Pipelines Moving Up and Left: More Return With Less Risk

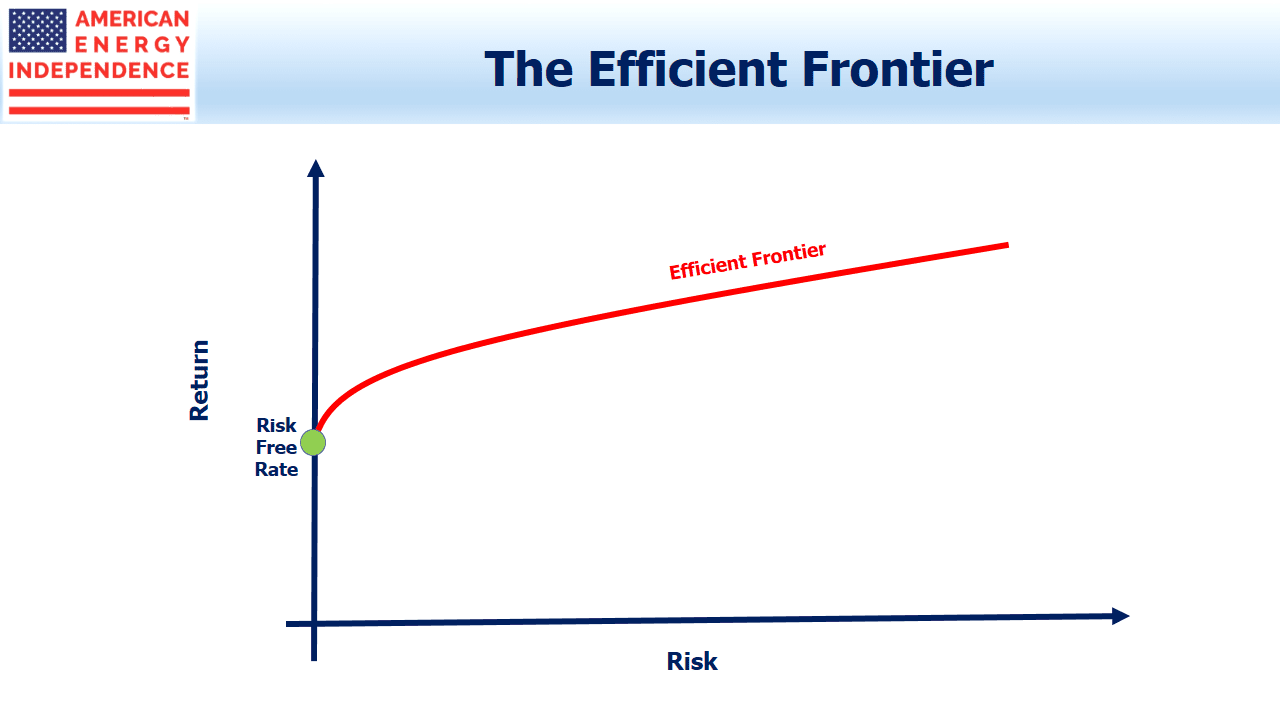

The Capital Asset Pricing Model (CAPM) is a widely accepted theoretical framework for valuing securities. An important feature is the Efficient Frontier. This reflects the concept that, although there’s an almost infinite number of portfolios that an investor can hold (think of all the individual stocks and bonds out there), a small number of these portfolios offer a combination of return and risk that’s better than most.

For example, if two portfolios had the same risk, the one with the higher return would be preferable. We can always figure out with hindsight what was the efficient portfolio — identifying the right one going forward is more difficult.

CAPM is a useful theoretical framework but has its shortcomings. One of the biggest is the idea that more risky investments deliver a higher return. It seems intuitively self-evident, but there’s plenty of research to show it’s not true. Beta, a measure of how risky a stock is compared to the market (which has a Beta of 1.0), suggests that high beta stocks (Beta > 1.0) should deliver higher returns than the market. Otherwise, investors wouldn’t own high beta stocks because they wouldn’t be getting sufficiently compensated for the increased risk.

The real world often fails to conform to neat algebraic solutions, and it turns out that low beta stocks do better. They don’t move as much and offer less excitement. Low Beta stocks receive less coverage on CNBC, since traders want movement. But they are Aesop’s tortoise, reaching the finish line ahead of their more energetic competition.

This weakness in CAPM is called the Low Beta Anomaly, and for those interested in learning more you can read Why the Tortoise Beats the Hare.

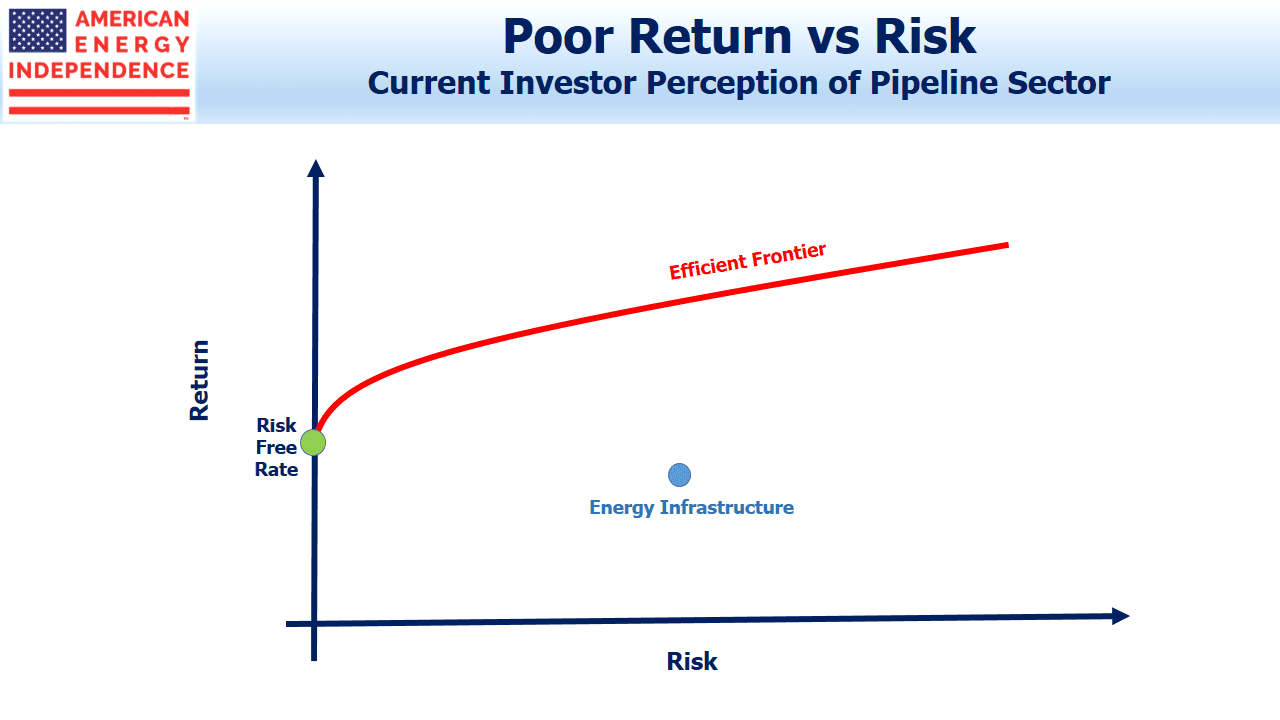

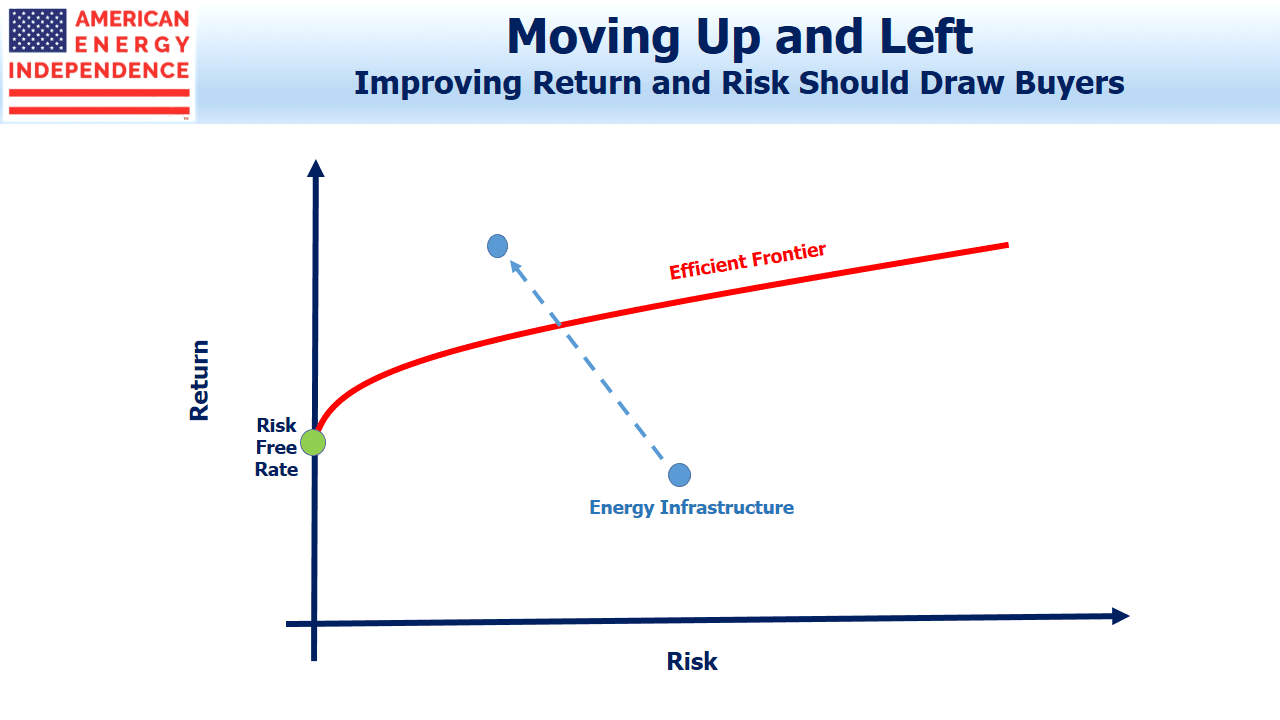

Returning to the Efficient Frontier, although we can’t be certain what investments provide the most CAPM efficiency, we can make informed assumptions about whether they’re becoming more or less attractive within this framework. Investors complain about heightened volatility in midstream, and likely assume more of the same in assessing the sector. For many, Energy infrastructure sits well within the Efficient Frontier boundary, making it unattractive.

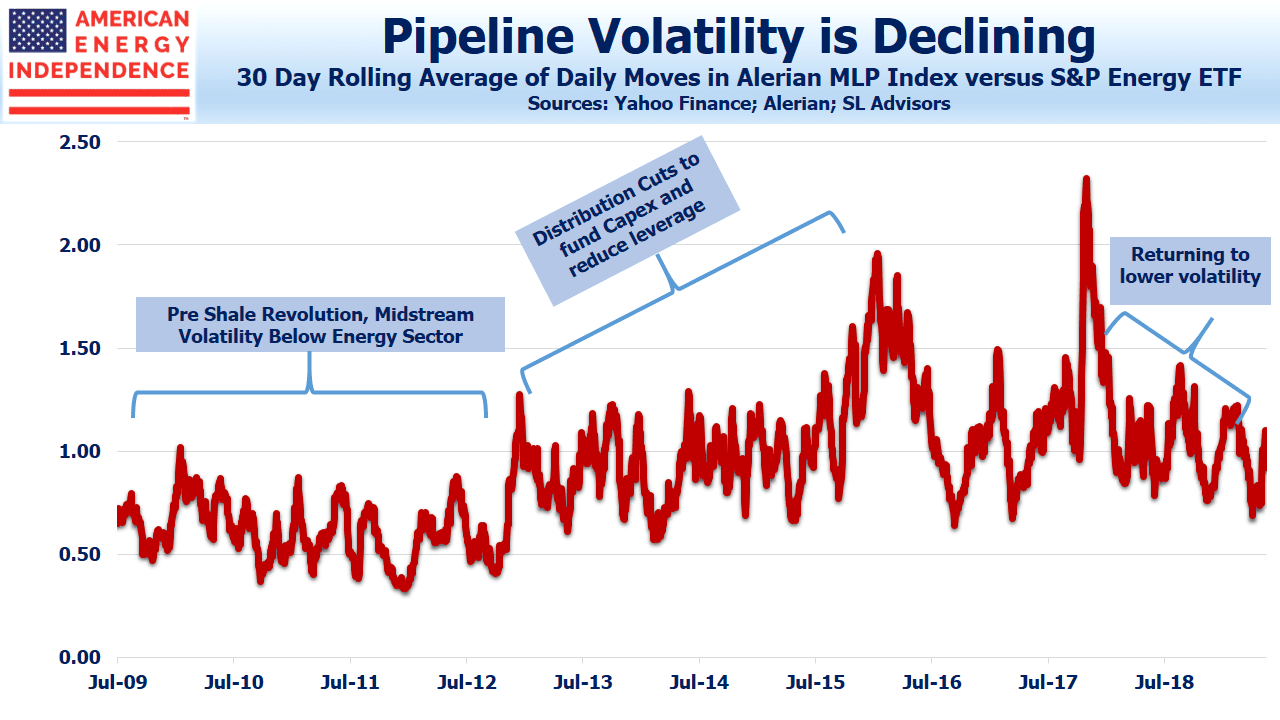

But Energy Infrastructure, as we wrote last week (see Pipeline Stocks Get That Warm Feeling Again), is becoming less volatile, especially when compared with broad energy as represented by the S&P Energy ETF (XLE). On the Efficient Frontier chart, this is moving it to the left, meaning it’s becoming less risky.

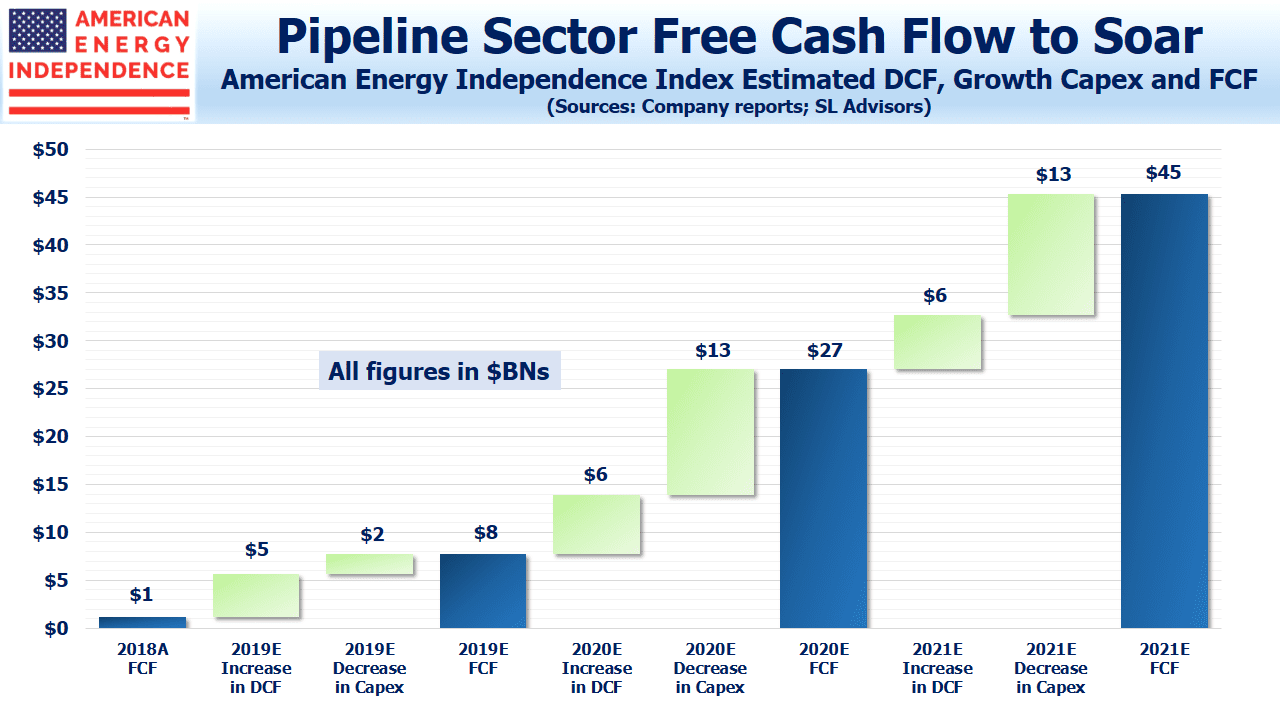

Returns are also improving, as defined by Free Cash Flow (FCF) generation. We wrote about this a few weeks ago (see The Coming Pipeline Cash Gusher). The members of the broad-based American Energy Independence Index generated just $1BN in FCF last year, which is an inconsequential return on around $540BN in market cap. However, a combination of lower spending on new projects (lower growth capex) plus improving cash flow from existing assets (higher Distributable Cash Flow, DCF) is set to boost sector FCF significantly over the next three years. By 2021 the $45BN in FCF we estimate would produce a FCF yield of over 8%, higher than the S&P500.

Making volatility forecasts is an imprecise task, and most investors will be satisfied with using historical data. This shows decreasing volatility, or risk. But it’s certainly possible to make return forecasts and they don’t need to have any relationship with recent history. Rising FCF should persuade investors that their return assumption for the sector can be revised up.

In the context of CAPM, higher return with less risk mean that the sector is shifting up and to the left, making it more attractive. The Efficient Frontier is a theoretical concept, and investments selected from along that line can all be judged efficient, with the different combination of return and risk reflecting investor preference.

As this virtuous combination of rising return with falling volatility becomes apparent, we think some investors will conclude that midstream energy infrastructure lies beyond the Efficient Frontier. This should attract inflows from investors who use this type of framework to assess opportunities.

When CAPM provides a buy signal, the much-sought generalist investor will have finally turned to pipelines. Over the next couple of years, the sector should benefit from this development.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I assume that when you refer to pipelines, you are including the entire panoply of midstream assets, (including gathering and processing, treating, fractionation, compression and other midstream assets) utilized in combination with pipelines and not just the pipes themselves.

Yes Elliot, pipelines as shorthand for midstream energy infrastructure.

Simon, Noticed that Plains GP was a holding. Why in the GP a better choice than the LP?

They trade pretty much together, but the GP gives a 1099 and distributions are ROC.