Muni Bonds Suggest No Recession

/

Many readers enjoyed the recent blog posts on Bad Investment Ideas. Our criticism of ESG was especially popular, with many assessing it as a meaningless investment fad. ESG isn’t inherently bad – who doesn’t want better “G” (Governance) at their portfolio companies? But if every company can find someone to rate them highly on ESG, it’s clearly not a very demanding metric.

We did receive some pushback on bonds, especially the comment that the entire asset class was not fit for purpose and should be abandoned. One investor noted that he’s finding value in two year treasury notes yielding 3.3%. Bob Radli from Palm Beach Gardens, FL, a long-time investor, said we were overlooking the benefits in holding long term municipal bonds with yields over 4%. He pointed out that bonds offer important stability, especially as investors approach retirement.

It’s true that this year’s bear market in bonds has improved their value even if they haven’t provided much diversification to date. Holding 100% equities is only appropriate for a narrow set of long term investors, and while we think government bonds continue to provide poor value, cash yields have been edging up as the Fed normalizes monetary policy.

We’ve noted in the past that a barbell of stocks and cash can be used to create an income generating portfolio with low risk (see The Continued Sorry Math Of Bonds). Assuming S&P500 dividends grow at 4%, as little as a fifth of a portfolio in stocks with the rest held in cash match the after-tax return of a ten-year bond yielding 3%*. A 20% drop in stocks would reduce the barbell portfolio by 4%. The ten year bond would fall in value by that amount with around a 0.50% rise in yields.

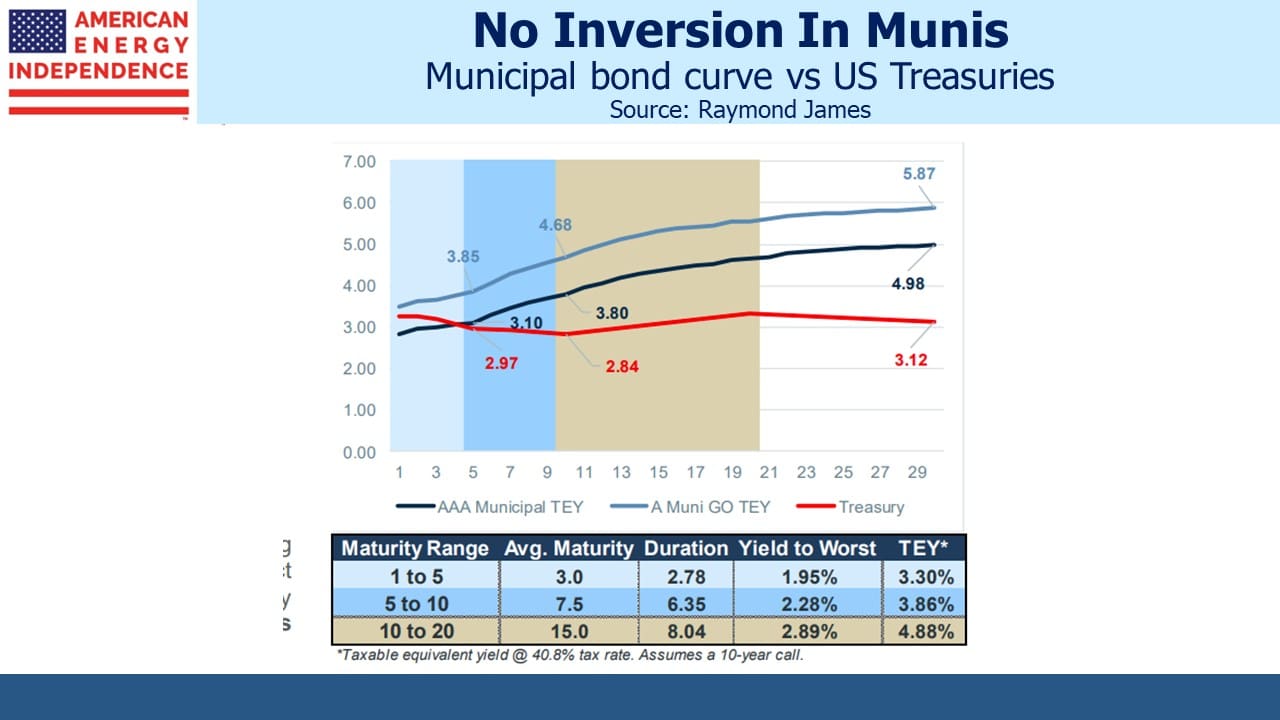

I suggested to Bob that one year munis might be safer because they’re more “cash-like” and if the Fed has to tighten more than expected the investor benefits from rolling over into higher yields. Interestingly though, unlike the treasury yield curve, the municipal bond yield curve is positively sloped. There is a penalty in the form of lower yields for choosing shorter maturities.

Municipal bond investors will not be surprised at this, but for decades muni yields were lower than treasuries because of their tax-advantaged status. Index-type data on munis is hard to find, but digging into the archives of the Federal Reserve of St. Louis it’s clear that treasury yields dipped below municipal bonds during the 2008 Great Financial Crisis (GFC) and have stayed there ever since.

It’s a measure of the distorting effect Quantitative Easing (QE) has had on the bond market. Munis are overwhelmingly owned by individuals. The law requires the Fed to avoid credit risk in its bond holdings, hence QE hasn’t depressed muni bond yields the way it has treasuries and other sectors whose yields are linked, such as Mortgage Backed Securities (MBS) and investment grade corporate bonds.

Long term yields would be higher without QE. The positive muni yield curve suggests that absent QE, ten year notes would be above 4.5% based on the relationship that prevailed pre-GFC. The inverted treasury yield curve isn’t forecasting a recession, it’s reflecting the distortion the Fed’s bloated balance sheet has created.

If the Fed is to get ten year treasury yields high enough to slow the economy, meaning at least to 4%, it’s going to require short term rates well above that. Two years ago they reinterpreted their mandate to tolerate inflation above target for longer in the past. It was unfortunate timing, because the fiscal and monetary response to Covid provided huge stimulus to the economy. Today’s high inflation is well above what they had in mind.

This Friday chair Powell will give a much anticipated speech that may offer clues to the near term path of rates. A chastened FOMC shows little inclination to claim inflation vanquished, even though most observers and their own Summary of Economic Projections forecast a substantial decline over the next couple of years.

Short term rates may go much higher if that’s what’s needed to push bond yields up – but the exit ramp will always be available in the form of still modest inflation expectations which support the “transient” narrative even if Powell has abandoned the term. There’s always the chance they’ll consider selling some of their MBS holdings as the appropriate reversal of QE. It’s unlikely, so a sharp move in the market would result.

Recent data suggests a US recession is unlikely. By contrast, Europe is grappling with natural gas prices 7-8X the US and wholesale power prices even a year out that are 10X the US. Belgium’s prime minister has warned that the next, “…five to ten winters will be difficult.” Presumably he won’t be in power for most of them.

The positively sloped curve for municipal bond yields highlights the continued downward pressure exerted on treasury yields by the Fed’s decision to not sell any of their QE-acquired holdings. The direction of interest rates remains delicately balanced. We may learn more on Friday.

*The other assumptions are: 1.5% dividend yield on S&P500; 25% combined Federal and state tax on dividends; 35% tax rate on interest income; average 2% cash return over ten years; unchanged S&P500 yield in ten years

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!