Pipeline Earnings Confirm Positive Trends

Energy remains probably the least loved of the S&P500’s 11 sectors. Over-investing in new projects has turned off many investors, who would like to see more cash returned via buybacks and dividends. And the Democratic primary debates remind that an anti-fossil fuel stance is needed to excite the party’s hard core, introducing some electoral uncertainty to the outlook.

The good news is that cash flows are growing, as pipeline companies are responding positively to investor feedback (see The Coming Pipeline Cash Gusher). And the aspirational goals of some Democrats to phase out oil and gas will collide with technical realities and popular reluctance to return to 18th century living standards.

Earnings season is generally confirming the positive free cash flow story we’ve articulated for midstream energy infrastructure (see The Coming Pipeline Cash Gusher). Enterprise Products Partners (EPD) continues to execute well, beating EBITDA expectations by around 10% with 18% year-on-year growth. Williams Companies (WMB) modestly exceeded expectations and provided good guidance, boosting the stock. This highlights that weak natural gas prices, which had kept the stock under pressure for a couple of weeks, have little impact on operating performance.

TC Energy (TRP, formerly known as Transcanada) reported another solid quarter. And Oneok (OKE) reported Distributable Cash Flow (DCF, the cash generated from existing assets after maintenance expense), of $541MM, $100MM ahead of expectations. Only Western Gas (WES) bucked the trend, with poorly-timed lower guidance just when Occidental (OXY) is considering selling their position following the acquisition of Anadarko (ADC).

Midstream energy infrastructure has undergone a transformation in recent years. Predictable and rising distributions were abandoned when the Shale Revolution required new pipelines. Income seeking investors felt betrayed, and many big MLPs converted to corporations so as to access a far broader set of investors (see It’s the Distributions, Stupid). Today, MLP-dedicated investors are missing two thirds of the sector including most of the big companies.

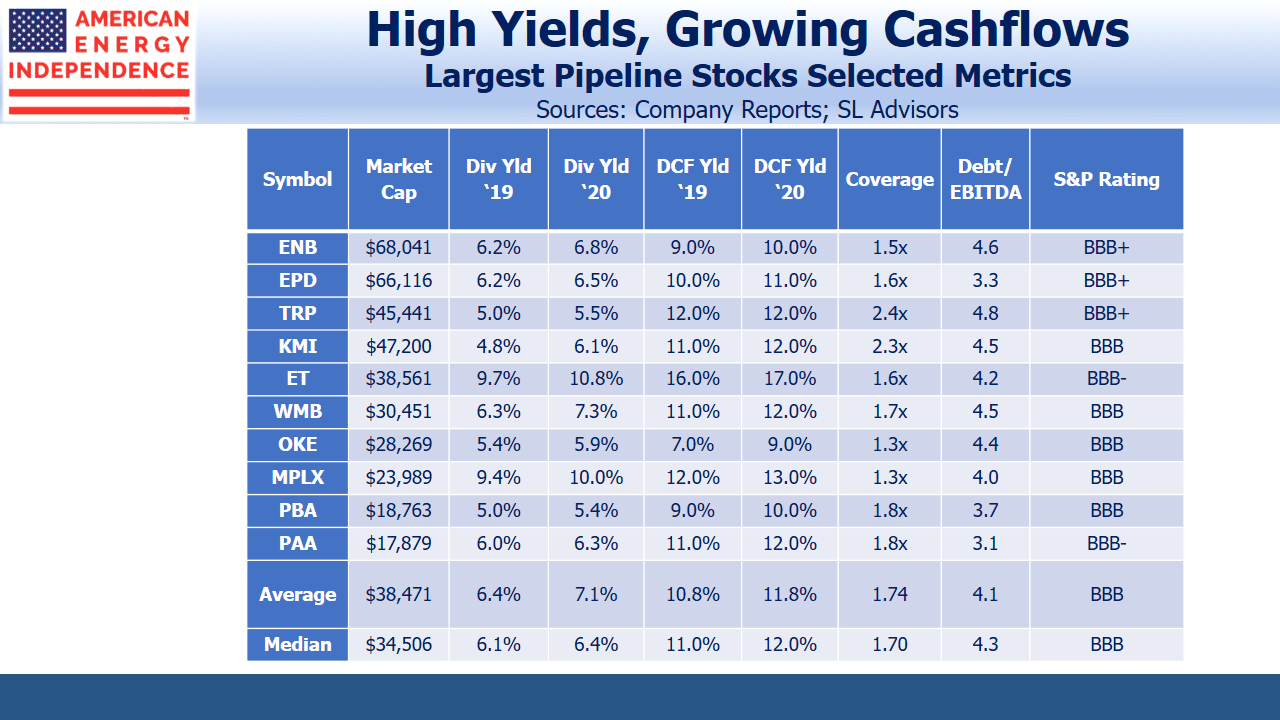

The ten biggest companies comprise the bulk of the industry. Dividends average 6.4%, comfortably covered by 10.8% DCF, which is growing at 9%. Leverage is down, at 4.1X Debt:EBITDA, and all are investment grade. Yields on their bonds are typically less than half their dividend yields, revealing that banks and rating agencies, with their access to proprietary information are far more optimistic than equity investors.

The positives include:

- Capex on new projects, which continues to fall from last year’s peak

- Improved governance for those MLPs that have converted to a corporate structure. This makes them more attractive to institutional buyers.

- Stronger balance sheets, especially compared to more levered sectors such as REITs and utilities where over 5X Debt:EBITDA is common

- Low borrowing costs

- Interest from private equity, whose managers see better value in public markets. IFM’s acquisition of Buckeye Partners for a 27.5% premium earlier this year was an example

- Free Cash Flow growth which is on course to leap from $1BN last year to $45BN by 2021, based on our analysis of the companies in the broadly-based American Energy Independence Index.

2Q19 earnings reports are so far confirming all the positives noted above. Midstream is out of favor, cheap and poised to rise.

We are invested in EPD, OKE, TRP, and WMB

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!