Are Pipelines Still Cheap?

Investors have endured several body blows this year. Inflation was already rising due to the strong rebound from Covid exacerbated by last year’s $1.9TN Covid relief spending. The long heralded and late removal of excessive monetary accommodation is about to start.

More recently, Russia’s invasion of Ukraine has abruptly upended decades of western engagement, ushering in sanctions, European rearmament and urgent diversification of energy supplies. As if this isn’t enough, China placed the 17.5 million residents of Shenzhen into lockdown after new virus cases doubled nationwide to almost 3,400. The rest of the world has resigned itself to living with Covid – China’s lone insistence on complete suppression seems futile but not yet abandoned.

There’s no shortage of articles, some quite thoughtful, on Russia’s invasion and its consequences. The Weakness of the Despot is an interview with historian Stephen Kotkin who has written two volumes on Stalin (he’s working on a third). Kotkin argues that Russia’s history repeatedly shows “its capabilities have never matched its aspirations” as a great power. In Possible Outcomes of the Russo-Ukrainian War and China’s Choice a Chinese academic argues that once it becomes clear Russia has blundered, Chinese interests will draw them back towards economically successful western nations, cooling relations with Russia.

Tempting as it is to become an expert on wars and geopolitics, the more useful insight we can offer is that Russia’s estrangement from most of the world is going to last years if not decades. We can be more confident on this forecast than the conflict itself or China’s next moves, because the fact and manner of Russia’s invasion can’t be undone.

For example, Christopher Smart, chief global strategist and head of the Barings Investment Institute, said “Until you have a new leader in Russia, one who apologizes for invading Ukraine and who writes a check for reparations, these sanctions are going to remain in place. And I don’t see any of the three things I just described happening.”

Some predict that Russia’s economy will be set back thirty years. The global oil giants were only the first in a long line of western companies to announce the exit or abandonment of their Russian operations. So far more than 300 of the world’s best known brands have announced plans to leave. The port of Hamburg reports that container traffic with Russia is “approaching zero,” compared with “hundreds of thousands annually” before the invasion.

CNBC noted that, “none of the experts who spoke to CNBC for this story believe that any of the current sanctions against Russia or Belarus are going to be eased or lifted for at least the next three years.”

As upwards of 300 companies deal with messy exits and the inevitable write downs, corporate memories will be scarred.

The change in trade flows as much of the world turns away from imports of Russian oil, gas and wheat represents as significant a change as we can recall to the world economy. The recent drop in crude oil was caused by the Chinese reminder that Covid remains with us, even if they’re alone in still trying to wipe it out. The rest of the world has moved on. “Remask between bites and sips,” the offensive demand on US commercial airlines to constantly adjust facegear while eating and drinking, is redundant and virtually the only restriction left while the CDC takes yet another month to review its policy for public transport. Bites and sips. Ugh.

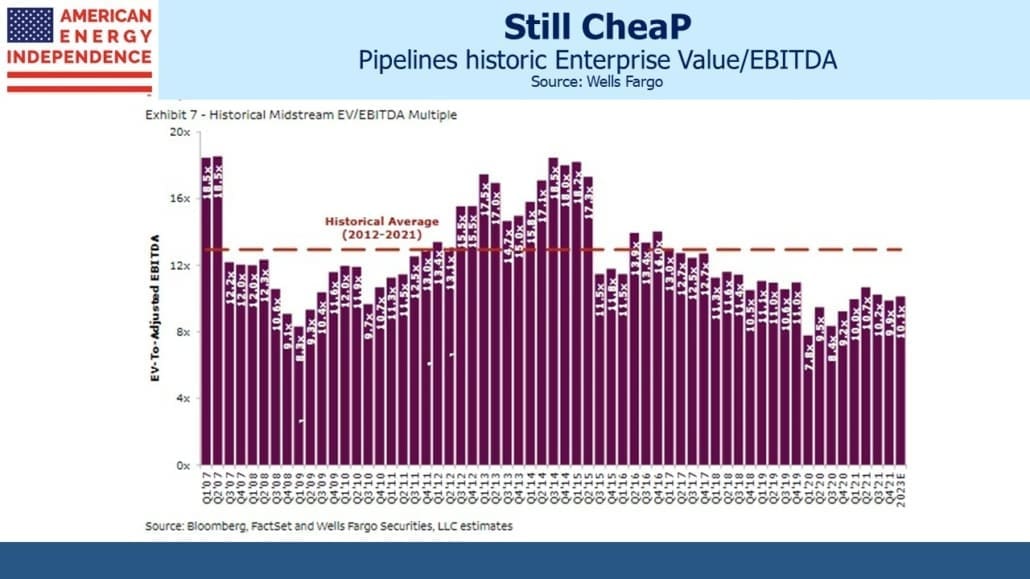

After the kind of run the energy sector has had, it’s reasonable to ask if it’s still cheap. On an Enterprise Value/EBITDA (EV/EBITDA) basis midstream is still well below its long term average. If the current 10X EV/EBITDA re-rated to 12X, assuming 50/50 debt/equity that would mean a 40% price increase from here. For several years the fear that the energy transition would lead to the early retirement of pipelines weighed on the sector, lowering terminal values. As it becomes increasingly clear that this transition, like those before it (wood to coal, coal to oil/gas) will take decades, equity investors should adopt the more realistic assessment that bond investors in the sector have always retained (see Pipeline Bond Investors Are More Bullish Than Equity Buyers).

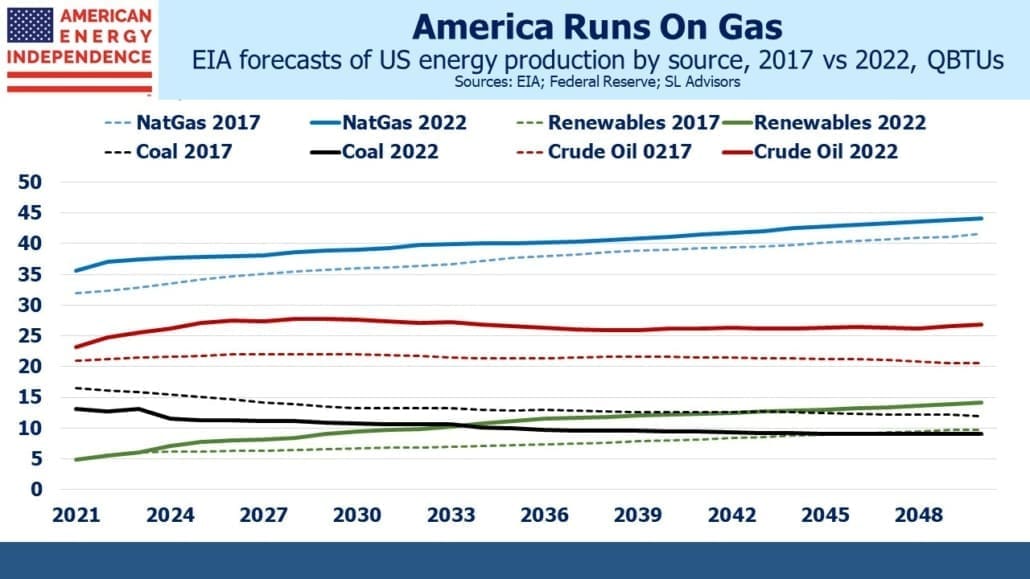

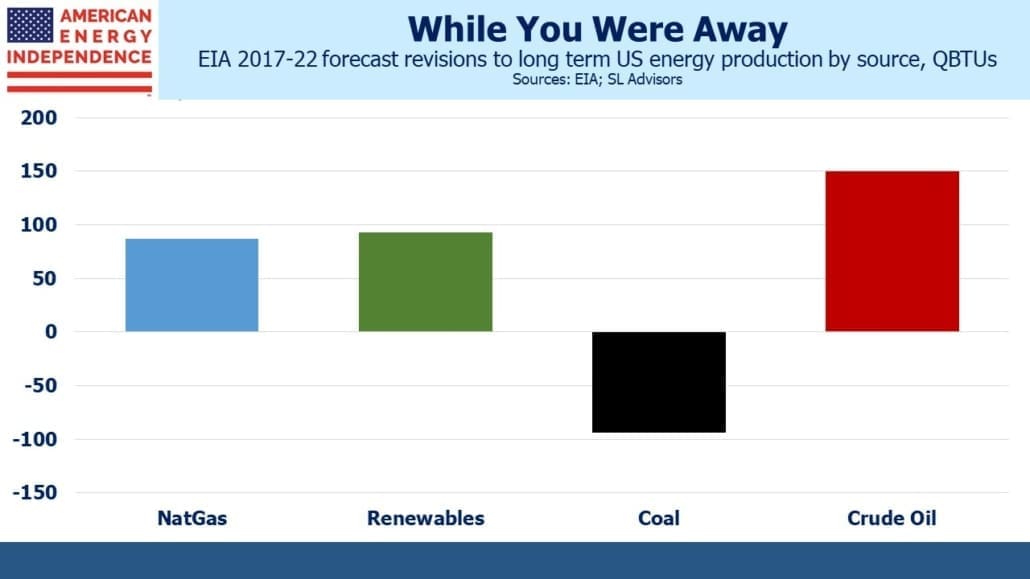

The US Energy Information Administration (EIA) forecasts continued growth in production of natural gas, crude oil and renewable power through 2050. Few have noticed that since 2017 the EIA has revised up its forecast long term output of natural gas nearly as much as renewable power. Crude oil has been revised up even further. The renewables increase matches the reduction in coal output. The numbers tell a different story than much of the liberal media.

Wells Fargo estimates that adding ten years to the expected economic life of midstream infrastructure provides a 1.0X uplift in EV/EBITDA, which we estimate is worth 20% on equity prices.

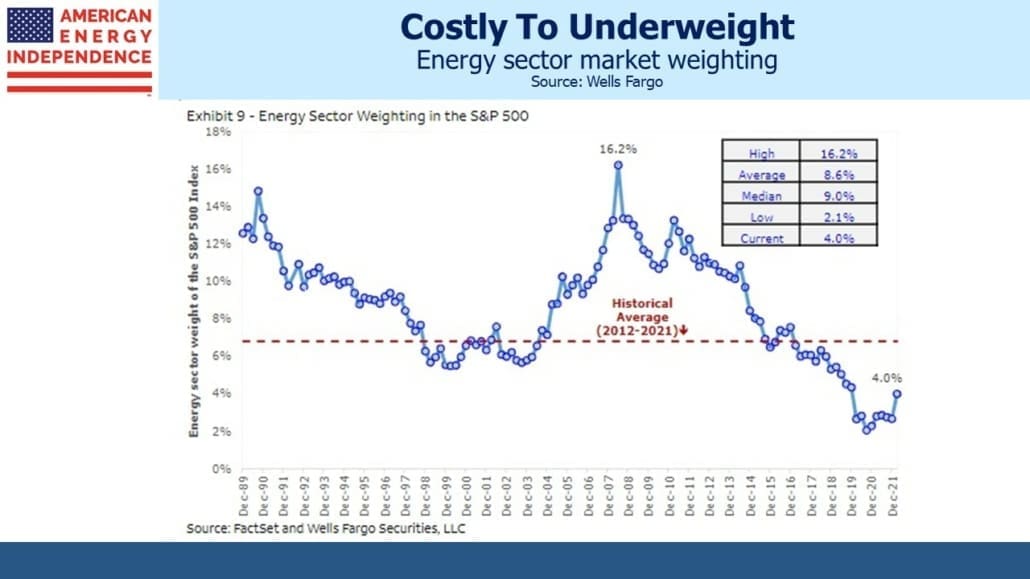

Moreover, the energy sector’s weighting in the S&P500 has almost doubled from its low of 2.1% reached in 2020. As it recovers, the cost of an underweight becomes more significant, something abundantly clear to investors so far this year. There are anecdotal reports of generalist investors adding to energy exposure.

The sector still has a long recovery ahead of it.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!