Futures Still Disbelieving The Fed

Memories of the 2013 “Taper Tantrum” loom over today’s FOMC as they engineer an exit that will hopefully be more elegant than our current one from Afghanistan. Both were well overdue, although there is no doubt the military withdrawal was handled disastrously. Can the Fed do better?

Unlike the Afghan army, the bond market has reacted well to the approaching loss of US government support. Treasury yields even dropped modestly on the week, with the ten-year still around 1.25%, 0.50% below its high in late March.

Real yields have stayed below –1.0%, with implied ten-year inflation (nominal yields less TIPs) of 2.3%. Since the Fed’s bond buying will be over within 6-9 months, today’s yields must reflect close to an equilibrium level for a bond market operating without the crutch of partial debt monetization.

Persistently low long-term interest rates remains one of the most important drivers of valuations. Japan holds $1.3TN in US treasury securities, and China over $1TN. These and other holders are clearly not seeking generous returns. Moreover, the specter of foreign investors dumping bonds and causing a recession has gone. Our second stint of Quantitative Easing (QE) shows that the Fed is a fully capable buyer of last resort. China’s position would sit comfortable alongside the other $8TN on the Fed’s balance sheet. Whatever risk premium bond yields once offered against such a possibility has evaporated.

The bond market’s positive response to tapering is more accurately a reflection of concern over the Delta virus. Cyclical stocks have been under pressure since mid-June, and on Thursday the S&P Energy ETF (XLE) dipped below the 200-day moving average. There are signs that Covid is flattering the bond market’s apparent equanimity over tapering. Nonetheless, the Fed stepping back when there’s clearly ample demand for bonds represents a more elegant exit than waiting until yields had risen to, say, 2%.

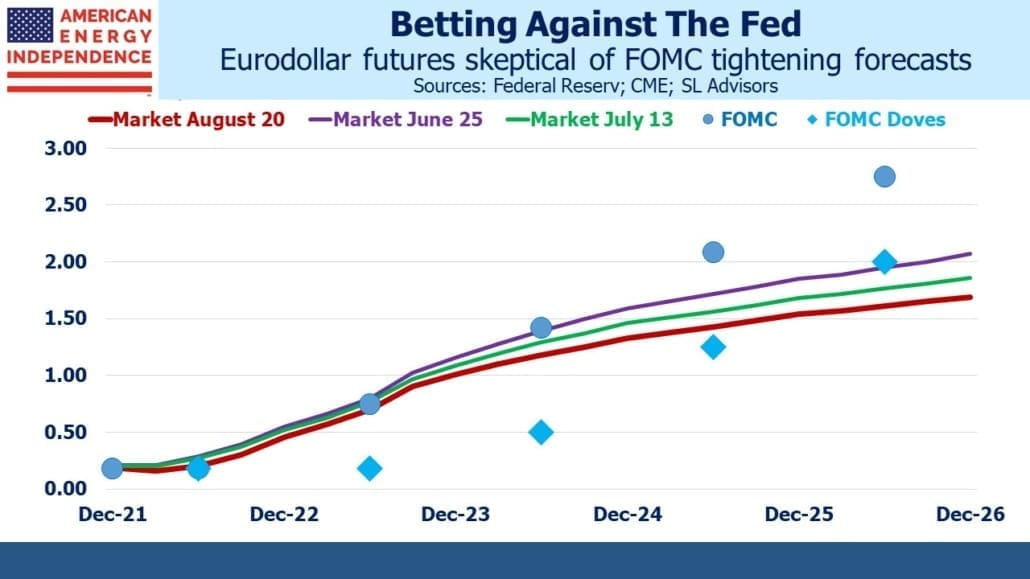

The eurodollar yield curve has flattened over the past couple of months as bond yields have drifted lower. Market interest rate forecasts are now solidly below those of the FOMC. Five years out, even the most dovish of the “blue dots” that indicate individual FOMC members’ rate forecasts is almost 0.40% above the market. Although bond investors have pushed yields lower in response to rising hospitalizations from the Delta virus, it’s unlikely FOMC members’ rate forecasts have altered much two to five years out. And the market is still forecasting around one tightening per year from 2023, about half the pace of FOMC members.

Given their explicitly reactive posture, it’s quite likely that the FOMC will be slow to normalize rates. Chair Powell never misses an opportunity to remind us that achieving full employment, which means an unemployment rate at least as low as the January 2020 pre-Covid level of 3.8%, is their objective. It’s likely that the FOMC will rely on emerging wage inflation as confirmation we’ve reached full employment. So they’ll be playing catch-up, which is why the current flatness of the eurodollar curve seems incorrect. Put another way, with the market priced for two tightenings during 2024-25, we think three is more likely than one, and four a decent possibility.

Interest rate futures reflect a slow pace of easing at odds with FOMC forecasts and past history. Given that a philosophy of unlimited spending now drives fiscal policy (see Modern Monetary Theory Goes Mainstream), if the lethargic pace of tightenings turns out to be accurate, there wil be ever greater calls for additional fiscal stimulus to boost economic growth.

It began with the Greenspan put, and successive Fed chairs have been awarded the same moniker. Add to that the Biden put. At the first sign of economic weakness the call will go out for more spending, which remains virtually costless. With debt funded at negative real rates, it almost seems irresponsible to not take advantage of the opportunity.

In 2008 Ben Bernanke revealed the limitless balance sheet capacity of the Federal Reserve, which has moved from $2TN to $8TN since then with no discernible disadvantage to the US economy. Covid-induced fiscal stimulus ushered in Modern Monetary Theory (MMT) as mainstream policy, exploiting a country’s unlimited ability to borrow in its own currency.

Now that Congress has discovered the Magic Money Tree (i.e. MMT), the conditions that justify super-stimulus will become steadily relaxed, just as the use of QE will transition from an extraordinary measure to business as usual.

It’s against that context that the forecasts embedded in the interest rate futures market must be judged.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!