Deja Vu All Over Again for Pipelines?

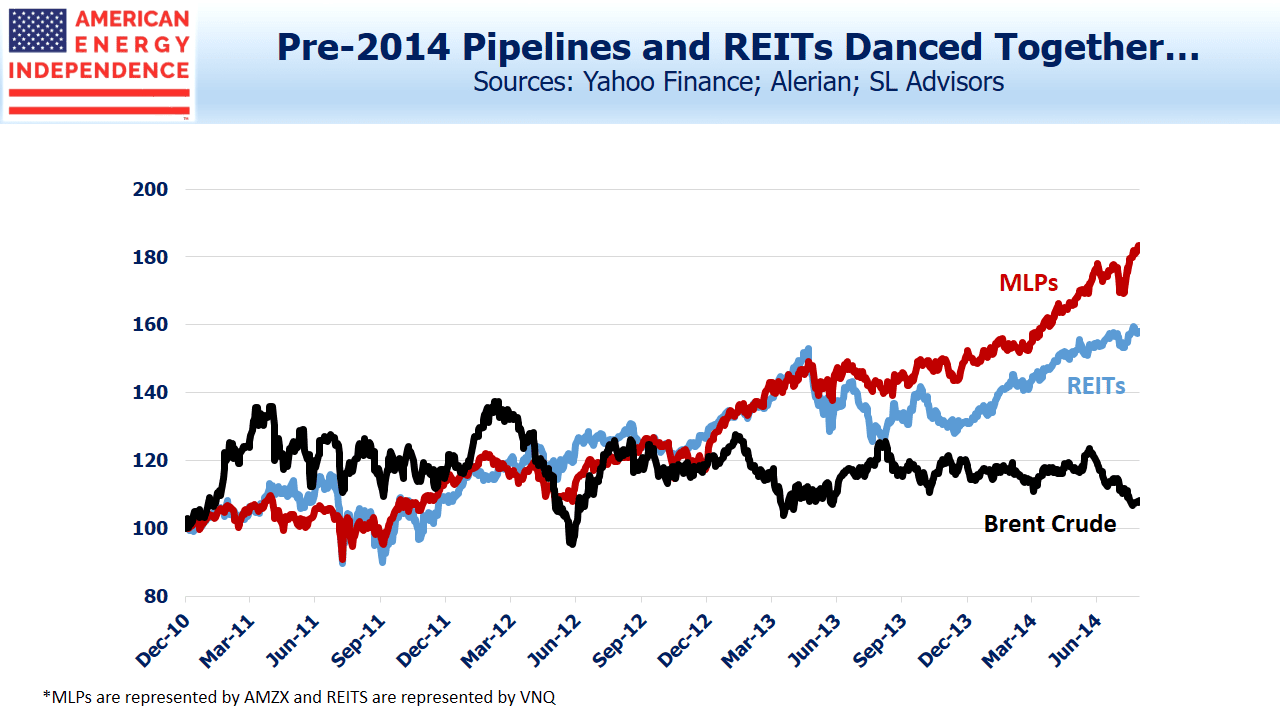

Years ago, before the Shale Revolution became the phenomenon it is, comparisons were often made between MLPs and REITs. Both offered attractive yields from real assets, and income-seeking investors were drawn to them.

As a result, their performance tracked each other pretty closely. Investors focused on the relative value of one versus another generally kept them in line. This was the period when pipelines earned their reputation as “toll-models”, driven by volumes with little relationship to crude oil.

Long-time investors in energy infrastructure fondly remember those days and many retain mixed feelings about America’s resurgence in oil and gas production. MLPs embraced growth projects, and payouts to investors soon suffered.

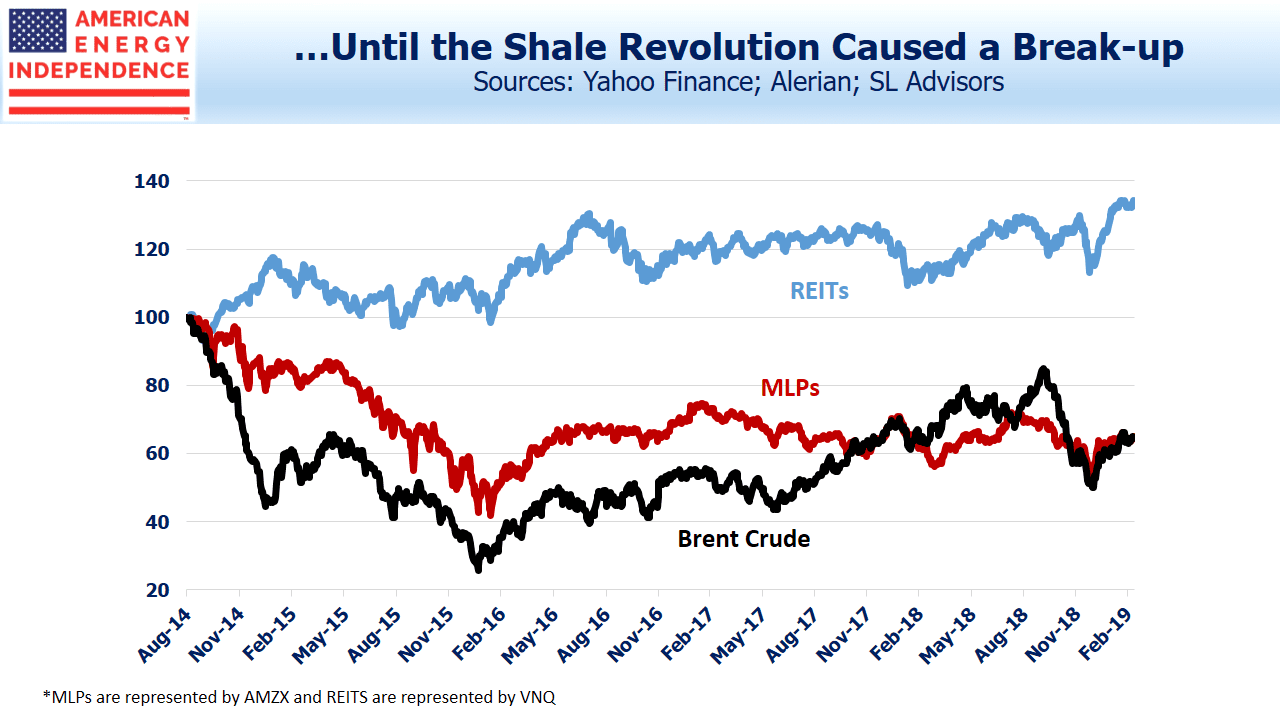

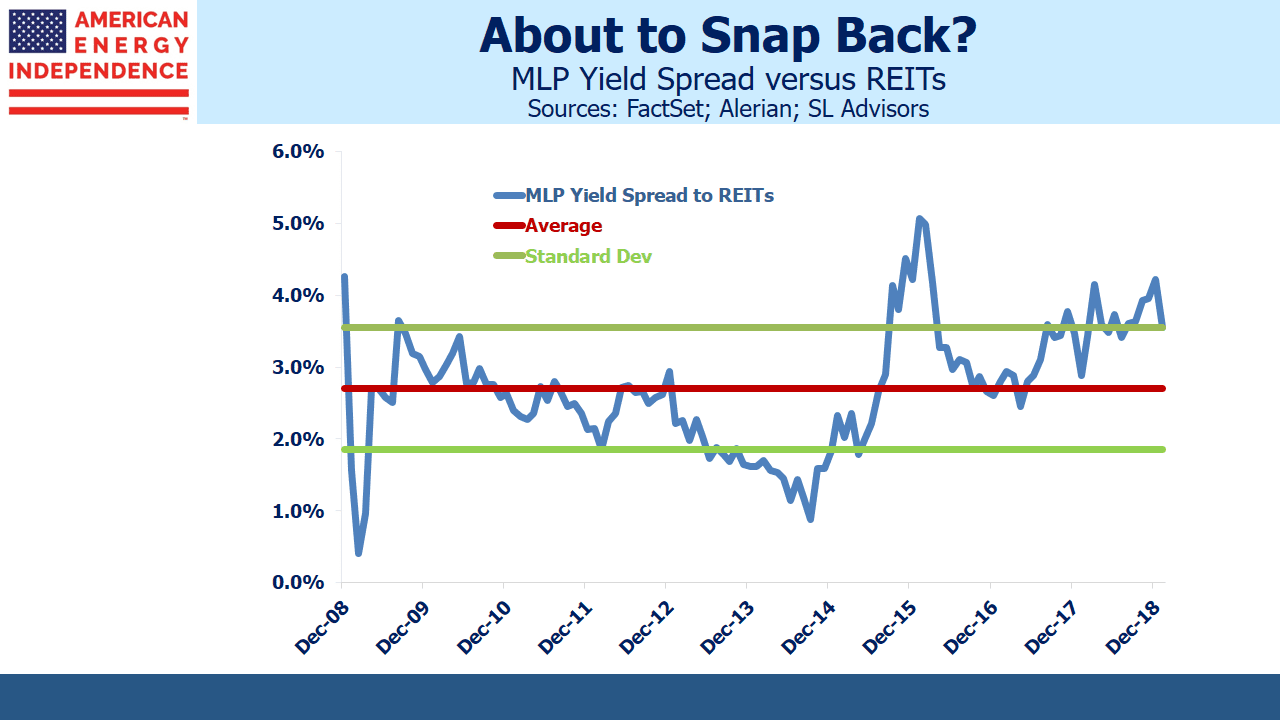

It’s worth recalling the pre-2014 era, because pipeline stocks are resuming dividend growth once again. The growing realization has already led to a strong start to 2019, with the sector up almost 20%. Comparisons with REITs or utilities made little sense for investors seeking income when MLP income was uncertain. The 36% drop in payouts from the Alerian MLP ETF (AMLP) reflect a big betrayal, but not a collapse in the business. Nonetheless, as we’ve often found when talking to investors, distribution cuts for any reason tend to drive them away.

Enterprise Products (EPD) CEO Jim Teague reflected the mood when he recently said, “So many of these guys cut their distributions. I wouldn’t buy their stock either.” Reliable payouts matter.

Since 2014 MLPs and REITs have maintained a loose relationship, and although the economic link between crude oil and pipeline company profits is generally weak, at times they have been manacled together. Some investors will ruefully add that the link is strongest when crude oil is falling.

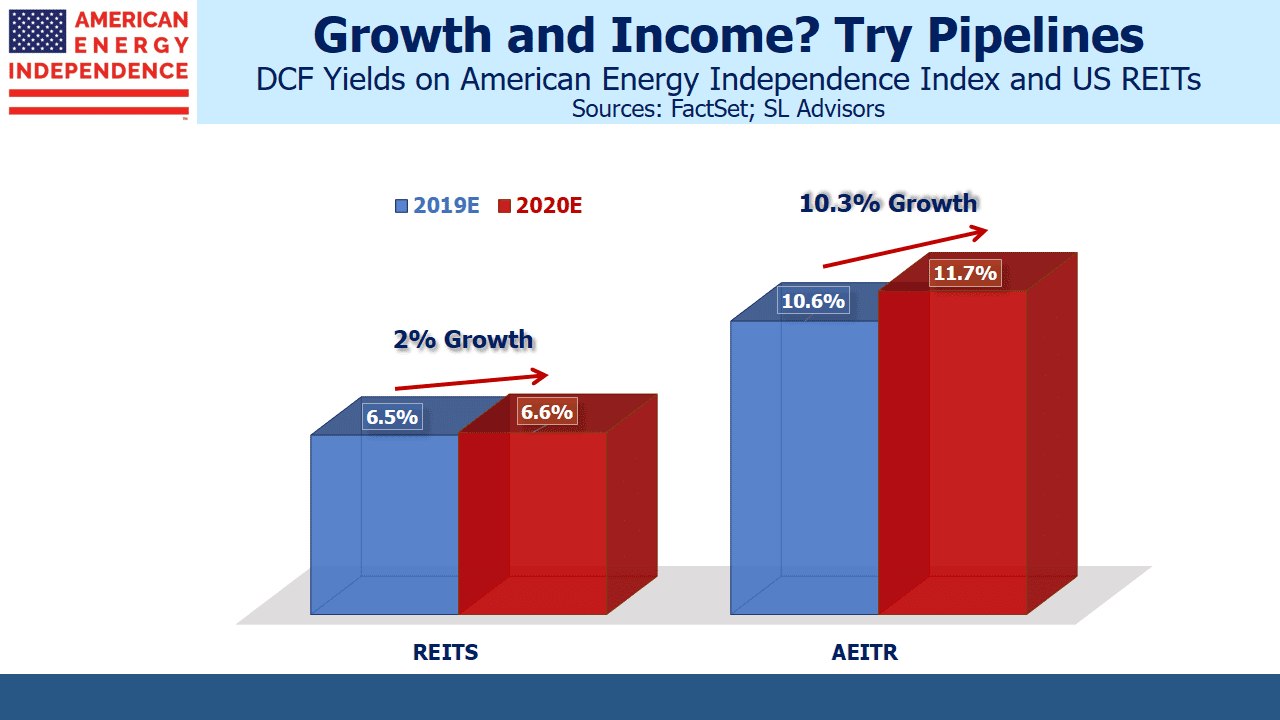

Rising pipeline distributions reflect an acknowledgment of investors’ requirement for greater capital discipline with predictable payouts. Growth capex for the industry was $55BN last year and looks likely to be lower this year, freeing up cash. Several big projects are nearing completion, which will further support cashflows.

Internally funded growth is the new normal. The older, wealthy Americans who are the main direct investors in MLPs have demonstrated resoundingly that they don’t want to finance growth. It’s why there were no MLP IPOs last year. Leverage is down to 4X Debt:EBITDA.

Energy infrastructure stocks offer compelling value versus REITs. Distributable Cash Flow (DCF) yields of 10-11% are growing 10% annually in the broad-based American Energy Independence Index (this is 80% corporations and 20% MLPs). REITs offer yields from Funds From Operations (cash generated from existing assets before growth capex, similar to pipeline companies’ DCF) of around 6% with little growth.

Income stability should draw more REIT investors to consider pipelines, which will restore the close relationship the two sectors shared for many years. This in turn will further weaken the link to crude oil.

The energy sector’s collapse in 2014-16 caused MLPs to fall more than they did during the 2008-9 financial crisis. Memories of that episode remain fresh, but many signs suggest that the stability of earlier years is returning.

Join us on Thursday, March 21st at 1pm EST for a webinar. We’ll review the prospects for continuing growth in US oil and gas production. To register please click here.

We are invested in EPD and short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com)

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Regarding the quote from Jim Teague, whom I as an EPD unit holder greatly respect, the reduction of a distribution is not always a fatal event for an MLP. Several years ago CEQP reduced its distribution (and eliminated its IDRs), and the unit price plummeted after the distribution reduction. New management was brought in, the business model and capital allocation were refined, the partnership is prospering, EBITDA growth is at 15%, and the unit price is strong.

And there is an interesting phenomenon which is a corollary to the text. Natural gas oriented partnerships also tracked crude oil prices on the way down. The relationships are indirect: Permian and some other basin gas is associated, and NGL prices often track crude, but these are indirect effects at best, and yet crude oil prices impacted natural gas oriented midstream operators.

And for we MLP investors (allegedly old rich guys) there is another benefit which should be mentioned. Thanks to depreciation, partnership distributions are largely or entirely tax deferred and while one’s adjusted basis is reduced thereby when we old guys die our heirs benefit from a stepped up basis.