Miscounting America’s Crude

Wednesday’s report on crude oil stocks from the Energy Information Administration (EIA) showed a sharp jump in storage of 1 million barrels per day (MMB/D). Given the already fragile mood around tariffs slowing GDP growth, crude oil prices predictably slumped.

Interestingly though, over the past year the “Adjustment”, or fudge factor which is used to make the numbers add up, has grown substantially.

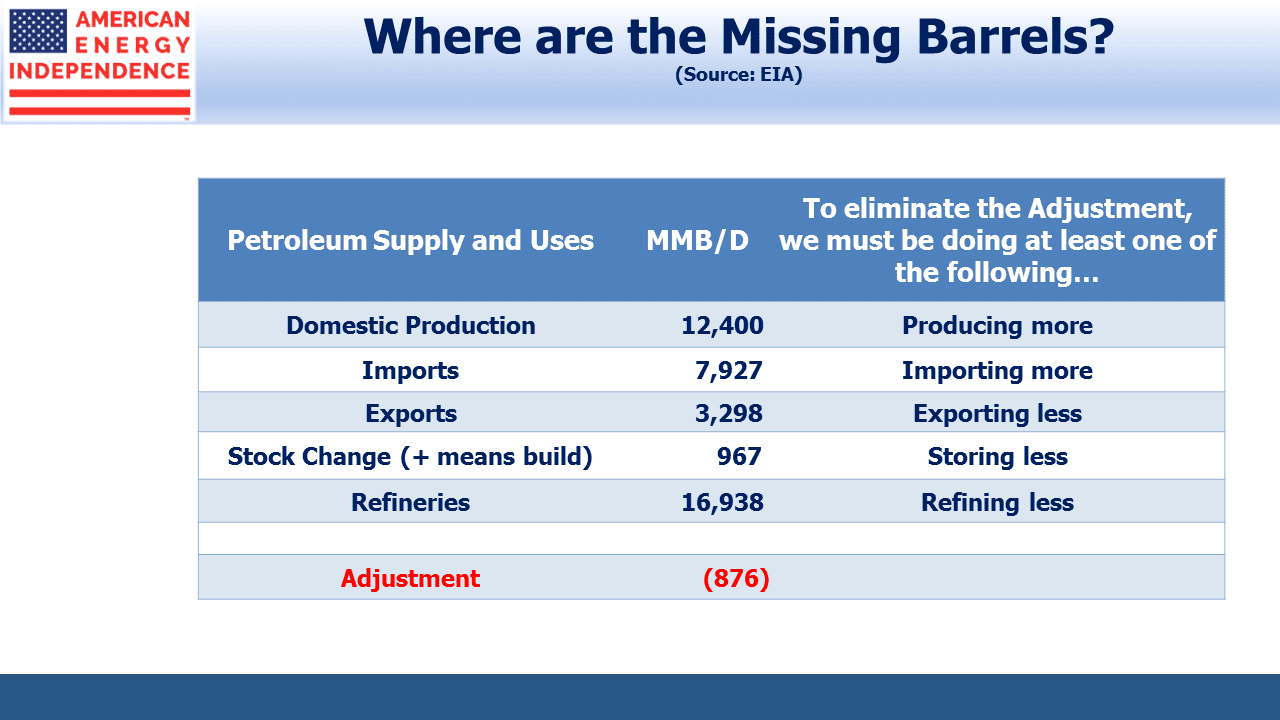

In simple terms, the EIA counts production, exports, imports, change in storage and refinery usage. This should pick up every barrel of oil moving through the U.S. It must frustrate the EIA’s number crunchers that the figures never foot, so they use a balancing item which used to be called “Unaccounted for Crude Oil”, nowadays simply the Adjustment. Since June 2018, the Adjustment has almost tripled.

Over the past year, crude oil used by U.S. refineries has been stable. Because much of America’s increased production is light crude from the Permian ill-suited to domestic refineries, imports have also remained unchanged. Higher exports have absorbed most of the increase in output.

The Adjustment exists solely because one of the other figures is wrong. So we’re refining more, exporting more, importing less, storing less or producing more than reported. Of these five different items, some should be easier to measure than others. The refinery figure seems unlikely to be far wrong; refineries must know what they’re using and there are 135 refineries in the U.S. from which to gather information.

Similarly, imports must surely be correct since the government licenses imports, and counting exports would also seem reasonably straightforward – the number of points of exports (cross-border pipelines and crude-loading export facilities) are known and not that numerous.

However, in reviewing the EIA’s methodology for calculating exports, they rely heavily on data from the U.S. Customs Border Protection (CBP) as well as figures from Statistics Canada (since exports to Canada don’t require a U.S. export license). The EIA runs the data through estimation models that they believe improve its accuracy. In some cases they’re using monthly data, even though their report is weekly.

There are many types of petroleum product beyond crude oil, including finished motor gasoline, kerosene, distillate and residual fuel oil among others. And the granting of an export license need not coincide with the physical shipment of the product. So it’s a more complex task than you might suppose.

Storage would also seem straightforward. Storage terminals are hard to miss. So the 967 thousand barrels per day (MB/D) build in storage ought to be reliable. Since the prior week saw a 41 MB/D decrease in storage, crude traders inferred softening demand.

But storage has its own complexity, since crude oil sitting on a tanker awaiting unloading is, in effect, floating storage. A possibility suggested by one sell-side firm is that floating storage was drawn down sharply. This presumes that several million barrels of crude was in tankers bobbing within U.S. territorial waters, already counted as imported but not yet unloaded. If true, this would mean the apparent jump in onshore storage was offset by a drawdown in floating storage, making the report far less bearish.

While this could explain the sudden, one-time shift in the storage figure, the Adjustment was the same last week, which undercuts the logic behind this explanation.

This brings us back to production, currently estimated at 12.4 MMB/D. Of the line items in the EIA’s report, it seems to us that this one is most plausibly the source of the growing Adjustment. There are around a million wells in the U.S. producing crude oil, from some decades old dribbling out a few barrels a day to new Permian wells producing 10 MB/D or more. We think it’s likely that the EIA is somehow undercounting crude oil output.

Flaring of associated natural gas in the Permian recently hit 661 million cubic feet per day (MMCF/D), up sharply from the previous high late last year of 450 MMCF/D. This reflects growing crude oil production. The continued shortage of take away infrastructure in the region to handle the natural gas that is extracted with the crude oil is why there’s more flaring.

Nobody really knows why the EIA’s weekly report includes an error term that is growing embarrassingly large. Robert Merriam, director of the office of petroleum and biofuels statistics at the EIA, admitted, “There’s something more systematic going on that our surveys aren’t capturing. We have some theories on what that may be and we’re trying to look into it.”

Undercounting crude oil production seems the most likely explanation. If so, this would reinforce a couple of important themes:

1) The U.S. continues to gain market share in world energy markets

2) Growing volumes even with moderate pricing defy those who argue that much of our shale activity is unprofitable

Oil and gas production continue to surprise to the upside, which can only be good for midstream energy infrastructure.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!