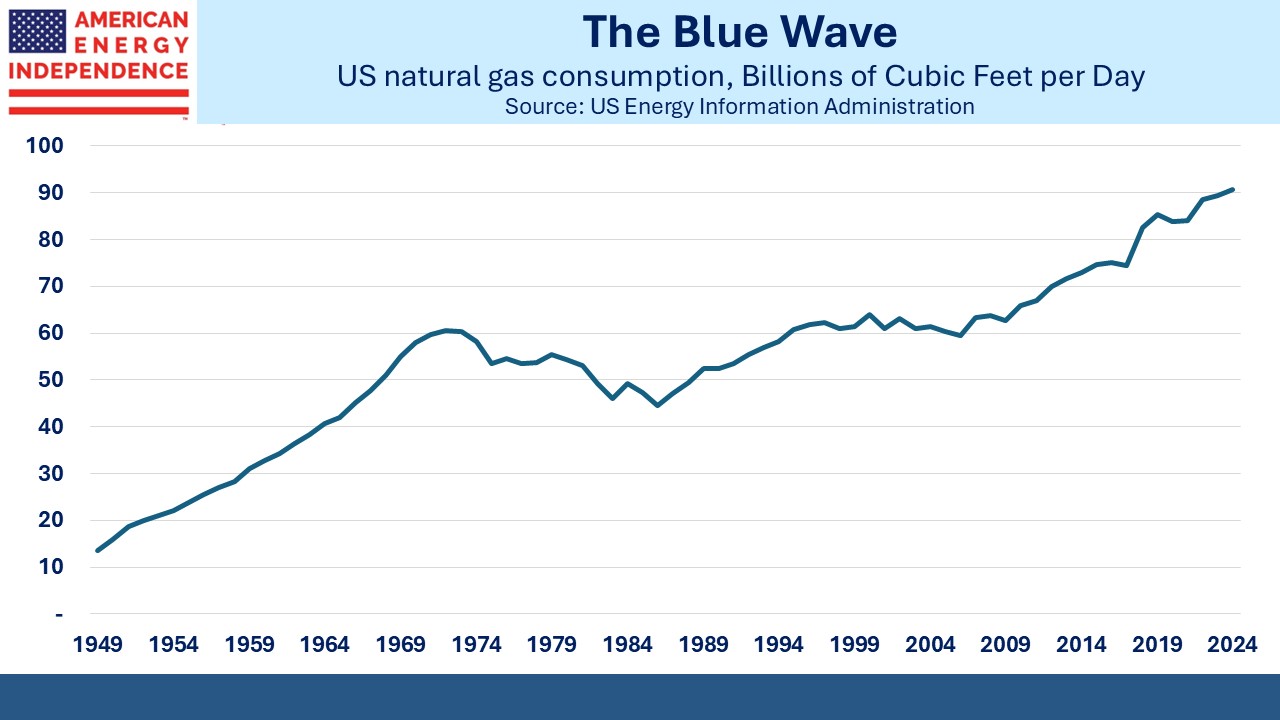

Natural gas feedstock to LNG terminals is running at 15 Billion Cubic Feet per Day (BCF/D), up from 12.5 BCF/D last year. By 2030 exports will have doubled from 2024.

Australian LNG giant Woodside Energy bought Tellurian last year as it was teetering towards bankruptcy, or “circling the drain” as RBN Energy puts it. Tellurian’s fatal error was to favor contracts that retained price risk. This reflected then-CEO Charif Souki’s long term bullish view on gas prices but impeded financing because of their increased risk profile.

Woodside just announced Final Investment Decision (FID) on the LNG Louisiana terminal, formerly called Driftwood when it was Tellurian’s chief asset. Ironically, they’ve moved ahead with only 1 Million Tons Per Annum (MTPA) of capacity contracted out, from a total of 16.5 MTPA. This is rare because LNG terminals are only good for one thing, so most operators ensure they’ll have enough long-term customers before starting construction.

Woodside believes they’ll negotiate better terms by assuring buyers the LNG really will be delivered. It’s a choice that was never available to Tellurian, whose failure to raise capital and reach FID meant some contracts were later voided. Woodside is a much bigger company but nonetheless S&P changed their credit outlook from stable to negative on the news. They may also calculate that competing projects that have not yet reached FID may now face increased hurdles to line up financing.

The news does assure that gas flows to the Gulf will continue higher.

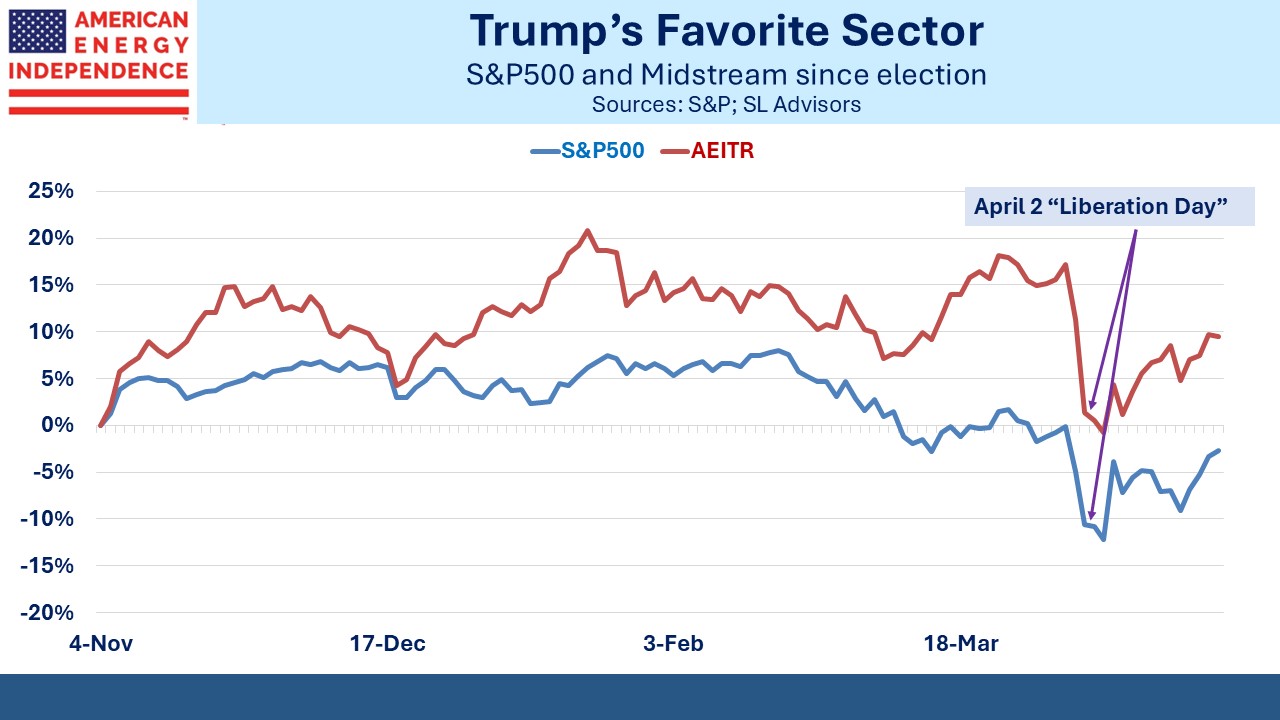

Tariff uncertainty has caused many companies to suspend earnings guidance for the year, most recently Ford who estimate a $2.5BN impact. Contrast this with Williams Companies, gliding through the market turmoil with equanimity. Much of the gas feeding Gulf coast LNG terminals will pass through their pipeline network. They raised full year guidance by $50MM to $7.7BN.

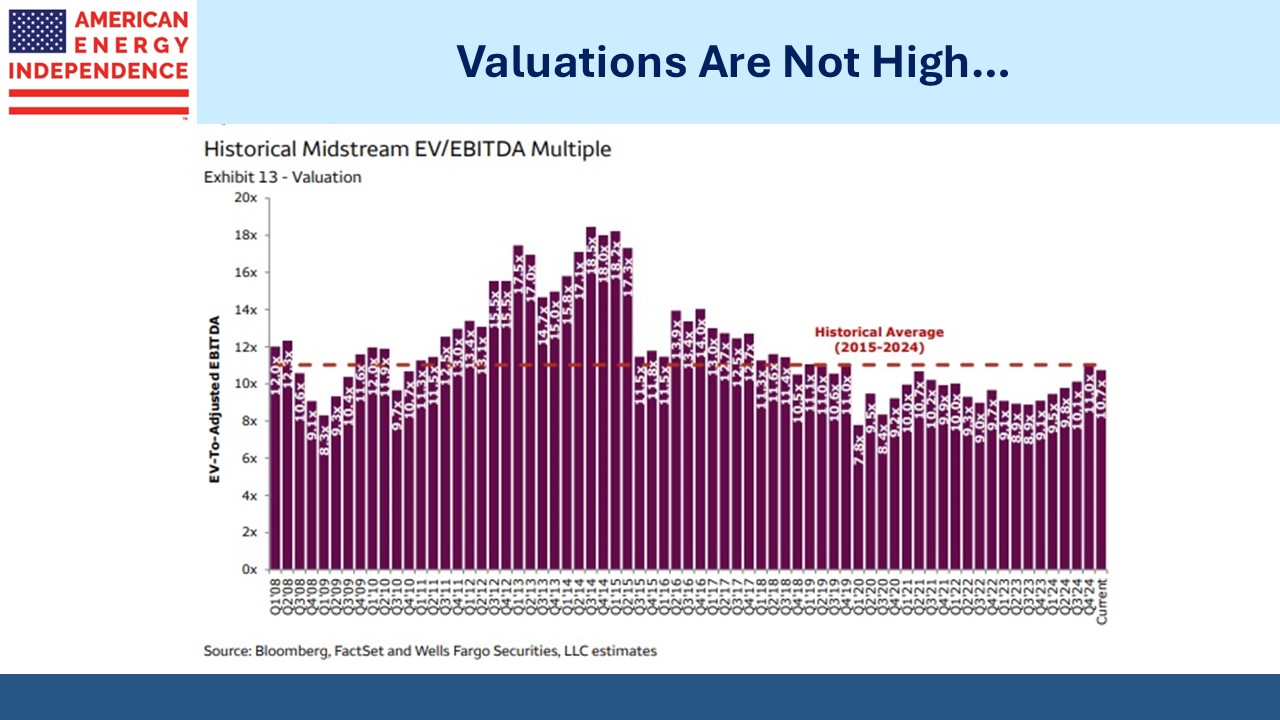

The energy sector is diverse. Gyrations in crude prices and fears of slower growth are impacting the big integrated oil companies. But the outlook for domestic gas infrastructure remains positive with no visible impact from the macro issues driving equity markets. It’s free of drama from oil prices or tariffs, the calm port in the storm.

We have two have funds that seek to profit from this environment: