Financial Discipline Among MLP Customers

Recent earnings reports suggest some moderation in the acceleration of U.S. shale drilling. The CEO of Schlumberger said that equity investors were propagating marginal activity by providing capital based on volumes rather than returns. The retiring Chairman of Halliburton, Dave Lesar, provided some wonderful quotes on his final investor call, including this assessment of the Shale Revolution:

“They are your classic American entrepreneurs, and their success should be recognized. In Silicon Valley, such a success would be greatly celebrated as another industry disruptor. The unconventional disruption is not widely celebrated beyond the energy space, but it should be. The development of US unconventional resources has been as disruptive to the global energy market as Amazon has been to Big Box Retailing or Uber to the taxi business… Made the US more energy independent, caused OPEC to react and changed the fundamental economics of offshore production.”

This is one of the reasons why America is Great.

Anadarko announced a $300MM (7%) reduction in their 2017 capex plan, noting that margins were too volatile to support their previously planned budget (some of this reduction was to non-shale, offshore projects). Halliburton’s Dave Lesar also noted a “tapping the brakes”, which the incoming CEO Jeff Miller clarified as, “going from 80 miles an hour to 70 miles an hour.” Other U.S. drillers including Hess and Sanchez similarly lowered capex. The anecdotal evidence of slower production growth supported crude prices last week, as did OPEC’s meeting in St. Petersburg at which Saudi Arabia pledged to unilaterally limit exports in a further effort to support prices.

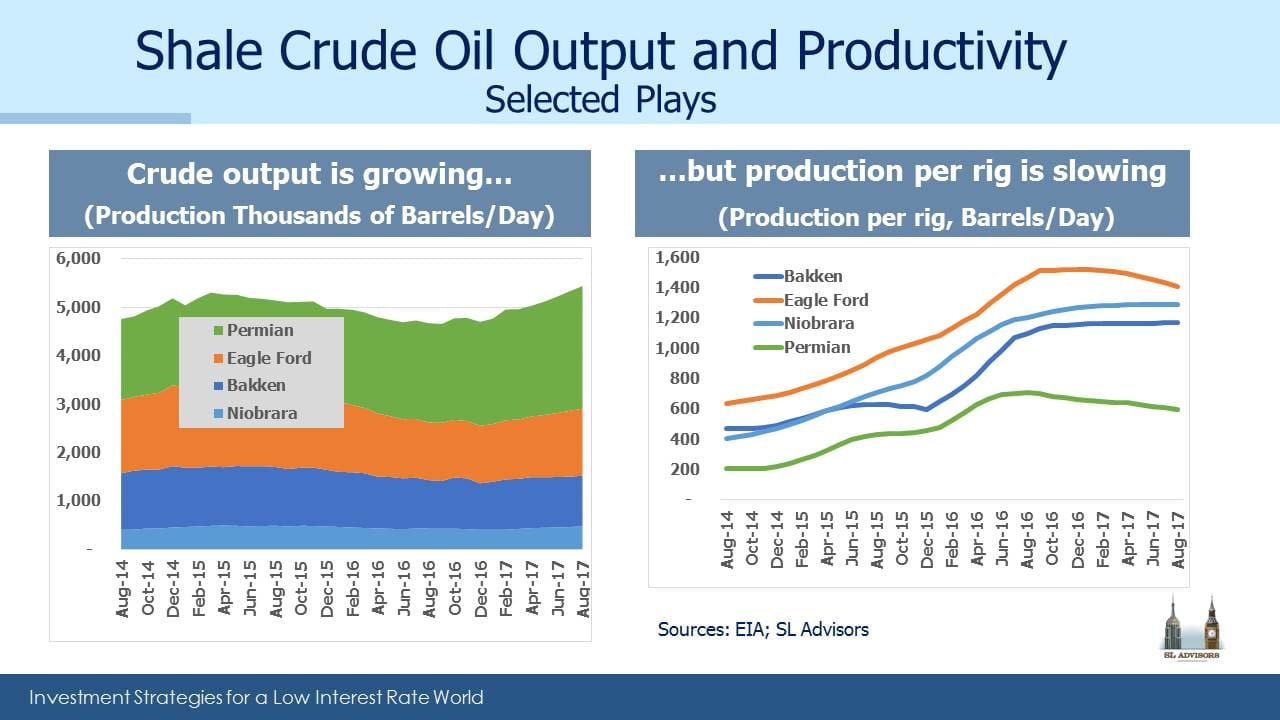

The U.S. Energy Information Agency (EIA) publishes a monthly Drilling Productivity Report (DPR). It includes data on output and productivity from the larger shale plays across the country. Many observers including ourselves have commented on the dramatic improvements in productivity that have been taking place. It’s no exaggeration to say that advances in drilling techniques and use of improved technologies have been hugely important drivers behind the rise in U.S. production, in spite of falling prices.

However, part of the productivity improvements have been due to an increased focus on the most productive wells. U.S. producers adopted a defensive posture in 2015-16 as crude prices collapsed, and that included focusing their efforts on their best plays. Although there’s no doubt that actual productivity improved enormously, the figures are likely somewhat flattered by this focus on the best assets.

One measure of productivity is initial output per well (Initial Production Rate, or IPR), and in some plays (notably including the Permian), this statistic has been declining modestly for about a year. It’s still higher than at any time prior to 2016, and enhancements such as multi-well pad drilling, longer laterals and new fracking techniques have been critical to success. Output continues to grow even while initial production rates are flattening out. It’s a consequence of drillers moving beyond their most productive plays, best rigs and most skilled crews. While they played defense successfully, operating efficiencies were achieved and are being applied more broadly. Although crude oil production from shale plays is likely to keep growing in the current economic environment, the flattening of IPRs is a sign of limits on unconstrained growth. A study from MIT concluded that productivity gains were being overstated by insufficiently considering “sweet-spotting”, the tendency to focus on the best acreage.

Recent earnings reports as well as the IPR data noted above suggest that, while U.S. output will continue to grow, there are visible limits on that growth. Furthermore, after seeing annual declines in breakeven prices of 20% in 2015 and 29% in 2016, Rystad Energy forecasts breakevens are poised to rise 7% in 2017. Nonetheless, productivity remains high enough and costs low enough to gain market share, but perhaps not enough to further depress prices.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!