Europe Follows California Into Renewables Oblivion

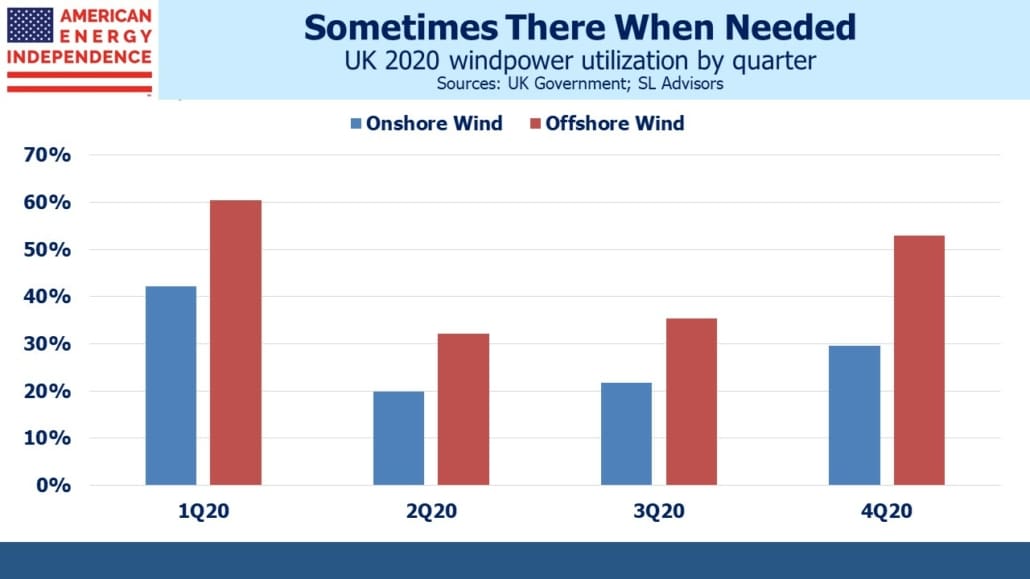

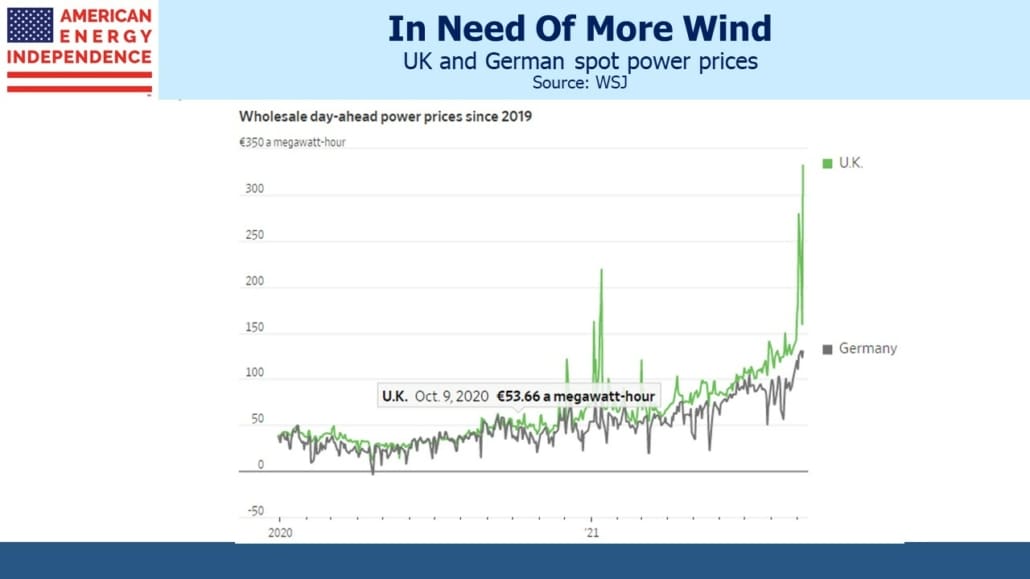

A feature of renewables not widely acknowledged is their relatively low capacity utilization. Solar is limited to daytime, with peak generation around midday. Output is typically 20-25% of capacity, meaning a 10 MW solar farm would generate 48-60MWh every 24 hours. The UK’s windpower capacity utilization was 37% last year, higher than is typical. As the chart shows, it bounces around unpredictably.

Offshore wind tends to produce more often than onshore, which is why the UK has been adding installations in the windy North Sea. The recent tranquility has cut wind to 7% of UK power generation, from 24% last year, likely bringing capacity utilization down to 10-11%. The sheep in the photo have evidently learned that windmills can offer relief from the sun at least as often as they produce electricity. It’s true the tower is stationary, but careful examination of the photo also reveals sheep standing in the shadow of the (presumably motionless) blades.

Three years ago efforts to develop fracking of natural gas in Britain were abandoned following relentless pressure from environmental extremists (see British Shale Revolution Crushed: America’s Unique Ownership of Oil and Gas). The UK’s Lord Ridley, a member of the House of Lords, warned that Russia was funding the opposition to these efforts to reduce Britain’s reliance on imported energy. NATO’s secretary general had voiced similar concerns as far back as 2014.

Ridley recently referred to Friends of the Earth, a vocal opponent of fracking in the UK, as “useful idiots” during a radio interview. They shared Russia’s objective of crushing domestic gas production, albeit for different reasons. Now the IEA is calling for Russia to increase such exports to Europe. Russian funding of western environmental opposition to natural gas production has delivered Russia an astronomical IRR, about to be paid for by European governments forced to subsidize household energy bills.

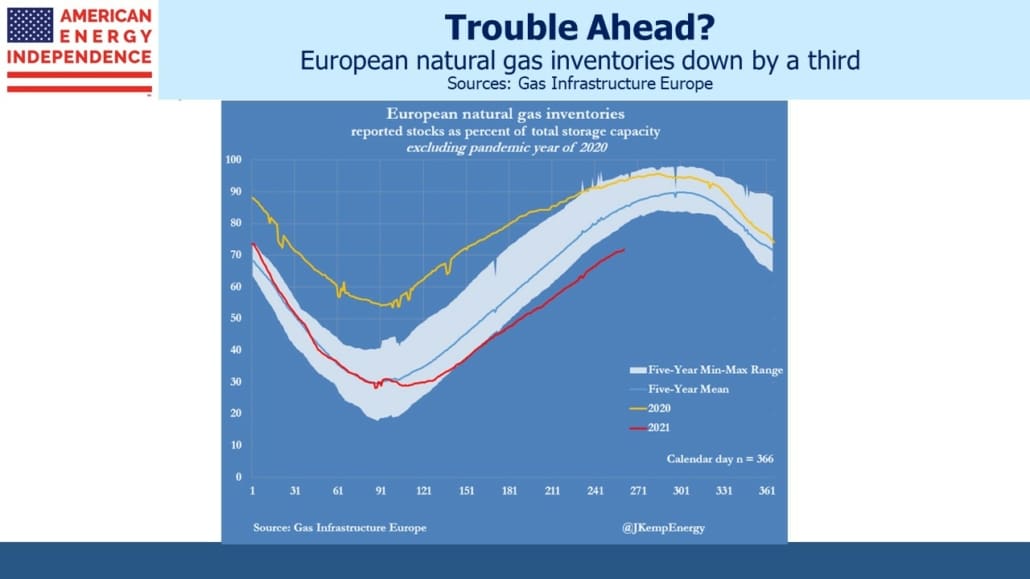

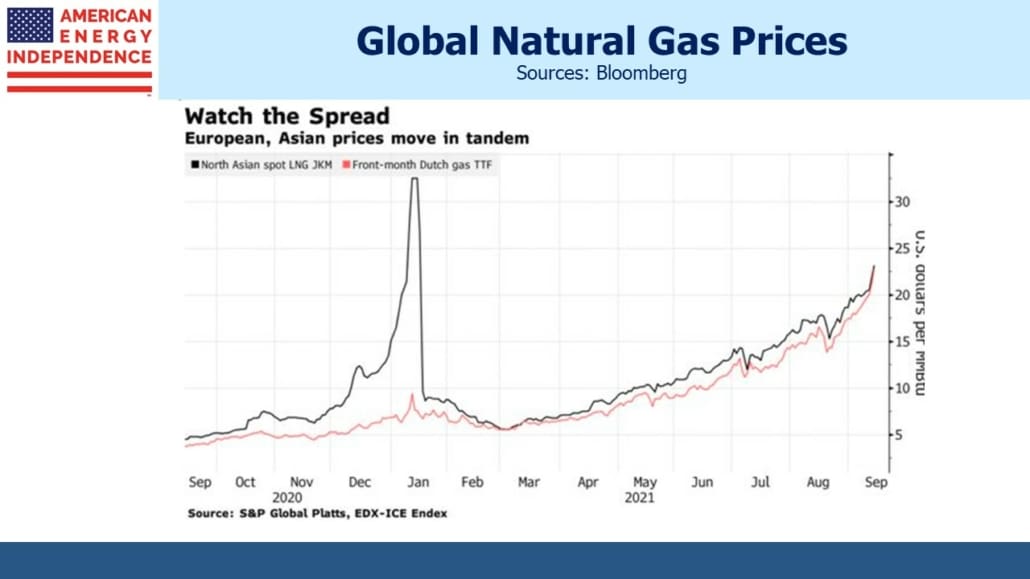

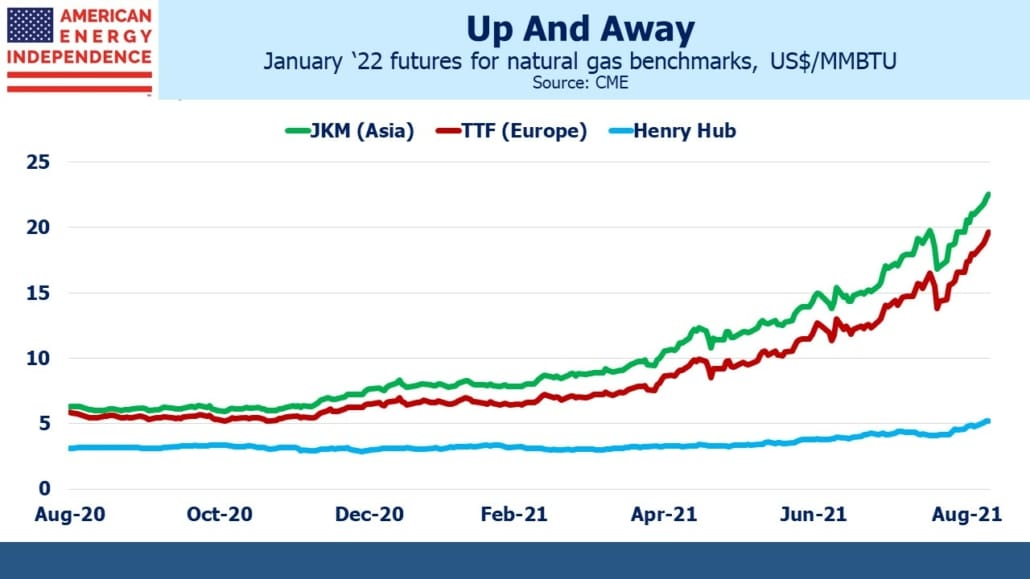

The energy squeeze confronting western Europe is coming at a time when energy demand is usually low. Cooler weather as summer ends is when natural gas supplies are typically built up in preparation for winter. For reasons that include mysteriously low Gazprom exports and a Brazilian drought that has lowered hydropower, global natural gas prices are soaring.

Analysts are warning that Europe faces a real possibility of power cuts if unusually cold weather exposes low gas inventories. Compounding matters, Gazprom CEO Alexey Miller recently said that, “… the Asian market is more attractive for producers and investors despite the record-breaking prices in Europe.”

Asian and European natural gas prices have risen together, with Asian buyers especially keen to avoid a repeat of last January’s winter squeeze. As a result, they are often outbidding European buyers for shipments of liquified natural gas.

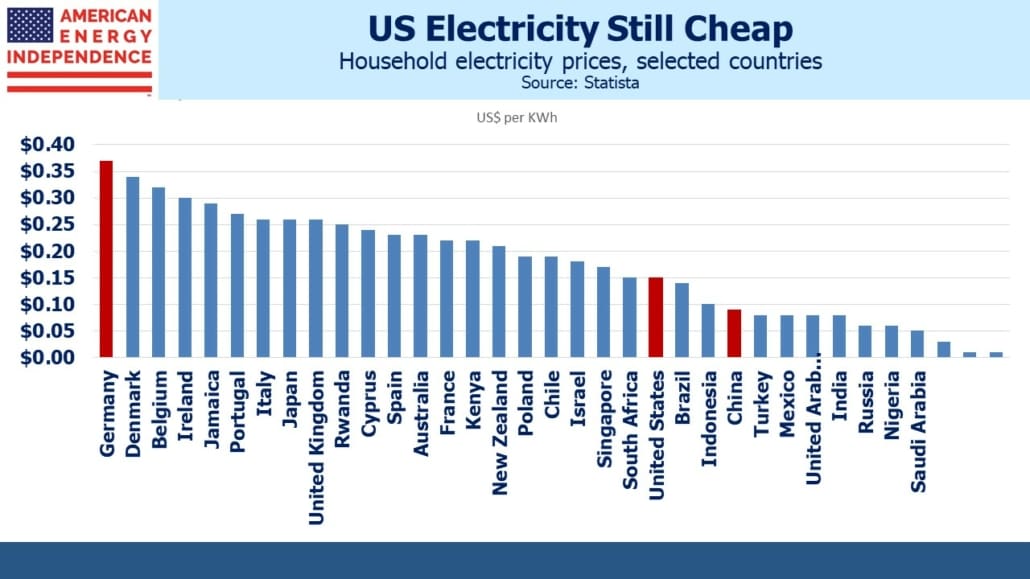

European governments are being forced to respond to sharply higher household electricity bills and bankruptcy risk among electricity providers. An Italian government source said, “a plausible amount to tackle the issue [of soaring energy costs] could reach up to €4.5bn.” U.K. Business Secretary Kwasi Kwarteng warned that the country faces a “long, difficult” winter with high energy prices tipping power suppliers into bankruptcy.

So far the UK is not planning to bail out power suppliers that fail, and PM Johnson has refused to scrap “green levies” on power bills even though they’ve helped cause the problem by subsidizing windpower investments.

Since the energy transition is all about new technologies, policymakers need to look beyond intermittent sources of energy. Direct Air Capture of CO2 is another example of what might be possible while allowing reliable electricity generation to continue.

On a different topic, my wife and I were disappointed to find downtown Minneapolis almost deserted on a recent Sunday lunchtime, still reeling from the twin blows of Covid lockdowns and violent protests following George Floyd’s murder. Nicollet is described as “downtown’s core shopping and entertainment artery” on the city’s hopelessly out of date website.

I posed next to the Mary Tyler Moore statue watched by two bored cops and no one else. A 20 minute drive north, a local strip mall had lost all its tenants except for a Dollar Tree. Afterwards we headed to Duluth, on Lake Superior, which was more vibrant.

We went to Minnesota to visit my wife’s penpal of 45 years, a relationship that began when they were both in middle school. Their friendship through writing predates our own. They had shared life’s events via air-mail letters and birthday cards, retaining this medium even when email because ubiquitous, but had never met until now. Over several very agreeable hours we became friends with a warm and friendly family, typical of the midwest. Our next meeting won’t take as long.