More Gas Demand Is Coming

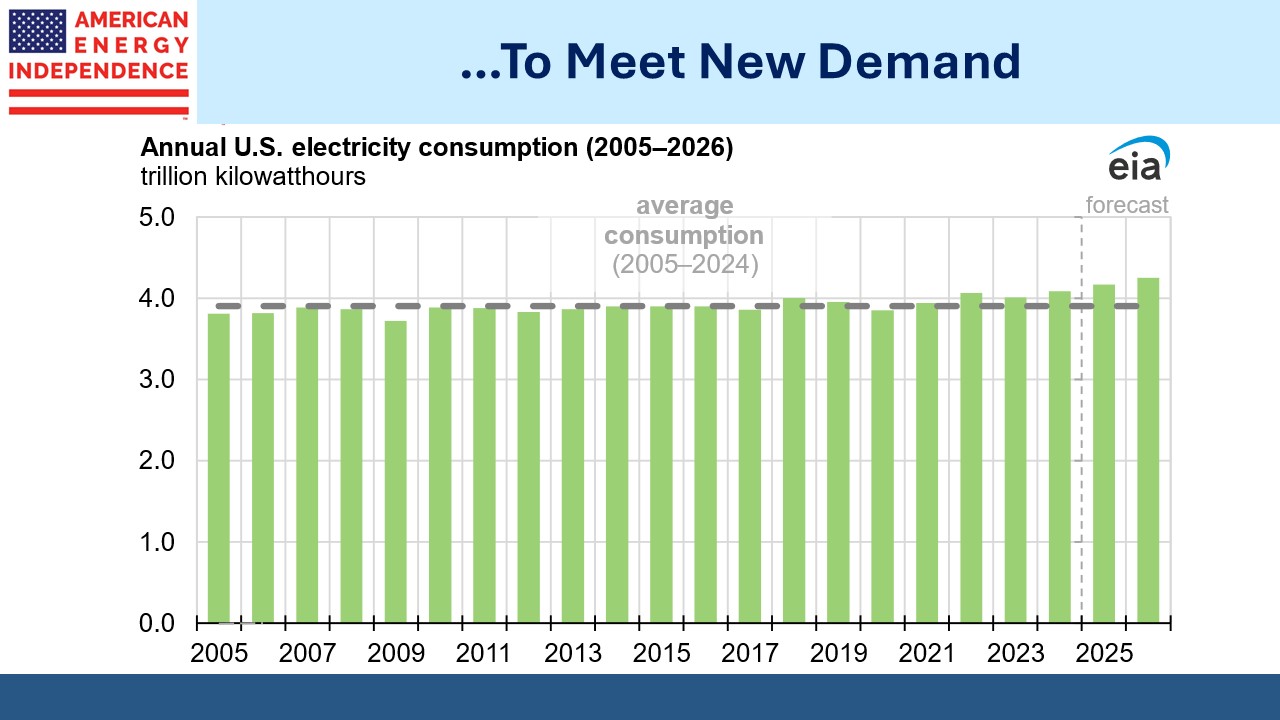

Last week the Energy Information Administration (EIA) released their Short Term Energy Outlook (STEO). People are often surprised to learn that US power demand has remained the same for the past couple of decades – at around 4,000 Terrawatt Hours (TwHs). The economy and population keep growing but offsetting this is improving energy efficiency.

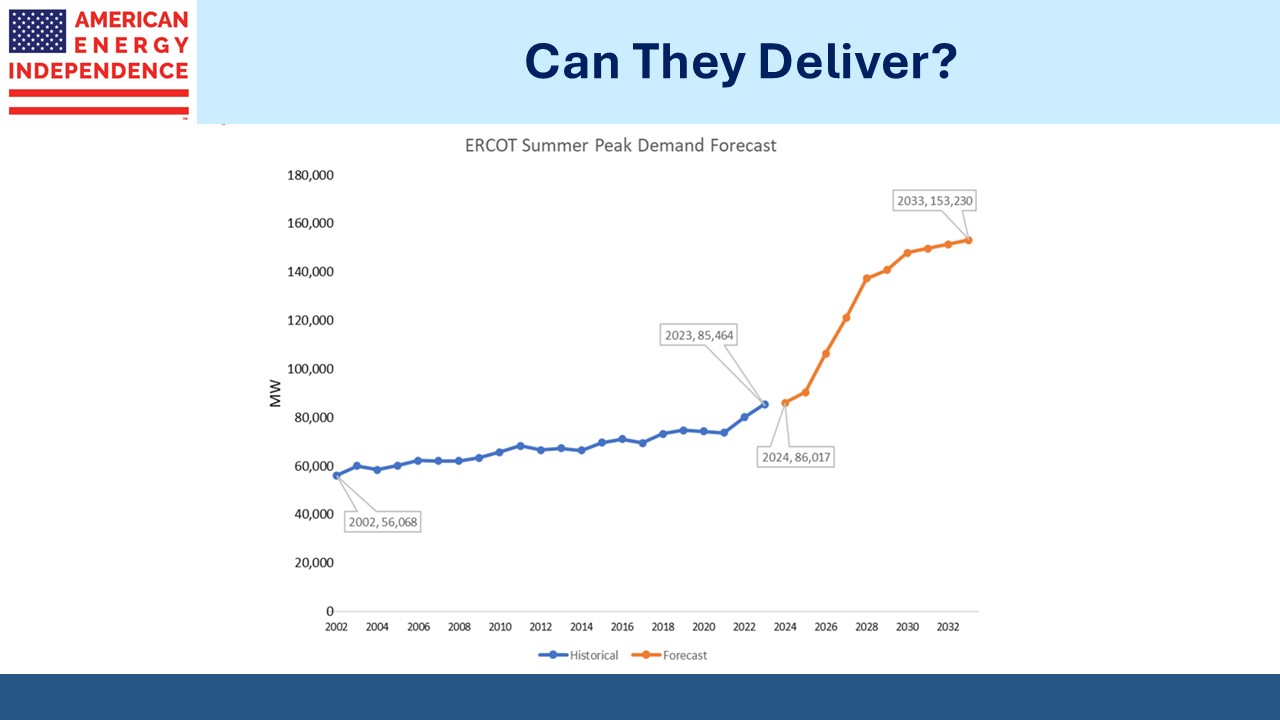

Electricity demand changes slowly. Utilities need to plan for new supply years in advance to allow enough time to add new generation and supporting infrastructure. So although the projected increase looks visually small, it’s a long time since the industry has had to plan for any meaningful increase.

The PJM grid system, which extends from mid-Atlantic states to Tennesse and Illinois, is forecasting 2% annual demand growth over the next decade. ERCOT, which covers Texas, is expecting similar annual growth through 2030. The EIA expects 2% demand growth across the country this year and next, although this will be spread unevenly with some areas seeing 2-3X as much.

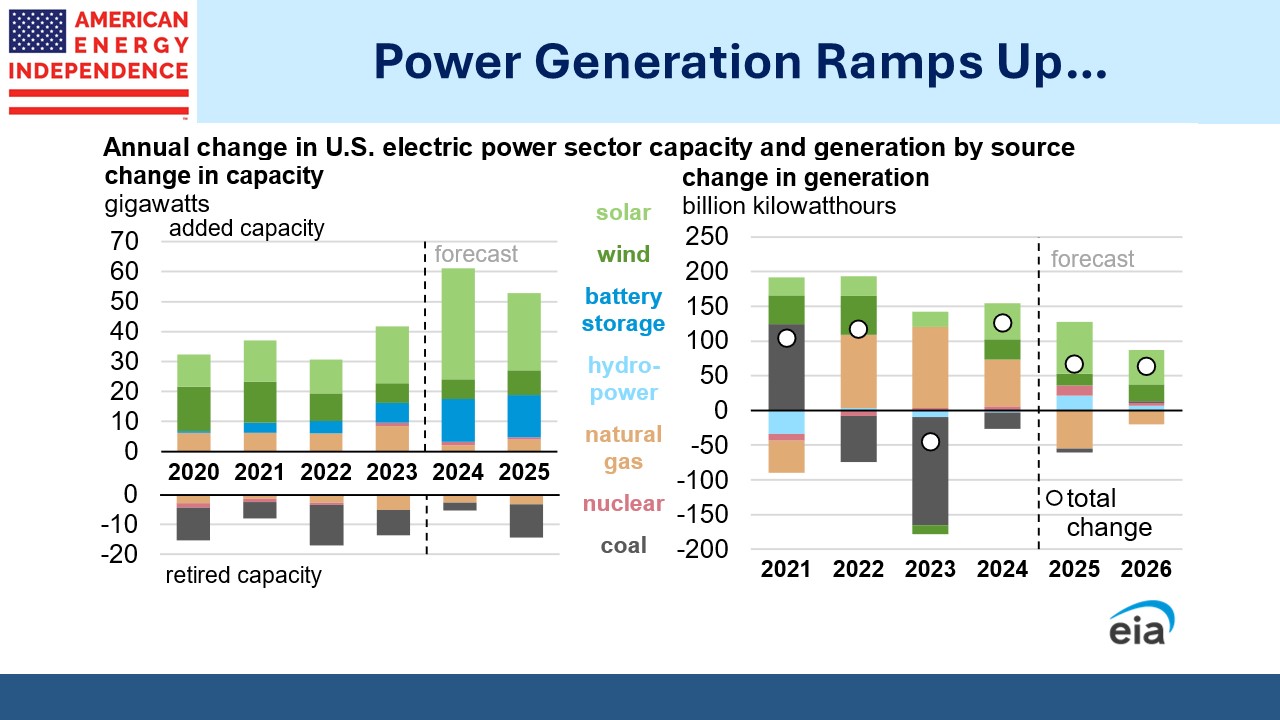

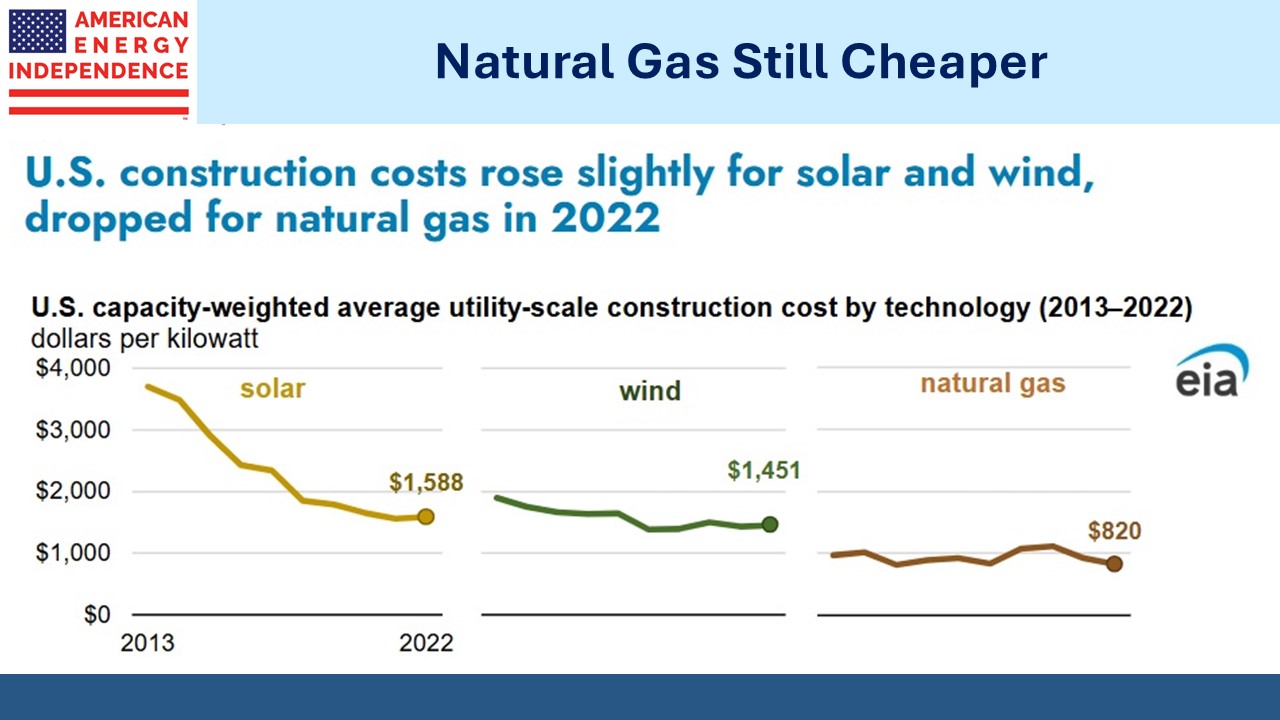

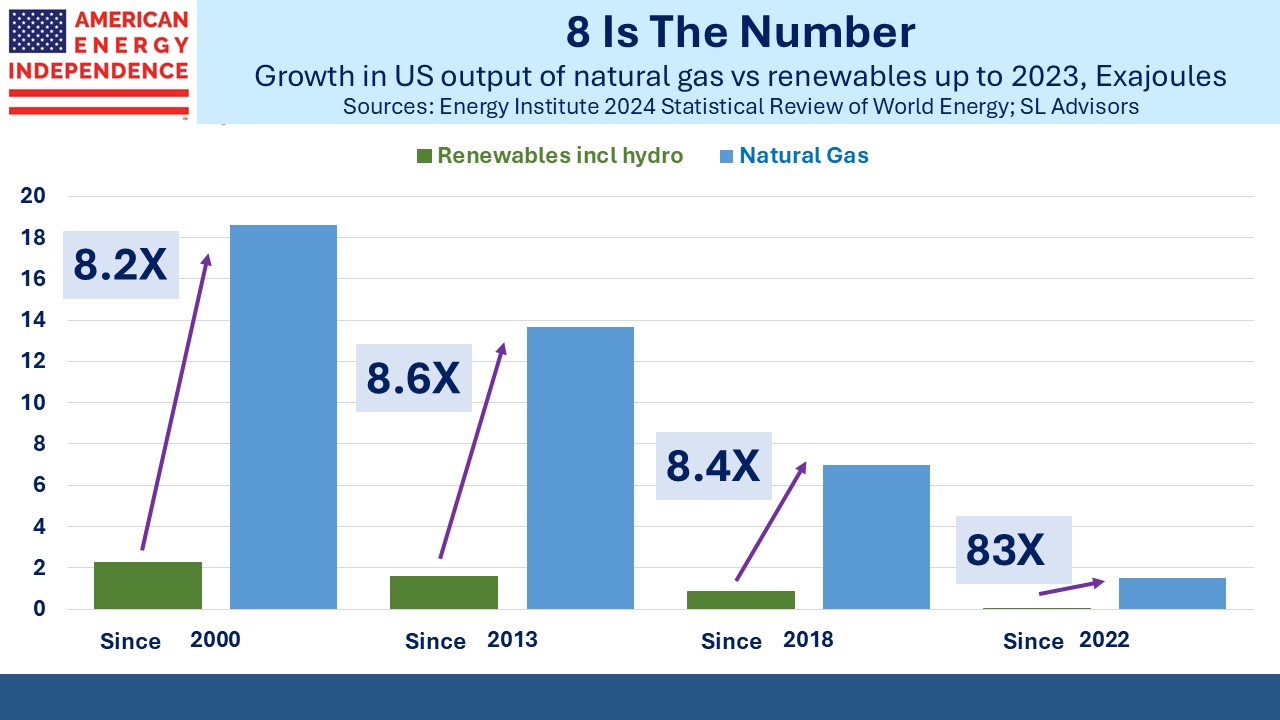

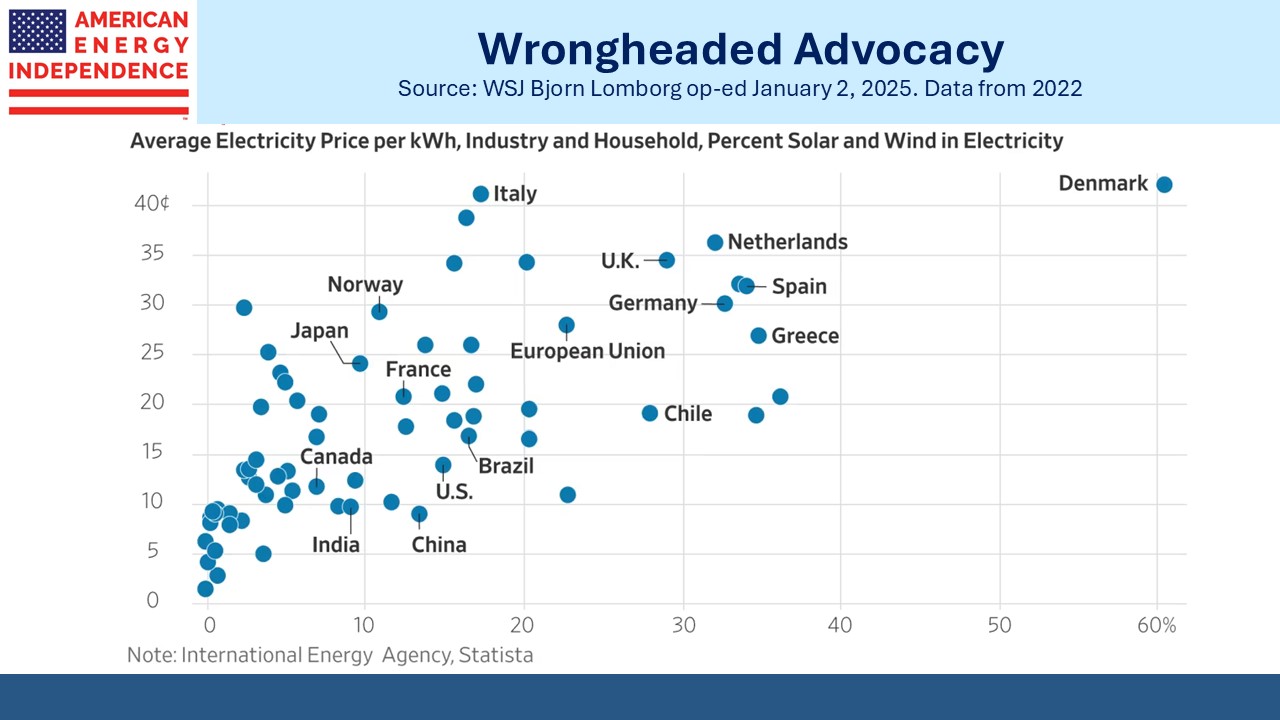

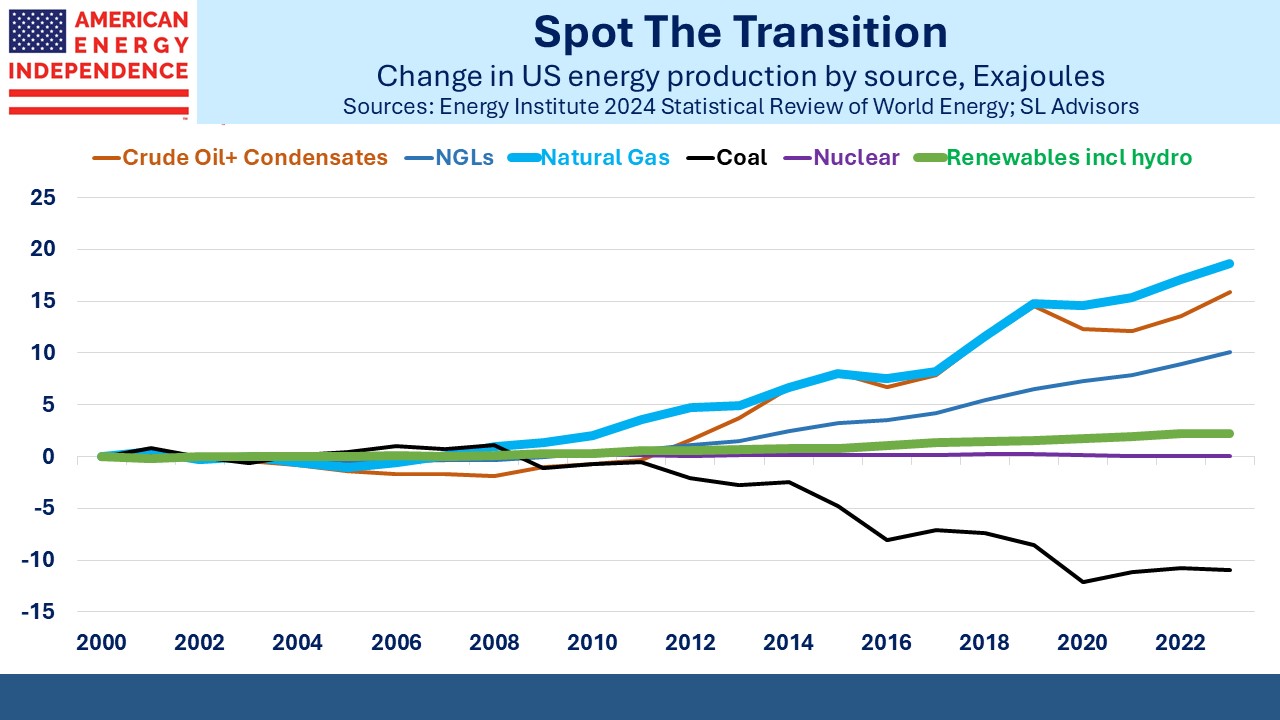

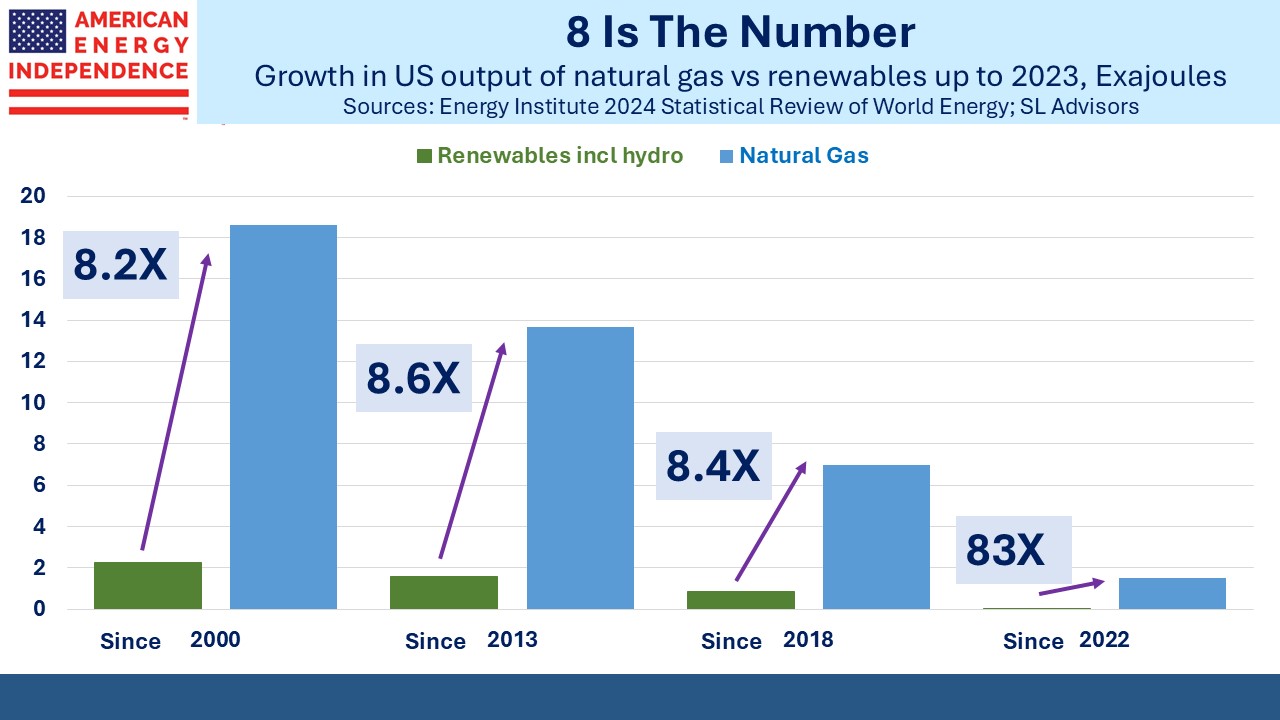

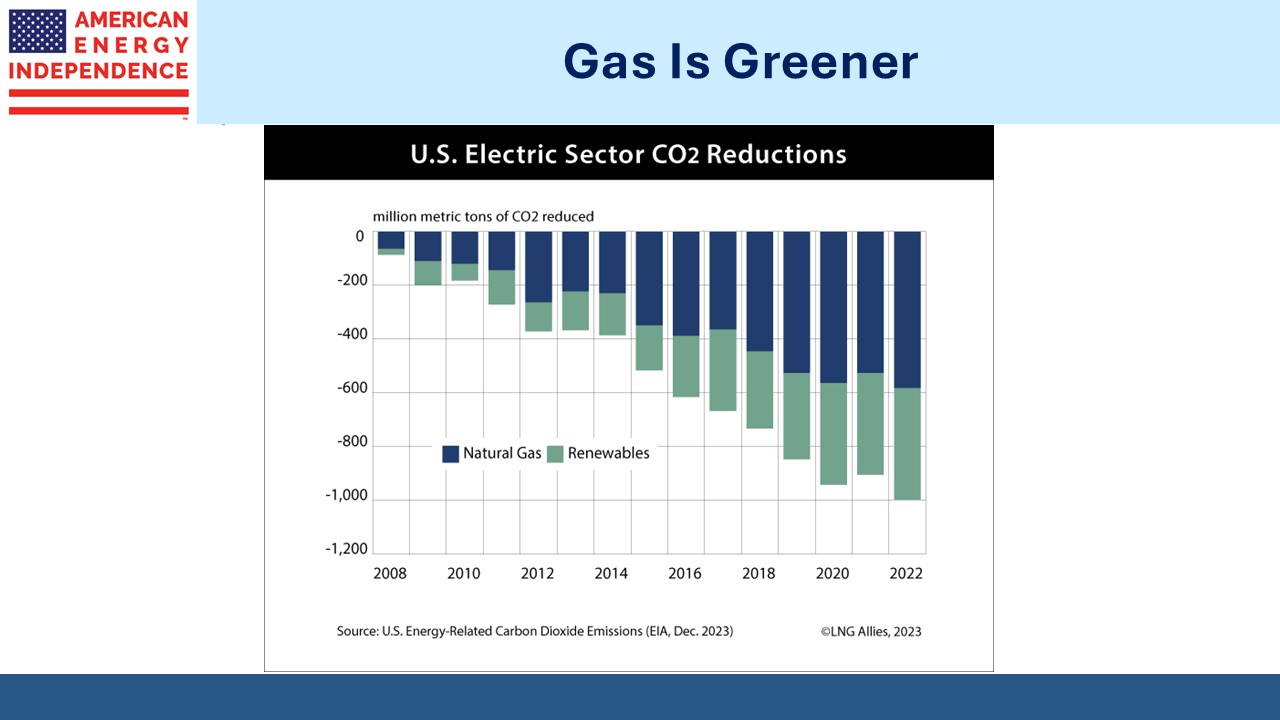

Renewables’ advocates typically promote added generation capacity as evidence of the energy transition to solar and wind, although as we regularly note the real transition is to natural gas (see The 8X Energy Transition). Last year the US added 50 gigawatts of solar and wind capacity, which produced an additional 50 billion kilowatt hours.

Adjusting for the different orders of magnitude and assuming the new capacity came online smoothly during the year (ie on average was available for half the year) gets to a 28% capacity utilization. That’s less than a third the uptime of natural gas power plants, which are also needed to compensate for the absence of solar and wind during dark and windless conditions (wonderfully named Dunkelflaute in German). We also added 10 gigawatts of battery storage.

Nobody knows if this was money well spent, because cost-benefit analysis doesn’t intrude on the deliberations of climate extremists. But we did use less coal, which was unambiguously good because it’s the highest emitter of greenhouse gas emissions per unit of energy output.

The EIA STEO is forecasting that this year natural gas derived power generation will drop by 55 TwHs even while total demand rises by around 70 TwHs. They expect increased solar to approximately equal the new demand.

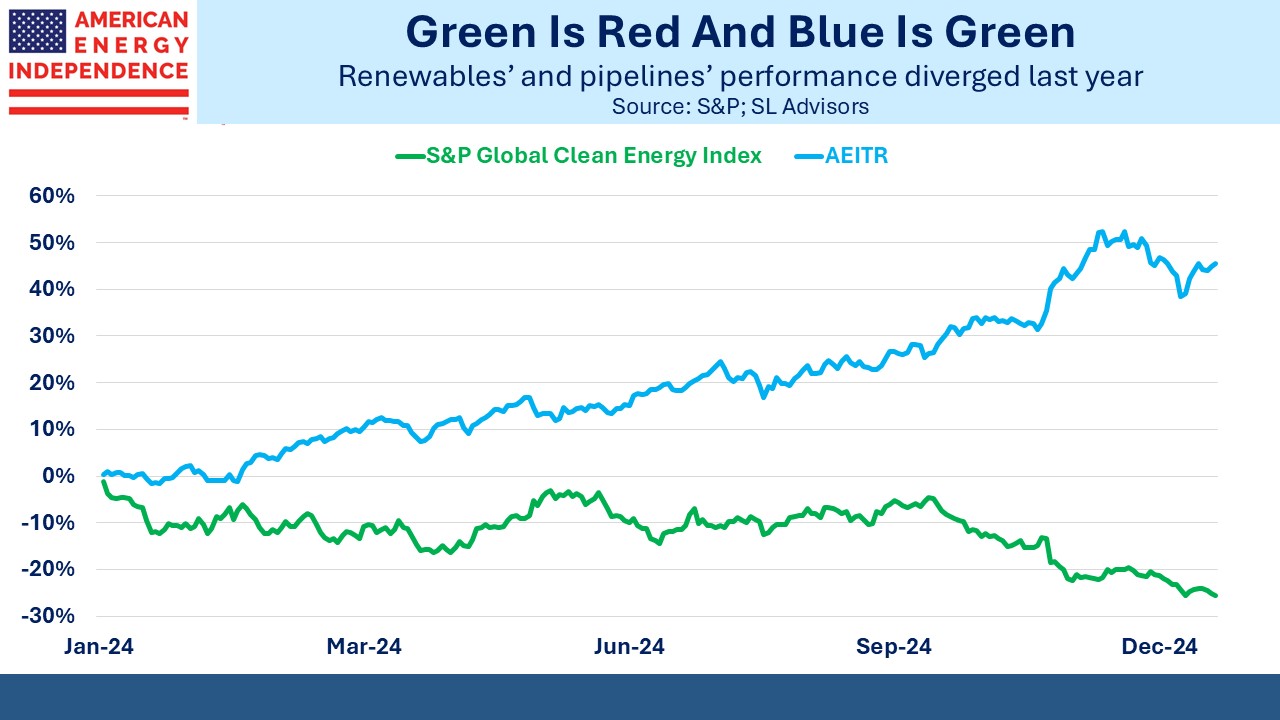

We think that’s an unreasonably pessimistic natural gas forecast. Natgas has been gaining market share over the past decade, rising from 28% in 2014 to 42.5% last year. Over that time it’s captured more than half of the incremental demand and in 2024 was 76%.

We know data centers are driving the increase in power demand, and that they need reliable power that’s not dependent on the weather. Midstream companies such as Williams report high levels of interest in “behind the meter” arrangements by which a data center contracts directly with a gas supplier to supply a dedicated power plant. This bypasses the grid and can offer a faster solution.

The US Department of Energy thinks AI could consume up to 12% of all US power generation within the next three years.

Energy consulting firm Enervus thinks as many as 80 new gas power plants could be added by 2030, representing 46GW of new capacity. This is almost 20% more than was added over the past five years.

So a forecast that the share of US electricity generated from natural gas will decline this year seems to overlook what we know is happening with AI, and the clear commitment of the incoming Trump administration to favor domestic hydrocarbon production.

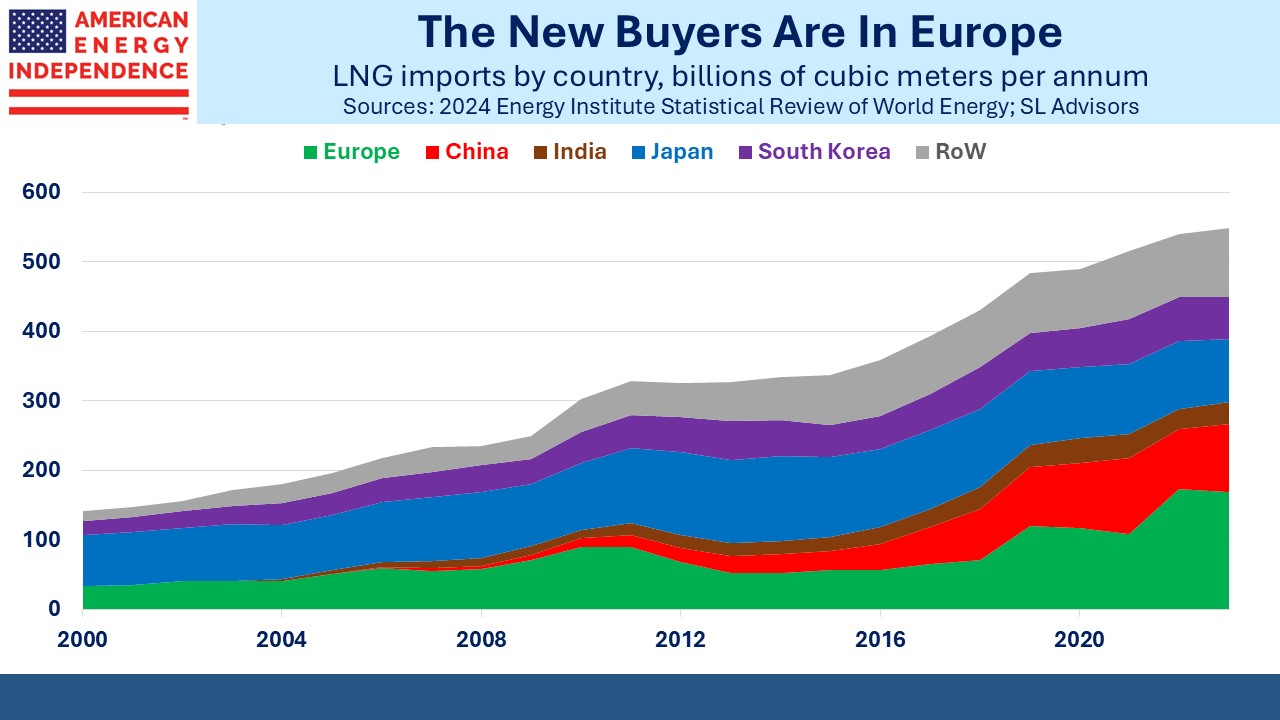

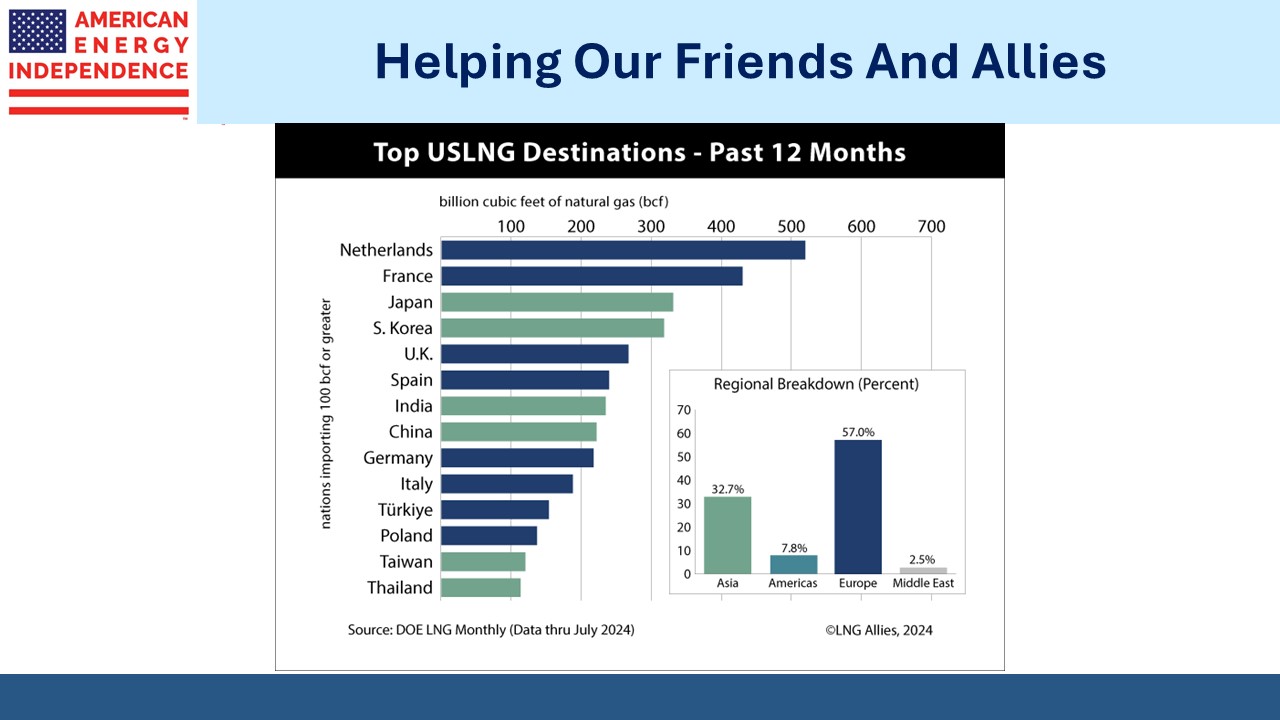

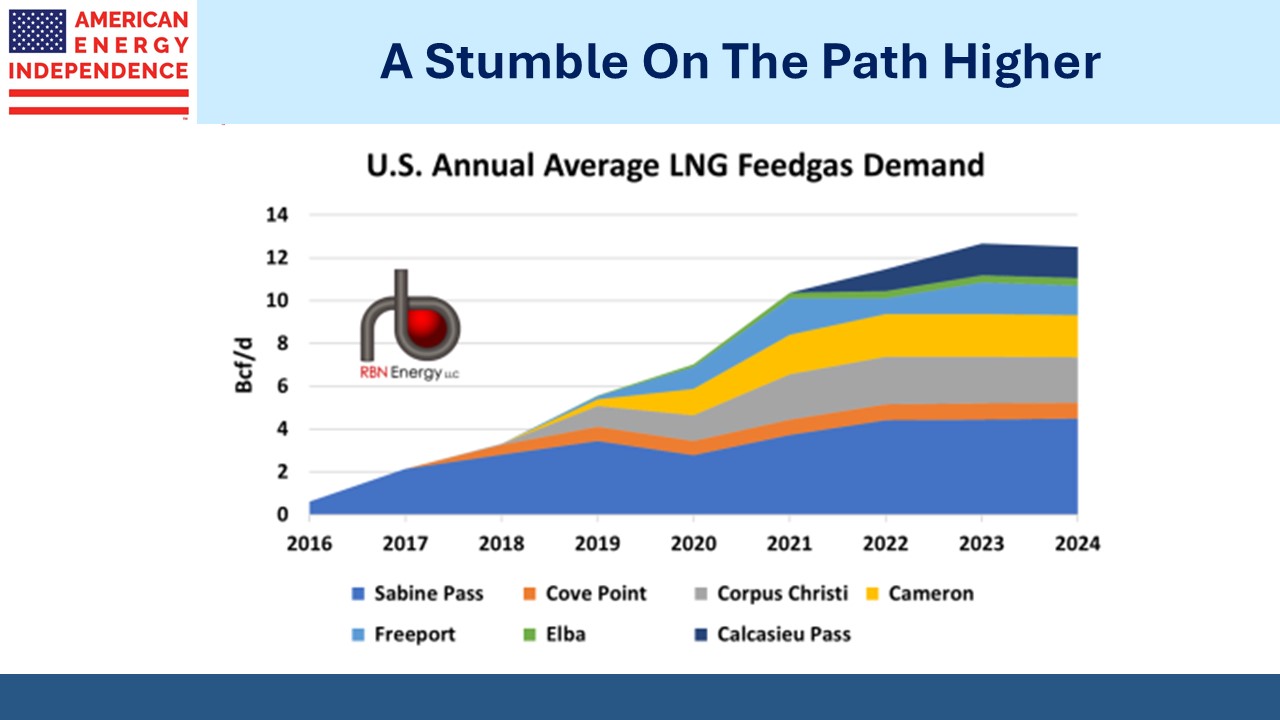

The STEO forecasts that LNG exports will reach 16 Billion Cubic Feet per Day (BCF/D) by 2026, up from 12 BCF/D last year. Pipeline exports will also grow, by 1.4 BCF/D as flows to Mexico increase.

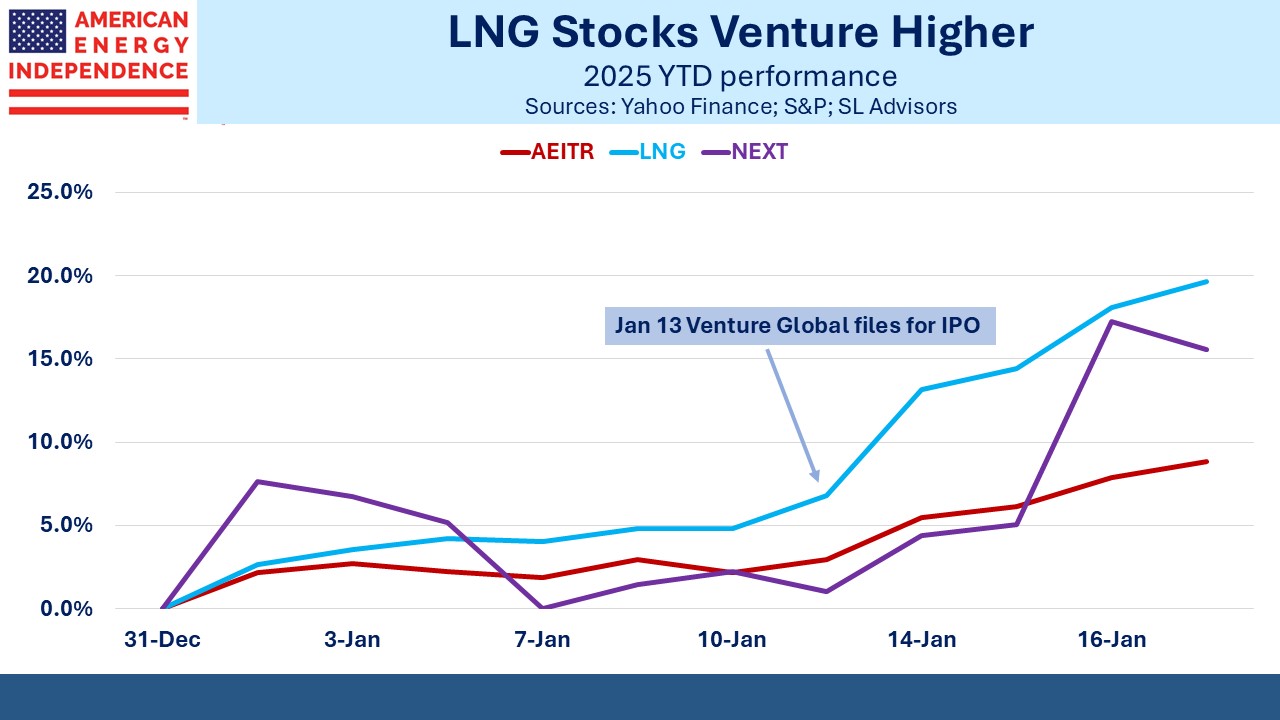

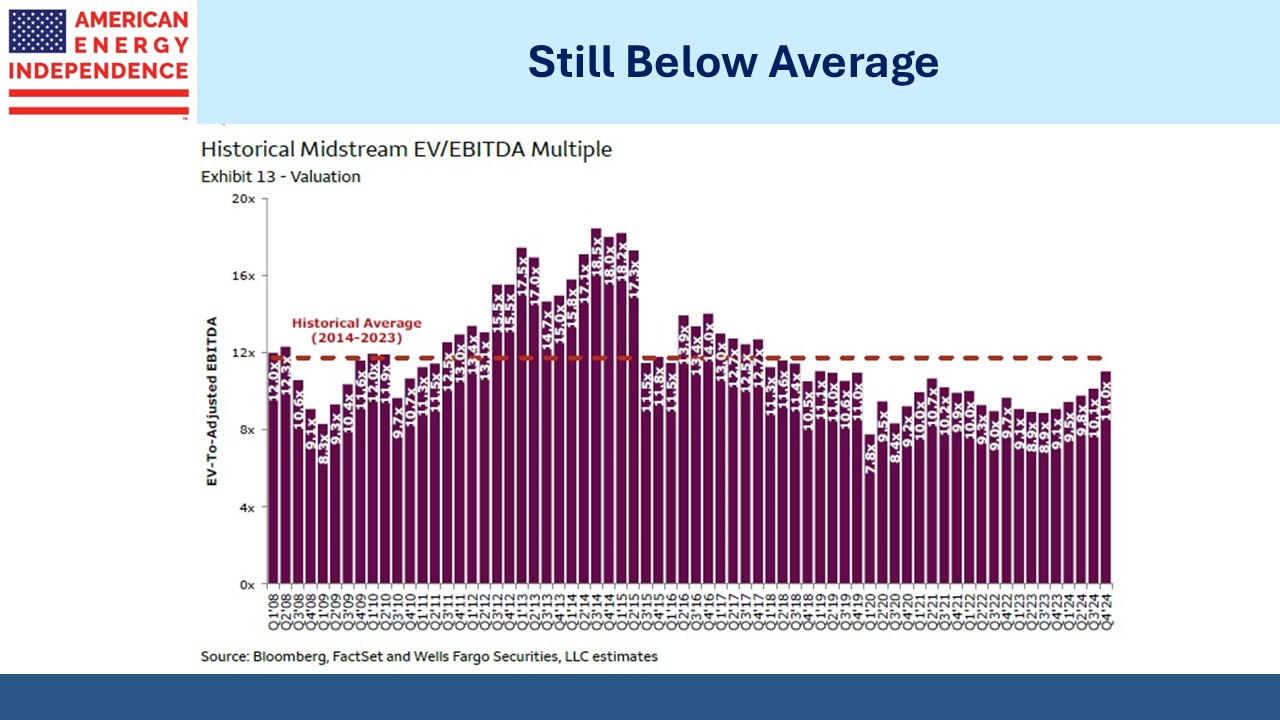

The LNG story received a boost from Trump’s November victory since it assured that the permit pause announced a year ago would be lifted. LNG terminals represent best in class energy infrastructure assets since they have 20-30 year contracts, providing unprecedented cash flow visibility.

Privately held Venture Global, which operates the Calcasieu Pass and Plaquemines LNG export terminals, is planning an IPO that could value the company at over $100BN. The pricing looks a little ambitious to us, but it has drawn attention to publicly traded LNG companies Cheniere and NextDecade, whose comparatively cheap valuations have drawn in new buyers. Both stocks have rallied strongly since Venture Global announced its IPO.

US LNG remains one of the most attractive sectors in our opinion. Cheap US natural gas and a president who wants energy dominance is a powerful combination. We think the return potential from LNG is not yet fully recognized by the market.

We have two have funds that seek to profit from this environment: