Magellan Midstream: Keeping Promises But Still Dragged Down by Peers

Many MLP management teams have pursued growth at the expense of honoring their promise of stable distributions. We think the sector’s persistently high yields need explaining. Last week’s blog post (Kinder Morgan: Still Paying for Broken Promises) drew thousands of pageviews and over a hundred comments on Seeking Alpha.

Although Kinder Morgan (KMI) got there through a series of steps, ultimately they redirected cashflows from distributions to new projects. From an NPV standpoint, financial theory holds that investors should be indifferent to how a company deploys its cash as they can always manufacture their own dividends by selling some shares.

Markets don’t work that way. Capital investments are not an expense, they’re a use of cash. But the dividend cuts required to fund them were treated as a drop in operating profit by investors. KMI should have understood this, because for many years prior to 2014 they sought investors who valued stable dividends. KMI then decided they no longer wished to appeal to those investors, and their valuation still reflects the betrayal. The bitterness of many investors is on full display via the comments on last Sunday’s blog.

KMI’s problem of an undervalued stock is self-inflicted – but what about other MLPs who have been faithful to their income-seeking investor base? Magellan Midstream (MMP) does all the right things:

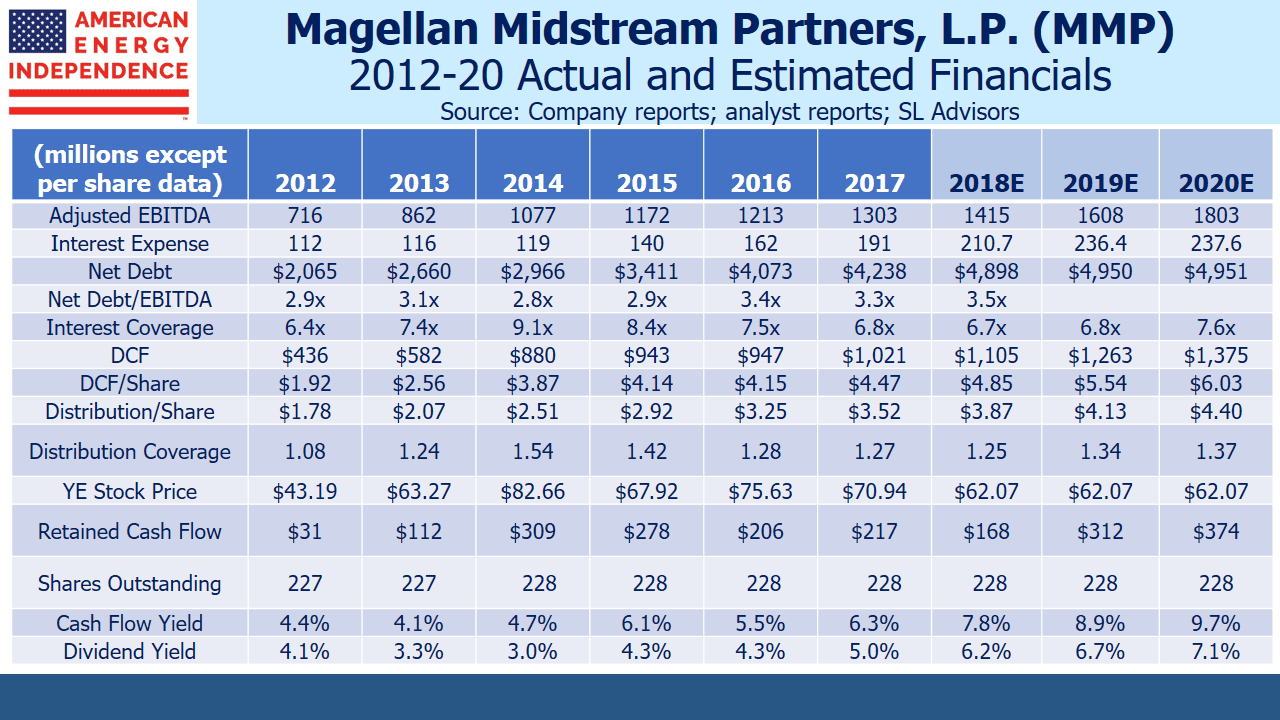

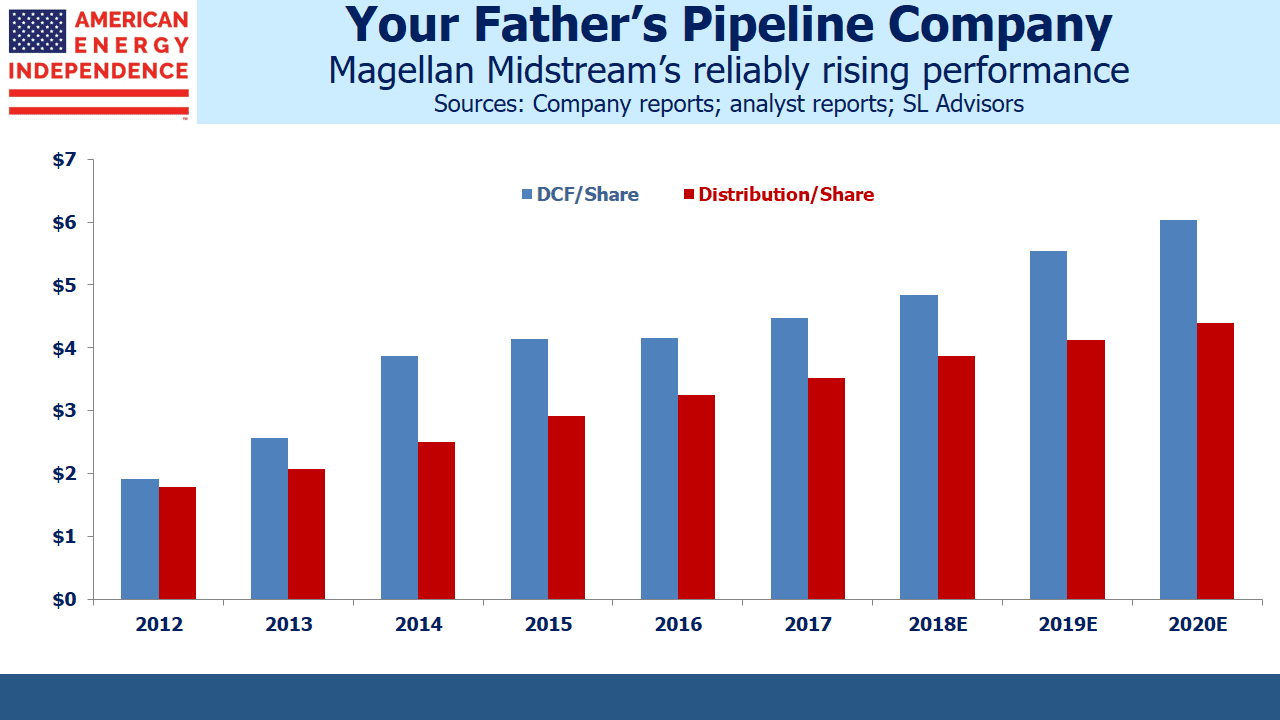

- Grows Distributable Cash Flow (DCF) annually

- Raises its dividend (distribution), annually

- Finances its growth projects with internally generated cash, thereby avoiding dilutive secondary offerings of equity

- Maintains a strong balance sheet with Debt:EBITDA consistently below 4X

Such judicious capital management has probably caused MMP to pass on growth opportunities that others have chosen. Energy infrastructure analysts widely hold that the sector remain undervalued. Dozens of MLP distribution cuts are at least part of the reason – so a company that has remained steadfast should stand out.

But while MMP’s unwavering embrace of its principles has helped, it hasn’t been enough to truly separate them from their less reliable peers.

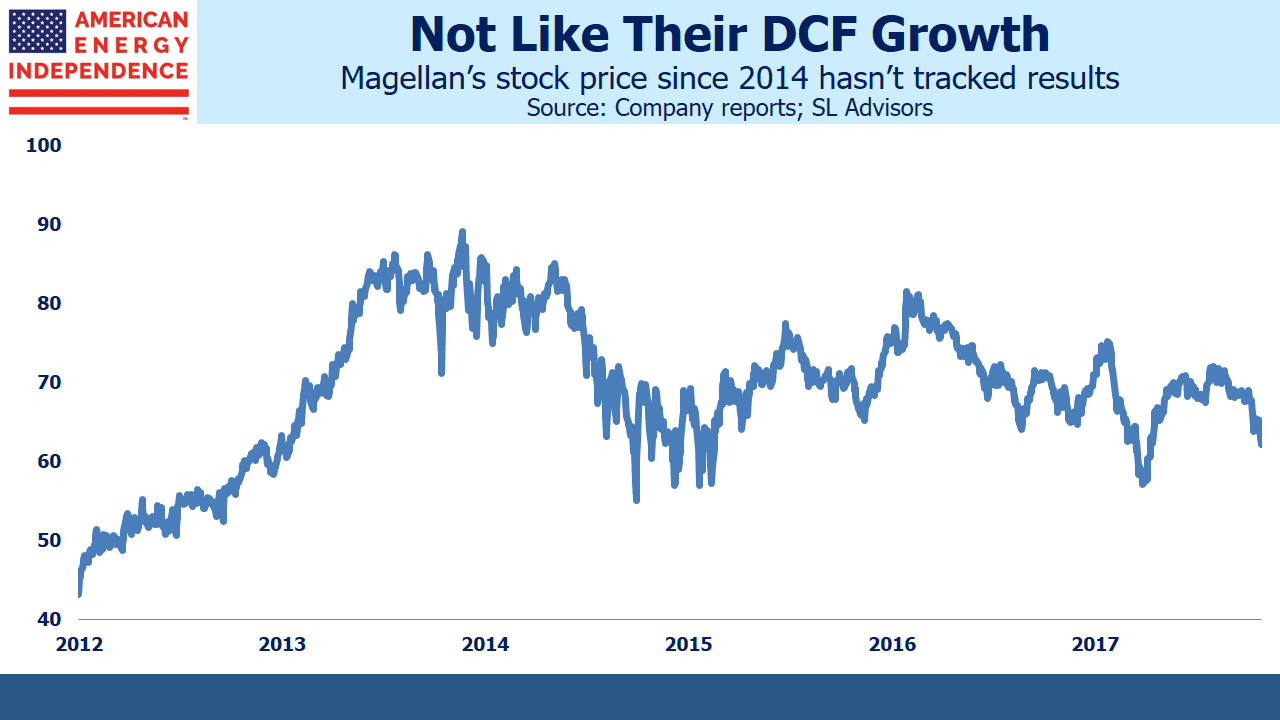

MLPs peaked in 2014. Since then, MMP has raised per unit EBITDA by 31%, per unit DCF by 25% and distributions are up 54%. Distribution coverage remains healthy at 1.25X.

MMP’s leverage has risen, from 2.8X to 3.5X, but will drop back next year as new projects come into production. Even at 3.5X it is comfortably below the 4X that most of their peers target.

Magellan’s management team hasn’t issued equity or made dilutive acquisitions. They’ve done just what they promised by increasing cash flows & distributions while maintaining a strong balance sheet. And yet, MMP’s stock price is 26% below where it ended 2014.

MMP’s yield is more than 2% below the AMZ, reflecting a valuation premium relative to the MLP index. But the entire sector is laboring under the history of dozens of distribution cuts, which have lowered the payout on the Alerian MLP ETF by 30%. MMP’s valuation has moved in the opposite direction from its steadily improving operating performance in recent years, reflecting that traditional MLP investors remain far less enthusiastic than in the past.

The most common question asked of investors is, given persistent undervaluation, what is the catalyst that will drive prices higher? We showed last week that an MLP’s DCF yield is analogous to the Funds From Operations measure used in real estate, since it represents cashflow generated after the cost of maintaining the assets but before investment in new projects. On that basis, MMP’s 9.1% DCF yield (based on $5.54 per unit for 2019) is pretty attractive for a long term holder.

However, many investors prefer immediately rising prices following a purchase to confirm their buy decision. Continued strong earnings should support increases in payouts. 3Q18 results for pipeline companies have been strong. Current forecasts are for 5-6% annual distribution growth for MLPs – slower than their growth in DCF as they build coverage for their distributions. Since many MLP managements continue to believe their stock undervalued, they prefer internally generated cash to issuing expensive equity. We agree. We expect dividend growth for the broad American Energy Independence Index (80% corporations and 20% MLPs) of 10% next year.

Rising dividends should improve sentiment.

We are long MMP and KMI.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Here are two thoughts stimulated by the very good analysis in the above article.

1. KMI engaged in a double betrayal. One was, as the article points out, the dividend reduction. The other was the imposition of taxes on the unit holders when the partnerships were merged into the C corporation, with the highest tax imposed on the most loyal unit holders, the longest term holders who had the lowest adjusted basis in their units.

2. Every substantive point made in the article about MMP can also be made about EPD, in which I am a long term and very satisfied unit holder, with the additional point being the strong financial support of EPD by the Duncan family which owns about a third of the EPD common units and has bought hundreds of million dollars of additional units in the DRIP to enable such achievements as the acquisition of Oil Tanking partners.,The market has rewarded neither EPD nor MMP for their managements’ unit holder friendliness and fiscal prudence or for their operational excellence.